This summary should help you stay updated on the latest developments about NTPC and its renewable energy initiatives. NTPC shares climbing over 4% after NTPC Green Energy filed IPO papers to raise Rs 10,000 crore:

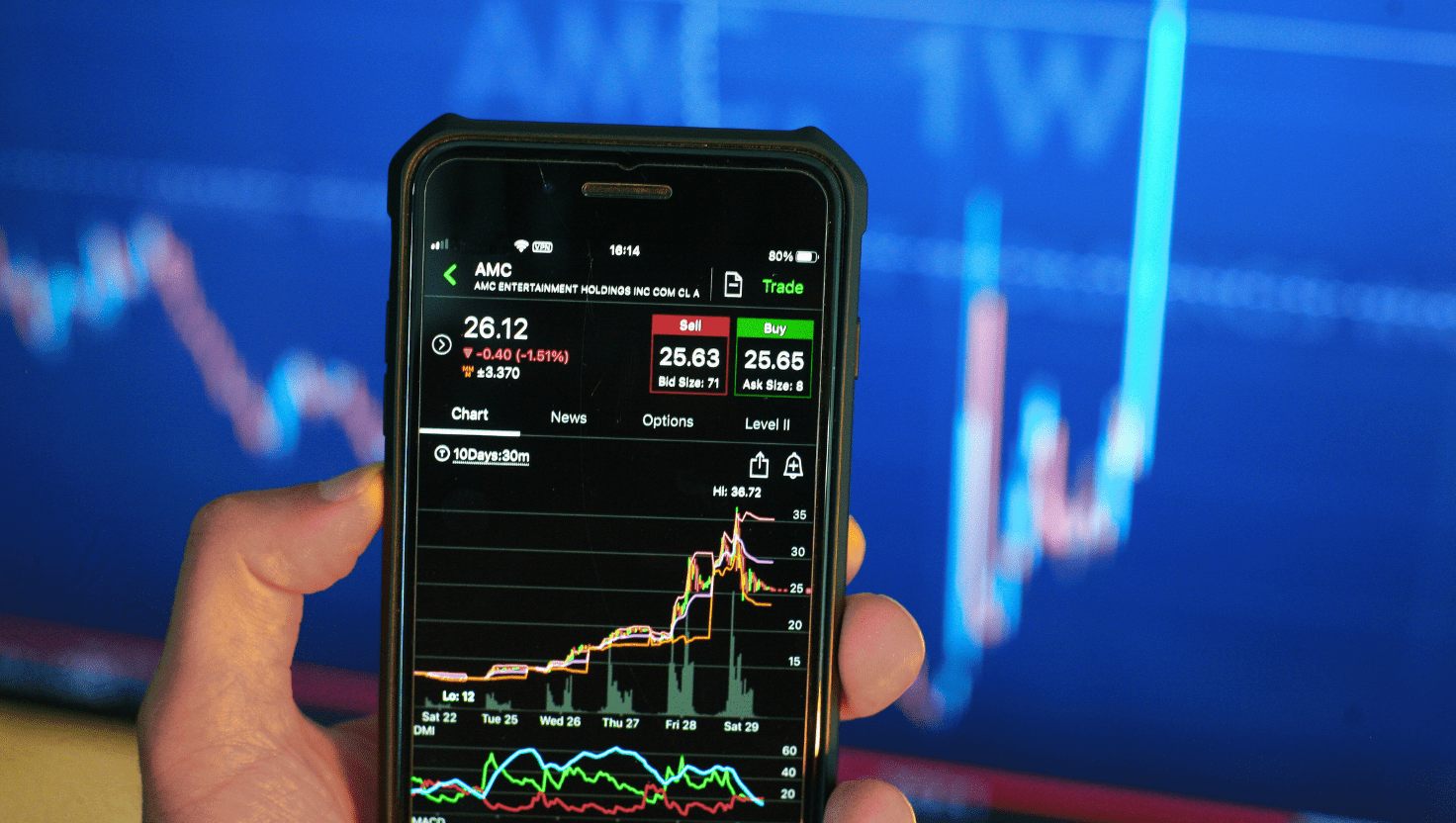

- NTPC Shares Surge: NTPC shares jumped over 4% after the IPO filing by its renewable energy arm, NTPC Green Energy.

- IPO Details: NTPC Green Energy aims to raise Rs 10,000 crore through this IPO, which is expected to be one of the largest in India for 2024.

- Stock Performance: The shares hit a new 52-week high of Rs 431.85 on the BSE, reflecting strong investor confidence.

- Use of Funds: The IPO proceeds will be used to repay loans and for general corporate purposes.

- Debt Repayment: Approximately 75% of the raised capital (Rs 7,500 crore) will be allocated to clear debts of NTPC Renewable Energy Limited (NREL).

- Market Reaction: The stock opened higher at Rs 425.50 and was trading at Rs 428.45, up 3.53%, with a market capitalization of Rs 4.15 lakh crore.

- Company Growth: NTPC shares have nearly doubled from their 52-week low of Rs 227.75, delivering 78% returns in the last year.

- Renewable Energy Focus: NTPC Green Energy is a ‘Maharatna’ central public sector enterprise with a significant renewable energy portfolio, including solar and wind projects.

- Lead Managers: The IPO is being managed by IDBI Capital Markets & Securities, HDFC Bank, IIFL Securities, and Nuvama Wealth Management.

- Strategic Importance: This IPO aligns with India’s renewable energy goals and NTPC’s strategic focus on expanding its green energy footprint.

-

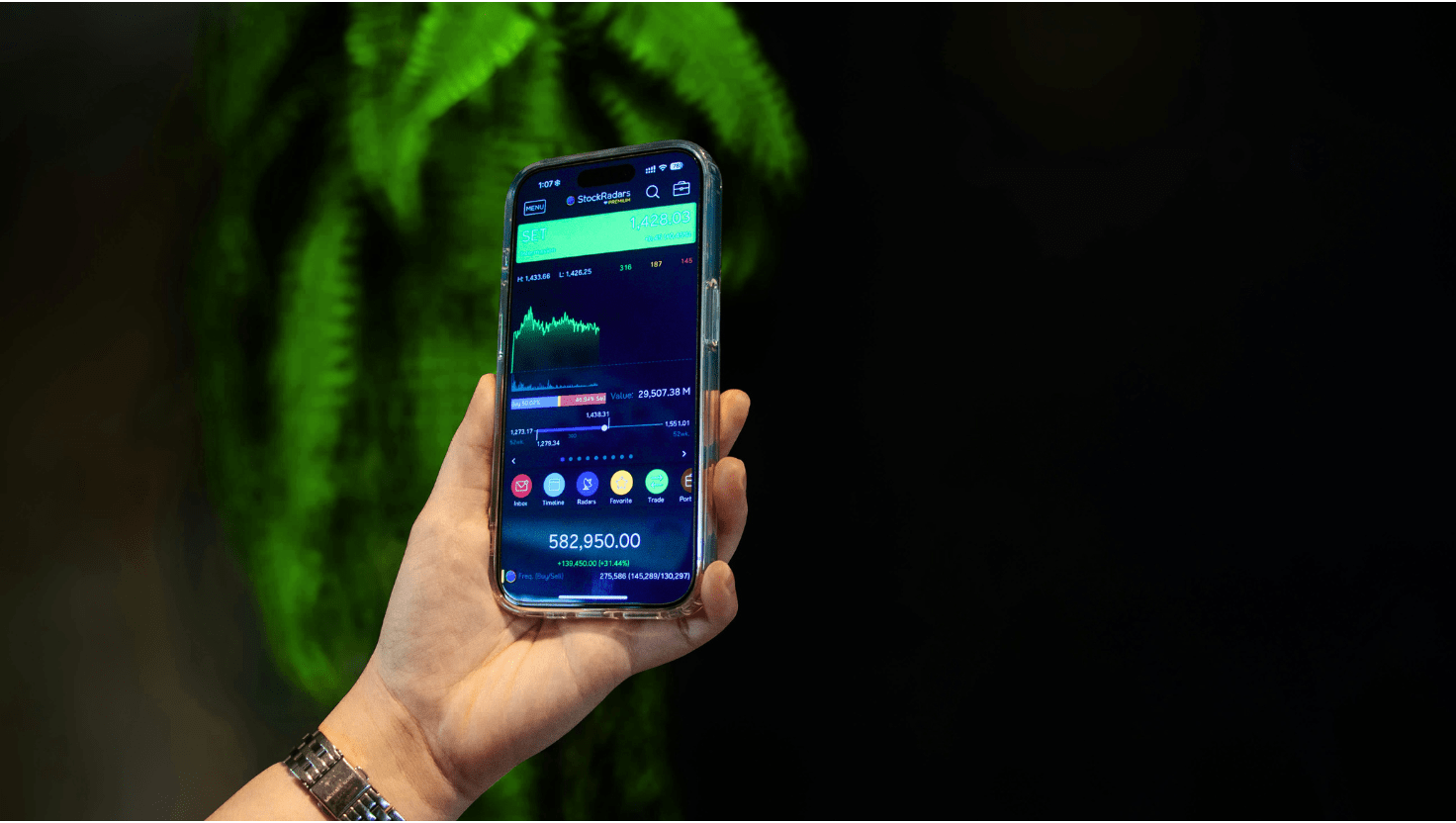

Top Stocks to Watch on Tuesday, July 15, 2025: Detailed Analysis

What’s driving the market on July 15, 2025? Will HCLTech recover from its earnings dip? Can Suzlon’s wind

-

Indian Stock Market Outlook: Sensex, Nifty 50, and Bank Nifty Predictions for July 15, 2025

Will the Indian stock market soar or stumble on July 15, 2025? Uncover Sensex, Nifty 50, and Bank

-

Is IDFC FIRST Mayura Credit Card the Ultimate Travel Hack for Zero Forex Fees?

Discover the IDFC FIRST Mayura Credit Card: a premium metal card with zero forex fees and lavish lounge

-

Is CASHe the Ultimate Hack for Quick Personal Loans Without Collateral?

Struggling with sudden expenses? Discover CASHe Personal Loans, India’s fastest way to borrow up to ₹3,00,000 instantly! With

-

Top Stocks to Watch on July 14, 2025:Uncover the Hottest Picks in the Indian Stock Market.

Will these Indian stocks soar or stumble on July 14, 2025? Dive into our suspenseful analysis of top