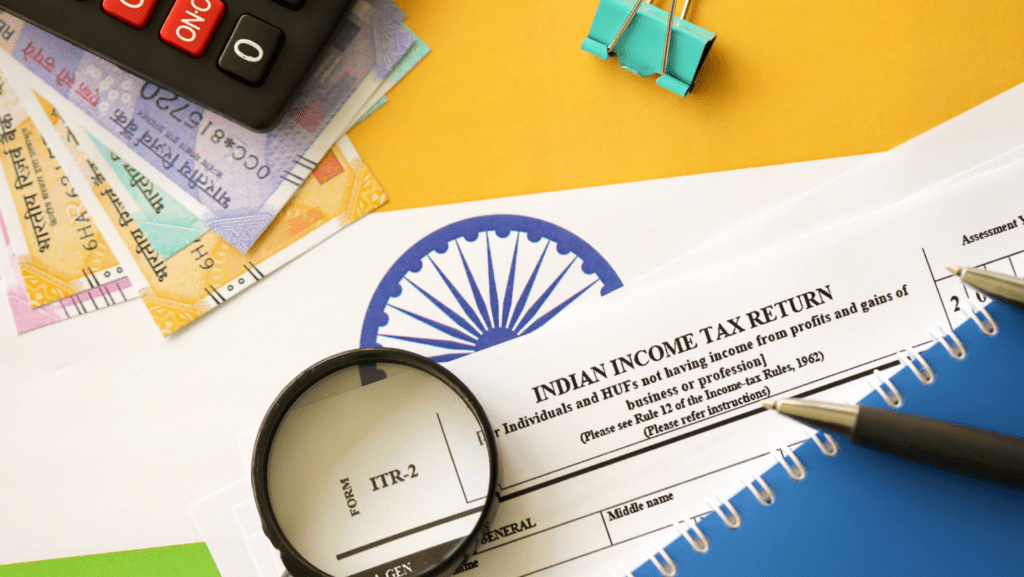

With the increasing scrutiny of financial activities, it’s essential to understand how income tax rules apply within a family. Let’s delve into the nuances of cash transactions between close family members, like between a father and son or husband and wife.

Does Income Tax Send Notices for Cash Transactions?

Tax experts clarify that if a husband gives money to his wife for household expenses or as a gift, this amount is considered the husband’s income. The wife, in this scenario, is not liable for income tax, and she will not get a notice from the Income Tax Department. But, if the wife invests this money repeatedly and earns an income from these investments, the resulting income is taxable in her name. The income tax on such investment returns will be calculated annually, and she will need to pay the applicable taxes.

Taxable and Non-Taxable Family Transactions

Let’s explore examples of taxable and non-taxable family transactions:

- Non-Taxable Family Transactions:

- Gifts: Gifts received from family members are generally non-taxable. Whether it’s a birthday present or a financial gift, you don’t need to pay income tax on it.

- Inheritances: Inherited assets, such as property or money, are typically not subject to income tax. However, any income generated from those assets (like rental income) may be taxable.

- Child Support Payments: Child support payments received by a custodial parent are non-taxable.

- Disability Benefits: Disability benefits received due to illness or injury are usually tax-free.

- Life Insurance Payouts: If you receive a life insurance payout due to the death of a family member, it’s generally not taxable.

- Taxable Family Transactions:

- Alimony (Post-2018): Alimony payments made after 2018 are taxable for the recipient.

- Profit from Partnership Firm: If you’re a partner in a firm, your share of the firm’s income is taxable.

- Rental Income from Family Property: If you earn rental income from a property owned jointly with family members, it’s taxable.

- Interest on Loans to Family Members: If you lend money to a family member and charge interest, that interest income is taxable.

- Income from Joint Ventures: Any income earned jointly with family members (e.g., business ventures) is subject to tax.

*Remember that tax laws can vary by country and region, so it’s essential to consult a tax professional for personalized advice based on your specific situation.

Assessments Related to Transactions between Family Members

Assessments related to transactions between family members are crucial for determining tax implications. Let’s explore the key aspects:

- Family Arrangements and Taxation:

- Family arrangements, including partition and compromise, play a significant role in preserving family property and maintaining peace.

- These arrangements are not governed by specific legislation but have evolved through customs and judicial decisions.

- Courts define family arrangements as agreements among family members, aiming to benefit the family by resolving disputes, preserving property, or avoiding litigation.

- Definition of ‘Family’ for Tax Purposes:

- Under the Income-tax Act, 1961, ‘family’ includes:

- Spouse and children of an individual.

- Parents, brothers, and sisters of the individual (wholly or mainly dependent on them).

- The term ‘family’ extends beyond legal succession rights and property claims.

- Under the Income-tax Act, 1961, ‘family’ includes:

- Tax Implications of Transactions Between Family Members:

- Gifts: Transfers as gifts between spouses are exempt from tax for the recipient. However, income generated from these funds may be taxable.

- Joint Property Ownership: When family members jointly own property, rental income is taxable. Capital gains tax applies upon property sale.

- Cash Transactions: Penalties under Sections 269SS and 269T (for cash transactions exceeding Rs 20,000) are often exempt for close relatives. However, income earned from invested funds remains taxable.

Restrictions Under Sections 269SS and 269T

According to Income Tax Sections 269SS and 269T, there is a limit on cash transactions exceeding Rs 20,000. Transactions over this amount can attract penalties. However, the law provides exemptions in certain situations, particularly in dealings between close relatives.

Here’s a checklist for compliance with Sections 269SS and 269T of the Income Tax Act:

- Section 269SS (Accepting Loans or Deposits):

- Accept loans, deposits, or advances exceeding ₹20,000 through account payee cheques, demand drafts, or electronic transfers.

- Avoid accepting cash payments beyond this limit.

- Maintain proper documentation for all transactions.

- Report such transactions in Form 3CD during tax audits.

- Section 269T (Repayment of Loans or Deposits):

- Repay loans or deposits exceeding ₹20,000 through non-cash modes (cheque, DD, ECS).

- Keep records of repayment transactions.

- Ensure compliance with the specified modes of repayment.

- Report these details in Form 3CD during tax audits

Exemptions under Sections 269SS and 269T

Let’s explore the exemptions under Sections 269SS and 269T of the Income Tax Act:

- Section 269SS:

- Purpose: This section aims to curb black money by regulating cash transactions related to loans, deposits, and specified sums.

- Restriction: A person cannot accept a loan, deposit, or specified sum of Rs. 20,000 or more in cash.

- Specified Modes of Transaction: Acceptance must occur through account payee cheques, bank drafts, electronic clearing systems (ECS), or other specified methods.

- Exceptions:

- Transactions with the government.

- Transactions with banking companies, cooperative banks, and post office savings banks.

- Transactions with corporations established by Central, State, or Provincial Acts.

- Section 269T:

- Purpose: This section ensures transparency in financial transactions involving loan repayments.

- Restriction: A person cannot repay a loan or deposit of Rs. 20,000 or more in cash.

- Exceptions:

- Repayments to the government.

- Repayments to banking companies, cooperative banks, and post office savings banks.

- Repayments to corporations established by Central, State, or Provincial Acts.

Penalties for Violating Sections 269SS and 269T

Let’s explore the penalties associated with violating Sections 269SS and 269T of the Income Tax Act:

- Section 269SS Penalty:

- If a loan or deposit is accepted in contravention of Section 269SS, the Income Tax Department may levy a penalty equal to the amount of the loan or deposit.

- Section 269T Penalty:

- Similarly, repayment of a loan or deposit in violation of Section 269T can attract a penalty of 100% of the amount of repayment.

Rectify a violation under these Sections

To rectify a violation of Sections 269SS and 269T of the Income Tax Act, follow these steps:

- Disclosure and Reporting:

- If you’ve violated these sections, promptly disclose the transaction details to the Income Tax Department.

- File the necessary forms (such as Form 35A) to report the violation.

- Pay the Penalty:

- Pay the penalty imposed by the Income Tax Department.

- The penalty amount is typically equal to the loan or deposit amount (for Section 269SS) or 100% of the repayment (for Section 269T).

- Maintain Proper Documentation:

- Keep records of the transaction, including evidence of the violation and penalty payment.

- Consult a tax professional for guidance on documentation and compliance.

How to Avoid such Violations

To avoid violations of Sections 269SS and 269T in the future, consider the following steps:

- Electronic Transactions: Opt for electronic modes of payment (such as bank transfers, cheques, or digital wallets) for loans, deposits, and repayments. These methods comply with the specified rules and help prevent violations.

- Documentation: Maintain proper documentation for all financial transactions. Record details like transaction dates, amounts, and parties involved. This documentation will be useful if any questions arise later.

- Awareness: Stay informed about tax regulations and updates. Regularly check official government websites or consult a tax advisor to understand the latest rules and exemptions.

- Professional Advice: Consult a tax professional for personalized guidance. They can provide specific recommendations based on your unique circumstances.

Remember, proactive compliance ensures smooth financial transactions and minimizes the risk of penalties.

Exemptions on Penalties for Family Transactions

The good news is that transactions between close relatives, such as between father and son or husband and wife, are often exempt from penalties under these sections. This means that while cash transactions within the family are generally safe from penalties, any income earned from investing that money may still be subject to tax.

Final Thought

Understanding these nuances can help you navigate financial transactions within your family more confidently. While routine cash transfers for expenses or gifts are typically safe, be mindful of the tax implications if those funds are invested and generate income. Always consider consulting with a tax professional to ensure compliance with the latest regulations and to avoid any unexpected tax liabilities.

Frequently Asked Questions (FAQ)

- Q: What is the penalty for accepting a loan or deposit in cash exceeding ₹20,000?

- A: Violating Section 269SS can result in a penalty equal to the loan or deposit amount.

- Q: Is rental income from jointly owned family property taxable?

- A: Yes, rental income from jointly owned property is subject to income tax.

- Q: Can I gift money to my spouse without tax implications?

- A: Gifts between spouses are generally non-taxable, but income earned from those funds may be taxable.

- Q: What’s the definition of ‘family’ for tax purposes?

- A: ‘Family’ includes spouses, children, parents, siblings, and dependent relatives.

- Q: How can I avoid violating Sections 269SS and 269T?

- A: Opt for electronic transactions, maintain documentation, and stay informed about tax rules.

- Q: What’s the penalty for violating Section 269T during loan repayments?

- A: Repaying loans exceeding ₹20,000 in cash can lead to a penalty of 100% of the repayment amount.

- Q: How do family arrangements impact taxation?

- A: Family arrangements resolve disputes and preserve property but aren’t governed by specific legislation.

- Q: Can I inherit property without paying income tax?

- A: Inherited assets are generally not taxable, but income generated from them may be.

- Q: What’s the purpose of Sections 269SS and 269T?

- A: These sections regulate cash transactions to prevent tax evasion and promote transparency.

- Q: How can I rectify a violation of these sections?

- A: Disclose the violation, pay the penalty, and maintain proper documentation.

-

ITR Filing: Can You Combine Two Businesses Under One PAN Without Penalties?

-

Can PM Vidyalaxmi’s Zero-Collateral Loans Make IITs and IIMs Affordable for You?

-

How Udyogini Scheme is Transforming Lives: Is This India’s Biggest Women Empowerment Revolution?

-

The Mysterious Role of Net Worth in Securing a Loan: Unravel the Secrets to Financial Success