In the contemporary, swiftly-evolving realm, credit cards have seamlessly morphed into an indispensable financial instrument, furnishing not only convenience and adaptability but also an abundant assortment of perks. Among these exceptional credit cards, the Axis Vistara Platinum Credit Card emerges as a remarkable contender, meticulously tailored to cater to the diverse requisites and predilections of the modern consumer. Through its myriad facets of attributes and privileges, this credit card has succeeded in distinguishing itself within the market. Within this comprehensive guide, we shall plumb the various dimensions of the Axis Vistara Platinum Credit Card, and delve into the manner in which it can heighten your sojourns and lifestyle exploits.

You can get Complimentary Economy Class domestic Vistara flight ticket

- Complimentary Club Vistara base membership

- Upto 3 free Economy domestic tickets on milestone spends

- 2 complimentary lounge visits per annum at select domestic airports & Much More!

- You Earn Flat Rs 1960 Profit on Successful Card Disbursal

Eligibility Criteria

There are certain eligibility criteria you will need to fulfil to avail Axis Bank’s Vistara Credit Card.To know about eligibility, please go through the section below:

- Primary cardholder between the age of 18 years and 70 years.

- Net income of Rs. 6,00,000 per annum.

- Resident of India

These criteria are only indicative. The bank reserves the right to approve or decline applications for credit cards.

Documentation Required for Axis Bank Vistara Credit Card

If you are planning on applying for the credit card, please keep your documents for Vistara Credit Card ready. You would need a copy of your PAN card or Form 60, colour photograph and latest pay slip among other documents. To know which documents need to be produced at the time of applying for the Vistara Credit Card, please go through the list below:

- PAN card photocopy or Form 60

- Latest payslip/Form 16/IT return copy as proof of income

- Residence proof (any one of the following)

- Passport

- Driving License

- Ration card

- Electricity bill

- Landline telephone bill

This list is only indicative. Documents required may vary on a case-to-case basis.

Contents Overview

- Introduction to the Axis Vistara Platinum Credit Card

- Principal Characteristics and Gains

- Access to Vistara Lounges

- Inaugural Bonus and Milestone Perks

- Gratuitous Club Vistara Membership

- Expedition and Lifestyle Privileges

- Application Walkthrough

- Prerequisites for Eligibility

- Procedural Outline for Application

- Tariffs and Levies

- Annual Levy

- Interest Tariffs

- Incidental Costs

- Benefits and Reclamation

- Accrual of Vistara Points through Transactions

- Adaptive Avenues for Reclamation

- Travel Safeguard and Coverage

- Indemnity against Airborne Mishaps

- Accountability for Lost Card

- Contactless Innovation and Safeguarding

- Ensured Transactions

- Touchless Transactions

- Strategies for Optimizing Card Potential

- Tactical Expenditure

- Punctual Disbursement

- Frequently Posed Queries

- Conclusion

Introduction to the Axis Vistara Platinum Credit Card

The Axis Vistara Platinum Credit Card represents a premium offering that harmoniously amalgamates the prowess of Axis Bank with the opulence exuded by Vistara Airlines. It has been meticulously curated to deliver an unparalleled sojourn in the realms of both travel and lifestyle to its esteemed cardholders. With a unique fusion of travel-centric benefits, rewards, and exclusive prerogatives, this credit card has burgeoned into an alluring choice for the intrepid globetrotter and discerning individuals who esteem superlative experiences.

Principal Characteristics and Gains

- Access to Vistara Lounges

A standout hallmark of the Axis Vistara Platinum Credit Card is the gateway it affords to Vistara’s premium lounges stationed across select airports. This provision extends the privilege for cardholders to recline, unwind, and savor an array of amenities while awaiting their flights. The serene ambience, plush seating, and courtesy refreshments synergistically enrich the holistic sojourn.

- Inaugural Bonus and Milestone Perks

Following the successful issuance of the card, patrons are cordially bestowed with a munificent welcome bonus, materializing as an allocation of Vistara Points. Furthermore, cardholders can unlock milestones of gratuity by attaining predefined spending benchmarks. These rewards might encompass surplus points, concessions on flight reservations, and an array of additional perks.

- Gratuitous Club Vistara Membership

By default, cardholders find themselves seamlessly enrolled within the echelons of the Club Vistara frequent flyer initiative, thereby unfurling an expanse of rewards and privileges. Accumulated Vistara Points are fungible for procuring flight tickets, upgrades, and a plethora of other enticing propositions.

- Expedition and Lifestyle Privileges

The Axis Vistara Platinum Credit Card transcends its advantages beyond air transit. Card bearers are primed to relish discounts and prerogatives pertaining to lodging reservations, gastronomic odysseys, retail indulgences, and immersive amusement. This metamorphoses the card into an all-encompassing companion for the art of living.

Application Walkthrough

Prerequisites for Eligibility

To embark upon the odyssey of securing the Axis Vistara Platinum Credit Card, prospective applicants are mandatorily required to satisfy a gamut of eligibility criteria. These prerequisites encompass a minimal stipulated age and an enduring wellspring of income. The bank’s digital platform serves as a fount of exhaustive enlightenment concerning these eligibility parameters.

Procedural Outline for Application

The overture of applying for the Axis Vistara Platinum Credit Card is meticulously engineered for expediency and seamlessness. Applicants are empowered to invoke the application process via the Axis Bank’s online portal or by engaging a proximate branch of the establishment. The compendium of mandated credentials encompasses proofs of identity, residence, and fiscal capacity.

Tariffs and Levies

- Annual Levy

The Axis Vistara Platinum Credit Card comes tethered to an annual levy, albeit potentially subject to exemption contingent upon the effulgent attainment of a specified monetary watermark. While this tariff underwrites entitlement to premier privileges, its integral import warrants prudent inclusion within the precincts of your fiscal blueprint.

- Interest Tariffs

Par for the course of all credit cards, the Axis Vistara Platinum Credit Card is imbued with an interest rate governing unresolved balances. The practice of judiciously hewing to the tenets of credit usage and assiduously adhering to repayment timelines unfailingly averts the specter of accreting onerous interest levies.

- Incidental Costs

Prudence demands a holistic awareness of ancillary costs that may lurk in the periphery. These encompass, inter alia, levies for withdrawing cash, traversing international boundaries in financial transactions, and dereliction in the punctual settlement of dues. A comprehensive acquaintanceship with these charges is quintessential for judicious financial stewardship.

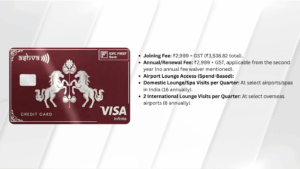

Fees and Charges for Axis Bank Vistara Credit Card

The fees and charges for Axis Bank Vistara Credit Card include standard joining fee, standard annual fee, standard add-on card joining fee, etc. The Axis Bank Vistara Credit Card fees are listed in the table below.

| Charges | Vistara Card | Vistara Signature | Vistara Infinite |

|---|---|---|---|

| Standard Joining Fee | Rs. 1,500 | Rs. 3,000 | Rs. 10,000 |

| Standard Annual Fee (2nd year onwards) | Rs. 1,500 | Rs. 3,000 | Rs. 10,000 |

| Standard Add-on Card Joining Fee | Nil | Nil | Nil |

| Standard Add-on Card Annual Fee | Nil | Nil | Nil |

| Finance Charges (Retail Purchases & Cash) | 3.6% per month (52.86% per annum) | 3.6% per month (52.86% per annum) | 3.6% per month (52.86% per annum) |

| Cash Withdrawal Fees | 2.5% (Min. INR 500) of the Cash Amount | 2.5% (Min. INR 500) of the Cash Amount | 2.5% (Min. INR 500) of the Cash Amount |

| Fee for Cash Payment | Rs 100/- | Rs 100/- | Rs 100/- |

| Card Replacement | Nil | Nil | Nil |

| Duplicate Statement Fee | Waived | Waived | Waived |

| Overdue Penalty or Late Payment Fee | Nil if Total Payment Due is less than Rs. 500 | Nil if Total Payment Due is less than Rs. 500 | Nil if Total Payment Due is less than Rs. 500 |

| Rs. 500 if total payment due is between Rs. 501 – Rs. 5,000 | Rs. 500 if total payment due is between Rs. 501 – Rs. 5,000 | Rs. 500 if total payment due is between Rs. 501 – Rs. 5,000 | |

| Rs. 750 if total payment due is between Rs. 5,001 – Rs. 10,000 | Rs. 750 if total payment due is between Rs. 5,001 – Rs. 10,000 | Rs. 750 if total payment due is between Rs. 5,001 – Rs. 10,000 | |

| Rs. 1200 if total payment due is greater than Rs.10,000 | Rs. 1200 if total payment due is greater than Rs.10,000 | Rs. 1200 if total payment due is greater than Rs.10,000 | |

| Over Limit Penalty | 2.5% of the over limit amount (Min. Rs. 500) | 2.5% of the over limit amount (Min. Rs. 500) | 2.5% of the over limit amount (Min. Rs. 500) |

| Chargeslip Retrieval Fee or Copy Request Fee | Waived | Waived | Waived |

| Outstation Cheque Fee | Waived | Waived | Waived |

| Cheque return or dishonour Fee or Auto-debit ReveINRal | 2% of the payment amount subject to Min. Rs.450, Max. Rs. 1,512 | 2% of the payment amount subject to Min. Rs.450, Max. Rs. 1,512 | 2% of the payment amount subject to Min. Rs.450, Max. Rs. 1,512 |

| Surcharge on purchase or cancellation of Railway Tickets | As prescribed by IRCTC/Indian Railways | As prescribed by IRCTC/Indian Railways | As prescribed by IRCTC/Indian Railways |

| Fuel Transaction Surcharge | 1% of transaction amount | 1% of transaction amount | 1% of transaction amount (Refunded for fuel transactions between INR 400 and INR 4000) |

| Foreign Currency Transaction Fee | 3.50% of the transaction value | 3.50% of the transaction value | 3.50% of the transaction value |

| Mobile Alerts for Transactions | Waived | Waived | Waived |

| Hotlisting Charges | Waived | Waived | Waived |

| Balance Enquiry Charges | Waived | Waived | Waived |

| Reward Redemption fee | No | No | No |

| Rent Transaction Fee (Applicable from 5th March 2023) | 1% capped at INR 1,500 per transaction on rental transactions | 1% capped at INR 1,500 per transaction on rental transactions | 1% capped at INR 1,500 per transaction on rental transactions |

| Dynamic Currency Conversion markup (Applicable from 5th March 2023) | 1% on international transaction performed in Indian currency at international location or transactions performed in Indian currency with merchants located in Indian but registered in foreign nation | 1% on international transaction performed in Indian currency at international location or transactions performed in Indian currency with merchants located in Indian but registered in foreign nation | 1% on international transaction performed in Indian currency at international location or transactions performed in Indian currency with merchants located in Indian but registered in foreign nation |

Benefits and Reclamation

Accrual of Vistara Points through Transactions

Each monetary transaction consummated through the medium of the Axis Vistara Platinum Credit Card effuses the accrual of Vistara Points within the purview of the cardholder. This burgeoning aggregation of points, particularly with respect to expenses tethered to expeditions, engenders an abundant reservoir amenable for subsequent redemption.

Adaptive Avenues for Reclamation

The cache of Vistara Points functions as a versatile currency, negotiable for the purposes of securing flight reservations, engendering hospitality havens, procuring merchandise, and sundry other sundry avails. The amplitude of options for reclamation guarantees card bearers the freedom to harmonize point usage with the mosaic of predilections and requisites that collectively shape their tapestry of preferences.

Travel Safeguard and Coverage

- Indemnity against Airborne Mishaps

An ensconced protection mechanism comes into play, characterized by indemnity against incidents of an aerial cataclysm. This safeguard functions as a financial sanctuary in the unfortunate eventuality of an adversity encountered during air travel.

- Accountability for Lost Card

The eventuality of card misplacement or larceny is contingently addressed through the shield of lost card accountability proffered by Axis Bank. This shelter curtails the fiscal liability borne by the cardholder vis-à-vis unauthorized transactions that may unfurl in the wake of the disappearance of the card.

Contactless Innovation and Safeguarding

- Ensured Transactions

The arsenal of the Axis Vistara Platinum Credit Card includes the armor of advanced security attributes, foremost among which is the deployment of EMV chip technology and PIN-based authentication. These multifarious layers of security collectively marshal safeguards that underpin the integrity of transactions.

- Touchless Transactions

In concordance with the zeitgeist of technological innovation, the card seamlessly accommodates transactions facilitated through contactless modes. This virtuosity enables card bearers to consummate instantaneous and fortified transactions by merely establishing contact between the card and a compatible point of transaction.

Strategies for Maximizing Card Potential

- Strategic Expenditure

Optimally harnessing the potential latent within the Axis Vistara Platinum Credit Card mandates a conscientious orchestration of financial allocation. Concenter your fiscal outlay upon categories that proffer augmented rewards while resonating with the distinctive tapestry of your lifestyle.

- Punctual Disbursement

Conscientiously disbursing credit dues within the stipulated timelines espouses twofold dividends—steering clear of the quagmire of exorbitant interest levies while concurrently nurturing the sustenance of a credit score that emanates robust health.

Conclusion

The Axis Vistara Platinum Credit Card unfurls as a portal unto an ethereal universe abounding in opulence, facilitation, and bounteous rewards. Whether your trajectory involves the recurrent traversing of diverse locales or you relish the embrace of exclusive prerogatives, this credit card unfurls an expansive panoply of privileges engineered to dovetail harmoniously with your aspirations. From the haven of lounge ingress to the accolade of milestone bonuses, its very essence is hewn to transmute the alchemy of your experiences while transfiguring your financial journey into a symphony of enrichment.

Frequently Asked Questions

- Can I procure the Axis Vistara Platinum Credit Card through online channels? Absolutely, you can seamlessly navigate the realms of card acquisition through the digital vestibule furnished by Axis Bank’s online interface.

- Does the inaugural year absolve the imposition of the annual fee? The yoke of the annual fee may very well be relinquished if your financial constitution predicates the attainment of the prescribed parameters.

- How can I garner Vistara Points? Vistara Points can be accrued in consonance with every monetary transaction executed through the conduit of the credit card.

- Are Vistara Points redeemable for liquid currency? Vistara Points are inherently designed for transmutation into vouchers for flight reservations, sojourns at lodgings, and an assortment of other alluring benefits, though they eschew transformability into liquid cash.

- Does the amplitude of lounge access privileges impose any circumscriptions? The extent and compass of the privileges extended for lounge access are contingent upon the tenets enshrined within the card’s terms and conditions and those underpinning the airline’s prerogatives.

-

Why Niva Bupa ReAssure 2.0 Platinum+ Is the Ultimate Health Insurance Plan for Your Family

Niva Bupa ReAssure 2.0 Platinum+ health insurance: unlimited restoration, no room rent limits, and wellness rewards. Compare benefits,

-

Trading Support and Resistance: Sensex, Nifty50, Bank Nifty Prediction for Tuesday, June 24, 2025

Discover expert insights on Sensex, Nifty50, and Bank Nifty predictions for June 24, 2025. Explore support and resistance

-

Stocks to Watch on June 23, 2025: HDFC Bank, Reliance, and More!

The Indian stock market outlook for June 23, 2025, with Nifty50, Bank Nifty, and Sensex predictions. Explore support,

-

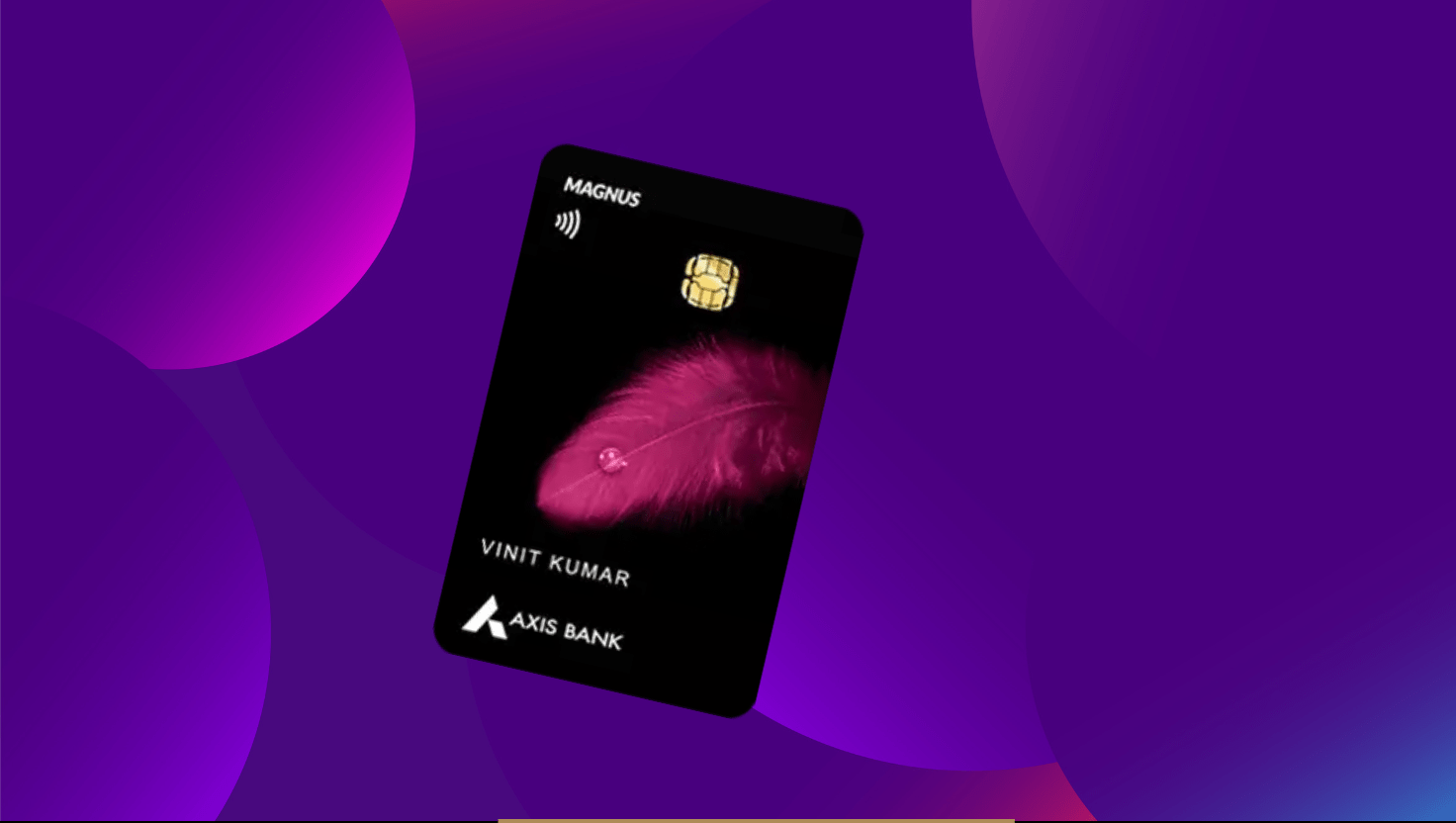

What Makes the Axis Magnus Credit Card a Premium Powerhouse?

The Axis Bank Magnus Credit Card is a premium credit card designed for high-net-worth individuals who prioritize luxury,

-

Banking Fee War: Why SBI Charges More Than Private Banks Like HDFC & ICICI

Why does SBI charge higher fees than ICICI and HDFC? Compare banking charges, hidden costs, and service fees