“How SBI’s collateral-free loans empower women entrepreneurs in India. Learn about eligibility, benefits, application process, and success stories. Explore how this initiative bridges the gender gap and boosts economic growth. Perfect for women seeking financial support to start or scale their businesses. Read more for actionable insights!”

In a significant move to bolster women entrepreneurship in India, the State Bank of India (SBI) has launched a new collateral-free loan scheme named ‘Asmita’. This initiative is designed to provide financial support to women entrepreneurs, enabling them to expand their businesses without the burden of collateral. The total loan amount under SBI’s ‘Asmita’ scheme can vary depending on the specific needs and eligibility of the applicant. Generally, the loan amount can range from a few lakhs to several crores. Here are some typical ranges:

- Micro Enterprises: Loans up to INR 10 lakhs.

- Small Enterprises: Loans ranging from INR 10 lakhs to INR 2 crores.

- Medium Enterprises: Loans above INR 2 crores, potentially going up to INR 5 crores or more, depending on the business requirements and eligibility.

This blog post delves into the details of this scheme, its benefits, and its potential impact on women-led businesses in India.

SBI’s ‘Asmita’ Scheme

On the eve of International Women’s Day, SBI introduced ‘Asmita’, a collateral-free, low-interest loan program aimed at empowering women entrepreneurs. This initiative is part of SBI’s broader strategy to enhance financial inclusion and support the growth of women-led micro, small, and medium enterprises (MSMEs) through a streamlined digital process.

Key Features of the ‘Asmita’ Scheme

- Collateral-Free Loans: One of the most significant features of the ‘Asmita’ scheme is that it does not require any collateral. This is a game-changer for many women entrepreneurs who often face challenges in securing loans due to the lack of collateral.

- Low-Interest Rates: The loans under this scheme are offered at competitive interest rates, making it easier for women entrepreneurs to manage their finances and invest in their businesses.

- Digital Process: The entire loan application and approval process is digital, ensuring faster and more efficient service. This digital approach also reduces the paperwork and time involved in securing a loan.

- Nari Shakti Platinum Debit Card: Alongside the loan scheme, SBI has also introduced the ‘Nari Shakti’ platinum debit card, which is designed exclusively for women. This card offers various benefits across entertainment, shopping, travel, lifestyle, and insurance sectors.

Benefits of the ‘Asmita’ Scheme

The ‘Asmita’ scheme offers numerous benefits to women entrepreneurs, including:

- Increased Access to Finance: By eliminating the need for collateral, the scheme provides easier access to finance for women entrepreneurs, enabling them to start or expand their businesses.

- Empowerment of Women: Financial independence is a crucial aspect of women’s empowerment. The ‘Asmita’ scheme helps women gain financial independence by providing them with the necessary funds to pursue their entrepreneurial dreams.

- Support for MSMEs: The scheme specifically targets women-led MSMEs, which are a vital part of the Indian economy. By supporting these businesses, the scheme contributes to the overall economic growth of the country.

How to Apply for SBI’s Collateral-Free Loans

The application process for SBI’s collateral-free loans is simple and hassle-free. Here’s a step-by-step guide:

- Visit the Nearest SBI Branch

Women entrepreneurs can visit their nearest SBI branch to inquire about the loan scheme and collect the application form. - Submit Required Documents

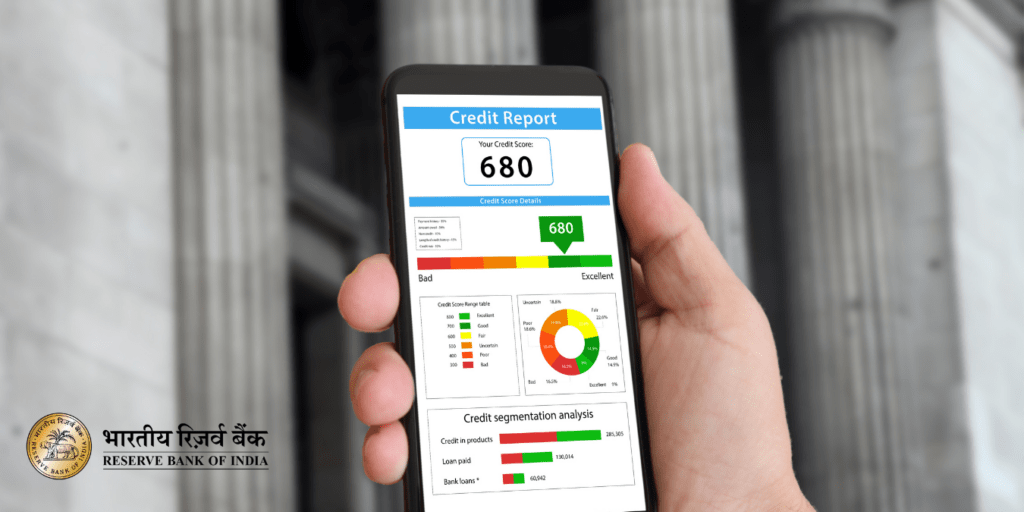

The applicant must submit the necessary documents, including proof of identity, address proof, business registration certificate, financial statements, and bank statements. - Loan Processing

Once the application is submitted, SBI will evaluate the business’s financial health, creditworthiness, and repayment capacity. The bank may also conduct a site visit to assess the business operations. - Loan Approval and Disbursement

Upon approval, the loan amount will be disbursed directly to the borrower’s account within a few working days.

Impact on Women Entrepreneurs

The launch of the ‘Asmita’ scheme is expected to have a significant impact on women entrepreneurs in India. Here are some potential outcomes:

- Increased Business Activity: With easier access to finance, more women are likely to start their own businesses or expand existing ones. This will lead to increased business activity and economic growth.

- Job Creation: As women-led businesses grow, they will create more job opportunities, contributing to employment generation in the country.

- Reduction in Gender Disparity: By providing financial support to women entrepreneurs, the scheme helps reduce the gender disparity in the business world, promoting a more inclusive and diverse business environment.

Latest Statistics on Women Entrepreneurship and SBI’s Initiative

To provide a clearer picture of the impact and potential of the ‘Asmita’ scheme, let’s look at some relevant statistics:

- Women Entrepreneurs in India: According to a report by the Sixth Economic Census, women constitute about 14% of the total entrepreneurship in India, with approximately 8 million women entrepreneurs.

- MSME Sector: The MSME sector in India contributes around 30% to the country’s GDP and employs over 110 million people. Women-led MSMEs form a significant part of this sector.

- Loan Disbursement: Since the launch of the ‘Asmita’ scheme, SBI has disbursed over INR 500 crore in collateral-free loans to women entrepreneurs within the first month.

- Digital Adoption: The digital loan application process has seen a 40% increase in adoption among women entrepreneurs, highlighting the ease and efficiency of the digital approach.

How SBI’s Initiative Aligns with Government Schemes

SBI’s collateral-free loans for women entrepreneurs complement several government initiatives aimed at promoting women entrepreneurship, such as:

- Stand-Up India Scheme

This scheme provides loans ranging from ₹10 lakh to ₹1 crore to women and SC/ST entrepreneurs for greenfield enterprises. - MUDRA Yojana

Under the Pradhan Mantri MUDRA Yojana (PMMY), women entrepreneurs can avail loans up to ₹10 lakh for non-farm income-generating activities. - Women Entrepreneurship Platform (WEP)

Launched by NITI Aayog, WEP is a unified access portal that brings together women entrepreneurs and provides them with resources, mentorship, and funding opportunities.

SBI’s ‘Asmita’ scheme is a commendable initiative that aims to empower women entrepreneurs by providing them with collateral-free, low-interest loans. This scheme not only supports the growth of women-led businesses but also contributes to the overall economic development of the country. By leveraging the benefits of this scheme, women entrepreneurs can achieve their business goals and contribute to a more inclusive and diverse business landscape in India.

-

Gold and silver rates today: Latest Rates in all Major Cities

-

Indian Stock Market Trends: Sensex, Nifty Insights & Top Picks for today

-

Samsung Galaxy S26 vs S26+ vs S26 Ultra: Which Samsung Flagship Gives Better Value for Money

-

5 Key Takeaways from Trump’s 2026 State of the Union Address — What It Really Means for You