How to withdraw cash at SBI ATMs using any UPI app—no card needed! Learn the step-by-step process, benefits, and limitations of this secure, cardless withdrawal feature. Embrace India’s digital banking revolution with SBI’s UPI-ATM service for hassle-free, instant cash access.

Digital payments are transforming the way Indians handle money, the State Bank of India (SBI) has introduced a ground-breaking feature that’s redefining convenience: cardless cash withdrawal at SBI ATMs using any Unified Payments Interface (UPI) app. Launched as part of the Interoperable Cardless Cash Withdrawal (ICCW) system, this innovation allows SBI customers and users of other UPI-enabled banks to withdraw cash without a debit or credit card, simply by scanning a QR code with apps like BHIM, Google Pay, PhonePe, or Paytm. This service is live across thousands of SBI ATMs, making it a game-changer for secure, hassle-free banking in India. This blog post explores how this feature works, its benefits, limitations, and why it’s a significant step toward a cashless future, all while incorporating the latest data to keep you informed.

What Is UPI-Based Cash Withdrawal at SBI ATMs?

The UPI-ATM service, also known as Interoperable Cardless Cash Withdrawal (ICCW), is a revolutionary offering by the National Payments Corporation of India (NPCI) in collaboration with banks like SBI. Introduced on September 5, 2023, in Mumbai, this service allows customers to withdraw cash from SBI ATMs without a physical card. Instead, users rely on their smartphones and a UPI app to complete the transaction by scanning a dynamic QR code displayed on the ATM screen. This feature is part of India’s broader push toward digital banking, with SBI leading the charge by integrating it across its vast network of over 64,000 ATMs and Automated Deposit cum Withdrawal Machines (ADWMs) nationwide.

The process is seamless, secure, and interoperable, meaning customers of any UPI-enabled bank can use this facility at SBI ATMs, provided the ATM supports the UPI-ATM feature. With India processing 18.67 billion UPI transactions worth ₹25.14 trillion in May 2025, the integration of UPI with ATMs is a natural progression of the country’s digital payment revolution.

Why This Matters for Indian Banking

India is a global leader in instant payments, accounting for 46% of all global instant payment transactions in 2022. The introduction of UPI-ATM withdrawals aligns with the Reserve Bank of India’s (RBI) vision to expand digital payment infrastructure, as outlined in its Payments Vision 2025 document. By eliminating the need for physical cards, SBI is not only enhancing user convenience but also addressing security concerns like card skimming and cloning, which have plagued traditional ATM transactions.

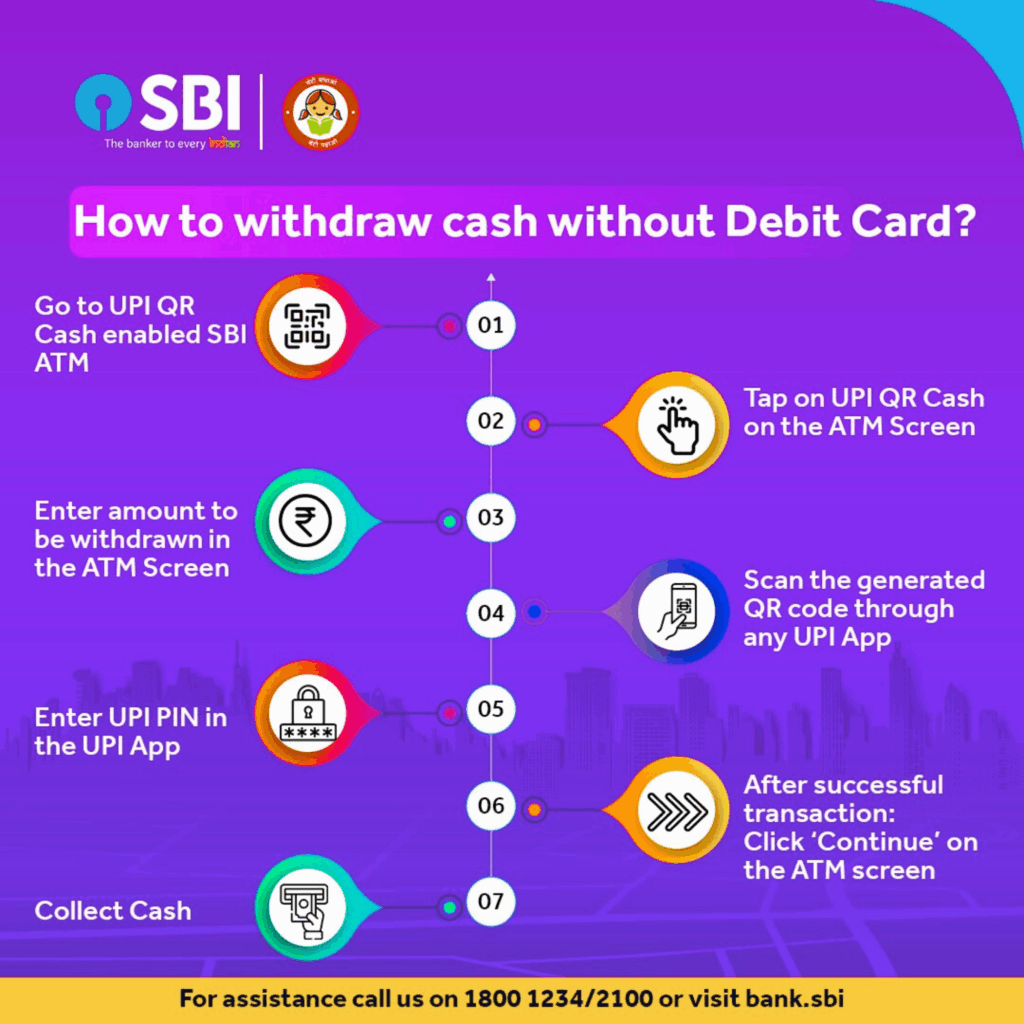

How to Withdraw Cash Using UPI at SBI ATMs

Withdrawing cash using a UPI app at an SBI ATM is straightforward and user-friendly. Here’s a step-by-step guide to help you navigate the process:

*Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

- Locate a UPI-Enabled SBI ATM: Not all ATMs support UPI withdrawals yet. Look for signage indicating “UPI Cash Withdrawal” on the ATM screen, typically at the bottom right or top left corner. SBI has equipped many of its 64,000+ ATMs with this feature, and you can use the SBI ATM Locator on their website to find one near you.

- Select the UPI Cash Withdrawal Option: At the ATM, choose the “UPI Cash Withdrawal” option from the menu.

- Enter the Withdrawal Amount: Input the amount you wish to withdraw. The maximum limit is ₹10,000 per transaction, subject to your bank’s daily UPI limits. For SBI customers, the daily UPI transaction limit is ₹1,00,000, with up to 20 person-to-person (P2P) transactions allowed daily.

- Scan the QR Code: A single-use dynamic QR code will appear on the ATM screen, valid for 30 seconds or until the scan is complete. Open any UPI app (e.g., BHIM SBI Pay, YONO SBI, Google Pay, PhonePe, or Paytm) and scan the QR code.

- Authorize the Transaction: Select the linked bank account you want to withdraw from, enter your UPI PIN, and confirm the transaction. The ATM will validate the request and dispense the cash instantly.

- Collect Your Cash: Once the transaction is successful, the ATM will dispense the cash, and you’ll receive a confirmation on your UPI app.

Pro Tip: Ensure your smartphone has an active internet connection and sufficient balance in your linked bank account. If the QR code times out, simply restart the process.

Supported UPI Apps

You can use any UPI app that supports ICCW transactions, including:

- BHIM SBI Pay

- YONO SBI or YONO Lite SBI

- Google Pay

- PhonePe

- Paytm

- Other third-party UPI apps enabled for UPI-ATM transactions

This interoperability ensures flexibility, allowing you to use your preferred app without being restricted to SBI’s proprietary apps.

Key Features of UPI-ATM Cash Withdrawal

The UPI-ATM service is packed with features that make it a compelling alternative to traditional card-based withdrawals:

- Cardless Convenience: No need to carry a debit or credit card, reducing the risk of loss or theft.

- Interoperability: Works with multiple bank accounts linked to a single UPI app, regardless of the bank.

- Enhanced Security: Dynamic QR codes and UPI PINs eliminate risks like card skimming and cloning.

- Transaction Limits: Up to ₹10,000 per transaction, with a maximum of two transactions per day (totaling ₹10,000) for UPI QR Cash withdrawals at SBI ATMs.

- No Additional Charges: NPCI does not levy extra fees for UPI-ATM transactions, though standard ATM charges may apply based on your account type and monthly transaction limits.

- Multi-Account Access: Withdraw cash from any linked bank account using a single UPI app, simplifying the process for users with multiple accounts.

Benefits of Using UPI for ATM Withdrawals

The UPI-ATM feature offers numerous advantages, making it a must-try for tech-savvy Indians and those seeking convenience:

- Hassle-Free Transactions: Forget your debit card at home? No problem. Your smartphone is all you need, making this ideal for emergencies or situations where carrying a card isn’t practical.

- Enhanced Security: The use of a dynamic QR code and UPI PIN ensures a secure transaction, minimizing risks associated with physical cards.

- Time-Saving: The process is quick, with cash dispensed instantly after PIN verification, reducing wait times at ATMs.

- Interoperable Across Banks: Whether you bank with SBI, HDFC, ICICI, or PNB, you can use this feature at any UPI-enabled ATM, promoting financial inclusion.

- Eco-Friendly: By reducing reliance on plastic cards, this system aligns with sustainable banking practices.

- Supports Digital India: This innovation furthers the Digital India initiative, encouraging cashless and digital transactions.

Limitations and Things to Keep in Mind

While the UPI-ATM feature is revolutionary, there are some limitations to consider:

- Transaction Limits: The ₹10,000 per transaction cap and two transactions per day limit may restrict users needing larger withdrawals. For SBI customers, this is part of the ₹1,00,000 daily UPI limit.

- UPI-Enabled ATMs Only: Not all SBI ATMs support this feature yet. Check for the “UPI Cash Withdrawal” option on the ATM screen.

- Internet Dependency: A stable internet connection is required to scan the QR code and authorize the transaction.

- Bank Support: Your bank must be live on the ICCW platform for you to use this feature. If you see an error like “Cash withdrawals through UPI aren’t supported by your bank,” contact your bank to confirm availability.

- Potential Glitches: If the ATM runs out of cash or the QR code times out, the transaction may fail, but funds are typically refunded within 5 business days. Always check your bank statement for reversals marked with “NFS.”

- Denomination Issues: If the ATM lacks the exact denominations (e.g., you request ₹1,200 but only ₹500 notes are available), the transaction may be declined.

SBI’s Role in Pioneering UPI-ATM Withdrawals

SBI, India’s largest public sector bank, has been at the forefront of adopting digital innovations. With over 50,000 ATMs nationwide, SBI’s integration of UPI-ATM withdrawals is a significant milestone. The bank’s revamped YONO app, launched in 2023, includes UPI features like Scan and Pay, Pay by Contacts, and Request Money, alongside the ICCW facility. This aligns with SBI’s mission of “YONO for Every Indian,” making digital banking accessible to all.

SBI’s BHIM SBI Pay and YONO Lite SBI apps are tailored for seamless UPI transactions, including ATM withdrawals. The bank’s collaboration with NPCI ensures that even non-SBI customers can use this feature at SBI ATMs, provided their bank supports ICCW.

Security Measures by SBI

SBI has implemented robust security protocols to protect UPI-ATM transactions:

- Dynamic QR Codes: Each QR code is single-use and expires within 30 seconds, reducing fraud risks.

- UPI PIN Authentication: Transactions require a 4-6 digit UPI PIN, distinct from your ATM PIN, ensuring only authorized users can withdraw cash.

- OTP for High-Value Transactions: For withdrawals above ₹10,000 using a debit card, SBI sends an OTP to your registered mobile number, adding an extra layer of security.

How UPI-ATM Fits into India’s Digital Payment Landscape

India’s UPI ecosystem has transformed the financial sector, with 18.67 billion transactions processed in May 2025 alone. The introduction of UPI-ATM withdrawals is a natural extension of this growth, building on the success of features like UPI Lite (for low-value transactions) and UPI Circle (for shared UPI IDs). The RBI’s recent launch of the UPI Interoperable Cash Deposit (UPI-ICD) feature at the Global Fintech Fest 2024 further demonstrates the versatility of UPI, allowing cash deposits at ATMs using the same technology.

The Payments Vision 2025 by RBI aims to scale UPI transactions to 1 billion per day, and innovations like UPI-ATM are critical to achieving this goal. By integrating UPI with ATMs, SBI and NPCI are bridging the gap between digital and cash-based transactions, catering to India’s diverse population.

Tips for a Smooth UPI-ATM Experience

To make the most of this feature, keep these tips in mind:

- Update Your UPI App: Ensure you’re using the latest version of your UPI app to avoid compatibility issues.

- Verify Bank Support: Confirm that your bank supports ICCW transactions. Contact your bank via www.digisaathi.info if you encounter errors.

- Check ATM Compatibility: Look for UPI-enabled ATMs to avoid wasting time.

- Maintain Internet Connectivity: A stable mobile data connection is crucial for scanning and authorizing transactions.

- Monitor Transaction Limits: Stay within the ₹10,000 per transaction and two transactions per day limits to avoid errors.

- Contact Support for Issues: If a transaction fails, raise a complaint with your bank or SBI’s customer care at 1800-11-2211 or 1800-425-3800, or email [email protected].

The Future of Cardless Withdrawals in India

The success of UPI-ATM withdrawals signals a shift toward a cardless future. Social media platforms like X have buzzed with excitement, with users calling it an “incredible innovation by Digital India” and predicting that “debit cards may be non-existent in the future.” Hitachi Payment Services, which launched India’s first UPI-ATM, is now working on UPI-based cash recycler machines (CRMs) to enable cash deposits via UPI, further expanding the ecosystem.

As banks like HDFC, ICICI, PNB, and others adopt this technology, the UPI-ATM network will grow, making cardless withdrawals ubiquitous. The RBI’s focus on internationalizing UPI, with partnerships in countries like Sri Lanka, UAE, and Singapore, suggests that this technology could soon go global.

Final Thought

The ability to withdraw cash at SBI ATMs using any UPI app is a transformative step in India’s digital banking journey. By combining convenience, security, and interoperability, SBI is empowering millions to access cash without the hassle of carrying a debit card. Whether you’re using BHIM SBI Pay, YONO SBI, or third-party apps like Google Pay, this feature offers a seamless, secure, and modern way to manage your finances. As India continues to lead the world in instant payments, innovations like UPI-ATM withdrawals are paving the way for a cashless, digitally inclusive future.