Bank of Baroda’s bob LITE Current Account, the 2025 game-changer for India’s entrepreneurs! With zero minimum balance, free Soundbox QR, and collateral-free overdraft, it fuels startups and SMEs in a $3.7 trillion economy. Why settle for costly banking? Unlock digital payment tools and transparent fees to skyrocket growth. As UPI transactions hit 150 billion (NPCI), bob LITE’s inclusive eligibility empowers all.

In India’s business ecosystem, where startups bloom, professionals pivot, and enterprises scale at lightning speed, a banking solution that matches this dynamism is no longer a luxury—it’s a necessity. Enter Bank of Baroda’s bob LITE Current Account, a revolutionary financial tool that’s redefining business banking in 2025. Tailored for new-age entrepreneurs, small businesses, and professionals, this account blends zero minimum balance flexibility with cutting-edge features to fuel growth, streamline operations, and empower dreams. But what makes bob LITE the talk of India’s financial corridors?

Why bob LITE Current Account Commands Attention

A current account that liberates you from the shackles of maintaining a Monthly Average Balance (MAB), letting you channel every rupee into your business’s growth. The bob LITE Current Account does exactly that, abolishing MAB requirements to offer liquidity freedom—a boon for startups, SMEs, and professionals navigating India’s competitive markets. This isn’t just a banking product; it’s a financial revolution designed to align with India’s entrepreneurial surge, where over 1.5 lakh startups are registered as of 2025, contributing to a $3.7 trillion economy (Source: DPIIT, 2025).

But the suspense lies in its cost-saving twist: no monthly charges for POS/MPOS and Soundbox QR for businesses meeting minimal transaction thresholds. This makes digital payments not just affordable but effortless, positioning bob LITE as a catalyst for India’s cashless revolution. With UPI transactions crossing 150 billion annually in 2025 (Source: NPCI), bob LITE ensures businesses stay ahead in the digital payment race without burning a hole in their pockets. Curious about what else this account offers? Let’s dive into its standout features.

Insightful Features That Redefine Business Banking

The bob LITE Current Account isn’t just about banking; it’s about empowering businesses with tools that blend tradition with futuristic innovation. Here’s a snapshot of its pivotal features, each crafted to elevate your financial game:

- Collateral-Free Overdraft (OD) Limit: Need instant working capital? Access funds without pledging assets, ensuring cash flow stability during market fluctuations. In 2025, when 62% of SMEs cite cash flow as their top challenge (Source: FICCI), this feature is a lifeline.

- Free Soundbox QR: Collect payments seamlessly with a 100% waiver on monthly rental charges for one Soundbox QR, provided you hit ₹1 lakh in monthly transactions. This aligns with India’s push for digital payments, where QR-based transactions grew by 45% in 2024 (Source: RBI).

- VISA Vyapaar DI Debit Card: Boost purchasing power with high transaction limits and global acceptance, perfect for businesses expanding beyond borders.

- Free Credit Card (Subject to Eligibility): Enhance liquidity with a corporate credit card, offering flexibility for vendor payments and operational expenses.

- Standing Instructions within Bank: Automate fund transfers within Bank of Baroda at zero cost, streamlining recurring payments like salaries or rentals.

- bob World Internet Banking & Payment Gateway: Manage accounts and accept payments via a state-of-the-art gateway supporting UPI, cards, and net banking—crucial in a market where e-commerce sales hit ₹12 lakh crore in 2025 (Source: IBEF).

- Baroda Cash Management Services (BCMS): Simplify bulk payments and collections with competitive rates, saving time and costs for businesses with high transaction volumes.

- Baroda Pay Point: Accept online and offline payments with low transaction fees, covering all modes under one platform, ideal for retail and service businesses.

These features aren’t just perks; they’re strategic tools designed to make your business agile, efficient, and future-ready. But who can tap into this financial powerhouse?

Trading Support, Resistance, Sensex, Nifty50, Bank Nifty: What to Expect from the Indian Stock Market on Tuesday, 08-04-2025

Analyze Indian Stock Market Trends On 18 September 2025: BSE Sensex, NSE Nifty 50, Nifty Bank

Aurobindo Pharma vs. Industry Peers: Financial Analysis, Market Position, and Strategic Initiatives

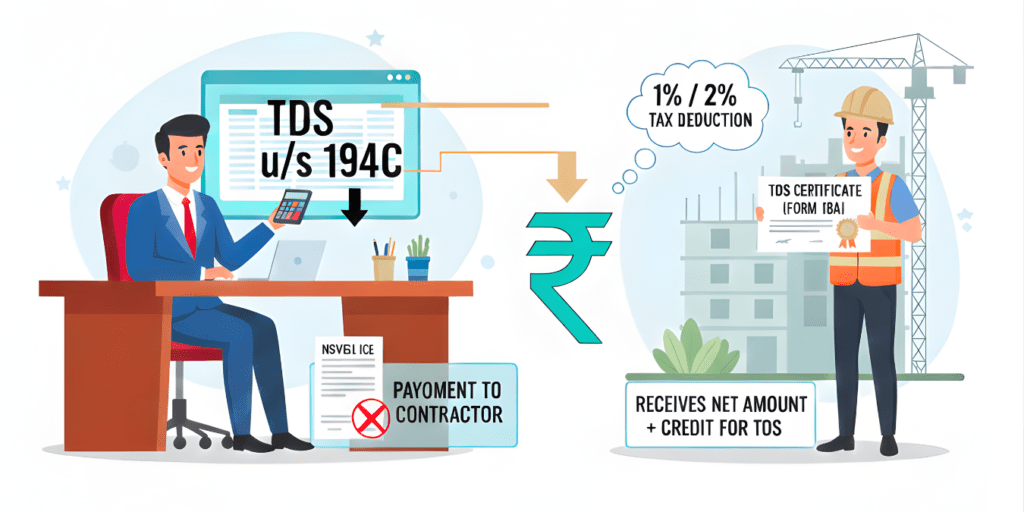

TDS 194C Alert: Contractor Payment Could Silently Block 30% of Your Business Expense

Striking Eligibility Criteria – Inclusivity at Its Core

Bank of Baroda’s bob LITE Current Account is a beacon of inclusivity, welcoming a diverse range of entities to fuel their financial aspirations. Eligible account holders include:

- Individuals (including minors aged 14+)

- Businesses and Professionals (sole proprietorships, partnerships, HUFs)

- Registered and Un-registered Trusts, Societies, Associations

- Private and Public Limited Companies

- Government Bodies, Panchayat Samities, Charitable Trusts

- Banks and Financial Institutions

This broad eligibility ensures that whether you’re a solo entrepreneur in Bengaluru, a women-led startup in Delhi, or a government body in rural India, bob LITE has your back. In 2025, with women entrepreneurs leading 20% of India’s startups (Source: NASSCOM), accounts like bob LITE are pivotal in fostering inclusive growth. But how do you get started?

Simplified Documentation Matrix for Seamless Onboarding

Opening a bob LITE Current Account is as smooth as India’s digital banking revolution. Bank of Baroda’s streamlined documentation process caters to diverse business types while ensuring compliance with RBI mandates. Here’s what you need:

- Companies: Certificate of Incorporation, PAN, Board Resolutions, Authorized Signatories’ KYC (Aadhaar, PAN, passport-size photos).

- Proprietorships: Registration certificates, GSTIN, utility bills, PAN, and identity proofs.

- Partnerships: Partnership Deed, PAN, Registration Certificates, KYC of partners.

- Trusts and Societies: Trust Deed, Registration Certificates, KYC of authorized persons.

- Individuals and HUFs: PAN, Aadhaar, Declarations, and identity proofs.

The process is digital-first, with Video KYC options reducing onboarding time to under 48 hours in 2025 (Source: Bank of Baroda). This efficiency ensures you’re not bogged down by paperwork but are ready to transact swiftly. Ready for the cost breakdown?

Transparent Fees & Charges Aligned with Business Needs

Bank of Baroda’s bob LITE Current Account is a masterclass in affordability, with a fee structure designed to minimize financial strain:

- Monthly Average Balance (MAB): Zero, with no penalties for non-maintenance.

- Soundbox QR Charges: 100% waiver on monthly rental for one Soundbox, subject to ₹1 lakh monthly transactions.

- Cash Deposit Charges: Free up to ₹50,000 or 10 packets (1,000 notes) daily at base/non-base branches; beyond that, ₹10 per packet (max ₹10,000/day).

- Cheque Book: First 50 leaves free; subsequent leaves at ₹5 each.

- Cash Withdrawals: 5 free transactions monthly at base/non-base branches (excluding ATMs); ₹150 per transaction thereafter.

- VISA Vyapaar Debit Card: Issued free, with high transaction limits.

- Account Closure/Transfer: Free transfers; closure within one year at ₹800 + GST.

- Standing Instructions: Free within Bank of Baroda; ₹50 + postage for external transactions.

- Outstation Cheque Credit: Up to ₹20,000 instantly for accounts with 6 months of satisfactory transactions.

This transparent fee model ensures startups and SMEs can focus on growth without hidden costs eating into profits. In 2025, when 73% of Indian businesses prioritize cost efficiency (Source: PwC India), bob LITE stands out as a budget-friendly ally.

A Banking Experience That Matches India’s Growth Pulse

India’s business landscape is a vibrant tapestry of innovation, with MSMEs contributing 30% to GDP and employing over 11 crore people (Source: MSME Ministry, 2025). The bob LITE Current Account is designed to sync with this growth pulse, offering digital agility, cost-effective solutions, and unmatched flexibility. Whether it’s leveraging the Baroda Payment Gateway for seamless e-commerce transactions or using BCMS for bulk payments, bob LITE ensures businesses stay ahead in a market where digital transactions are projected to hit ₹1,500 trillion by 2026 (Source: RBI).

The account’s zero-balance feature removes entry barriers, while tools like the VISA Vyapaar Debit Card and free credit card (subject to eligibility) empower businesses to scale without liquidity constraints. For professionals like doctors, CAs, or architects, the collateral-free overdraft facility is a game-changer, offering instant funds to seize time-sensitive opportunities. And with bob World Internet Banking, you can manage finances from anywhere, anytime—a must in India’s 24/7 business environment.

The Emotional Hook: Empowering Dreams, One Transaction at a Time

Picture this: A young entrepreneur in Mumbai launches her e-commerce startup, juggling vendor payments and inventory costs. Traditional banking fees drain her resources, and maintaining a minimum balance feels like a penalty for dreaming big. Enter bob LITE, with its zero MAB and free digital payment tools, allowing her to redirect funds to marketing and product development. Within months, her business doubles its revenue, all because her bank didn’t clip her wings but gave her room to soar. This is the emotional resonance of bob LITE—empowering dreams in a nation where every third Indian aspires to be an entrepreneur (Source: EY India, 2025).

Stunning Suggestions to Maximize bob LITE’s Potential

To make the most of bob LITE in 2025, consider these actionable tips:

- Leverage Digital Payments: Use the free Soundbox QR to tap into India’s booming digital payment market, saving on transaction fees.

- Automate Finances: Set up standing instructions for recurring payments to save time and ensure timely transactions.

- Utilize Overdraft Wisely: Use the collateral-free OD for short-term needs like inventory purchases, avoiding high-interest loans.

- Go Global with VISA Vyapaar: Expand your business internationally with the card’s global acceptance and high limits.

- Streamline with BCMS: For businesses with high transaction volumes, use Baroda Cash Management Services to cut costs and boost efficiency.

These strategies can transform bob LITE from a mere account into a growth engine for your business.

The Suspenseful Twist: Why bob LITE Outshines the Rest

Here’s the twist: While other banks impose hefty MAB penalties or charge for digital payment tools, bob LITE flips the script with zero-balance freedom and waived charges. In 2025, when competitors like HDFC and ICICI still mandate minimum balances of ₹10,000–₹25,000 for current accounts, bob LITE’s no-MAB policy is a disruptive force. Add to that its inclusive eligibility and tailored features for startups, women entrepreneurs, and large enterprises, and you have a banking solution that’s not just keeping up but setting the pace.

Shareable Hooks for Viral Impact

- “Zero Balance, Infinite Possibilities”: Share how bob LITE’s no-MAB policy is empowering Indian entrepreneurs to dream bigger.

- “The Future of Business Banking is Here”: Highlight bob LITE’s digital tools like Soundbox QR and BCMS that make transactions a breeze.

- “From Startups to SMEs: One Account, Endless Opportunities”: Spread the word about bob LITE’s inclusive eligibility for all business types.

- “Save More, Grow More”: Post about the waived fees and free services that make bob LITE a cost-effective choice in 2025.

Final Thought

In India’s thriving 2025 business landscape, the bob LITE Current Account isn’t just a banking product—it’s a partner in progress. By eliminating minimum balance hurdles and offering a suite of digital-first, cost-effective tools, it empowers entrepreneurs, professionals, and organizations to chase their ambitions without financial friction. As India races toward a $5 trillion economy, bob LITE stands as a beacon of innovation, inclusivity, and opportunity. Open your account today and let your business soar—because with bob LITE, the only limit is your vision.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.