AI to Take Over Banking Jobs? How OpenAI’s Project Mercury Will Change Indian Banking Jobs

Discover the shocking truth about AI’s secret plan to disrupt Indian banking jobs in 2025! OpenAI’s Project Mercury is set to automate entry-level tasks, but the real impact on junior bankers remains hidden. Are Indian banks ready for this swift revolution? Find out why your career could change forever—and what to do now!

The Indian banking sector stands at a thrilling yet challenging crossroads as artificial intelligence (AI) gears up to transform its very fabric. Imagine junior bankers—the backbone of daily financial operations—suddenly replaced by smart AI systems handling their most grueling, repetitive tasks. This is no science fiction. OpenAI’s latest bold move, ‘Project Mercury,’ is making this a near reality. Launched in October 2025, this secretive initiative employs AI trained by over 100 former investment bankers to automate entry-level banking tasks that were traditionally time-consuming and labor-intensive. What does this mean for India’s vast workforce and the future of banking jobs? This article delves into the intricacies, trends, and impact, blending insider insights, Indian context, and practical analysis for anyone invested in financial careers or the evolving economy.

Project Mercury: The AI Revolution in Banking Begins

OpenAI’s Project Mercury is not just another tech experiment; it’s a potential game-changer aimed at revolutionizing how banking functions globally and in India. By enlisting ex-bankers with deep domain knowledge from global giants such JPMorgan Chase, Morgan Stanley, and Goldman Sachs, OpenAI pays these experts $150 per hour to create detailed financial models. These models then form the “training ground” where AI learns to automate complex tasks such as financial modeling for IPOs, mergers, buyouts, and restructuring deals. This smart AI promises to drastically cut down the mundane and repetitive workload faced by junior bankers who often work over 80 hours a week.

In practical terms, what Watson did for healthcare, OpenAI’s Mercury aims to do for banking entry-level tasks—replace grunt work with speed, precision, and 24/7 efficiency. Yet, this does not just serve global banking hubs. India’s large pool of junior bankers who grind on spreadsheets and presentations now face a future where AI could handle much of their workload, or even replace the role altogether.

Firms Already Using AI in Indian Banking

Several leading firms in Indian banking have already integrated AI technology to enhance their operations and customer services. Here are notable examples:

- HDFC Bank: Uses AI-powered chatbots and virtual assistants for 24/7 customer queries, fraud detection, and personalized banking services. Their AI platforms also analyze customer behavior to offer tailored financial products.

- ICICI Bank: Implements AI for credit risk assessment, real-time fraud detection, and automated loan processing. The bank employs AI-driven analytics to optimize wealth management and investment advisory services.

- State Bank of India (SBI): Leverages AI to streamline loan approvals, detect fraudulent transactions, and improve customer interaction through voice recognition and chatbot technologies.

- Axis Bank: Uses AI and machine learning models for predictive analytics to manage credit portfolios and for enhancing cybersecurity measures.

- Kotak Mahindra Bank: Employs AI in risk management frameworks and digital onboarding processes, enabling faster and smarter customer verification and credit evaluation.

These banks exemplify India’s rapid adoption of AI to automate backend functions, improve customer experience, and manage risks better, reflecting wider trends in the industry’s digital transformation.

Why India’s Banks Cannot Ignore AI

The Indian banking sector, with its expansive workforce and pivotal role in the country’s growth story, feels the pressure to innovate. Despite a five-fold increase in IT spending in the last decade, productivity gains in Indian banks remain stubbornly low at just 1%. According to a recent Boston Consulting Group (BCG) report, AI could reshape 35-50% of job roles in Indian banking—a staggering figure that reflects the sector’s urgent need for transformation.

India is unique due to its vast unbanked population, digital payment revolution, and the ambitious Viksit Bharat mission aimed at achieving faster economic growth. AI-driven automation could enable banks to cut costs, enhance operational efficiency, and expand credit access, which is critical as credit growth lagged behind nominal GDP growth in FY25. The adoption of AI is not a luxury but a necessity for Indian banks to break rigid cost structures and compete globally.

What Entry-Level Tasks Will AI Automate?

Project Mercury targets the very core of junior bankers’ daily tasks—financial modeling and analysis often done in tedious Excel spreadsheets. These include:

- Building detailed transaction models for IPOs, mergers, restructuring, and buyouts

- Revising and tweaking large PowerPoint presentations to support deal pitches

- Manually updating spreadsheets with new financial data and assumptions

- Performing due diligence data analysis and scenario testing

This process involves AI understanding financial statements, valuation techniques, and transaction structures. By automating these, junior analysts can save countless hours weekly from routine busywork and focus on higher-value problem-solving, client interaction, or strategic tasks.

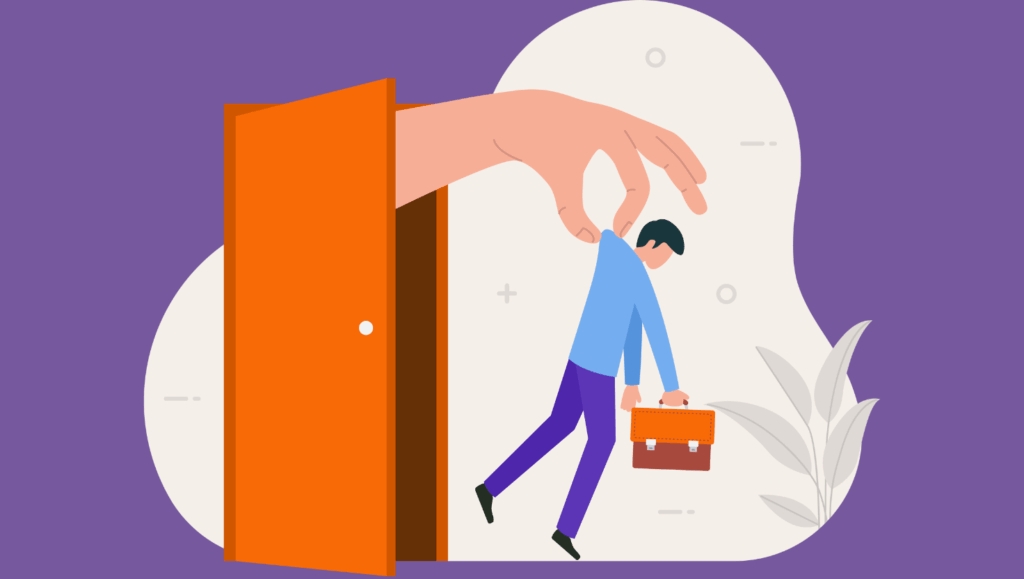

The Indian Workforce’s Concern: Will AI Replace Jobs?

Unsurprisingly, there is SHOCKING apprehension among India’s junior bankers and entry-level employees in financial services. Project Mercury symbolizes a broader trend where AI could make many roles redundant. But the story is nuanced.

While automation will certainly disrupt jobs, it will also create new opportunities for those willing to reskill and adapt. Indian banks and regulators are urged to think ahead—focusing on upskilling employees in areas where human judgment, creativity, and emotional intelligence remain critical. Advanced AI can assist but not fully replace financial advisors, relationship managers, or strategic decision-makers anytime soon.

The workforce must see AI as a smart assistant, not just a replacement. Indian private and public banks are already investing in technical skills training to prepare employees for hybrid roles where AI tools and humans collaborate.

Real-World Examples & Market Trends in India

India’s banking ecosystem is rapidly embracing digital and AI-powered solutions. Key recent trends include:

- Banks launching AI chatbots for personalized customer service and fraud detection

- Adopting AI for real-time payments and risk management

- Increased use of AI-driven credit underwriting and loan processing to speed approvals

- Private banks like HDFC and ICICI experimenting with AI analytics to enhance wealth management services

In this backdrop, OpenAI’s Project Mercury concept could be a powerful blueprint for Indian banks aiming to automate backend functions, improve speed and accuracy, and reduce operational costs without compromising service quality.

Ethical and Practical Challenges Ahead

As Indian banks move to embrace AI, there are essential challenges around data privacy, ethical AI use, and fair workforce transition. Ensuring transparency in AI decision-making and protecting sensitive customer data must be priorities.

Moreover, regulators in India need coordinated policies balancing AI innovation with workforce protection. Without proper governance, AI adoption could deepen inequalities or lead to job losses without adequate social safeguards.

Meanwhile, banking executives must manage employee anxieties with thoughtful change management and clear communication, positioning AI as complimentary to human skills, not a threat.

How Can Indian Professionals Future-Proof Their Careers?

For junior bankers and financial professionals wary of AI takeover, the proactive path includes:

- Developing skills in AI tools, data analytics, and financial technology

- Gaining expertise in strategic advisory, client management, and complex problem-solving

- Pursuing certifications and short courses on AI applications in finance

- Embracing lifelong learning to stay ahead in a fast-evolving industry

Adaptability, technical know-how, and emotional intelligence will be the secret weapons in an AI-augmented banking world. Professionals who learn to collaborate with AI will not only survive but thrive.

Key Takeaways

- OpenAI’s Project Mercury automates junior banking tasks like financial modeling and spreadsheet work using AI trained by over 100 ex-bankers.

- Indian banking jobs could see a 35-50% transformation due to AI adoption, per BCG.

- AI boosts productivity and operational efficiency while helping banks expand credit access, vital for India’s economic growth.

- Junior bankers face job disruption but opportunities exist in upskilling and hybrid AI-human roles.

- Digital banking trends in India show rapid AI adoption for customer service, risk, payments, and wealth management.

- Challenges include ethical AI use, data privacy, and workforce transition planning.

- Professionals must future-proof careers by embracing AI skills, lifelong learning, and strategic thinking.

Final Thought

As OpenAI's Project Mercury boldly steps onto the global banking stage, the question in India is less about AI taking over and more about how Indian professionals will harness this hidden, powerful wave of automation. Will it be the end of entry-level banking jobs, or a smart new chapter where human talent teams up with AI for unprecedented productivity? The secret lies in adaptation, curiosity, and bold transformation. The future is not just automation — it’s smart collaboration. And in this brave new world, those who prepare wisely will unlock not just survival, but thriving success beyond imagination.

Curious to see how Indian banks will navigate this AI revolution and what it means for your career? Stay tuned as this story unfolds — the transformation is only just beginning.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.