A Concise Overview of Axis Magnus Credit Card

The Axis Magnus Credit Card stands as a premier financial instrument that bestows a plethora of advantages and attributes upon its holders. It has been meticulously crafted to cater to the preferences of those individuals who hold exclusivity, convenience, and rewards in high esteem. The ensuing discourse takes a comprehensive dive into the myriad facets of the Axis Magnus Credit Card, accentuating its extraordinary attributes and benefits.

Spotlighting its Distinctive Premium Attributes and Gains

The Axis Magnus Credit Card garners attention owing to its remarkable assortment of premium attributes and benefits that have been custom-tailored to elevate the lifestyle of its cardholders. Spanning from a substantial credit ceiling to exclusive incentives and personalized concierge amenities, this credit card embarks on a journey to provide an impeccable, opulent experience.

| Travel & Stay WELCOME/ANNUAL BENEFIT Choose between one complimentary domestic flight ticket and a Tata CLiQ voucher worth Rs.10000 as your annual benefit. AIRPORT CONCIERGE SERVICE Enjoy 8 complimentary end-to-end VIP services at the airport. INTERNATIONAL LOUNGE ACCESS Avail unlimited complimentary international lounge visits and 8 additional guest visits per year with the Priority Pass card. DOMESTIC LOUNGE ACCESS Enjoy unlimited visits to select airport lounges in India. | Lifestyle & Entertainment BOOKMYSHOW BENEFITS Buy one movie/non-movie ticket and get upto Rs.500 off on the second. DINING DELIGHTS Enjoy upto 40% discount at over 4000 restaurants across India. EXTRAORDINARY WEEKENDS Curated experiences from across the world with extraordinary weekends. | Health & Wellness INSURANCE BENEFITS MEDICAL CONCIERGE PROGRAM Virtual health assistance including tele-consultation, health coaching, home quarantine programs, personalized oncology care and more. SECOND MEDICAL OPINION Avail expert medical opinion from a panel of world class specialists at leading institutions. PREVENTIVE HEALTHCARE Benefit from special preventive healthcare packages and a range of privileges with SRL diagnostics, Dr. Lal PathLab and Metropolis GLOBAL TRAVEL & MEDICAL ASSISTANCE Travel safe with inoculation & visa requirement information, legal & medical service referral, emergency evacuation, etc. | More benefits ANNUAL FEE WAIVER Annual fee of Rs 10,000 + Taxes waived off on spend of Rs.15 lakhs in preceding year. BENEFITS ON FEES AND CHARGES Lowered interest rate of 3% on extended credit Reduced mark-up fee of 2% on foreign transactions No cash withdrawal fees Fuel surcharge waiver of 1% for transactions between Rs.400 to Rs.4000. REWARDS PROGRAM 25,000 EDGE REWARDS Points worth Rs. 5,000 on monthly spends of Rs. 1Lakh. 5X EDGE REWARDS on travel spends via TRAVEL EDGE. 12 Axis EDGE REWARDS Points on every Rs.200 that you spend. 24X7 DEDICATED CONCIERGE Get assistance on flight bookings, table reservations, gift deliveries and more. |

Salient Attributes of the Axis Magnus Credit Card

Generous Credit Ceiling

The Axis Magnus Credit Card proffers a substantial credit ceiling, bestowing upon cardholders the monetary flexibility required for consequential acquisitions and effective management of their financial outlays.

Diverse Selection of Variants (Platinum, Gold, Titanium, etc.)

With a range of variants encompassing Platinum, Gold, Titanium, and more, the Axis Magnus Credit Card ensures the individualistic alignment of the card with the predilections and fiscal requisites of the cardholders.

Cutting-Edge Contactless Transaction Technology

This card boasts cutting-edge contactless transaction technology, thereby facilitating swift and secure transactions through a mere tap, thereby heightening the convenience associated with transactions.

Global Acceptance and Reach

The Axis Magnus Credit Card prides itself on its worldwide acceptance, ensuring that cardholders can wield its purchasing power across the globe, be it for international transactions or voyages.

Enhanced Measures for Security

With a prioritization of user security, this card incorporates sophisticated security measures, such as PIN safeguarding, real-time transaction surveillance, and SMS alerts.

Incentive Regimen

The incentive regimen of the card presents captivating perks, including cashback on purchases, reward points for transactions, and exclusive entry to a diverse array of privileges.

Travel Advantages

Cardholders are poised to relish a medley of travel perks, encompassing discounts on airfare, lodging arrangements, and comprehensive travel insurance coverage, thereby enhancing the enjoyment and tranquility of their journeys.

Concierge Services

The Axis Magnus Credit Card is complemented by personalized concierge services that cater adeptly to the cardholder’s requisites, spanning from reservations to travel coordination and entertainment access.

Incentives and Privileges

Cashback and Reductions on Day-to-Day Expenditures

Cardholders are eligible to secure cashback and reductions on day-to-day expenditures, thus contributing to prudent savings on groceries, dining, shopping, and a gamut of other outlays.

Accrual of Reward Points upon Transactions

Each transaction performed using the Axis Magnus Credit Card accumulates reward points, which can be redeemed for compelling offers, merchandise acquisitions, or even as cashback, thereby augmenting the worth of each financial transaction.

Exclusivity in Access to Airport Lounges

Among the entitlements conferred by the card is access to premium airport lounges, a provision that offers travelers a sanctuary to relax and unwind prior to their flights.

Dining and Entertainment Entitlements

Cardholders are bestowed with exclusive privileges in the realms of dining and entertainment, encompassing distinctive concessions at partner restaurants, cinema halls, and entertainment venues.

Complimentary Travel Assurance

The card’s repertoire includes complimentary travel assurance, an offering that engenders travel with a sense of security, safeguarding both the cardholder and their kin.

Priority Patron Support

The card extends priority patron support, a service dedicated to addressing cardholders’ queries, concerns, and requisite assistance, thus ensuring a seamless experience.

Application and Qualification

| ELIGIBILITY CRITERIA FOR AXIS BANK MAGNUS CREDIT CARD: Primary cardholder between age of 18 years and 70 years Add-on cardholder should be over 18 years Salary of Rs.18 Lakhs per annum or Annual Income Tax Return filed for Rs.18 Lakhs Resident of India *The above criteria are only indicative. The bank reserves the right to approve or decline applications for credit card. | DOCUMENTATION: The below documents are required for application: PAN card photocopy or Form 60 Latest payslip/ Form 16/IT return copy as proof of income Residence proof (Passport/Driving license/ Electricity Bill/ Landline telephone bill) *The above list is only indicative. Documents required may vary on a case to case basis. |

Criteria for Eligibility (Income, Credit Rating, etc.)

In order to solicit the Axis Magnus Credit Card, aspirants must meet specified eligibility criteria, which encompass a minimal income threshold and a commendable credit rating.

Dual Avenues for Application (Online and Offline)

The application procedure for the card is marked by its convenience, offering both online and offline alternatives, thereby accommodating applicants with a choice that resonates with their predilections.

Mandatory Documentation

Applicants are mandated to furnish certain documents, encompassing substantiation of identity, residential address, income records, and supplementary pertinent information, with the aim of consummating the application procedure.

Appraisal and Ratification Periods

Submitted applications traverse a comprehensive review process, and once sanctioned, the card is ordinarily dispatched within a stipulated timeframe, hence underpinning an experience that is both streamlined and efficacious.

Tariffs and Levies

Structural Framework of Annual Charges for Various Iterations

Diverse iterations of the Axis Magnus Credit Card are accompanied by a multiplicity of annual charges, thereby furnishing individuals with the flexibility to elect a card that resonates harmoniously with their fiscal inclinations and proclivities.

Interest Tariffs on Outstanding Balances

Grasping the interest tariffs levied on outstanding balances emerges as pivotal for judicious financial management, thereby circumventing superfluous encumbrances.

Penalties and Dues for Overdue Payments

Cognizance of the penalties and dues attributed to overdue payments is imperative for cardholders, in order to avert the accumulation of interest and to sustain a commendable credit history.

Overseas Transaction Levies

For transactions that traverse international borders, the card may incur overseas transaction levies; a nuanced understanding of these impositions empowers prudent decision-making when engaging in overseas transactions or acquisitions.

Guidelines for Responsible Credit Card Utilization

Effective Management of Credit Utilization

Safeguarding a salubrious credit utilization ratio surfaces as quintessential for financial well-being, and the ensuing composition proffers insights into its adept management.

Timely Settlements to Eschew Interest Incurrence

The imperative of settling credit card dues punctually is underscored to forestall the accrual of interest, thereby nurturing an affirmative credit history.

Vigilant Surveillance of Transactions

Regularly surveilling transactions emerges as germane in identifying incursions of an unauthorized or suspicious nature, thus safeguarding the fiscal integrity of cardholders.

Prudent Exploitation of Rewards and Advantages

Adopting a judicious approach toward capitalizing on the card’s rewards and benefits is an act of sagacity, and this treatise avails recommendations for optimizing the value inherent in these offerings.

Endorsements by Clients

Affirmative Anecdotes Shared by Cardholders

Genuine anecdotes of positive encounters recounted by extant cardholders contribute a personal dimension, spotlighting the pragmatic advantages and merits of the Axis Magnus Credit Card.

Manifestation of Tangible Advantages and Gratification

Via genuine endorsements, readers glean insight into how the card augments the lives of real users, amplifying the value it imparts to their fiscal odyssey.

Frequently Posited Queries (FAQs)

Q1: Nature and Distinctiveness of the Axis Magnus Credit Card

A1: The Axis Magnus Credit Card, a Distinguished Masterpiece

The Axis Magnus Credit Card, a credit card of eminence, unfurls an array of singular features and advantages. Its distinct offerings, such as a substantial credit ceiling, a rewards program, and bespoke concierge services, conspire to differentiate it from standard credit cards.

Q2: Protocol for Axis Magnus Credit Card Application

A2: Application for the Axis Magnus Credit Card

The solicitation of the Axis Magnus Credit Card can be actualized through either the virtual domain, via the official website of the bank, or through the tangible avenue of visiting a proximate Axis Bank branch in person. The procedure, straightforward and user-friendly, caters to ease of engagement.

Q3: Criteria for Attaining this Credit Card

A3: Parameters for Credit Card Acquisition

In order to secure the Axis Magnus Credit Card, one must fulfill specified parameters, encompassing a stipulated minimum income, an enviable credit rating, and other meticulously stipulated qualifications delineated by the bank.

Q4: Assortment of Axis Magnus Credit Card Variants

A4: A Panoply of Axis Magnus Credit Card Variants

An assemblage of variants for the Axis Magnus Credit Card prevails, including Platinum, Gold, and Titanium iterations. Each variant bequeaths distinct benefits and features, thereby empowering individuals to select the variant that resonates harmoniously with their predilections.

Q5: Pivotal Facets of the Rewards Regimen for the Axis Magnus Credit Card

A5: The Rewards Program’s Pivotal Attributes for the Axis Magnus Credit Card

The rewards regimen proffers benefits such as cashback on quotidian expenditures, reward points garnered from transactions, and the gateway to airport lounges. This array of privileges amplifies the worth of card usage.

Q6: Feasibility of International Transactions with the Axis Magnus Credit Card

A6: Global Utilization with the Axis Magnus Credit Card

Indeed, the Axis Magnus Credit Card stands as a global companion, facilitating international transactions and purchases. However, an awareness of potential foreign transaction fees is prudent.

Q7: Supervision of Credit Card Transactions and Outlays

A7: Scrutiny of Credit Card Transactions and Financial Outlays

Axis Bank has provisioned an online portal and mobile application to enable the vigilant monitoring of transactions, bill settlements, and credit card account management. Consistent oversight guarantees a mastery over financial affairs.

Q8: Fortifications Ensuring Card and Account Security

A8: Ensuring Card and Account Integrity Through Robust Safeguards

The Axis Magnus Credit Card integrates advanced fortifications, including PIN safeguarding, SMS alerts for transactions, and real-time scrutiny, all culminating to ensure the inviolability of card and account.

Q9: Fiscal Structure of Annual Fees for Various Iterations of the Axis Magnus Credit Card

A9: A Fiscal Blueprint for Annual Charges Across Axis Magnus Credit Card Iterations

The annual fee landscape fluctuates in tandem with the variant of the Axis Magnus Credit Card selected. The Platinum, Gold, and Titanium variants feature a spectrum of fee structures, thus conferring a pliable fiscal choice.

Q10: Maximizing Travel Benefits of the Axis Magnus Credit Card

A10: Unveiling the Optimum Potential of Travel Perquisites with the Axis Magnus Credit Card

Travel benefits encompass reductions on air travel, hotel accommodations, and encompassing travel insurance. To exploit these privileges optimally, prudent engagement with relevant transactions and exploration of exclusive offerings is advised.

-

How PPF’s 7.1% Interest Rate Can Build Your ₹40 Lakh Corpus by 2040

PPF : Unravel its meaning, 7.1% interest rate, and tax-free benefits! Learn how to maximize returns, build wealth,

-

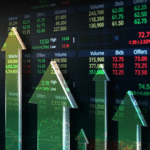

Trading the Indian Stock Market: Sensex, Nifty 50, Bank Nifty Outlook for July 4, 2025

Nifty 50 & Bank Nifty predictions for July 4, 2025, with key support, resistance levels, and trading strategies.

-

ICICI Bank FD Rates 2025: Unlock Wealth Creation with ICICI Bank Fixed Deposits

ICICI Bank Fixed Deposits 2025! Earn up to 7.10% interest, enjoy tax-saving benefits, and open FDs seamlessly online.

-

UPI-ICD Review: Is the UPI ATM Interoperable Cash Deposit the Future of Banking in India?

UPI-ICD: India’s cardless cash deposit revolution! Deposit cash at UPI-enabled ATMs using your UPI app. Explore its features,

-

PNB Monsoon Bonanza: Save Big on Home Loan and Car Loans until Sep 30, 2025!

Punjab National Bank Monsoon Bonanza 2025! Enjoy zero processing fees on home and car loans, plus bank-covered charges

-

Punjab National Bank Waives Penal Charges: Zero Penalties for Non-Maintenance of Minimum Balance from July 1, 2025

Punjab National Bank’s game-changing waiver of penal charges for non-maintenance of Minimum Average Balance, effective July 1, 2025!

-

HDFC Bank Fixed Deposits Interest Rates 2025: Is 18-Month Tenure Your Key to Higher Returns?

HDFC Bank Fixed Deposit Rates 2025! Earn up to 6.60% p.a. (7.10% for seniors) on deposits below ₹3

-

SBI Fixed Deposit Rates 2025: How SBI Term Deposits Secure Your Financial Future

SBI’s revised 2025 term deposit rates! Unlock high returns with Amrit Vrishti, Green Rupee, and senior citizen FD