Introduction

ICICI Pru iProtect Smart Term Plan is a term insurance plan that offers financial protection for your family in case of your death, disability, or critical illness. You can choose from four benefit options, three premium payment options, and five riders to customize your plan according to your needs and goals. The premium for this plan depends on the life cover amount and other benefit options you choose. It also varies according to your age, gender, health status, and lifestyle. You can also get tax benefits on the premiums paid and the benefits received as per the prevailing tax laws. This plan is one of the popular term insurance plans offered by ICICI Pru, which has a high claim settlement ratio of 97.90% for the financial year 2020-21.

Some of the features and benefits of this Plan

ICICI Pru iProtect Smart Term Plan is a term insurance plan that offers multiple options to suit your needs. It provides financial protection for your family in case of your death, disability, or critical illness. Here are some of the features and benefits of this plan:

- You can choose from four benefit options: Life, Life Plus, Life & Health, and All in One. Each option has different coverage and premium rates.

- You can choose to receive the benefit payout as a lump sum, a monthly income for 10 years, or a combination of both.

- You can increase your life cover at key stages of your life, such as marriage and birth of children, without any medical tests.

- You can get additional protection against accidental death and 34 critical illnesses by paying extra premium.

- You can get special premium rates if you are a woman or a non-tobacco user.

- You can get tax benefits on the premiums paid and the benefits received as per the prevailing tax laws.

ICICI Pru iProtect Smart Term Plan premium

The premium for ICICI Pru iProtect Smart Term Plan depends on the life cover amount and other benefit options you choose. It also varies according to your age, gender, health status, and lifestyle. You can use the life insurance premium calculator or the smart term insurance calculator to find out the annual premium for this plan for a policy term of 30 years and life cover up to 15 crores. Alternatively, you can also check the sample premium sheet for a healthy non-smoking male on the official website. Here are some sample premium sheet for a healthy non-smoking male is as under :

| Age | Life Cover (₹) | Policy Term | Annual Premium (₹) |

|---|---|---|---|

| 30 years | 50 Lakh | 45 years | 9,840 |

| 30 years | 1 Crore | 45 years | 16,941 |

| 35 years | 50 Lakh | 40 years | 12,084 |

| 35 years | 1 Crore | 40 years | 20,582 |

ICICI Pru iProtect Smart Term Plan eligibility criteria

The eligibility criteria for ICICI Pru iProtect Smart Term Plan are as follows:

- The minimum age of entry is 18 years (age completed birthday).

- The maximum age of entry is 65 years (age completed birthday).

- The minimum maturity age is 23 years.

- The maximum maturity age is 75 years.

- The minimum premium amount is Rs. 2,400 p.a. (excluding service tax and cess).

These eligibility criteria may vary depending on the benefit option, premium payment term, and sum assured that you choose.

ICICI Pru iProtect Smart Term Plan Documents required

To buy ICICI Pru iProtect Smart Term Plan, you will need to provide the following documents:

- PAN card: This is mandatory for all applicants and serves as an ID and age proof.

- Age and address proof: You can use any of the following documents as your age and address proof: masked Aadhaar card, passport, driving license, voter ID, or job card issued by NREGA.

- Income proof: You will need to show proof of your income to determine the amount of life cover you can opt for. You can use any of the following documents as your income proof: salary slip, ITR, bank statement, Form 16, CA certificate, agricultural income certificate, land records, Form 26 AS, or mandi receipts.

- Passport size recent photograph: You will need to upload your photo while applying online. Make sure it is clear and follows the guidelines given by the insurer.

- Medical reports: Depending on your health status and pre-existing diseases, you may be asked to undergo medical tests to assess your current health condition. You will need to submit the medical reports along with your application.

ICICI Pru iProtect Smart Term Plan minimum and maximum age

According to the official website and other sources, the minimum and maximum age to apply for ICICI Pru iProtect Smart Term Plan are as follows:

- The minimum age of entry is 18 years (age completed birthday).

- The maximum age of entry is 65 years (age completed birthday).

- The minimum maturity age is 23 years.

- The maximum maturity age is 75 years.

These eligibility criteria may vary depending on the benefit option, premium payment term, and sum assured that you choose. You can check the premium and benefits for different options on the official website.

ICICI Pru iProtect Smart Term Plan sum assured

The sum assured for ICICI Pru iProtect Smart Term Plan is the amount of money that the policyholder or the nominee will receive in case of death, disability, or critical illness of the insured person. The sum assured depends on various factors such as the benefit option, premium payment term, age, gender, health status, and lifestyle of the insured person.

The minimum sum assured for this plan is subject to the minimum premium of Rs. 2,400. The maximum sum assured is unlimited, but it may vary as per the company policy and underwriting norms. The sum assured can be increased at key stages of life, such as marriage and birth of children, by paying extra premium.

You can choose from four benefit options for this plan: Life, Life Plus, Life & Health, and All in One. Each option has different coverage and premium rates. For example, the Life option provides only a lump sum payout in case of death of the insured person, while the All in One option provides additional payouts in case of accidental death, disability, or critical illness.

You can also choose from three premium payment options for this plan: Regular Pay, Limited Pay, and Single Pay. Each option has different premium payment terms and policy terms. For example, the Regular Pay option allows you to pay premiums throughout the policy term, while the Single Pay option allows you to pay a one-time premium at the start of the policy.

ICICI Pru iProtect Smart Term Plan premium payment term

The premium payment term for ICICI Pru iProtect Smart Term Plan is the duration for which you have to pay the premiums to keep your policy active. The premium payment term depends on the option that you choose from the following:

- Regular Pay: You have to pay the premiums throughout the policy term, which can range from 5 to 74 years, depending on your age and benefit option.

- Limited Pay: You have to pay the premiums for a shorter duration than the policy term, which can be 5, 7, or 10 years, or up to age 60.

- Single Pay: You have to pay a one-time premium at the start of the policy, and enjoy the benefits for the entire policy term, which can range from 5 to 40 years.

ICICI Pru iProtect Smart Term Plan policy term

The policy term for ICICI Pru iProtect Smart Term Plan is the duration for which your policy remains active and provides you the benefits. The policy term depends on the benefit option and the premium payment option that you choose. Here are the possible ranges of policy term for this plan:

- Benefit Option: Life or Life Plus

- Premium Payment Option: Regular Pay or Limited Pay

- Policy Term: 10 to 40 years

- Premium Payment Option: Single Pay

- Policy Term: 5 to 20 years

- Premium Payment Option: Regular Pay or Limited Pay

- Benefit Option: Life & Health or All in One

- Premium Payment Option: Regular Pay or Limited Pay

- Policy Term: 10 to 30 years

- Premium Payment Option: Regular Pay or Limited Pay

You can choose a policy term that suits your needs and goals, subject to the minimum and maximum age at maturity, which are 23 years and 75 years respectively.

ICICI Pru claim settlement ratio

The claim settlement ratio of ICICI Pru is the percentage of claims that the insurer pays out of the total claims received in a year. It is an indicator of the insurer’s reliability and credibility in honouring the claims of its policyholders.

According to the official website and other sources, the claim settlement ratio of ICICI Pru for the financial year 2020-21 was 97.90%. This means that out of 11,212 death claims received by ICICI Pru, 10,978 were settled within 12 working days. The total death benefit paid by ICICI Pru was Rs. 1,023.64 crore.

ICICI Pru also offers a “Claim for Sure” feature that guarantees one-day death claim settlement, payment of interest on claim amount for every day of delay beyond one working day, and quick and hassle-free claim service. ICICI Pru has a simple and transparent three-step claim settlement process that involves reporting, reviewing, and settling the claim. The policyholders or their nominees can register their claims online, through SMS, email, phone, or by visiting the nearest branch. The insurer also provides various modes of electronic transfer for the settlement of claims.

ICICI Pru is one of the leading life insurance companies in India that offers a range of term insurance plans to suit the needs and goals of its customers. Some of the popular term plans offered by ICICI Pru are iProtect Smart, iCare II, iReturn, and iTerm Plus. These plans provide financial protection to the family in case of death, disability, or critical illness of the policyholder. They also offer various benefits such as flexible pay out options, increasing cover, riders, tax benefits, etc.

Can I get a loan against this policy?

No, you cannot get a loan against this policy. There is no loan facility available under this term insurance plan. This means that you cannot borrow money from the insurer by using your policy as collateral. This is a common feature of most term insurance plans, as they are designed to provide pure protection and not savings or investment benefits. If you are looking for a plan that offers loan facility, you may consider other types of life insurance plans, such as endowment, money-back, or unit-linked plans. However, these plans may have higher premiums and lower coverage than term insurance plans.

ICICI Pru iProtect Smart Term Plan tax benefits

Yes, there are some tax benefits on premiums or benefits of ICICI Pru iProtect Smart Term Plan. According to the web search results, here are some of them:

- The premiums you pay for this plan are eligible for deduction under Section 80C of the Income Tax Act, 1961, up to a maximum of Rs. 1.5 lakh per annum.

- The death benefit or sum assured received by the nominee is exempt from tax under Section 10 (10D) of the Income Tax Act, 1961, subject to certain conditions.

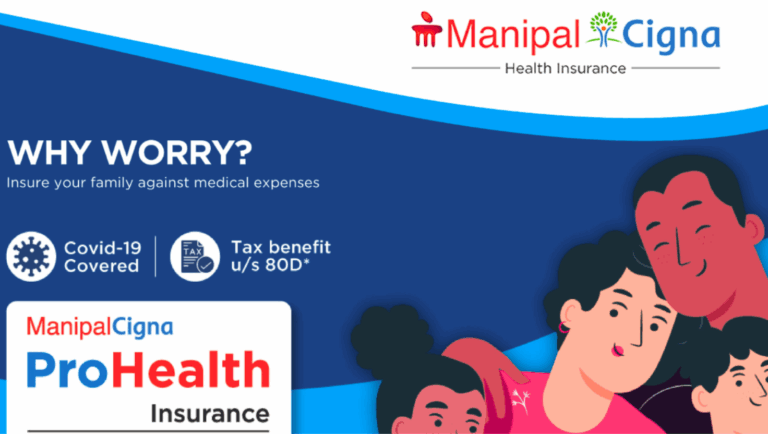

- If you opt for the critical illness benefit option, you can get an additional deduction of up to Rs. 25,000 under Section 80D of the Income Tax Act, 1961.

These tax benefits are subject to the prevailing tax laws and may change from time to time. You are advised to consult a tax expert before making any decision.

ICICI Pru iProtect Smart Term Plan riders

Yes, there are five riders available with this plan that offer enhanced coverage against various risks. These are:

- Accidental Death Benefit: This rider provides an additional payout in case of death due to an accident, over and above the base sum assured.

- Critical Illness Benefit: This rider provides a lump sum payout on the first diagnosis of any of the 34 covered critical illnesses, without any hospital bills required.

- Income Benefit: This rider provides a fixed monthly income to the nominee for 10 years, in case of death or disability of the policyholder.

- Waiver of Premium: This rider waives off all the future premiums in case of disability or critical illness of the policyholder, and the policy continues as before.

- Permanent and Partial Disability Benefit: This rider provides a lump sum payout in case of permanent or partial disability due to an accident, which can be used for medical expenses or income replacement.

You can choose any or all of these riders as per your needs and preferences, by paying a small additional premium. These riders can enhance the protection of your plan and offer you peace of mind.

ICICI Pru iProtect Smart Term Plan claim rider benefit

To claim a rider benefit under ICICI Pru iProtect Smart Term Plan, you need to follow these steps:

- Contact the insurer as soon as possible and inform them about the event that triggers the rider benefit, such as death, disability, or critical illness. You can call their toll-free number 1860 266 7766 or email them at [email protected].

- Submit the required documents to the insurer, such as the claim form, policy document, identity proof, medical reports, death certificate, etc. You can find the complete list of documents on their website or download the claim form.

- The insurer will verify your claim and process it within 12 working days. If your claim is approved, they will pay the rider benefit to you or your nominee, as per the payout option chosen by you. If your claim is rejected, they will inform you about the reason and the grievance redressal mechanism.

ICICI Pru iProtect Smart Term Plan add or remove rider

you can add or remove a rider later, subject to the following conditions:

- You can add a rider at any policy anniversary during the policy term, provided you meet the eligibility criteria and underwriting requirements of the rider.

- You can remove a rider at any policy anniversary during the policy term, provided you have paid at least one full year’s premium for the rider.

- The rider benefit will cease immediately on removal of the rider or on payment of the rider benefit, whichever is earlier.

- The rider premium will be adjusted accordingly on addition or removal of the rider.

Conclusion

ICICI Pru iProtect Smart Term Plan is a term insurance plan that provides you with a high level of protection at an affordable premium. You can customize your plan with various options and riders to suit your needs and goals. You can also enjoy tax benefits on the premiums paid and the benefits received. This plan is offered by ICICI Pru, which is a reliable and credible insurer with a high claim settlement ratio.

Frequently Asked Questions (FAQs)

- What is ICICI Pru iProtect Smart Term Plan?

- ICICI Pru iProtect Smart Term Plan is a comprehensive life insurance policy designed to provide financial protection for your loved ones in the event of your untimely demise.

- Who is eligible for this plan?

- Individuals aged 18 to 65 years can apply for ICICI Pru iProtect Smart Term Plan.

- How does the plan work?

- You pay regular premiums, and in the event of your death during the policy term, a lump sum amount is paid to your nominee.

- Can I customize my coverage with this plan?

- Yes, you can customize your coverage by choosing from various options such as life cover, accidental death benefit, and critical illness cover.

- Is the premium amount fixed throughout the policy term?

- No, you have the flexibility to choose between fixed and increasing premiums based on your preference.

- What is the minimum and maximum policy term available?

- The policy term can range from 5 years to 40 years, allowing you to select a term that suits your needs.

- Is there a grace period for premium payments?

- Yes, there is a grace period of 30 days for premium payments, ensuring your policy remains active even if you miss a premium due date.

- Can I surrender the policy before the maturity date?

- Yes, you can surrender the policy, but the surrender value depends on the terms and conditions outlined in the policy document.

- Are there any tax benefits associated with this plan?

- Yes, premiums paid under ICICI Pru iProtect Smart Term Plan are eligible for tax benefits under Section 80C of the Income Tax Act, and the death benefit is tax-free under Section 10(10D).

- What happens if I survive the policy term?

- If you survive the policy term, there is no maturity benefit, as this plan primarily provides financial protection to your nominees in case of your demise.

-

How PPF’s 7.1% Interest Rate Can Build Your ₹40 Lakh Corpus by 2040

PPF : Unravel its meaning, 7.1% interest rate, and tax-free benefits! Learn how to maximize returns, build wealth,

-

Trading the Indian Stock Market: Sensex, Nifty 50, Bank Nifty Outlook for July 4, 2025

Nifty 50 & Bank Nifty predictions for July 4, 2025, with key support, resistance levels, and trading strategies.

-

ICICI Bank FD Rates 2025: Unlock Wealth Creation with ICICI Bank Fixed Deposits

ICICI Bank Fixed Deposits 2025! Earn up to 7.10% interest, enjoy tax-saving benefits, and open FDs seamlessly online.

-

UPI-ICD Review: Is the UPI ATM Interoperable Cash Deposit the Future of Banking in India?

UPI-ICD: India’s cardless cash deposit revolution! Deposit cash at UPI-enabled ATMs using your UPI app. Explore its features,

-

PNB Monsoon Bonanza: Save Big on Home Loan and Car Loans until Sep 30, 2025!

Punjab National Bank Monsoon Bonanza 2025! Enjoy zero processing fees on home and car loans, plus bank-covered charges

-

Punjab National Bank Waives Penal Charges: Zero Penalties for Non-Maintenance of Minimum Balance from July 1, 2025

Punjab National Bank’s game-changing waiver of penal charges for non-maintenance of Minimum Average Balance, effective July 1, 2025!

-

HDFC Bank Fixed Deposits Interest Rates 2025: Is 18-Month Tenure Your Key to Higher Returns?

HDFC Bank Fixed Deposit Rates 2025! Earn up to 6.60% p.a. (7.10% for seniors) on deposits below ₹3