Bank of Maharashtra Breaks the Floor: Why 7.10% May Be the Lowest You'll See

7.10% isn’t just a rate cut—it’s a “wealth trap” for the unaware. BoM’s aggressive slash hides a secret credit filter that could cost you ₹1.8 Lakhs. Why is this specific number the tipping point for 2026? Don’t sign until you check the one clause banks are praying you miss.

What if I told you that the most significant number in India’s financial landscape right now isn’t the Sensex hitting a new high or the GDP growth rate—but a simple, unassuming 7.10%? While most headlines are celebrating Bank of Maharashtra’s recent 25 basis point rate cut as a standard holiday gift to borrowers, they are missing a crucial, nearly invisible signal that could define your financial freedom for the next decade. This isn’t just about cheaper EMIs; it’s a quiet declaration of a new credit war that could leave unprepared borrowers paying lakhs more than they should. Why is this specific rate cut the “tipping point” for the Indian economy in late 2025, and what is the one trap hidden in the fine print that you need to avoid today?

The 25 BPS Slash: More Than Just a Number

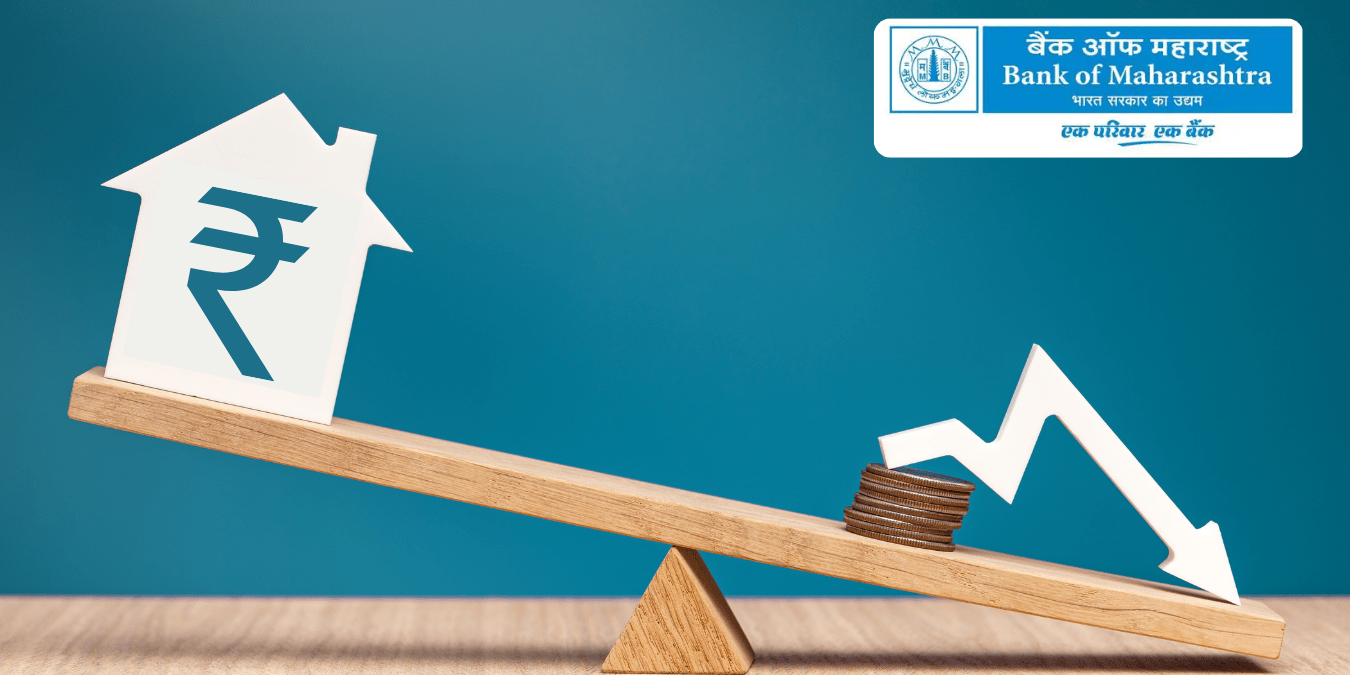

On December 7, 2025, Bank of Maharashtra (BoM) officially slashed its retail loan rates by 25 basis points (bps), bringing its home loan interest rate down to a startling 7.10% and car loans to 7.45%. This move follows the Reserve Bank of India’s (RBI) decisive cut of the repo rate to 5.25% earlier this week, marking a cumulative reduction of 125 bps throughout 2025.

While a 0.25% drop might seem like small change on paper, the compounding mathematics tells a shocking story. On a standard ₹50 lakh home loan over 20 years, this reduction doesn’t just save you a few hundred rupees a month; it wipes out approximately ₹1.8 lakh in interest payments over the loan’s tenure. For the average middle-class Indian family aspirational about homeownership, this is the equivalent of getting a free renovation or a small car essentially “on the house.”

The Hidden Credit Score Trap

Here is the aspect most enthusiastic borrowers miss: 7.10% is not for everyone. The aggressive headline rate acts as a magnet, but it often comes with a stringent "credit elite" filter. Banks typically reserve their rock-bottom rates for borrowers with CIBIL scores of 800 or above. If your score hovers around 750, you might still be quoted 7.35% or higher, erasing the perceived benefit.

This segmentation reveals a subtle strategy: banks are not just cutting rates to be generous; they are aggressively hunting for "prime" customers to clean up their loan books. By offering 7.10%, BoM is effectively poaching the safest borrowers from private competitors, forcing a consolidation in the market where your credit score is now your most powerful bargaining chip.

2025: The Year of the Borrower’s Market

To understand the gravity of this cut, we must look at the macro picture. The table below compares how Bank of Maharashtra’s new aggressive stance stacks up against the broader market trends as of December 2025.

| Bank / Institution | Home Loan Starting Rate (Dec 2025) | Market Position |

| Bank of Maharashtra | 7.10% | Market Leader (Aggressive) |

| Karnataka Bank | 7.30% | Challenger |

| Central Bank of India | 7.35% | Challenger |

| Major Private Banks | 7.40% - 7.50% | Conservative |

BoM’s 7.10% is currently among the lowest in the industry, undercutting even major private players. This signals a desperate need for public sector banks to deploy excess liquidity. With the repo rate at 5.25%, the spread (margin) for banks is narrowing, meaning they must make up for lower margins with higher volume. This is excellent news for you: banks are now in a "rate war," and you are the prize they are fighting over.

Comparison0020of BoM New Rates with other Public Sector Banks

The following comparison highlights the aggressive gap Bank of Maharashtra (BoM) has opened against its public sector peers. While most major PSBs are hovering between 7.35% and 7.50%, BoM’s cut to 7.10% positions it as the clear market disruptor.

| Bank | Starting Home Loan Rate (p.a.) | Recent Action (Dec 2025) | The "Hidden" Cost Difference* |

| Bank of Maharashtra | 7.10% | Cut by 25 bps (Dec 7) | Baseline (Cheapest) |

| Central Bank of India | 7.35% | Competitive positioning | Pays ₹17,000 more interest |

| Canara Bank | 7.40% | Rates held steady | Pays ₹21,000 more interest |

| Union Bank of India | 7.45% | Adjusted post-repo cut | Pays ₹25,000 more interest |

| Bank of Baroda | 7.45% | Benchmark (BRLLR) cut to 7.90% | Pays ₹25,000 more interest |

| State Bank of India (SBI) | 7.50% | Conservative stance | Pays ₹29,000 more interest |

| Punjab National Bank | 8.10% | Cut RLLR to 8.10% | Pays ₹72,000 more interest |

* Hidden Cost Difference: Estimated annual extra interest paid on a ₹50 Lakh loan compared to Bank of Maharashtra's 7.10% rate.

Can Existing Borrowers Request an Immediate EMI Revision from BoM?

No, you cannot demand an immediate revision on the spot, but your rate will adjust automatically very soon if you are on the right regime. For RLLR-linked borrowers, the revision is automatic but follows a "reset calendar" (usually quarterly). For MCLR or Base Rate borrowers, you are stuck with higher rates unless you actively intervene and pay a fee to switch.

Here is the breakdown of what you can and cannot do right now:

1. If You Are on RLLR (Repo Linked Lending Rate)

- Status: You are in the best position. Your loan is directly tied to the RBI’s repo rate.

- The "Reset" Catch: Bank of Maharashtra (BoM) does not reduce your EMI the day the news breaks. Your rate is updated on your specific Reset Date. BoM typically resets RLLR accounts quarterly.

- Example: If your reset dates are Jan 1, April 1, July 1, and Oct 1, you must wait until Jan 1, 2026, to see the new 7.10% (or adjusted) rate reflect in your account.

- Action Required: None. The system is automated. However, check your loan agreement for your specific reset cycle.

2. If You Are on MCLR (Marginal Cost of Funds Based Lending Rate)

- Status: You are effectively "trapped" in a slower-moving regime. MCLR loans have a reset period of 6 months or 1 year. Even if the repo rate drops today, your rate might not change for another 8-10 months until your next annual reset arrives.

- Immediate Solution: You can request a "Switchover" to the RLLR regime immediately.

- Cost: BoM charges a switchover fee (typically around ₹5,000 + GST or 0.5% of the outstanding amount, depending on the specific loan terms).

- Math: If your loan is ₹50 Lakhs and you are paying 8.5% (MCLR), switching to ~7.10% (RLLR) saves you ~₹5,000 per month. The fee pays for itself in just one month.

3. The "EMI vs. Tenure" Choice

- Default Behavior: When rates drop, banks usually keep your EMI amount the same but reduce your loan tenure (e.g., your 20-year loan finishes in 18 years). This saves you interest but doesn't free up monthly cash.

- Requesting Lower EMI: If you specifically want more cash in hand every month (lower EMI), you must submit a written request to your home branch. This is a manual revision and may incur a small administrative fee.

Recommendation for Monday Morning:

Log in to your net banking or check your loan statement.

- If it says "RLLR": Relax. Wait for your next quarter reset.

- If it says "MCLR" or "Base Rate": Visit your branch immediately. Submit an application to "Switch to RLLR". Do not wait for the automatic reset—it is too slow and will cost you thousands in lost savings.

Actionable Takeaways: How to Capitalize Now

The window to act is narrow. Here is how you can leverage this news immediately:

- For Existing Borrowers: If your current home loan interest rate is 7.60% or higher, you are overpaying. Contact your bank immediately for a "rate conversion" or "repricing." If they refuse, threaten a balance transfer to BoM or another aggressive lender. The processing fees for transfer are often negligible compared to the long-term savings of a 50 bps difference.

- The "Repo-Link" Check: Ensure your loan is linked to the RLLR (Repo Linked Lending Rate), not the older MCLR regime. RLLR loans transmit these rate cuts instantly (usually within a quarter), whereas MCLR loans are stickier and slower to adjust.

- Auto Upgrades: With car loan rates hitting 7.45%, the total cost of ownership for vehicles has dropped significantly. If you delayed a purchase in 2024 due to high rates, the math has now shifted in your favor.

Final Thought: The "Neutral Stance" Wildcard

Before you rush to sign the papers, there is one final twist. The RBI has retained a "neutral stance" alongside its rate cut. This cryptic banker-speak means they are watching inflation like a hawk. If inflation spikes in Q1 2026, this rate-cut cycle could halt abruptly. We are likely at the bottom of the interest rate cycle—meaning 7.10% might be the floor. Waiting for rates to drop to 6.5% could be a gamble that costs you the opportunity to lock in historically low rates today. Are you ready to move, or will you wait and watch the door close?

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.