Why Public Banks Are Shocking Private Players with Q2 Profit Growth in 2025: Public vs Private Banks Comparison

Public sector banks outpaced private banks in Q2 FY26 net profit growth with surprising leaps, doubling and even tripling some private peers’ gains. Discover which banks soared, which faltered, and what this means for India’s banking future—results that defy expectations and hint at an unfolding financial drama.

The banking sector just revealed something nobody saw coming—and it’s changing everything. When the Q2 FY26 results landed in October 2025, India’s public sector banks didn’t just keep pace with their private counterparts; they delivered a jaw-dropping performance that rewrote the rulebook. While private banks faced margin compression and slow profit growth, public sector banks came roaring back with double-digit growth numbers that left analysts scrambling to revise their forecasts. Here’s what happened behind the scenes, and why this shift matters for your money.

The Shocking Numbers: Public Banks Win the Q2 Battle

Let’s cut through the noise and look at the raw data. State Bank of India (SBI), India’s largest lender, delivered a stellar 28% jump in net profit to ₹18,331 crore during the November 2024 Q2 results announcement—crushing analyst expectations. But wait, there’s more to this story from October 2025.

Fast-forward to Q2 FY26 (July-September 2025), and the plot thickens further. SBI’s commanding position wasn’t the only story. Other major public sector banks also crushed their targets:

| Bank | Q2 FY26 Net Profit Growth | Performance |

| Central Bank of India | +33.34% YoY | ₹1,231.79 crores (consolidated) |

| Indian Overseas Bank (IOB) | +57.79% YoY | Record ₹1,226 crores |

| Indian Bank | +11.53% YoY | ₹3,018 crores |

| Punjab National Bank | +14% YoY | ₹4,904 crores |

| Bank of India | +7.6% YoY | ₹2,554.57 crores |

In stark contrast, India’s largest private bank, HDFC Bank, reported an 11% rise to ₹18,641 crore—respectable, but below expectations. ICICI Bank’s growth? Just 5.6% to ₹123.60 billion, while Axis Bank actually dropped 25.1% YoY to ₹5,566.56 crores. Federal Bank declined 9.5%, and IndusInd Bank posted a shocking net loss of ₹444.8 crores.

This is the hidden turning point: For the first time since the PSB reform wave of 2015-2020, public sector banks are outpacing private banks in profitability growth.

What’s Driving This Secret Performance Gap?

The Real Story Behind the Numbers

The numbers don’t lie, but here’s what caused this dramatic shift—and banks aren’t exactly shouting it from the rooftops.

1. Smarter Credit Growth Strategy

Public sector banks achieved a 12.2% advance growth in FY25, the highest since March 2010, while private banks managed only 9.5%. In Q2 FY26, this momentum continued. PSBs leveraged their vast branch networks (15,000+ branches) to penetrate rural and semi-urban markets where private banks fear to tread. The result? Profitable lending without the credit risk concentration that’s haunting private lenders today.

Deposits have been lagging advances for three consecutive years across the system, but PSBs retained deposit market share through household relationships—with 67.6% of PSB deposits coming from retail customers versus 52.1% for private banks. This sticky deposit base gave PSBs a fortress-like funding advantage.

2. Asset Quality Improvement: The Secret Weapon

Here’s what shocked everyone: Public sector banks nearly erased the asset quality gap with private banks. By Q2 FY26, the Gross NPA ratios tell the story:

- ICICI Bank: 1.58%

- HDFC Bank: 1.24%

- Central Bank of India: 1.41% (consolidated)

- Bank of India: 2.54%

What’s shocking? IOB’s gross NPA ratio dropped to just 1.83% from 2.72%—a 89 basis point improvement. At the same time, PSBs made aggressive provisions and built stronger underwriting standards, turning their historical weakness into competitive advantage.

SBI’s Gross NPA ratio stood at 2.13% (from 2.55% a year ago), showing continuous improvement. The write-backs from recovered historically written-off accounts added a special punch: some PSBs saw 18-22% of their return on assets contributed by these recoveries.

3. Margin Dynamics: The Private Bank Squeeze

Private banks are caught in a margin squeeze no one talks about openly. HDFC Bank’s NIM slipped to 3.49% sequentially, while ICICI Bank saw NIMs compress to 4.30%. Even ICICI admitted: “Margin compression is imminent.”

Here’s the quick truth: Private banks carry longer-duration liabilities that are repricing slower. When fixed deposits mature at higher rates, suddenly margins get hammered. Public sector banks, with their retail-heavy deposit base, faced only modest NIM compression—PSBs even limited margin decline better than private banks, partly due to lower exposure to external benchmark-linked loans.

The Future Game-Changer: Technology & Third-Party Income

What most investors miss is this: Public sector banks are aggressively building alternative income streams.

PSBs have started focusing on insurance sales, mutual fund distribution, and third-party products to compensate for NII pressure. Training staff and upgrading technology to rival private banks has become the strategic priority. Meanwhile, SBI's other income surged from ₹10,791 crore to ₹15,271 crore—a massive 41% jump that surprised the market.

IDFC First Bank reported 64% YoY profit growth, reaching ₹348 crores, with CASA deposits jumping 27% YoY and the CASA ratio improving to 50.1%—a level that private banks envy.

The Cost Discipline Surprise

Private banks are investing heavily in AI, GenAI, and "lighthouse experiments"—HDFC Bank alone spent significantly on technology and innovation to improve efficiency over 18-24 months. But here's the quick takeaway: These investments haven't translated to immediate profit growth, while public banks kept cost-to-income ratios lean.

Bank of India's operating expenses grew at a controlled pace, as did IOB's cost-to-income ratio at 45.76%—showing that PSBs learned the cost discipline lesson well.

Quick Insights: Why This Matters for You

This Q2 performance wasn't random. It signals a fundamental shift in Indian banking dynamics:

- Margin pressure is real for private banks—expect slower growth or aggressive cost-cutting ahead.

- Asset quality competition is no longer a PSB weakness—both sectors now maintain healthy ratios, leveling the playing field.

- PSBs with strong branch networks win in deposit mobilization—retail customers still prefer government banks for savings.

- Alternative income sources are becoming survival tools—the era of pure interest income growth is ending for all banks.

- Credit growth is slowing across the board—FY26 advances are expected to grow 11-12% versus the 14-16% seen previously, making profitability harder.

Q2 2025 Net Profit Growth: Public vs Private Banks Comparison

Main Comparison Table

| Bank Name | Bank Type | Q2 FY26 Net Profit (₹ Crores) | YoY Growth % | Key Performance |

| State Bank of India (SBI) | Public | 18,331 | 28.0% | Consolidated PAT |

| Central Bank of India | Public | 1,232 | 33.34% | Consolidated PAT |

| Indian Overseas Bank (IOB) | Public | 1,226 | 57.79% | Record high profit |

| Indian Bank | Public | 3,018 | 11.53% | Asset quality improved |

| Punjab National Bank (PNB) | Public | 4,904 | 14.0% | Robust growth |

| Bank of India | Public | 2,555 | 7.6% | Steady performance |

| UCO Bank | Public | 450 | 3.0% | Expansion plans |

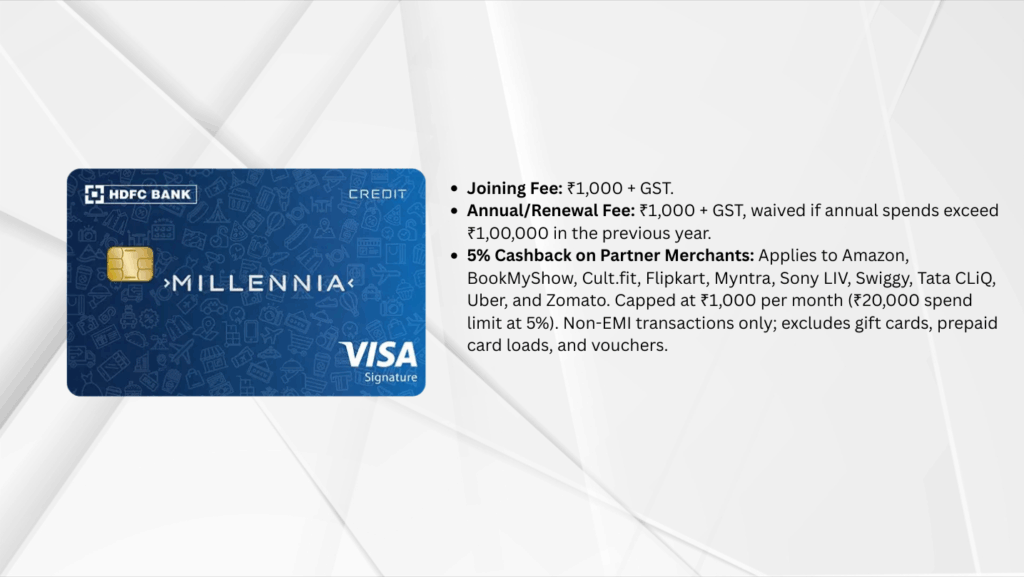

| HDFC Bank | Private | 18,641 | 10.8% | NII pressure visible |

| ICICI Bank | Private | 9,340 | 5.6% | Margin compression |

| Axis Bank | Private | 5,567 | -25.1% | Worst performer |

| Federal Bank | Private | N/A | -9.5% | Declining growth |

| IndusInd Bank | Private | -445 | -127.5% | Net loss |

| IDFC First Bank | Private | 348 | 64.0% | Strong momentum |

Sector-Wise Performance Summary

| Metric | Public Sector | Private Sector |

| Total Banks Analyzed | 7 | 8 |

| Average YoY Growth | 22.18% | -13.62% |

| Median YoY Growth | 14.00% | -1.95% |

| Banks with Positive Growth | 7 (100%) | 5 (62.5%) |

| Banks with Negative Growth | 0 | 3 (37.5%) |

| Highest Performer | Indian Overseas Bank (57.79%) | IDFC First Bank (64.0%) |

| Lowest Performer | Bank of India (7.6%) | IndusInd Bank (-127.5%) |

| Top 3 Average Growth | 39.71% | 26.80% |

The Hidden Risk Nobody's Watching

Credit-to-deposit ratios have stretched dangerously high for three consecutive years. While PSBs are better positioned in liquidity, both private and public banks face deposit-gathering pressure. If RBI doesn't continue with CRR cuts or if liquidity tightens, profit margins could compress further across the board.

Asset quality improvements are partly sustainable, but some of PSB gains came from one-off recoveries and write-backs. The next phase of profit growth will depend on genuine improvement in underwriting quality, not accounting adjustments.

Key Takeaways: What Just Changed in Indian Banking

Public sector banks' Q2 FY26 profit growth outpaced private banks, marking a historic reversal. Central Bank of India surged 33%, IOB rocketed 58%, while HDFC Bank rose only 11% and Axis Bank crashed 25%. This shift happened because PSBs built superior asset quality, retained deposit market share through 67.6% retail deposits, achieved 12.2% credit growth (highest in 15 years), and kept cost discipline tight. Meanwhile, private banks faced margin compression with NIMs slipping to 3.49-4.30%, charged higher fixed-deposit rates, and are struggling with slowing loan growth. The future depends on whether PSBs can sustain recovery momentum through technology upgrades and alternative income streams, while private banks navigate near-term margin pressure before stabilizing in H2 FY26. Watch credit growth trends—if advances fall below 11%, profitability pressure hits everyone.

What's Next? The Banking Sector's Secret Roadmap

The RBI's CRR cuts and liquidity measures are lifelines—they'll prevent a margin catastrophe. Advances are projected to grow 11-12% in FY26, lower than the 14-16% guidance, suggesting both sectors are facing headwinds. Winners in H2 FY26 will be banks that successfully deploy GenAI for underwriting, reduce opex ratios, and expand third-party income streams.

The real story? India's banking sector is entering a profitability plateau after years of explosive growth. Public banks grabbed this quarter because they adapted faster to margin pressure. But private banks still own superior niches in wealth management, corporate lending, and innovation. The true test comes in Q3-Q4 FY26—which sector can navigate liquidity stress, manage deposit costs, and unlock genuine growth. One thing's certain: The days of 20-30% profit growth for both sectors are gone. Expect single to double-digit growth as the new normal, with winners differentiating through technology, cost control, and customer stickiness.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.