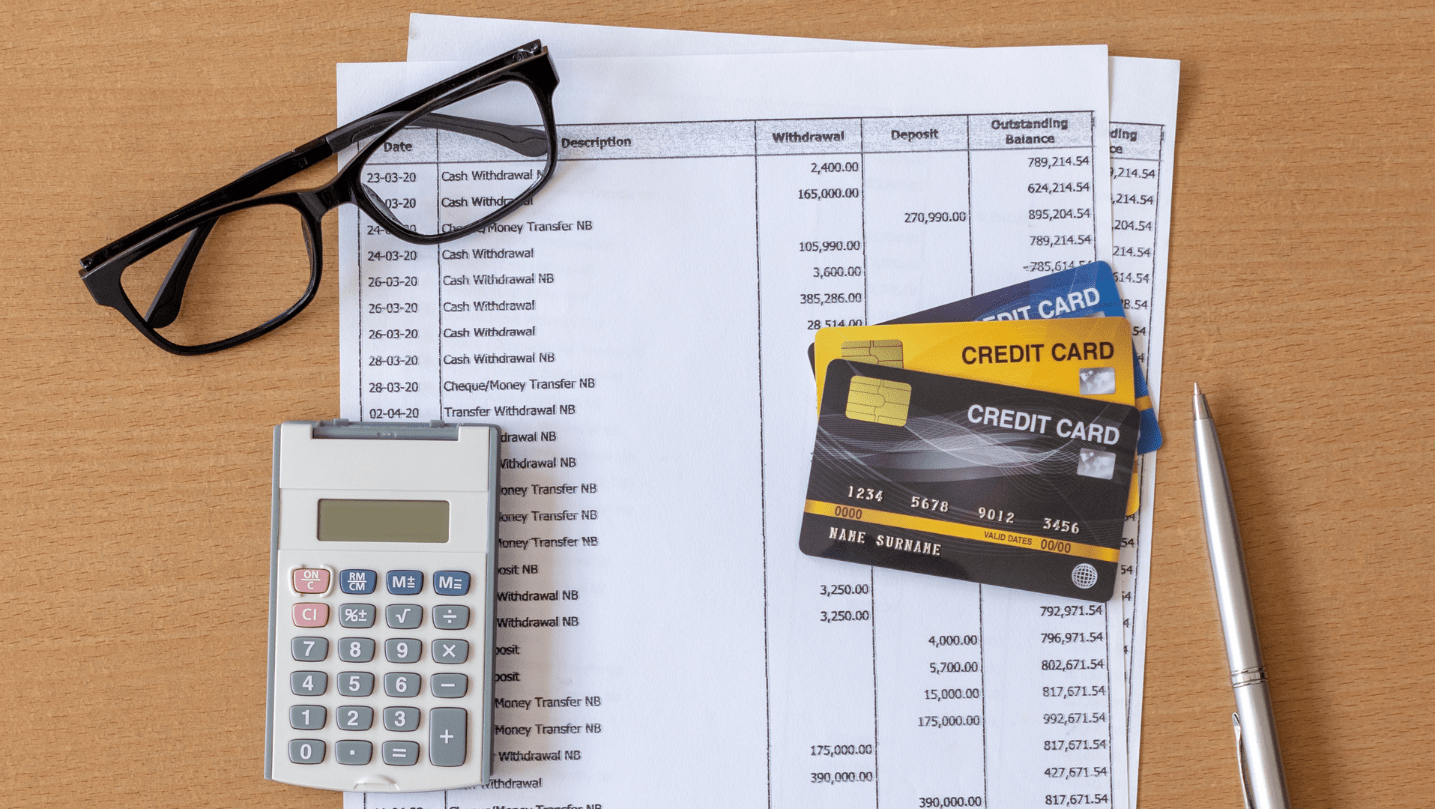

“Worried about an unauthorized charge on your credit card? Learn your liability as a cardholder, fraud protection rights, and how to avoid paying for fraudulent transactions. Know the law and act fast to secure your finances!”

Credit cards have become an indispensable tool for financial transactions, offering convenience, rewards, and flexibility. However, with the rise in online transactions, unauthorized charges on credit cards have emerged as a significant concern for Indian cardholders. If you’ve ever noticed an unfamiliar transaction on your credit card statement, you’ve likely wondered: What is my liability as an Indian credit card holder? This comprehensive guide explores the latest regulations, your rights, and actionable steps to protect yourself from fraudulent charges.

Understanding Unauthorized Credit Card Charges

An unauthorized credit card charge refers to any transaction made without the cardholder’s consent. This could result from credit card fraud, such as:

- Physical theft: Someone steals your card and uses it for purchases.

- Skimming: Fraudsters copy your card details using electronic devices.

- Phishing: Scammers trick you into sharing card information through fake emails or websites.

- Data breaches: Hackers access your card details from unsecured databases.

- Online fraud: Unauthorized transactions on international or domestic websites.

According to the Reserve Bank of India (RBI), credit card fraud in India has been on the rise, with over 1.2 million cases reported in 2023 alone. The Federal Trade Commission (FTC) notes that globally, credit card fraud accounts for billions in losses annually, underscoring the need for robust consumer protections.

What Is My Liability as an Indian Credit Card Holder?

The good news for Indian credit card holders is that the RBI has implemented stringent guidelines to protect consumers from unauthorized transactions. These regulations, outlined in the RBI Circular DBR.No.Leg.BC.78/09.07.005/2017-18, limit your liability based on how quickly you report the fraud. Let’s break it down:

1. Zero Liability

You face zero liability in the following scenarios:

- The unauthorized transaction occurs due to negligence by the bank or a third party (e.g., a data breach at a merchant’s end).

- You report the fraud within three working days of noticing the unauthorized charge.

- The fraud involves a transaction where the cardholder’s identity wasn’t compromised (e.g., the card wasn’t physically stolen, but the number was used).

For example, if a hacker uses your card details for an online purchase and you notify your bank within three days, you won’t be liable for any amount. The bank must reverse the charge within 10 working days or provide a temporary credit until the investigation is complete.

2. Limited Liability

If you report the unauthorized transaction between 4 and 7 working days, your liability is capped based on the type of account or transaction:

- Basic savings accounts: Maximum liability of ₹5,000.

- Other accounts: Up to ₹10,000.

- High-value accounts or credit cards: Up to ₹25,000 or the transaction value, whichever is lower.

3. Full Liability

If you fail to report the unauthorized charge beyond 7 working days, your liability depends on the bank’s board-approved policy. In some cases, you may be responsible for the entire amount, especially if the bank proves negligence on your part (e.g., sharing your PIN or OTP).

Exceptions

- If the fraud results from gross negligence (e.g., willingly sharing your card details with a scammer), you may bear full liability, regardless of when you report.

- Transactions requiring One-Time Passwords (OTPs) are generally secure, as OTPs are linked to your registered mobile number. If an OTP was used, the bank may argue that you authorized the transaction unless you can prove otherwise.

Latest Data: In 2024, the RBI reported that 95% of unauthorized transaction disputes were resolved in favor of cardholders when reported within three days, highlighting the importance of prompt action.

Key Regulations Protecting Indian Credit Card Holders

The RBI has introduced several measures to safeguard cardholders, ensuring banks bear the brunt of unauthorized charges in most cases. Here are the key regulations:

1. RBI’s Customer Protection Guidelines

The RBI’s 2017 circular on limiting customer liability emphasizes:

- Banks must proactively monitor for suspicious transactions.

- Cardholders are entitled to zero liability if the bank fails to secure its systems.

- Banks must resolve disputes within 90 days and provide temporary credits during investigations.

2. Mandatory SMS and Email Alerts

Since 2018, banks are required to send real-time SMS and email alerts for every credit card transaction, regardless of the amount. This ensures you can spot unauthorized charges immediately.

3. Two-Factor Authentication (2FA)

All online transactions in India require 2FA, typically involving an OTP sent to your registered mobile number. This reduces the risk of fraud, as scammers need access to your phone to complete transactions.

4. Zero Liability Policies by Card Networks

Major card networks like Visa, Mastercard, and RuPay offer zero liability protection for unauthorized transactions, provided you report promptly and maintain your account in good standing. For instance:

- Visa’s Zero Liability Policy guarantees no liability for fraudulent charges if reported within five business days.

- Mastercard India ensures cardholders aren’t held responsible for unauthorized online or offline transactions.

Steps to Take If You Spot an Unauthorized Charge

Discovering an unauthorized charge can be alarming, but swift action can minimize your liability and financial loss. Follow these steps:

Step 1: Block Your Card Immediately

- Call your bank’s 24/7 customer care number (listed on the back of your card or bank’s website) to block the card.

- Alternatively, use your bank’s mobile app or net banking portal to freeze the card. For example:

- SBI Credit Card: SMS “BLOCK XXXX” (last four digits of your card) to 5676791.

- HDFC Credit Card: Call 1800-258-6161 or block via net banking.

- Axis Bank: Call 1860-419-5555 or use the mobile app.

Step 2: Report the Fraud

- Notify your bank within three days to qualify for zero liability.

- Provide details like the transaction date, amount, and merchant name.

- Request a complaint reference number for tracking purposes.

Step 3: File a Written Complaint

- Send an email or written letter to the bank’s grievance redressal team, including:

- Your name and account number.

- Details of the unauthorized transaction.

- Date you noticed the fraud.

- Keep a copy of all correspondence.

Step 4: Monitor Your Account

- Check your credit card statements and online banking for additional suspicious activity.

- Update passwords and PINs to prevent further fraud.

Step 5: Escalate If Needed

- If the bank doesn’t resolve the issue within 90 days, approach the RBI Banking Ombudsman via the RBI website or by calling 14440.

- The Ombudsman resolves disputes free of cost and ensures fair treatment.

Pro Tip: Many banks, like ICICI and HDFC, offer instant card-blocking features on their apps, reducing the time it takes to secure your account.

How to Prevent Unauthorized Charges

Prevention is better than cure. Here are practical tips to protect your credit card from fraud:

1. Enable Transaction Alerts

- Register for SMS and email alerts to stay informed about every transaction.

- Monitor your account regularly via mobile apps or net banking.

2. Use Secure Websites

- Shop only on websites with “https://” and a padlock icon.

- Avoid saving card details on e-commerce platforms.

3. Be Wary of Phishing

- Don’t click on suspicious links or share OTPs with anyone.

- Verify emails claiming to be from your bank by contacting customer care directly.

4. Protect Your Card Details

- Never share your CVV, PIN, or OTP with anyone, including bank representatives.

- Use virtual cards for online transactions, offered by banks like SBI and HDFC.

5. Freeze Your Card When Not in Use

- Many banks allow you to temporarily disable your card via apps, preventing unauthorized use.

6. Check for Skimming Devices

- Inspect ATMs and POS terminals for tampered card readers before swiping.

Latest Trend: In 2025, tokenization is gaining traction in India, replacing card numbers with unique tokens for online transactions, significantly reducing fraud risks.

Case Studies: Real-Life Examples

Case 1: Phishing Scam

In 2024, Priya from Mumbai received an email claiming her HDFC credit card was compromised. The email prompted her to enter her card details on a fake website. After noticing a ₹50,000 charge, she reported it within two days. HDFC reversed the charge, citing zero liability, as Priya hadn’t shared her OTP.

Case 2: Delayed Reporting

Rahul from Delhi spotted a ₹20,000 unauthorized transaction but reported it after 10 days due to travel. His bank, ICICI, held him liable for ₹10,000, as per RBI guidelines for late reporting.

These cases highlight the importance of vigilance and timely action.

Role of Banks and Card Networks

Banks and card networks play a crucial role in combating fraud:

- Banks: Monitor transactions for anomalies using AI-based systems. For instance, SBI flagged 10,000 suspicious transactions in 2024, preventing losses.

- Card Networks: Visa, Mastercard, and RuPay invest in fraud detection technologies like 3D Secure and tokenization.

- Insurance: Some premium cards, like American Express Platinum, include fraud protection insurance, covering losses even in rare cases.

What Happens During a Fraud Investigation?

When you report an unauthorized charge, the bank:

- Blocks the card to prevent further misuse.

- Investigates the transaction, contacting merchants and card networks.

- Resolves the dispute within 90 days, either reversing the charge or explaining why it’s valid.

- Provides evidence if the claim is denied, which you can challenge.

If the bank rules against you, request detailed evidence (e.g., merchant details, IP addresses) and escalate to the Ombudsman if necessary.

Future of Credit Card Security in India

The RBI and banks are adopting advanced technologies to curb fraud:

- Biometric Authentication: Fingerprint and facial recognition for transactions.

- AI Fraud Detection: Real-time monitoring to flag suspicious activity.

- Tokenization: Replacing card details with encrypted tokens for online purchases.

By 2026, the RBI aims to make tokenization mandatory for all online transactions, potentially reducing fraud by 50%, according to industry estimates.

Liability as a Credit Card Holder

As a credit card holder, your liability for unauthorized charges is limited, thanks to the RBI’s robust regulations. By reporting fraud within three days, you can enjoy zero liability, ensuring minimal financial impact. Stay vigilant, enable transaction alerts, and use secure practices to protect your card. If fraud occurs, act swiftly to block your card, report the issue, and escalate unresolved disputes to the RBI Banking Ombudsman.

-

Why A Karnataka HC Judgment Could Make Government Officials Think Twice Before Relieving Officers Without A Next Posting

-

PM Kisan 22nd Installment Date 2026: Expected Release, Beneficiary Status & Complete Guide

-

Livspace Fires 1,000 Employees and Cofounder Quits: Inside India’s Most Shocking Startup Shakeup of 2026

-

US Supreme Court Strikes Down Trump’s Global Tariffs as ‘Unlawful’ — The 18% Tariff on India Is Now Illegal