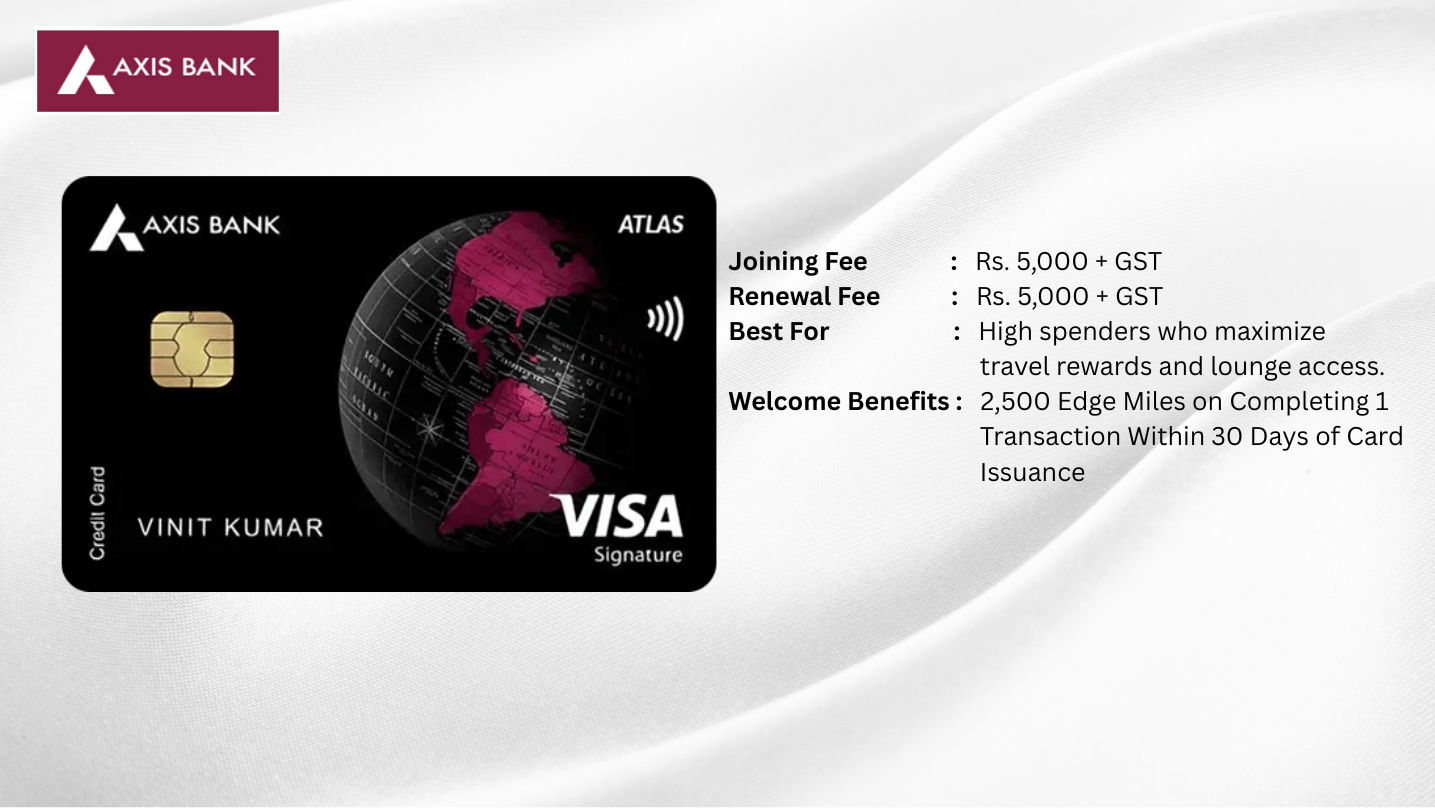

Unlock 18 Lounge Access Visits with Axis Bank Atlas Credit Card—Here’s How!

Axis Bank Atlas Credit Card: a premium travel card with 5 EDGE Miles/₹100 on travel, flexible redemptions, and generous lounge access. Ideal for frequent travelers, but high fees and caps apply. Compare with peers and maximize rewards today!

The Axis Bank Atlas Credit Card is a premium travel-focused credit card designed for frequent travellers seeking to maximize rewards through air miles and travel-related benefits. Launched by Axis Bank, it targets individuals with high travel expenditures, offering a robust rewards program centered around EDGE Miles, which can be redeemed for flights, hotel stays, or transferred to partner airline and hotel loyalty programs. The card operates on a tiered membership system—Silver, Gold, and Platinum—based on annual spending, unlocking enhanced benefits as spending increases. With features like complimentary airport lounge access, dining discounts, and milestone rewards, it positions itself as a strong contender in the premium travel credit card segment in India.

Review

The Axis Bank Atlas Credit Card stands out for its airline-agnostic rewards system, allowing flexibility in redeeming EDGE Miles across over 20 airline and hotel partners at a 1:2 conversion ratio (except for Marriott Bonvoy, where 2 EDGE Miles = 1 point). This flexibility is a significant draw for travellers who prefer not to be tied to a single airline or hotel chain. The card’s tiered structure incentivizes higher spending, with benefits like bonus EDGE Miles and increased lounge access at higher tiers. However, recent updates effective April 20, 2024, introduced caps on accelerated rewards and excluded categories like rent and utilities from earning EDGE Miles, slightly diminishing its appeal for some users. Despite these changes, the card remains a compelling option for those with significant travel-related spending, particularly due to its competitive reward rates and lounge access. User sentiment on platforms like X highlights its value for high spenders but notes complexity in maximizing rewards due to exclusions and caps.

Rewards and Benefits

The Axis Bank Atlas Credit Card offers a structured rewards program with the following key benefits:

Reward Structure

- Welcome Benefit: 2,500 EDGE Miles upon completing the first transaction within 37 days of card issuance (for cards sourced post-April 20, 2024). Earlier versions offered 5,000 EDGE Miles for three transactions within 60 days.

- Earning EDGE Miles:

- 5 EDGE Miles per ₹100 spent on travel-related transactions (up to ₹2 lakh per month) through the Axis Bank Travel EDGE Portal, direct airline, or hotel bookings (MCC codes 3000–3350, 4511 for airlines; 3501–3838, 7011 for hotels).

- 2 EDGE Miles per ₹100 spent on all other eligible transactions, with exclusions for gold/jewellery, rent, wallet, government institutions, insurance, fuel, and utilities.

- Post ₹2 lakh monthly travel spend, the reward rate drops to 2 EDGE Miles per ₹100.

- Milestone Benefits:

- Silver Tier (up to ₹7.5 lakh annual spend): 2,500 EDGE Miles on ₹3 lakh spend.

- Gold Tier (₹7.5–15 lakh annual spend): 5,000 EDGE Miles on ₹7.5 lakh spend.

- Platinum Tier (above ₹15 lakh annual spend): 10,000 EDGE Miles on ₹15 lakh spend.

- Renewal Benefits: EDGE Miles awarded based on tier at renewal:

- Silver: 2,500 EDGE Miles

- Gold: 5,000 EDGE Miles

- Platinum: 7,500 EDGE Miles

- Redemption Options:

- Axis Bank Travel EDGE Portal: 1 EDGE Mile = ₹1 for booking flights, hotels, or experiences.

- Miles Transfer Program: Transfer EDGE Miles to partner airline/hotel programs at 1:2 ratio (e.g., 1 EDGE Mile = 2 partner miles, except Marriott Bonvoy at 2:1). Annual transfer cap: 30,000 EDGE Miles for Group A partners, 120,000 for Group B partners, and 150,000 total per customer ID.

- Partners include Air India, Vistara, Emirates, Singapore Airlines, Club ITC, Accor ALL, and IHG. Transferring via Club ITC to Marriott Bonvoy can yield a 1:3 ratio.

- Joining Fees: Rs 5000 + GST

- Annual Fees: Rs 5000 + GST

- 5000 EDGE Miles as Welcome Benefit.

- 8 Domestic and 4 International Airport Lounge visits.

- Tier based rewards based on annual spending.

Travel Benefits

- Lounge Access:

- Silver Tier: 8 domestic and 4 international lounge visits annually.

- Gold Tier: 12 domestic and 6 international lounge visits.

- Platinum Tier: 18 domestic and 12 international lounge visits.

- Access includes primary cardholder and guests, though occasional glitches may result in guest charges, reversible via customer support.

- Fuel Surcharge Waiver: 1% waiver on fuel transactions between ₹400–₹4,000 (max ₹400/month).

- Airport Concierge Services: Discontinued as of April 20, 2024.

Lifestyle Benefits

- Dining Discounts: Up to 25% off (max ₹800) twice per month via EazyDiner on a minimum bill of ₹2,000.

- No Forex Markup Fee: Highlighted in some reviews as a benefit, though most sources confirm a 3.5% + GST forex markup fee, making it less competitive for international spending.

Fees and Charges

- Joining Fee: ₹5,000 + GST (₹5,900 total).

- Annual Fee: ₹5,000 + GST, non-waivable but offset by renewal EDGE Miles based on tier.

- Forex Markup Fee: 3.5% + GST, high for a travel card.

- Over Limit Penalty: 2.5% of over limit amount (minimum ₹500).

- Redemption Fees:

- ₹99 + GST for redeeming EDGE Miles on Travel EDGE Portal.

- ₹199 + GST for converting EDGE Miles to partner points.

- Interest Rate: Up to 3.6% per month (52.86% annually) on unpaid balances.

- Cash Advance Fee: Typically 2.5% (minimum ₹500), though some premium Axis cards have zero cash advance charges.

.

Pros

- High Reward Rate on Travel: 5 EDGE Miles per ₹100 on travel spends (up to ₹2 lakh/month) translates to a 10% reward rate when transferred at 1:2 to partners valuing miles at ₹1 each.

- Flexible Redemption: Airline-agnostic miles transferable to over 20 partners, offering versatility.

- Tiered Benefits: Higher tiers unlock significant lounge access and bonus miles, ideal for high spenders.

- Welcome and Milestone Benefits: Up to 2,500 EDGE Miles as a welcome bonus and 10,000 EDGE Miles for milestone spends enhance value.

- Lounge Access: Generous domestic and international lounge visits, including guests, add significant value.

Cons

- High Annual Fee: ₹5,000 + GST with no waiver option may deter moderate spenders.

- Reward Caps: 5 EDGE Miles capped at ₹2 lakh/month travel spends; annual transfer cap of 150,000 EDGE Miles (30,000 for Group A partners).

- Exclusions: No EDGE Miles for gold/jewellery, rent, wallet, government, insurance, fuel, or utilities, limiting earning potential.

- High Forex Markup: 3.5% + GST is steep for a travel card, reducing appeal for international spending.

- Complex Reward System: Tiered structure and caps require careful planning to maximize benefits.

- No Insurance Coverage: Lacks travel insurance, unlike some competitors.

- Recent Devaluations: Caps and exclusions introduced in April 2024 reduced overall value.

Comparison with Peers

Below is a detailed comparison of the Axis Bank Atlas Credit Card with its peers: HDFC Diners Club Black, Axis Bank Magnus, and SBI Card Elite, focusing on key parameters relevant to travel-focused cards.

|

Feature |

Axis Bank Atlas |

HDFC Diners Club Black |

Axis Bank Magnus |

SBI Card Elite |

|

Annual Fee |

₹5,000 + GST (non-waivable) |

₹10,000 + GST (waivable on ₹8 lakh annual spend) |

₹12,500 + GST (waivable on ₹25 lakh annual spend) |

₹4,999 + GST (non-waivable) |

|

Welcome Benefit |

2,500 EDGE Miles (₹2,500–₹5,000 value at 1:2 transfer) |

10,000 Reward Points (₹3,000–₹5,000 value) |

25,000 EDGE Points (₹5,000–₹10,000 value at 5:4 transfer) |

7,500 Reward Points (₹1,875–₹3,000 value) |

|

Reward Rate |

5 EDGE Miles/₹100 on travel (up to ₹2L/month); 2 EDGE Miles/₹100 on others |

3.3 Reward Points/₹150 on general spends; 10X on select categories |

12 EDGE Points/₹200 on general spends; 60 EDGE Points/₹200 on select spends |

5 Reward Points/₹100 on dining/travel; 2 Reward Points/₹100 on others |

|

Reward Value |

1 EDGE Mile = ₹1 (Travel EDGE) or 2 partner miles (₹1–₹2/mile) |

1 RP = ₹0.3–₹1 depending on redemption |

1 EDGE Point = ₹0.2–₹0.8 (5:4 transfer to miles) |

1 RP = ₹0.25–₹0.5 depending on redemption |

|

Lounge Access |

Silver: 8 domestic, 4 international; Gold: 12 domestic, 6 international; Platinum: 18 domestic, 12 international |

Unlimited domestic and international lounge access |

Unlimited domestic and international lounge access |

8 domestic, 4 international lounge visits annually |

|

Forex Markup Fee |

3.5% + GST |

2% + GST |

2% + GST |

3.5% + GST |

|

Milestone Benefits |

Up to 10,000 EDGE Miles based on tier (₹3L–₹15L spend) |

10,000 RP on ₹4L quarterly spend |

25,000 EDGE Points on ₹25L annual spend |

10,000 RP on ₹10L annual spend |

|

Dining Benefits |

25% off up to ₹800 via EazyDiner (2x/month) |

2X Reward Points on dining; partner discounts |

25% off via EazyDiner; partner discounts |

5 RP/₹100 on dining |

|

Travel Insurance |

None |

Up to ₹2 crore travel insurance |

Up to ₹2 crore travel insurance |

Up to ₹1 crore travel insurance |

|

Redemption Flexibility |

High (20+ airline/hotel partners, 1:2 ratio) |

Moderate (air miles, hotel bookings, vouchers) |

High (multiple airline/hotel partners, 5:4 ratio) |

Moderate (air miles, hotel bookings, vouchers) |

Analysis

- Axis Bank Atlas: Best for frequent travellers with high travel spends (up to ₹2 lakh/month) due to its 5 EDGE Miles/₹100 rate and flexible 1:2 mile transfer. However, the high forex markup and reward caps limit its appeal for international travellers and moderate spenders.

- HDFC Diners Club Black: Offers superior lounge access (unlimited) and lower forex markup (2%), making it better for international travellers. Its reward rate is lower but more versatile across categories, and it includes travel insurance.

- Axis Bank Magnus: Higher annual fee but offers unlimited lounge access and higher milestone rewards for ultra-high spenders. Better suited for those with diverse spending patterns but less travel-focused than Atlas.

- SBI Card Elite: Comparable annual fee and lounge access to Atlas Silver tier, but lower reward rates and less flexible redemption options make it less competitive for air miles enthusiasts.

Recommendations

The Axis Bank Atlas Credit Card is highly recommended for:

- Frequent Travellers: Those spending ₹7.5–15 lakh annually, particularly on direct airline and hotel bookings, can maximize the 5 EDGE Miles/₹100 rate and tiered benefits (Gold/Platinum tiers). The 1:2 mile transfer ratio offers excellent value for redemptions with partners like Singapore Airlines or Accor ALL.

- Lounge Access Seekers: The card’s tiered lounge access (up to 18 domestic and 12 international visits) is generous, especially for Platinum tier holders, rivalling premium cards like HDFC Diners Club Black.

- High Spenders: Achieving Platinum tier (₹15 lakh annual spend) unlocks 17,500 EDGE Miles (milestone + renewal), translating to 35,000 partner miles, potentially worth ₹35,000–₹70,000.

Who Should Avoid It?

- Moderate Spenders: Those spending below ₹7.5 lakh annually may find the ₹5,000 annual fee and reward caps less justifiable, especially with exclusions on utilities and rent.

- International Travellers with High Forex Spends: The 3.5% forex markup fee is a significant drawback compared to cards like HDFC Diners Club Black (2%) or Axis Bank Burgundy Private (0%).

- Users Seeking Simplicity: The tiered system and reward caps require strategic spending to maximize value, which may be too complex for casual users.

Alternatives

- HDFC Diners Club Black: Ideal for international travellers due to lower forex fees, unlimited lounge access, and travel insurance, though it has a higher annual fee.

- Axis Bank Select: Better for moderate spenders seeking a lower fee (₹3,000) and versatile rewards, with a fee waiver at ₹8 lakh spend.

- SBI Card Elite: Suitable for those with lower travel spends who still want lounge access and decent rewards at a similar fee.

- Amex Platinum Travel Card: Offers first-year-free benefits and strong travel rewards, complementing Atlas for those unable to maximise its travel spend caps.

Final Thought

The Axis Bank Atlas Credit Card is a strong choice for frequent travellers with high direct travel spends, offering a robust rewards program and generous lounge access. Its 1:2 mile transfer ratio and tiered benefits make it a top contender in the air miles segment, despite recent devaluations. However, its high annual fee, reward caps, and exclusions (e.g., utilities, rent) make it less suitable for moderate spenders or those prioritizing simplicity. Comparing it to peers, it excels in reward flexibility but lags in forex fees and insurance coverage. Travellers spending over ₹7.5 lakh annually, particularly on travel, should consider this card, while others may find better value in alternatives like the HDFC Diners Club Black or Axis Bank Select.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

Somebody essentially assist to make significantly

articles I’d state. That is the first time I frequented your website page and to this point?

I surprised with the research you made to make this actual

publish incredible. Fantastic process!

Thanks for sharing your thoughts. I truly appreciate your

efforts and I am waiting for your further write ups thanks once again.