India’s credit card debt crisis has exploded, with ₹6,742 crore in defaults and 11.1 crore cards fueling ₹21.09 lakh crore in 2025 spending. Soaring 46% interest rates and 8.2% delinquencies trap millions in a financial nightmare. From jobless youth to struggling families, the emotional toll is devastating. Can you escape the debt spiral? Uncover shocking 2025 data, gripping stories, and expert solutions to break free from the silent crisis threatening India’s future. Swipe wisely, or pay forever—discover how to reclaim your financial freedom now.

Credit card debt in India is no longer a silent crisis; it has transformed into a loud, pressing issue affecting millions of households across the country. As Indian consumers increasingly rely on credit cards to fuel their lifestyles and meet day-to-day expenses, a deeper crisis is brewing — one of escalating debt, financial insecurity, and growing defaults. Social media platforms like the ‘Credit Cards India’ subreddit are filled with desperate cries: “Lost my job, ₹80k in credit card debt, no income. What are my options?” or “Drowning in credit card debt (ICICI, Axis, HDFC, Federal)—no income, no support. Please help.” These stories reflect a grim reality where credit cards, meant to ease financial burdens, are trapping users in cycles of debt.

As of December 2024, credit card defaults in India surged by 28%, reaching ₹6,742 crore, according to Reserve Bank of India (RBI) reports. This alarming rise signals a deeper issue beyond poor budgeting—a growing reliance on credit to sustain lifestyles amid stagnant incomes and economic pressures. This blog post dives into the credit card debt crisis in India, leveraging the latest 2025 data, expert insights, and real-life narratives to explore its causes, consequences, and solutions from an Indian perspective.

The Credit card debt crisis in India Boom and Rising Debt

Expansion and Spending Surge

India’s credit card market has exploded, with 11.1 crore active credit cards by May 2025, nearly doubling from 6.1 crore in January 2021. The total value of credit card transactions soared to ₹21.09 lakh crore by March 2025, a 15% increase year-on-year, with monthly swipes hitting ₹1.89 lakh crore in May 2025, up from ₹64,737 crore in early 2021. This surge reflects growing consumer confidence post-pandemic but also a dangerous dependence on credit for daily expenses.

Online payments and point-of-sale (POS) transactions dominate, fuelled by e-commerce growth and digital payment adoption. Banks like HDFC, SBI, ICICI, and Axis have aggressively expanded credit card issuance, offering premium cards with rewards, cashback, and travel perks. However, this convenience masks a darker trend: many Indians are swiping not for luxury but for necessities, driven by rising costs and limited savings.

Rising Household Debt and Financial Vulnerability

Household debt in India has skyrocketed, reaching 41.9% of GDP by December 2024, more than doubling over the past decade. Non-housing retail loans, including credit card debt, account for 54.9% of total household debt, outpacing housing loans. For every ₹100 borrowed, ₹55 goes toward high-interest consumer loans like credit card balances and consumer durable loans. Unlike productive debt for homes or businesses, this consumption-driven borrowing often leads to financial distress, pushing households into a precarious cycle of repayments.

The middle and lower-middle classes, aspiring to keep up with urban lifestyles, are particularly vulnerable. With stagnant wages and rising inflation, many turn to credit cards as a stopgap, unaware of the long-term consequences. This shift highlights a broader socio-economic challenge: the gap between aspirations and financial reality.

Loan Write-Off vs. Loan Waive-Off: How Loan Settlements Can Haunt You for Years

What Most Women Miss About Canara Angel’s Savings Account ₹10 Lakh Cancer Cover in 2025

UPI Goes Live in Qatar: Seamlessly Pay at Duty-Free Shops and Tourist Hotspots with UPI Payments

GST Annual Return Extension: Will Taxpayers Get Relief Before December 31 Deadline?

India’s Credit Card Debt Crisis (2022–2025)

| Aspect | 2022 | 2023 | 2024 | 2025 |

| Active Credit Cards (Crore) | 7.8 (Jul) | 9.5 (Dec) | 10.5 (Dec) | 11.1 (May) |

| Credit Card Spending (₹ Lakh Crore) | 1.29 (Oct) | 1.72 (Oct) | 18.68 (FY) | 21.09 (Mar) |

| Monthly Spending (₹ Lakh Crore) | 1.13 (May) | 1.48 (Aug) | 1.7 (Jul) | 1.89 (May) |

| Outstanding Debt (₹ Lakh Crore) | 1.13 | 2.0 | 2.7 (Jun) | 2.9 (May) |

| Non-Performing Assets (NPAs) (₹ Crore) | 3,000 | 5,250 (Dec) | 6,742 (Dec) | 33,886 (91-360 days overdue, Mar) |

| NPA Growth Rate (YoY) | - | - | 28.42% | 44% (91-360 days overdue) |

| Default Rate (%) | - | 1.6 (Mar) | 1.8 (Jun) | 8.2 (91-180 days, Mar) |

| Household Debt (% of GDP) | 37% | 39% | 41.9% (Dec) | - |

| Key Drivers | Post-COVID spending boom, e-commerce growth, EMI schemes | Aggressive card issuance, low financial literacy, BNPL schemes | Digital payments surge, job losses, impulsive spending | Rising living costs, reliance on credit for essentials |

| RBI Interventions | New guidelines for card issuance | Risk weight increase to 150% on unsecured loans | Stricter co-branded card norms, reduced credit growth | Tighter lending standards, focus on financial literacy |

| Impact on Consumers | Increased EMI reliance, minimum payment traps | Loan-stacking, rising delinquencies | Debt spiral for millennials, Gen Z; defaults up | Emotional stress, harassment by recovery agencies |

| Solutions Emerging | Budgeting, debt consolidation loans | Debt settlement platforms like Zavo, Freed | Personal loans for debt repayment, financial education | Enhanced awareness campaigns, stricter regulations |

The Hidden Costs of Credit Card Debt Crisis in India: Addiction

The Debt Trap: High Interest and Rising Delinquencies

Credit card debt is one of the costliest forms of borrowing in India, with interest rates often exceeding 42-46% annually on unpaid balances beyond the 45-50 day interest-free period. This high cost creates a vicious cycle where small unpaid amounts balloon into unmanageable sums. For instance, a ₹50,000 balance at 45% interest can double in less than two years if only minimum payments are made.

Delinquencies are rising alarmingly. By March 2025, overdue credit card payments in the 91–180 days category reached 8.2%, up from 6.9% the previous year. For debts overdue 181–360 days, the figure climbed to 1.1%. The default rate on loans overdue for over 90 days jumped to 15% in March 2025, from 12.5% in 2024, signalling a growing number of borrowers trapped in prolonged default cycles.

Why Credit Card Debt Is Difficult to Escape

Banks and fintechs aggressively market credit cards with incentives like cashback, reward points, and interest-free EMI schemes. These perks encourage frequent swiping but obscure the risks of accumulating debt. Many users, especially younger consumers, fall for the allure of “buy now, pay later” offers, only to realize later that missed payments trigger steep penalties and interest.

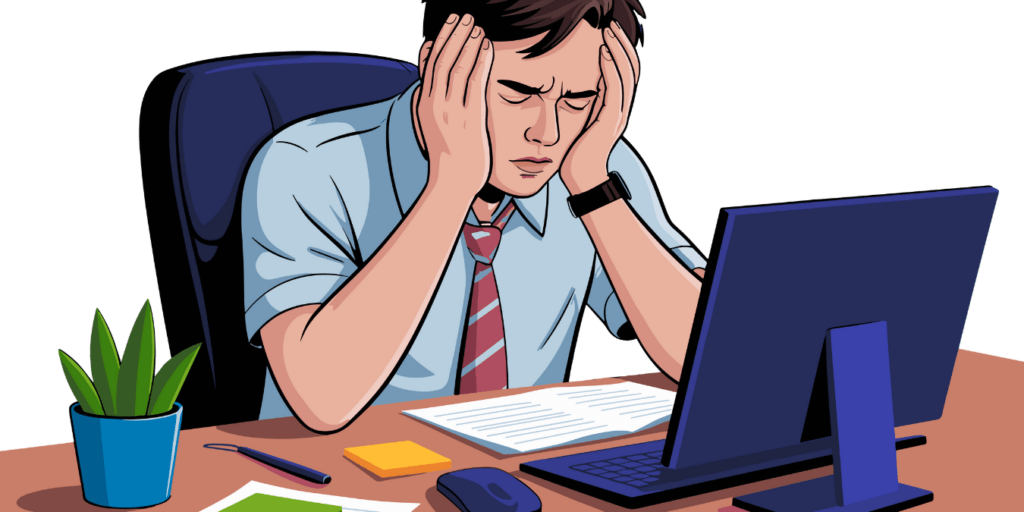

For many, credit cards are no longer a lifestyle tool but a survival mechanism. Job losses, medical emergencies, or unexpected expenses push individuals to rely on credit for routine bills, creating a chronic repayment burden. The psychological toll is significant, with social media posts revealing stress, shame, and mental health struggles among those drowning in debt.

EMIs and Foreclosure: Too Costly, Too Complex

EMI schemes, marketed as interest-free, often come with hidden costs like processing fees (1-2% of the transaction) and foreclosure charges (around 3% of the principal plus GST). Banks like SBI, HDFC, ICICI, and Axis impose lock-in periods, making early repayment costly or inaccessible. For example, foreclosing a ₹1 lakh EMI loan could incur ₹3,000-5,000 in fees, deterring borrowers from clearing debts early.

This complexity traps users in prolonged repayment cycles. For those juggling multiple credit cards, managing EMIs becomes overwhelming, especially when income disruptions like layoffs or pay cuts occur. The result is a treadmill of payments, penalties, and mounting stress.

Real Stories Reflecting the Credit Card Debt Crisis in India

The human cost of India’s credit card debt crisis is starkly visible on platforms like Reddit and Twitter. A 28-year-old IT professional from Bengaluru shared, “I used my HDFC card for rent and groceries after a layoff. Now, ₹1.2 lakh in debt, I’m paying EMIs with another card.” A single mother in Mumbai wrote, “My ICICI card debt is ₹90k. I can’t sleep, fearing collection calls.” These stories highlight the emotional and financial toll on the middle and lower-middle classes, who lack safety nets to weather economic shocks.

The crisis disproportionately affects urban millennials and Gen Z, lured by aggressive marketing and societal pressure to maintain appearances. Many borrow informally or use multiple cards to stay afloat, compounding their financial woes. The lack of financial literacy exacerbates the issue, leaving borrowers unaware of interest calculations or debt management options.

Emerging Solutions and Financial Remedies

Debt Consolidation Loans

Debt consolidation offers a lifeline for those overwhelmed by credit card debt. These personal loans, with interest rates as low as 11-12% per annum (compared to 42-46% for credit cards), allow borrowers to pay off multiple high-interest debts, simplifying repayments into a single, affordable EMI. Platforms like Lendbox and Cred provide paperless, instant loans for debt consolidation, helping borrowers reduce interest burdens and regain financial control.

For example, consolidating ₹2 lakh in credit card debt at 12% interest instead of 45% could save over ₹60,000 annually in interest, making repayment more manageable. However, borrowers must exercise discipline to avoid accruing new credit card debt post-consolidation.

Debt Settlement and Negotiation Services

Debt settlement companies negotiate with creditors to reduce the owed amount, offering relief for those facing unmanageable dues. By settling for a lump-sum payment (often 30-50% of the original debt), borrowers can avoid prolonged collection pressures and non-performing asset (NPA) status. While this impacts credit scores, it provides a fresh start for those in severe financial distress.

Financial Literacy and Regulation

Addressing the credit card debt crisis requires systemic change. The RBI has introduced stricter regulations, imposing higher risk weights on unsecured loans to curb reckless lending. Banks are now more cautious, slowing credit card issuance growth to 12% in 2024-25 from 20% in 2022-23. However, consumer education remains critical. Awareness campaigns on responsible borrowing, budgeting, and understanding credit card terms can empower users to make informed decisions.

Financial institutions and NGOs are stepping up, offering workshops and online resources. Apps like Walnut and Cred provide tools to track spending and manage dues, while government initiatives like the National Financial Literacy Mission aim to bridge the knowledge gap.

Final Thought: Navigating India’s Credit Card Debt Crisis

The credit card debt crisis in India is a wake-up call, reflecting deeper economic insecurities and the pressures of modern lifestyles. With defaults soaring to ₹6,742 crore and household debt at 41.9% of GDP, the stakes are high. Every swipe carries the risk of a lifelong repayment burden if not managed wisely.

For Indian consumers, breaking free requires discipline, financial literacy, and proactive steps like debt consolidation or settlement. Policymakers and banks must also act—through stricter regulations, transparent terms, and robust education programs—to protect vulnerable borrowers while preserving credit access. This crisis, though daunting, is not insurmountable. With empathy, innovation, and informed choices, millions can escape the debt trap and build a secure financial future.