Introduction

Aditya Birla Finance offers a versatile personal loan solution designed to cater to your diverse financial needs. Whether you’re planning a dream wedding, renovating your home, managing medical expenses, or consolidating debt, Aditya Birla’s personal loan provides the financial support you need with ease and convenience.

With loan amounts up to ₹50 lakhs, competitive interest rates, and flexible repayment options extending up to 7 years, Aditya Birla Finance ensures that you can achieve your goals without financial strain. The application process is straightforward, requiring minimal documentation and no collateral, making it accessible and hassle-free.

Experience quick disbursal and dedicated customer support, ensuring that your financial journey is smooth and stress-free. Trust Aditya Birla Finance to be your reliable partner in fulfilling your financial aspirations.

Key Features

Aditya Birla Finance offers a personal loan that is designed to meet a wide range of financial needs with flexibility and convenience. Here are the key features of this loan:

- High Loan Amount: You can avail a loan amount of up to ₹50 lakhs, making it suitable for significant expenses such as weddings, home renovations, or medical emergencies.

- Competitive Interest Rates: The loan comes with attractive interest rates that remain fixed throughout the tenure, ensuring predictable and manageable monthly payments.

- Flexible Repayment Tenure: Borrowers can choose a repayment period ranging from 12 to 84 months (1 to 7 years), allowing you to select a tenure that best fits your financial situation and repayment capacity.

- No Collateral Required: This is an unsecured loan, meaning you do not need to provide any security or collateral to avail the loan. This makes the process simpler and faster.

- Quick Disbursal: The loan application process is streamlined for quick approval and disbursal, ensuring that you get the funds when you need them the most.

- Minimal Documentation: The documentation process is straightforward, requiring basic documents such as identity proof, address proof, income proof, and bank statements. This reduces the hassle and speeds up the approval process.

- Easy Application Process: You can apply for the loan online through the Aditya Birla Finance website. The online application process is user-friendly and can be completed in a few simple steps.

- Customer Support: Aditya Birla Finance provides dedicated customer support to assist you throughout the loan application and repayment process. You can reach out to their customer care for any queries or assistance.

- Prepayment and Foreclosure: The loan offers the flexibility of prepayment and foreclosure options, allowing you to repay the loan ahead of schedule if your financial situation permits.

These features make Aditya Birla Personal Loan a reliable and convenient option for managing your financial needs effectively.

- Diesel Prices Surge in India: Hormuz Halt Puts Spotlight on Reserves and Russian Supplies

- Indian Stock Market Trends: Volatility Signals Big Opportunities Ahead?

- MacBook Neo A18 Pro Processor Benchmarks: How It Handles Apple Intelligence and Multitasking on 8GB RAM

- Iran-Israel Conflict Sent Gold to ₹1.71 Lakh/10g — Here’s What Happens to the Price If Tensions Ease

- Groww and Zerodha’s Kamath Brothers Just Bet ₹1,240 Crore on MSEI — But Can It Survive Against NSE’s 90% Market Stranglehold?

Eligibility Criteria for Aditya Birla Personal Loan

Aditya Birla Finance offers personal loans with straightforward eligibility criteria, making it accessible for a wide range of applicants. Here are the detailed eligibility requirements:

- Nationality: Applicants must be Indian citizens.

- Age: The age criteria for applying for a personal loan range from 23 to 60 years. This ensures that both young professionals and those nearing retirement can apply, provided they meet other criteria.

- Employment Status: The loan is available to both salaried and self-employed individuals. Salaried individuals should have a stable job with a reputable organization, while self-employed individuals should have a consistent income source.

- Income: A minimum monthly income requirement is set to ensure the applicant can manage the loan repayments. For salaried individuals, the minimum monthly income should be ₹45,000. This threshold helps in assessing the repayment capacity of the borrower.

- Work Experience: Salaried applicants should have at least 2-5 years of work experience. This demonstrates job stability and a steady income flow, which are crucial for loan approval.

- Credit Score: A good credit score is essential. While the exact score requirement may vary, a higher credit score increases the chances of loan approval and may also result in better interest rates.

- Documentation: Applicants need to provide essential documents such as identity proof (Aadhaar card, passport, PAN card), address proof (utility bills, rental agreement), income proof (salary slips, bank statements), and employment proof (appointment letter, employment certificate).

- Additional Criteria: Depending on the applicant’s profile, additional documents or criteria may be required. For instance, self-employed individuals might need to provide business continuity proof and financial statements.

By meeting these eligibility criteria, applicants can ensure a smoother and quicker loan approval process. Aditya Birla Finance aims to make personal loans accessible while maintaining a robust assessment to ensure responsible lending.

Purposes to meet your financial needs

Aditya Birla Finance offers personal loans that can be used for a variety of purposes to meet your financial needs. Here are some common purposes for which you can use an Aditya Birla personal loan:

- Medical Emergencies: Cover unexpected medical expenses, including hospital bills, surgeries, and treatments.

- Home Renovation: Finance home improvement projects such as renovations, repairs, and upgrades to enhance your living space.

- Wedding Expenses: Manage the costs associated with weddings, including venue booking, catering, and other related expenses.

- Education: Fund your children’s education expenses, including tuition fees, books, and other educational materials.

- Travel: Plan and finance your dream vacation or travel for personal or professional reasons.

- Purchase of Consumer Durables: Buy household or electronic goods such as appliances, gadgets, and furniture.

- Debt Consolidation: Consolidate multiple debts into a single loan to simplify repayments and potentially reduce interest costs.

- Other Personal Needs: Address any other immediate personal financial requirements that may arise.

These flexible loan options ensure that you can use the funds for a wide range of purposes, making it easier to manage your finances and achieve your goals.

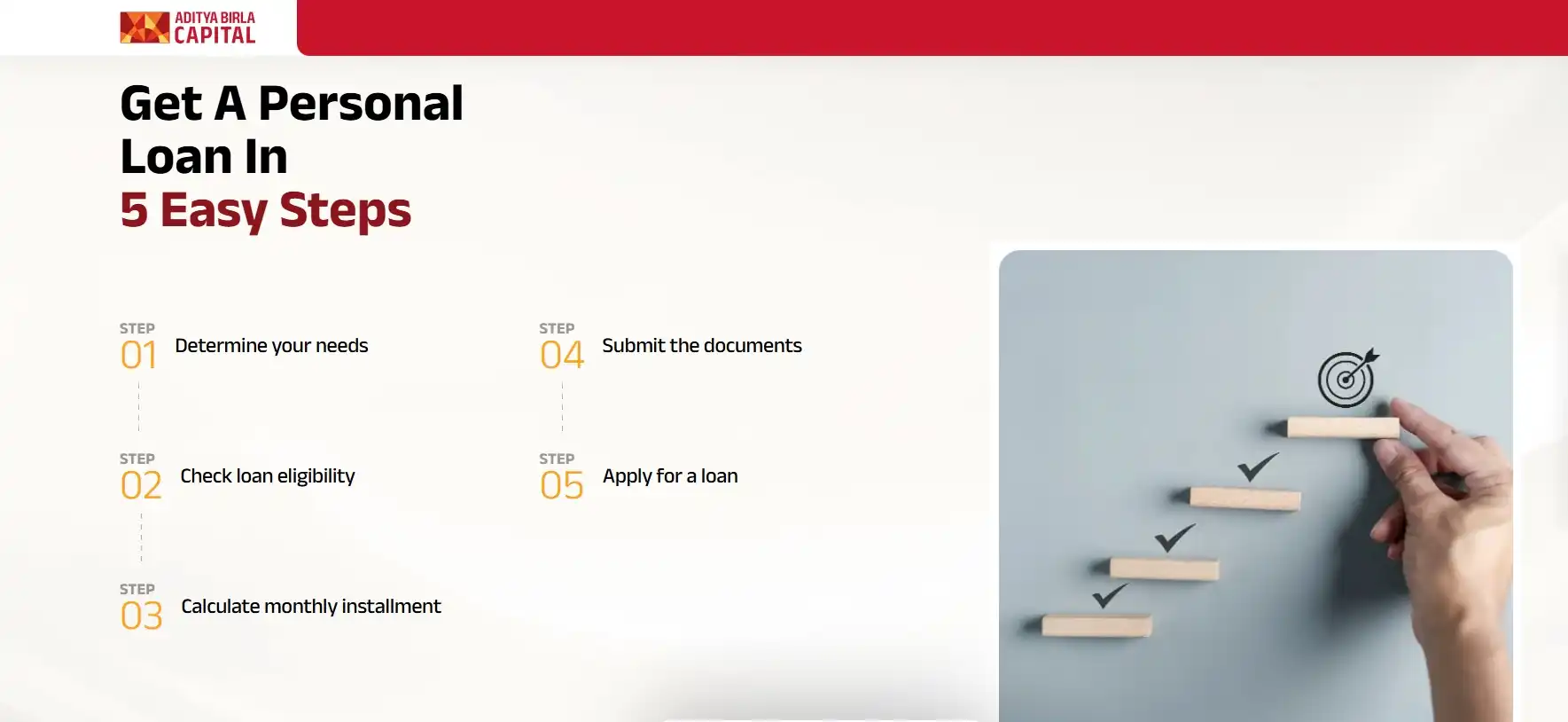

Application Process

Applying for an Aditya Birla personal loan is a straightforward and user-friendly process. Here’s a step-by-step guide to help you through it:

- Determine Your Loan Requirements: Assess your financial needs and decide on the loan amount and tenure that best suits your situation.

- Check Eligibility: Ensure you meet the eligibility criteria, including age, income, employment status, and credit score. This step is crucial to avoid any delays in the application process.

- Gather Required Documents: Prepare the necessary documents such as identity proof (Aadhaar card, passport, PAN card), address proof (utility bills, rental agreement), income proof (salary slips, bank statements), and employment proof (appointment letter, employment certificate).

- Visit the Official Website: Go to the Aditya Birla Finance website and navigate to the personal loan section.

- Fill Out the Application Form: Click on the “Apply Now” button and fill in the required details accurately. This includes personal information, employment details, and loan requirements.

- Register with OTP: Provide your 10-digit mobile number linked to your Aadhaar account. You will receive an OTP (One-Time Password) on your mobile, which you need to enter to proceed.

- Submit Documents: Upload the required documents as part of the application process. Ensure all documents are clear and legible to avoid any processing delays.

- Choose Loan Details: Select the loan amount and repayment tenure that best fits your financial plan. Use the EMI calculator available on the website to understand your monthly installments.

- Complete KYC: Complete the Know Your Customer (KYC) process online by submitting the necessary documents and verifying your identity.

- Review and Submit: Review all the details you have entered to ensure accuracy. Once satisfied, submit your application.

- Loan Approval and Disbursal: After submission, the application will be reviewed by Aditya Birla Finance. If approved, the loan amount will be disbursed to your bank account, often within a few working days.

By following these steps, you can efficiently apply for an Aditya Birla personal loan and meet your financial needs with ease.

Fees and Charges

When considering a personal loan from Aditya Birla Finance, it’s important to be aware of the various fees and charges associated with the loan. Here is a detailed overview:

- Processing Fees:

- A processing fee of up to 3% of the loan amount is charged to cover the administrative costs of processing your loan application. This fee is typically deducted from the loan amount at the time of disbursal.

- Pre-Closure Charges:

- If you decide to pre-close your loan, a fee of 4% of the outstanding principal amount is applicable. Additionally, there is a charge of ₹1,000 per instance for obtaining a pre-closure quote.

- Part Pre-Payment Charges:

- For part pre-payments, if the amount is less than 20% of the principal outstanding, there are no charges. However, if the part pre-payment exceeds 20% of the principal outstanding, a fee of 4% plus GST is applicable. Note that no pre-payment is allowed in the first 12 months from the date of disbursement.

- Default Penal Interest:

- In case of delayed payments, a penal interest rate of 24% per annum is charged on the overdue amount.

- Cheque Return Charges:

- A fee of ₹750 per instance is charged for any cheque return or ECS failure.

- Duplicate Statement Charges:

- If you request a duplicate statement or repayment schedule, a fee of ₹200 per instance is applicable.

- Loan Rescheduling Charges:

- If you need to reschedule your loan, a charge of ₹5,000 plus GST per instance is applicable.

- CIBIL Report Retrieval Fee:

- A fee of ₹100 plus GST per instance is charged for retrieving your CIBIL report.

- NOC Issuance Charges:

- A fee of ₹500 is charged for issuing a No Objection Certificate (NOC).

- Swap Charges:

- For swapping from a fixed rate to a floating rate or vice versa, a charge of 3% of the loan outstanding is applicable.

Understanding these fees and charges can help you make an informed decision and manage your loan effectively.

Contact Information for Aditya Birla Personal Loan

If you have any questions or need assistance with your Aditya Birla personal loan application, you can reach out to their customer support team through various channels. Here are the detailed contact options:

- Customer Care Number:

- Toll-Free Number: 1800 270 7000

- Available from Monday to Saturday, 9:00 AM to 6:00 PM (excluding public holidays).

- Email Support:

- Email Address: [email protected]

- You can send an email with your queries, and the support team will respond promptly.

- Branch Visit:

- You can visit any of the Aditya Birla Finance branches for in-person assistance. To find the nearest branch, use the branch locator tool on their official website.

- Online Chat Support:

- Visit the Aditya Birla Finance website and use the live chat feature to get instant support from a customer service representative.

- Social Media:

- Facebook: Aditya Birla Capital

- Twitter: @AdityaBirlaGrp

- LinkedIn: Aditya Birla Capital

- You can follow their social media pages for updates and also reach out with your queries.

- Postal Address:

- Head Office: Aditya Birla Finance Limited, One World Center, Tower 1, 18th Floor, Jupiter Mills Compound, Senapati Bapat Marg, Elphinstone Road, Mumbai – 400013, Maharashtra, India.

- Website:

- For more information, visit the official website: Aditya Birla Finance

These contact options ensure that you can get the support you need through your preferred method of communication. Whether you have questions about eligibility, documentation, or the application process, the Aditya Birla Finance customer support team is ready to assist you.

Conclusion

Aditya Birla Finance’s personal loan is a versatile financial product designed to cater to a wide range of personal financial needs. Whether you’re planning a wedding, renovating your home, managing medical expenses, or consolidating debt, this loan offers a reliable solution with its high loan amounts, competitive interest rates, and flexible repayment options.

The application process is straightforward and user-friendly, ensuring that you can access the funds you need with minimal hassle. With no requirement for collateral, quick disbursal, and minimal documentation, Aditya Birla Finance makes it easy for you to secure a personal loan. The eligibility criteria are clear and inclusive, accommodating both salaried and self-employed individuals, provided they meet the necessary income and credit score requirements.

Moreover, Aditya Birla Finance provides robust customer support through various channels, including phone, email, online chat, and social media, ensuring that you can get assistance whenever you need it. The availability of prepayment and foreclosure options adds to the flexibility, allowing you to manage your loan repayment in a way that best suits your financial situation.

In summary, Aditya Birla Finance’s personal loan stands out as a reliable and convenient option for addressing your financial needs. Its comprehensive features, ease of application, and strong customer support make it a preferred choice for many borrowers. Whether you need funds for an emergency or a planned expense, Aditya Birla Finance is committed to helping you achieve your financial goals with confidence and ease.

If you have any further questions or need assistance with your application, don’t hesitate to reach out to their customer support team. They are ready to help you every step of the way.

Frequently Asked Questions (FAQ)

- What is the maximum loan amount I can avail?

- You can avail a personal loan of up to ₹50 lakhs, depending on your eligibility and financial profile.

- What are the interest rates for Aditya Birla personal loans?

- The interest rates are competitive and fixed throughout the loan tenure. The exact rate depends on your credit score and other eligibility criteria.

- What is the repayment tenure for the loan?

- The repayment tenure ranges from 12 to 84 months (1 to 7 years), allowing you to choose a period that suits your financial situation.

- Do I need to provide any collateral for the loan?

- No, Aditya Birla personal loans are unsecured, meaning you do not need to provide any collateral or security.

- How quickly can I get the loan amount disbursed?

- The loan amount is typically disbursed within a few working days after approval, ensuring you get the funds when you need them.

- What documents are required for the loan application?

- You need to provide identity proof, address proof, income proof (salary slips, bank statements), and employment proof.

- Can I prepay or foreclose my loan?

- Yes, Aditya Birla Finance offers prepayment and foreclosure options, allowing you to repay the loan ahead of schedule if desired.

- What is the minimum income requirement to apply for the loan?

- For salaried individuals, the minimum monthly income should be ₹45,000. This ensures you have the repayment capacity for the loan.

- How can I apply for the loan?

- You can apply online through the Aditya Birla Finance website by filling out the application form and submitting the required documents.

- Who can I contact for assistance with my loan application?

- You can reach out to Aditya Birla Finance customer care at 1800 270 7000 or email [email protected] for any queries or assistance.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!