In today’s rapidly evolving world, the paramount importance lies in attaining financial autonomy and adaptability. A quintessential instrument in achieving these aspirations is none other than the AU LIT Credit Card. This exposé delves deep into the attributes, advantages, and intricacies inherent to the AU LIT Credit Card, illuminating how it can serve as an invaluable augmentation to your financial arsenal.

Table of Contents

- Introduction

- The Essence of AU LIT Credit Card

- Pivotal Facets of AU LIT Credit Card

- Streamlined Application Procedure

- Credit Extents and Interest Metrics

- Bounties and Cashback Initiatives

- Navigating Your AU LIT Credit Card Online

- Safeguard Protocols and Anti-Fraud Measures

- Comparative Scrutiny vis-à-vis Alternative Credit Cards

- Upsides and Downsides of AU LIT Credit Card

- Pointers for Prudent Credit Card Utilization

- Liquidating Credit Card Debt

- FAQs: Resolving Common Queries

- In Summation

Introduction

The AU LIT Credit Card isn’t a mere plastic artifact; it represents a gateway to a realm of fiscal potentials. Amid an era where convenience, incentives, and adaptability reign supreme, this credit card has been meticulously crafted to address the multifaceted requisites of contemporary individuals.

- Customize your card according to your needs, opt for any benefit by paying a fee

- Get Amazing Partner Discounts & Much more!

- You Earn Flat Rs 1540 Profit on Successful Card Disbursal

PARTNER DISCOUNTS

- 10% Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

- Additional 10% Off (Upto Rs 1000) on a minimum purchase of Rs 3999 on selected styles on Myntra

- 15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

- 10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

CUSTOMIZATION OPTIONS ON AU LIT CREDIT CARD –

Get 1% fuel surcharge waiver on fuel transactionsRs 99 (For 90 Days)

- Get complimentary 3 month Zee5 membershipRs 199 (For 90 Days)

- Get 1 complimentary Domestic Airport lounge visits per quarter

- Get 2% additional cashback on achieving milestone spends

- Get complimentary 3 month Amazon prime membership

- Get 5X Reward Points for online spendsRs 299 (For 90 Days)

- Get 2 complimentary Domestic airport lounge visits

- Get 5% additional cashback on achieving milestone

- Get 10X Reward Points for Offline

- Get 5% additional cashback on all Dining

- Get 5% additional cashback on all Grocery

- Get 5% additional cashback on all TravelRs 499 (For 90 Days)

- Get complimentary 3 month Cult.fit membership

ELIGIBILITY CRITERIA

- Employment status: Salaried or Self-Employed

- Income: Rs 25,000 per month (Salaried and Self-employed)

- Required Age: 21-60 years

- Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

- No Delayed Payments in the last 12 months

- Required Credit Score: 700+

DOCUMENTS NEEDED

- Valid PAN Card

- Aadhar Card – should be linked to Mobile (For EKYC)

- Address proof

- Income Proof (if opted for Income surrogate)

The Essence of AU LIT Credit Card

The AU LIT Credit Card is an all-encompassing financial instrument proffered by AU Financial Services. It amalgamates the expediency of a credit card with an array of features tailored to elevate your financial stewardship experience. Be it routine transactions, flight reservations, or exclusive privileges, this card aspires to streamline your dealings while furnishing supplementary advantages.

Pivotal Facets of AU LIT Credit Card

• Versatile Credit Threshold: The card extends a supple credit threshold contingent upon your fiscal profile, ensuring your unfettered access to resources as needed.

• Incentives and Cashback: Accumulate incentives on each transaction, redeemable for diverse perks including rebates, vouchers, and even direct cashback.

• Sojourn Perquisites: Revel in privileges associated with travel such as gratuitous airport lounge entry, comprehensive travel insurance, and reduced rates on lodgings.

• Touchless Transactions: The card accommodates touchless transactions, empowering you to effectuate prompt and secure dealings sans the need for card swiping or insertion.

• Digital Account Oversight: Access your account online to monitor transactions, settle bills, and regulate your credit threshold.

• EMV Chip Safeguard: Embedded with an EMV chip, the card features an augmented layer of safeguarding against fraudulent machinations.

Streamlined Application Procedure

Procuring an AU LIT Credit Card entails a straightforward sequence. Simply navigate to the AU Financial Services website, complete the digital application form, and furnish the mandated documents. Subsequent to review of your application and creditworthiness evaluation, your card shall be accorded approval.

Credit Extents and Interest Metrics

The ascribed credit cap hinges on factors such as your credit chronicle, income, and prevailing fiscal responsibilities. Interest rates may oscillate based on market dynamics and your credit dossier. Acquainting oneself with these stipulations before card utilization is of paramount significance.

Bounties and Cashback Initiatives

The AU LIT Credit Card proffers a comprehensive bounty regime. Each transaction engenders an accumulation of bounty points which can be cashed in for enticing propositions, discounts, or even direct cashback, thus augmenting the value of your expenditures.

Navigating Your AU LIT Credit Card Online

The convenience of the AU LIT Credit Card extends to its online administration ecosystem. Via the bank’s website or mobile application, you can track expenditures, scrutinize real-time transactions, settle bills, and even configure automated remittances.

Safeguard Protocols and Anti-Fraud Measures

AU Financial Services accord preeminence to the integrity of your transactions. The incorporation of EMV chip technology in the card furnishes augmented defense against counterfeit fraudulence. Moreover, the bank extends round-the-clock vigilance for any anomalous activities, thereby assuring your tranquility.

Comparative Scrutiny vis-à-vis Alternative Credit Cards

For a comprehensive assessment of the spectrum of advantages, discerning juxtaposition of the AU LIT Credit Card with analogous credit cards in the domain is prudent. Parameters such as incentives, interest rates, annual levies, and supplementary privileges warrant due contemplation to facilitate an enlightened choice.

Upsides and Downsides of AU LIT Credit Card

Upsides:

• Flexibility in credit extents

• Rewarding cashback schemes

• Expedient travel and lifestyle prerogatives

• Streamlined digital administration

Downsides:

• Interest rates could surge if managed injudiciously

• Incurrence of annual charges possible

Pointers for Prudent Credit Card Utilization

• Punctual Remittances: Timely remittances foster a positive credit history and mitigate interest outlays.

• Expenditure Vigilance: Periodic review of transactions is imperative to remain within financial confines.

• Avoid Minimum Payments: Transgressing the minimum requisites aids in curbing interest outgoings.

• Capitalize on Rewards: Optimize rewards by capitalizing on their conversion into valuable propositions.

Liquidating Credit Card Debt

In the event of accumulating credit card indebtedness, devising a structured reimbursement plan is advisable. Priority ought to be accorded to repaying high-interest obligations initially, with contemplation of debt amalgamation avenues if requisite.

FAQs: Resolving Common Queries

Q1: How can I apply for the AU LIT Credit Card?

A1: Application for the AU LIT Credit Card is straightforward. Peruse our website, complete the digital application form, and furnish stipulated documentation. Following review and evaluation, we shall communicate a verdict.

Q2: What is the minimal credit score requisite for endorsement?

A2: While manifold factors inform our evaluation, a loftier credit score augments endorsement prospects. However, we scrutinize each application individually, precluding immediate denial based on a lower credit score.

Q3: Can I augment my credit cap subsequently?

A3: Affirmative, augmentation is feasible. In the event of judicious card utilization and improved fiscal circumstances, petitioning for a credit extension is permissible. We shall review your request and adjust the cap accordingly.

Q4: Are there international transaction surcharges?

A4: Indeed, surcharges for international transactions utilizing your AU LIT Credit Card in a currency other than that denominated on the card may apply. It is judicious to scrutinize stipulated terms for detailed fee information.

Q5: How does the rewards system operate?

A5: The rewards system is tailored to acknowledge your employment of the AU LIT Credit Card. Each transaction accretes rewards points, convertible into an array of advantages such as concessions, vouchers, or even direct cashback. Usage frequency begets commensurate rewards accrual.

In Summation

The AU LIT Credit Card transcends the role of mere fiscal transaction facilitator; it assumes the mantle of a financial companion conferring convenience, incentives, and assurance. Boasting an array of versatile facets and advantages, this credit card is poised to assume a pivotal role in your fiscal aspirations, concurrently enriching your lifestyle.

-

Are You Ready for Home Loan – Some Tips for Choosing the Best Home Loan?

Expert tips to choose the best bank home loan in India for 2025! Compare low interest rates, save

-

Big Spenders Beware: Why Is the Income Tax Department Targeting Credit Card Bills Over ₹1 Lakh

Why the Income Tax Department is eyeing credit card bills over ₹1 lakh in 2025! Learn how to

-

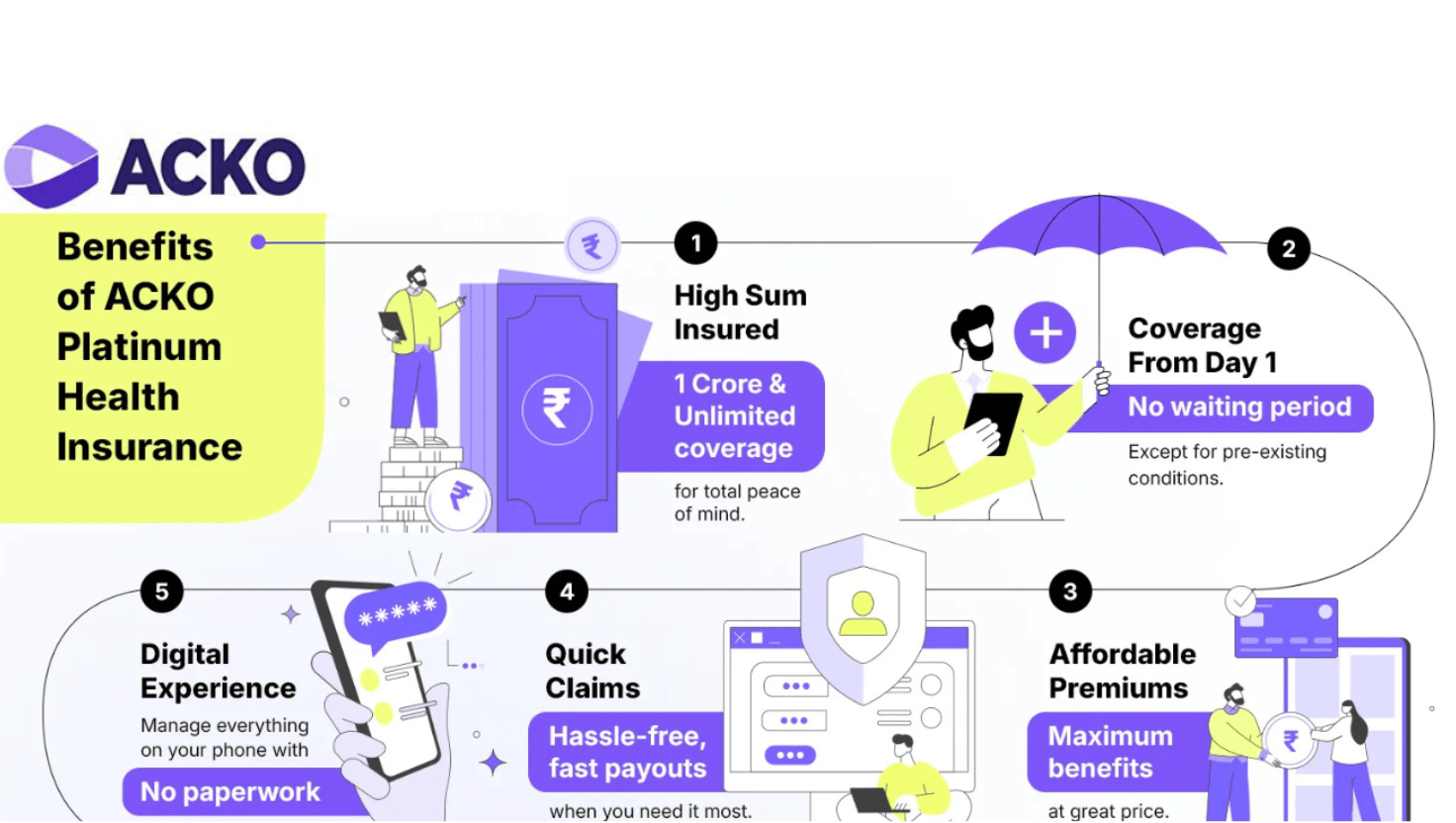

Is ACKO Platinum Health Plan the Most Affordable ₹1 Crore Coverage Option

Explore the ACKO Platinum Health Plan: affordable ₹1 crore coverage with zero waiting period, no co-payment, and unlimited

-

Why ManipalCigna ProHealth’s High Sum Insured Boosts Your Financial Security

Explore ManipalCigna ProHealth Insurance: comprehensive coverage, high sum insured, and cashless hospitals. Enjoy maternity cover, critical illness add-ons,

-

Indian Stock Market Trends: Top Gainers, Losers, and Trading Strategies for June 27, 2025

The Indian stock market outlook for June 27, 2025! Explore Nifty 50, Sensex, and Bank Nifty predictions, key