Explore the HDFC Millennia Credit Card: 5% cashback on Amazon, Swiggy, and more, plus 8 domestic lounge visits yearly. With exclusive dining perks and rewards for millennials, discover why it’s a top choice. Learn its benefits and compare with peers at HDFC Bank. Ideal for online shoppers!

The HDFC Bank Millennia Credit Card is a cashback-focused credit card tailored for millennials and young professionals who frequently shop online and dine out. With a modest annual fee and a rewards program centered on popular merchants like Amazon, Flipkart, and Swiggy, it appeals to moderate spenders seeking value on everyday transactions. The card also offers milestone-based benefits like lounge access and gift vouchers, making it a versatile option for lifestyle and travel perks. Below is a detailed overview of its features, rewards, benefits, fees, charges, pros, and cons, based on the latest information from HDFC Bank’s official website and other reliable sources.

Overview

The HDFC Bank Millennia Credit Card, available on the Mastercard or Visa platform, is designed for tech-savvy, urban consumers who prioritize online shopping, dining, and occasional travel. It offers 5% cashback on select partner merchants and 1% on other spends, credited as CashPoints redeemable against statement balances or rewards catalogs. The card supports contactless payments for transactions up to ₹5,000 without a PIN, UPI-linked payments, and EMI conversion for large purchases. With features like quarterly milestone rewards and domestic lounge access, it balances affordability with lifestyle benefits. The card is marketed as an entry-level option but requires a higher income threshold than some competitors, targeting salaried professionals and self-employed individuals.

Eligibility Criteria

- Age: 21–40 years for salaried or self-employed individuals.

- Income:

- Salaried: Minimum monthly income of ₹35,000.

- Self-employed: Annual Income Tax Return (ITR) of ₹6,00,000 or more.

- Nationality: Indian resident.

- Credit Score: A score of 750+ is recommended for approval.

- Documents: Aadhaar card, PAN card, address proof (e.g., utility bill, passport), income proof (salary slips, bank statements, or ITR), and a recent photograph.

- Employment: Minimum 6 months of employment with the current organization for salaried applicants.

Application Process

- Visit the HDFC Bank website (www.hdfcbank.com) or mobile app.

- Navigate to “Credit Cards” and select “Millennia Credit Card.”

- Click “Apply Now,” complete the online form, and upload KYC documents.

- Complete video KYC or in-person verification as prompted.

- Track application status using the 16-digit reference number via the HDFC Bank portal or customer care (1800 266 4332).

Rewards and Benefits

The card’s rewards program revolves around CashPoints, which are earned on transactions and redeemable for statement credit (1 CashPoint = ₹1), products/vouchers (1 CashPoint = ₹0.30), or flight/hotel bookings (capped at 50% of booking value). CashPoints expire after 2 years from accumulation. Key rewards and benefits include:

- Cashback Rewards:

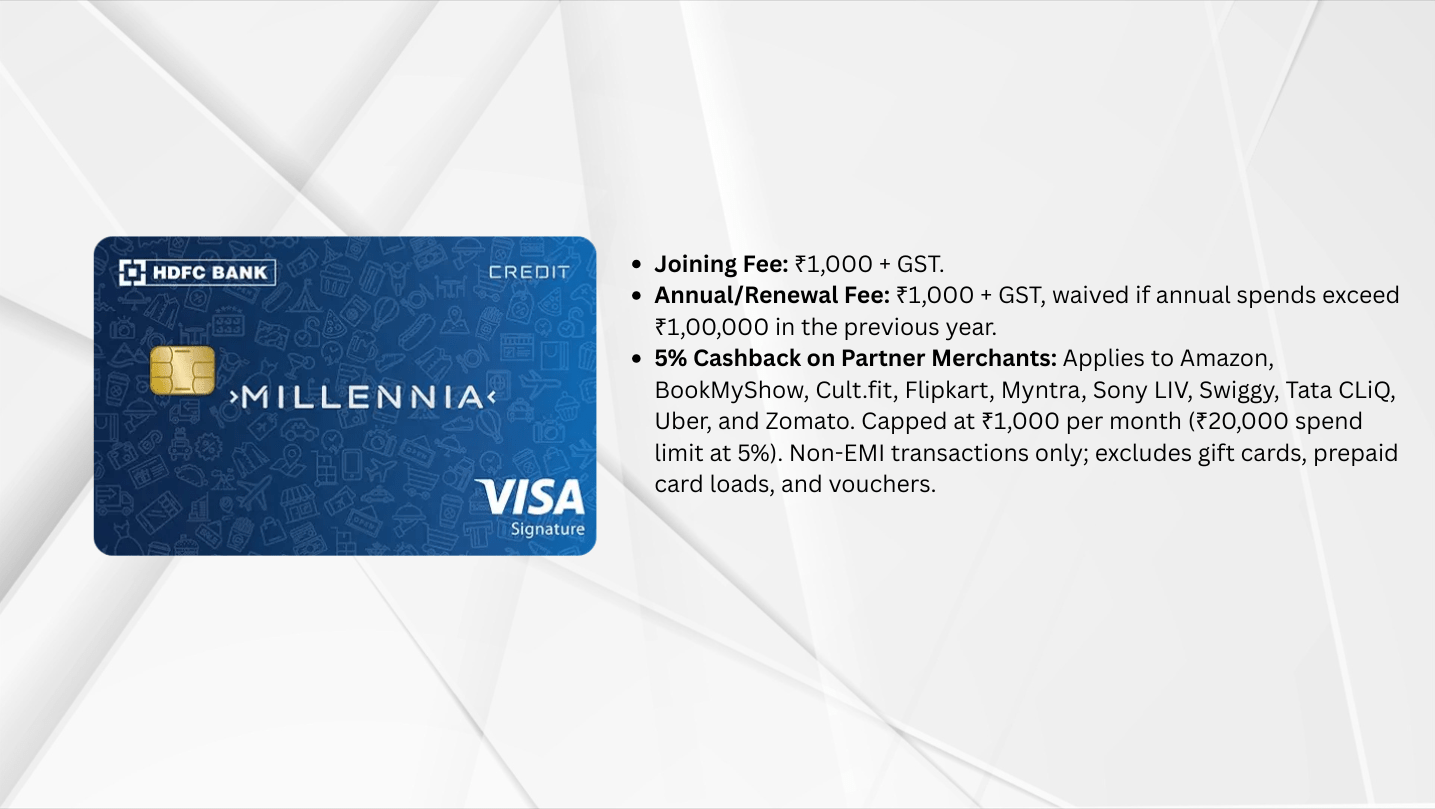

- 5% Cashback on Partner Merchants: Applies to Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato. Capped at ₹1,000 per month (₹20,000 spend limit at 5%). Non-EMI transactions only; excludes gift cards, prepaid card loads, and vouchers.

- 1% Cashback on Other Spends: Covers all eligible online and offline transactions, including EMI spends and wallet loads, capped at ₹1,000 per month. Exclusions include fuel, rent payments, and government-related transactions.

- SmartBuy Bonus: Additional 5% cashback (up to ₹750/month) on transactions via HDFC’s SmartBuy portal, but cannot be combined with the 5% merchant cashback (total 6% if SmartBuy is used for partner merchants).

- Redemption: Minimum 500 CashPoints for statement credit redemption. A ₹50 + GST fee applies for cashback redemption; ₹99 + GST for other redemptions (e.g., vouchers, travel). Monthly caps: 3,000 CashPoints for cashback, 50,000 for travel bookings.

- Welcome Benefits:

- 1,000 CashPoints (worth ₹1,000) upon paying the joining fee and making a transaction within 90 days.

- Quarterly Milestone Rewards:

- Spend ₹1,00,000 or more in a calendar quarter to choose between a ₹1,000 gift voucher (e.g., Amazon, Flipkart) or one Dreamfolks airport lounge access voucher (domestic lounges, one visit per quarter, up to 4 annually). Vouchers must be claimed within 60 days of notification.

- Dining Discounts:

- Up to 20% off on restaurant bills via Swiggy Dineout (minimum order ₹2,000, valid twice monthly with coupon code HDFCCARDS). Flat ₹200 discount on eligible transactions.

- Fuel Surcharge Waiver:

- 1% waiver (up to ₹250 per statement cycle) on fuel transactions between ₹400 and ₹5,000 at any fuel station in India.

- Contactless Payments:

- Enabled for tap-to-pay transactions up to ₹5,000 without a PIN, ensuring fast and secure payments.

- Zero Lost Card Liability:

- No liability for fraudulent transactions if the card loss is reported immediately to HDFC’s 24-hour helpline (1800 266 4332 or 022-61606160 for overseas).

- Interest-Free Credit Period:

- Up to 50 days, subject to merchant charge submission.

- EMI Conversion:

- Convert purchases above ₹2,500 into EMIs with flexible tenures via Smart EMI, Insta Loan, or Jumbo Loan options. Transactions over 60 days cannot be converted.

- UPI Payments:

- Link the card to UPI apps for seamless digital transactions.

Fees and Charges

The card has a moderate fee structure with a spend-based waiver, but additional charges apply for specific transactions. Key fees and charges include:

- Joining Fee: ₹1,000 + GST.

- Annual/Renewal Fee: ₹1,000 + GST, waived if annual spends exceed ₹1,00,000 in the previous year.

- Finance Charges: 3.6% per month (43.2% APR).

- Cash Advance Fee: 2.5% of the withdrawn amount or ₹500, whichever is higher.

- Foreign Currency Markup Fee: 3.5% + GST (approximately 4.13%).

- Rewards Redemption Fee:

- ₹50 + GST for statement credit redemption.

- ₹99 + GST for products, vouchers, or travel redemptions.

- Late Payment Charges:

- ₹0 for dues less than ₹100.

- ₹100 for dues between ₹100 and ₹500.

- ₹400 for dues between ₹501 and ₹5,000.

- ₹600 for dues between ₹5,001 and ₹10,000.

- ₹800 for dues between ₹10,001 and ₹25,000.

- ₹950 for dues between ₹25,001 and ₹50,000.

- ₹1,100 for dues above ₹50,000.

- Third-Party Charges (effective August 1, 2024):

- 1% fee (capped at ₹3,000) on rent payments via apps like CRED or Paytm (from the second transaction per month).

- 1% fee (capped at ₹3,000) on utility spends above ₹50,000 per month.

- 1% fee (capped at ₹3,000) on fuel spends above ₹15,000 per month.

- Card Replacement Fee: ₹100–₹250.

- Other Charges:

- ₹100 for cash payments at HDFC Bank branches/ATMs.

- 1% + GST on railway ticket purchases.

- 1% + GST on Dynamic Currency Conversion for international transactions.

- All taxes apply as per government regulations.

Pros

- High Cashback on Popular Merchants: 5% cashback on Amazon, Flipkart, Swiggy, and other partners is competitive, ideal for online shoppers (up to ₹1,000/month).

- Quarterly Milestone Rewards: ₹1,000 gift vouchers or lounge access for ₹1,00,000 quarterly spends add significant value (up to ₹4,000/year in vouchers).

- Fee Waiver: Annual fee of ₹1,000 is waived with ₹1,00,000 annual spends, achievable for moderate spenders.

- Dining Benefits: Up to 20% off via Swiggy Dineout and ₹200 flat discounts enhance dining savings.

- Wallet Load Rewards: 1% cashback on wallet loads is rare, benefiting users of Paytm, PayZapp, or MobiKwik.

- Lifestyle Perks: Contactless payments, EMI conversion, and UPI compatibility offer convenience for modern users.

- Welcome Bonus: 1,000 CashPoints (₹1,000) upon joining fee payment recovers the initial cost.

- Occasional LTF Offers: Lifetime-free (LTF) offers are sometimes available, especially via card-to-card applications.

Cons

- Cashback Caps: ₹1,000 monthly cap on 5% and 1% cashback categories limits earnings for high spenders (e.g., max ₹12,000/year at 5%).

- Redemption Fees: ₹50 for statement credit and ₹99 for other redemptions reduce reward value.

- No Direct Cashback: Rewards as CashPoints require manual redemption, unlike automatic statement credits on Swiggy HDFC or SBI Cashback cards.

- Limited Lounge Access: Lounge access requires ₹1,00,000 quarterly spends and replaces the ₹1,000 voucher, making it less accessible than cards like IDFC FIRST Millennia (4 railway lounge visits/quarter).

- Merchant Restrictions: 5% cashback is limited to 10 partner merchants, reducing flexibility compared to SBI Cashback (5% on all online spends).

- High Income Requirement: ₹35,000 monthly income is steeper than Swiggy HDFC (₹15,000) or IDFC FIRST Millennia (₹25,000).

- Reward Exclusions: No CashPoints on fuel, rent, or government transactions, and EMI/wallet spends earn only 1%.

- Inconsistent Reward Crediting: Some users report delays or errors in CashPoint crediting, requiring follow-ups with customer care.

Comparison of the HDFC Bank Millennia Credit Card With its Peers

Below is a comparison table of the HDFC Bank Millennia Credit Card with its peers in the entry-level, lifestyle-oriented credit card segment in India, focusing on cards targeting millennials and young professionals. The peers selected are IDFC FIRST Millennia Credit Card, Axis Bank Neo Credit Card, and SBI SimplyCLICK Credit Card, as they compete in the same category with similar reward structures and benefits. The table highlights key features such as fees, rewards, benefits, and eligibility to help you make an informed choice.

| Feature | HDFC Bank Millennia Credit Card | IDFC FIRST Millennia Credit Card | Axis Bank Neo Credit Card | SBI SimplyCLICK Credit Card |

| Annual Fee | ₹1,000 + GST (waived on spending ₹1,00,000 annually) | Lifetime Free (No joining or annual fee) | ₹250 + GST (waived on spending ₹2,500 within 45 days of issuance) | ₹499 + GST (waived on spending ₹1,00,000 annually) |

| Welcome Benefits | ₹1,000 gift voucher on spending ₹30,000 within 90 days | ₹500 voucher on spending ₹5,000 within 30 days; 5% cashback (up to ₹1,000) on first EMI transaction within 90 days | ₹250 cashback on first online transaction above ₹2,500 | ₹500 Amazon voucher on spending ₹5,000 within 90 days |

| Reward Points | 5% cashback (as CashPoints) on Amazon, Flipkart, BigBasket, Swiggy, etc.; 1% on other spends; Points expire after 2 years | 10X on spends > ₹20,000/month and birthday spends; 6X on online spends up to ₹20,000; 3X on offline spends up to ₹20,000; 1X on utility/insurance; Never-expiring | 10% off on movies, 5% off on utility bills via select partners; 1 EDGE point/₹200 spent | 10X on Amazon, BookMyShow; 5X on other online spends; 1X on offline; Points expire after 2 years |

| Reward Redemption | 1 CashPoint = ₹1 (statement credit), ₹0.30 (flights/hotels), ₹0.25 (products/vouchers); ₹50 + GST for cash redemption, ₹99 + GST for others | 1 RP = ₹0.25; Redeem for online/in-store purchases or via idfcfirstrewards.poshvine.com; ₹99 + GST convenience fee | 1 EDGE point = ₹0.20; Redeem via EDGE Rewards platform | 1 RP = ₹0.25; Redeem via SBI Card portal or app |

| Travel Benefits | 8 domestic lounge visits/year (max 2/quarter, on ₹1,00,000 quarterly spend) | 4 complimentary railway lounge visits per quarter | None | None |

| Fuel Surcharge Waiver | 1% waiver (up to ₹250/month) on transactions between ₹400–₹5,000 | 1% waiver (up to ₹200/month) on transactions between ₹200–₹5,000 | None | 1% waiver (up to ₹100/month) on transactions between ₹500–₹3,000 |

| Movie/Dining Discounts | 5% cashback on Swiggy; Up to 20% off at partner restaurants via Swiggy Dineout | 25% discount on movie tickets (up to ₹100/month) via Paytm; Up to 20% off at 1,500+ restaurants | 10% off on BookMyShow (up to ₹100/month); 15% off at partner restaurants | 10X points on BookMyShow; No specific dining offers |

| Interest Rate (APR) | 43.2% p.a. (3.6% per month) | 9%–42% p.a. (0.75%–3.5% per month) | 49.56% p.a. (3.6% per month) | 42% p.a. (3.5% per month) |

| Cash Withdrawal | 2.5% fee (min ₹500) + 3.6% monthly interest from transaction date | Interest-free for up to 48 days; ₹199 transaction fee | 2.5% fee (min ₹500) + 3.6% monthly interest from transaction date | 2.5% fee (min ₹500) + 3.5% monthly interest from transaction date |

| Other Benefits | ₹1,000 gift vouchers on ₹1,00,000 quarterly spends; Zero lost card liability | Complimentary roadside assistance worth ₹1,399; Personal accident cover of ₹2 lakh; Lost card liability cover of ₹25,000 | 5% cashback on utility bills via select partners; EMI conversion on spends > ₹2,500 | Milestone benefits: ₹2,000 voucher on annual online spends of ₹1,00,000 |

| Eligibility | Min. income: ₹35,000/month (salaried); Age: 21–60; Good credit score (750+) | Min. income: ₹25,000/month; Age: 21–65; Good credit score | Min. income: ₹20,000/month; Age: 18–70; Good credit score | Min. income: ₹20,000/month; Age: 21–60; Good credit score |

| Foreign Currency Markup Fee | 2% + GST | 3.5% + GST | 3.5% + GST | 3.5% + GST |

Final Thought

The HDFC Bank Millennia Credit Card is a strong choice for millennials who shop frequently with partner merchants like Amazon, Flipkart, and Swiggy, offering 5% cashback and dining discounts that align with urban lifestyles. Its quarterly milestone rewards, fuel surcharge waiver, and occasional LTF offers add value for moderate spenders. However, the ₹1,000 monthly cashback cap, redemption fees, and reliance on CashPoints rather than direct statement credits make it less competitive for high spenders or those seeking simplicity compared to alternatives like the Swiggy HDFC Bank Credit Card or SBI Cashback Credit Card. The lounge access tied to high quarterly spends is also a drawback for travelers. To maximize benefits, focus on partner merchant spends, hit the ₹1,00,000 annual spend for fee waivers, and redeem CashPoints promptly to avoid expiry. Always verify the latest terms on the HDFC Bank website (www.hdfcbank.com) or contact customer care (1800 266 4332) before applying.

How Much Will You Really Get if Your Bank Locker Is Robbed? Shocking Truths About Insurance Cover

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!