The $68 Billion Rupee Trap: How Stablecoins Could Silently Hijack India's Financial Freedom

A silent invasion is underway: while Indians traded $300B in crypto this year, a “stable” asset is quietly threatening the Rupee’s dominance and UPI’s future. The $68 billion question isn’t just about savings—it’s about who really controls your money. Discover the hidden trap before the next Terra-style collapse strikes.

What if the very technology promising to revolutionize your cross-border payments could simultaneously weaponize your savings against the rupee? While India celebrates its ranking as the world’s #1 crypto adopter in 2025—tied with the United States—a shadowy financial instrument is quietly gaining ground that could undermine the Reserve Bank of India’s control over your money, trigger currency substitution at unprecedented scales, and turn India’s thriving UPI ecosystem into a relic of the past.

The culprit? Stablecoins—those seemingly innocuous digital dollars pegged to the US dollar that promise lightning-fast remittances and dirt-cheap transaction fees. Yet behind this facade of convenience lurks a systemic threat so potent that Europe’s top policymakers warn it could “threaten the entire financial system, not just in Europe, but the whole world”. For India’s 750 million smartphone users and tech-savvy Gen Z investors (who now comprise 37.6% of the nation’s crypto base), understanding this hidden danger isn’t just important—it’s financially existential.

The Invisible Dollar Invasion: Why Your Rupee Might Already Be Losing

Stablecoins have exploded to a staggering $251.7 billion market capitalization by mid-2025, with projections suggesting they could balloon to $500 billion—or even $2 trillion—within the next few years. Tether (USDT) alone commands $112 billion in circulation, representing 68% of the entire stablecoin market. For Indian users trading nearly $300 billion in digital assets between January and July 2025—an 80% year-on-year surge—stablecoins like USDT and USDC have become the go-to instruments for remittances and trading.

But here's the shocking reality financial authorities don't want you dwelling on: stablecoins enable $125 billion in annual remittances from India while cutting costs by nearly 90%, yet they simultaneously threaten "dollarization" and catastrophic capital flight. RBI Deputy Governor T. Rabi Sankar has explicitly warned that stablecoins risk "currency substitution," potentially fragmenting India's meticulously built UPI payment infrastructure that processes billions of transactions monthly. Chief Economic Adviser V. Anantha Nageswaran didn't mince words: "The alarm bells are ringing".

The Bank for International Settlements (BIS) issued a stark 2025 warning about stablecoins undermining monetary sovereignty, creating transparency issues, and accelerating capital exodus from emerging economies like India. When foreign currency-denominated stablecoins gain widespread adoption, they don't just offer payment alternatives—they erode the effectiveness of existing foreign exchange regulations and weaken central banks' grip on monetary policy transmission.

The Terra Collapse Blueprint: A $500 Billion Lesson India Can't Afford to Ignore

Remember May 2022? Probably not, if you weren't tracking crypto markets. But what happened then should terrify every Indian investor dabbling in stablecoins today. Terra's algorithmic stablecoin UST and its sister token Luna wiped out an estimated $500 billion from cryptocurrency markets in a single week—the first major "run" in crypto history.

Unlike Tether or Circle's fiat-backed stablecoins, UST relied on algorithmic mechanisms and smart contracts to maintain its $1 peg. When confidence evaporated, UST holders raced for exits, triggering a "death spiral" that printed billions of Luna tokens, flooding the market and driving values to essentially zero despite Luna Foundation deploying $1.5 billion in Bitcoin reserves. Over $30 billion in value evaporated within seven days.

The Terra catastrophe exposed stablecoins' fundamental vulnerability: the risk of confidence runs that can propagate to broader crypto markets and traditional financial sectors. Network science analysis revealed how dependency structures among 61 major cryptocurrencies shifted dramatically during the crash, creating contagion channels through financial sector exposures, wealth effects, and confidence shocks.

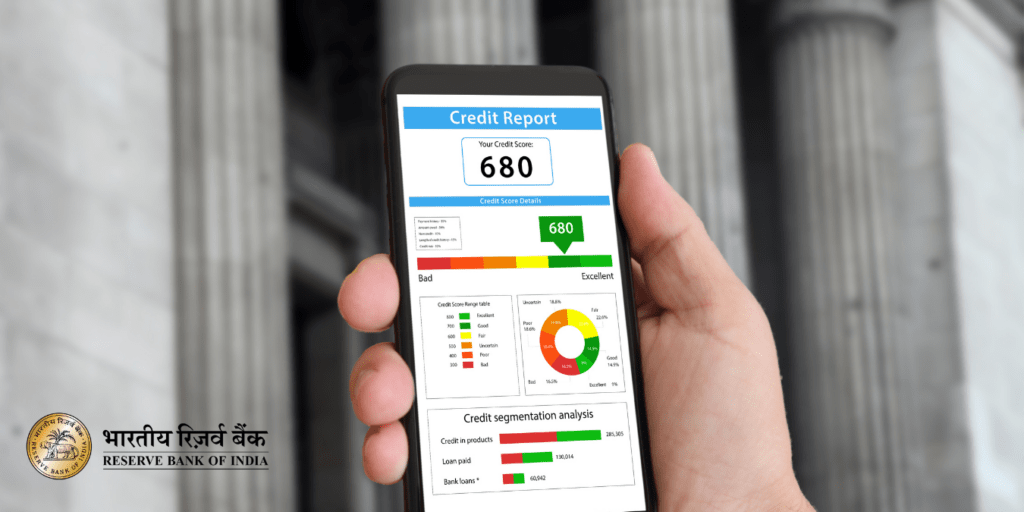

For India—where retail crypto transactions surged 125% between January-September 2024 and the same period in 2025—the Terra lesson is chilling. Even fiat-backed stablecoins face reserve management risks, credit and liquidity vulnerabilities, and the danger of fire sales if sudden redemptions force issuers to dump backing assets. The BIS has documented "substantial deviations from par" in many stablecoins, highlighting the "fragility of their peg".

India's $68 Billion Dilemma: Innovation vs. Sovereignty

Here's where the Indian narrative gets devastatingly complex. According to Aishwary Gupta, Global Head of Payments at Polygon Labs, integrating stablecoins into India's international payment systems could save the country a staggering $68 billion annually by slashing transaction costs and accelerating cross-border flows. For a nation where remittances constitute a significant GDP component, this represents transformative economic potential.

Yet regulatory inaction and interministerial conflicts have left India paralyzed while competitors surge ahead. The United States passed the GENIUS Act in 2025, mandating 1:1 cash or Treasury-backed stablecoins with monthly transparency reports and dual federal-state supervision, positioning itself to capture $200 billion in market potential. Singapore and Hong Kong implemented licensing frameworks, attracting stablecoin innovation and institutional capital.

Meanwhile, India's government confirmed in September 2025 its reluctance to pass comprehensive crypto legislation, citing systemic-risk concerns. Crypto remains legal to hold and trade but barred for payments—a regulatory gray zone that 93% of users find frustratingly unclear and 84% view as punitively taxed. The 2025 Budget expanded scrutiny to undisclosed crypto income, with exchanges mandated to begin OECD-aligned transaction reporting by 2027.

The RBI firmly opposes private stablecoins, arguing they threaten the rupee's dominance and could fragment the payments landscape dominated by UPI. Currently, stablecoins are treated as Virtual Digital Assets (VDAs), taxed and monitored under AML frameworks with no separate licensing regime. India's tax structure for digital assets remains among the strictest worldwide, driving many traders offshore.

The Dollarization Dagger: How Stablecoins Could Weaponize Your Savings

For emerging economies, the proliferation of dollar-linked stablecoins represents more than monetary risk—it's strategic dependency. The widespread use of USD stablecoins could entrench American financial dominance and make the global system more vulnerable to US regulatory or sanctions policies.

India's advantage lies in UPI, which processes billions of transactions seamlessly. Yet even UPI cannot fully shield India from external financial flows driven by global stablecoins. Without regulatory guardrails, India faces unwanted capital movements and cross-border transaction volatility. The widespread adoption of stablecoins might lead to fragmentation in national payment systems, potentially undermining UPI—the cornerstone of India's digital payment ecosystem.

The IMF warns that stablecoins functioning well in stable times become vulnerable to "de-pegging" and sudden runs under stress, threatening financial stability through growing interconnections with non-bank financial institutions. The widespread use of dollar-pegged stablecoins could undermine the RBI's ongoing e-Rupee (CBDC) pilot, threatening India's monetary sovereignty and creating deposit competition that weakens the banking system.

European asset manager Amundi raised concerns that a boom in dollar-backed stablecoins following the US GENIUS Act could trigger major money flow shifts that destabilize global payment systems. JPMorgan forecasts stablecoin circulation could double to $500 billion, potentially reaching $2 trillion, forcing increased purchasing of US Treasury bonds—beneficial for America's budget deficit but creating challenges for other nations.

Smart Contract Bombs and Oracle Manipulation: The Technical Landmines

Beyond macroeconomic threats, stablecoins harbor technical vulnerabilities that could detonate investor portfolios instantly. Access control flaws allow unauthorized users to mint tokens, change parameters, or trigger emergency functions—posing major stability risks. Oracle manipulation attacks feed false price data to smart contracts, leading to incorrect liquidations, unfair arbitrage, or disruption of algorithmic stablecoin mechanisms.

Crypto-backed stablecoins contend with collateral volatility and liquidation mechanisms that can trigger under-collateralization during extreme market swings. Even conservative reserve management strategies for fiat-backed stablecoins may not cover operational costs, while aggressive investments add credit and liquidity risks.

The regulatory risk landscape compounds these dangers. Classification uncertainty means the same stablecoin may be treated as a payment instrument, security, or deposit across different countries, triggering conflicting requirements. Extraterritorial regulations add complexity—US rules may apply to transactions involving US persons while EU rules may apply to stablecoins offered to EU residents regardless of issuer location.

Actionable Survival Strategies for Indian Investors and Policymakers

For Individual Investors:

Diversify Beyond Dollar-Pegged Stablecoins: Don't concentrate holdings in USDT or USDC. Explore INR-pegged tokens when regulated options emerge, and maintain significant exposure to traditional banking instruments.

Verify Reserve Transparency: Only use stablecoins from issuers providing monthly audited reports showing 1:1 backing with liquid assets. Avoid algorithmic stablecoins entirely after the Terra disaster.

Understand Tax Implications: India's 30% tax on crypto gains (plus 1% TDS on transactions) makes stablecoin trading expensive—factor this into your cost-benefit analysis before chasing remittance savings.

Monitor Regulatory Developments: Stay updated on RBI's e-Rupee pilots and potential stablecoin licensing frameworks through official channels, as rapid policy shifts could impact holdings overnight.

For Policymakers:

Establish Tiered Regulatory Frameworks: Like the GENIUS Act, India should create clear licensing requirements, mandate reserve audits, and implement consumer protection mechanisms. The principle of "same risks, same regulation" requires tailored approaches addressing stablecoins' specific features.

Launch Cross-Border Stablecoin Pilots: The RBI should allow banks and NBFCs to test stablecoin use in remittance corridors under Regulatory Sandbox programs, monitoring costs, speed, and transparency.

Promote Rupee-Denominated Alternatives: Rather than banning stablecoins outright, encourage INR-pegged stablecoin development backed by government securities—coexisting with CBDC while serving different purposes. Tokenized rupees can handle domestic flows while INR stablecoins on public blockchains power cross-border trade.

Coordinate International Standards: Work through the Financial Stability Board (FSB) and G20 to address cross-border stablecoin flows, preventing regulatory arbitrage. Partner with Singapore and UAE to create regional payment corridors using rupee or CBDC frameworks that promote financial multipolarity.

The Verdict: Innovation Without Surrender

India stands at a financial crossroads. The country's grassroots crypto adoption—driven by 750 million smartphone users, some of the world's lowest mobile data costs, and a tech-savvy young population—has created unstoppable momentum. Between January and July 2025 alone, Indians traded $300 billion in digital assets, with stablecoins exploding in popularity for remittances and trading.

The $68 billion annual savings potential from stablecoin-enabled cross-border payments represents genuine economic transformation. Yet the risks are equally transformative: monetary sovereignty erosion, UPI fragmentation, banking system weakening, capital flight acceleration, and exposure to confidence runs that could trigger contagion across financial markets.

The solution isn't prohibition—it's intelligent regulation. As RBI Governor highlighted, India needs coordinated frameworks spanning disclosure norms, reserve verification, and redemption mechanisms before stablecoins become mainstream. The RBI, SEBI, and finance ministry must synchronize efforts, learning from both the US GENIUS Act's clarity and the EU's MiCA framework that limits USD stablecoin volumes while encouraging euro-denominated alternatives.

Central Bank Digital Currencies and stablecoins need not be competitors—they can serve complementary roles, with CBDCs handling regulated domestic flows and INR stablecoins enabling programmable cross-border payments. The key is establishing legal clarity that prevents misuse, fosters trust, and protects both individual consumers and systemic stability.

The Future Shock You Can't Ignore

As global stablecoin market capitalization races toward potential $2 trillion levels and India continues leading worldwide crypto adoption, the next 12-24 months will determine whether the rupee remains master of its domain or becomes a secondary currency in its own economy. The Financial Stability Board warns that stablecoins' linkages with traditional finance are growing rapidly, raising policy challenges from preserving financial integrity to mitigating stability risks.

Will India's policymakers move beyond interministerial infighting to craft world-leading regulatory frameworks that capture stablecoins' $68 billion opportunity while safeguarding monetary sovereignty? Or will regulatory paralysis surrender India's fintech leadership to Singapore, Hong Kong, and the United States—leaving 750 million Indian smartphone users vulnerable to the next Terra-style collapse? The alarm bells are ringing. The question is: are we listening?