Wondering how many cut notes you can exchange in Indian banks? RBI allows exchange of up to 20 damaged or mutilated notes per day. Learn the rules, conditions, and where to exchange torn currency notes legally. Get all details on note exchange limits and procedures here!

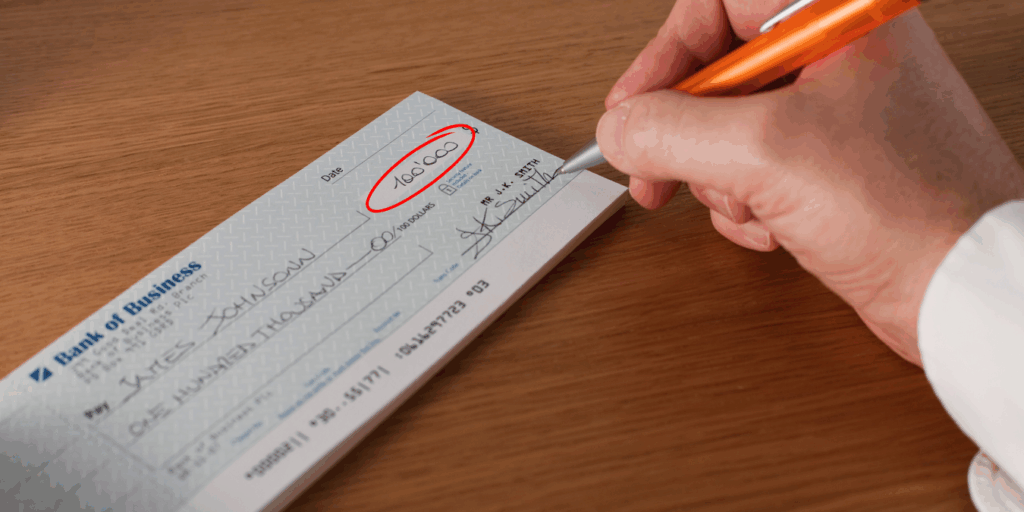

Handling damaged or cut currency notes is a common yet often misunderstood scenario. Whether you’ve received a torn note from an ATM, a bulk payment, or everyday transactions, the question arises: How many cut notes can a person exchange in the bank? With digital payments soaring, physical currency still holds significance in daily life, making it crucial to understand the Reserve Bank of India (RBI) guidelines for exchanging soiled, mutilated, or cut notes.

What Are Cut or Damaged Notes?

Before exploring the exchange limits, let’s clarify what constitutes a cut or damaged note. According to the RBI, currency notes fall into two primary categories when damaged:

- Soiled Notes: These are notes that have become dirty due to regular use or are slightly torn. A two-piece note pasted together, where both pieces belong to the same note and retain essential features, is also considered soiled.

- Mutilated Notes: These are notes with missing portions, composed of more than two pieces, or deliberately cut, torn, or tampered with. Essential features include the name of the issuing authority, guarantee clause, promise clause, signature, Ashoka Pillar emblem or Mahatma Gandhi portrait, and watermark.

The RBI’s Master Circular (updated April 3, 2023, and May 15, 2023) provides clear directives for exchanging such notes, ensuring public convenience and preventing misuse.

How Many Cut Notes Can You Exchange?

The number of cut or damaged notes you can exchange depends on the quantity, value, and condition of the notes, as well as the exchange method. Here’s a breakdown based on the latest RBI guidelines:

1. Small Quantities: Up to 20 Notes Per Day

- Limit: You can exchange up to 20 notes with a maximum value of ₹5,000 per day at any bank branch, free of charge.

- Conditions:

- The notes must not be deliberately cut or tampered with, as such notes are rejected under RBI’s Note Refund Rules, 2009.

- The cut should not pass through the number panels (serial numbers on the note).

- Essential features must be intact for mutilated notes.

- Where: Exchange is available at counters of any public sector bank, private sector bank currency chest branch, or RBI Issue Offices. No forms are required, making it hassle-free.

- Example: If you have 15 torn ₹200 notes (total ₹3,000), you can walk into any bank and exchange them over the counter without fees.

2. Larger Quantities: Over 20 Notes or ₹5,000

- Limit: If the number of notes exceeds 20 or the total value surpasses ₹5,000 per day, banks accept them against a receipt, and the exchange value is credited later.

- Service Charges: Banks may levy service charges for bulk exchanges, as permitted by RBI guidelines.

- Precautions: For amounts exceeding ₹50,000, banks take additional precautions, such as verifying the source to prevent fraudulent activity.

- Process:

- Non-Chest Branches: For 5–20 notes (up to ₹5,000), non-chest branches assess and pay over the counter. If unable to decide, they send the notes to a currency chest branch, issuing a receipt with a payment date (within 30 days). You’ll need to provide bank account details for electronic credit.

- Bulk Exchanges: For more than 5 notes (≤ ₹5,000), send them via insured post to a nearby currency chest branch with your bank account details, or exchange in person. For values > ₹5,000, visit a currency chest branch directly.

3. Extremely Damaged Notes

- Condition: Notes that are excessively brittle, badly burnt, charred, or inseparably stuck together cannot be exchanged at regular bank branches.

- Procedure: These must be tendered to an RBI Issue Office for adjudication under a Special Procedure. The 19 RBI Issue Offices are located in cities like Ahmedabad, Bangalore, Mumbai, Delhi, and others.

- Note: Deliberately cut notes showing uniform mutilation patterns (e.g., in large batches) are rejected to curb fraudulent intent.

Where Can You Exchange Cut Notes?

The RBI has made the exchange process accessible across India to ensure public convenience:

- Public Sector Bank Branches: All branches are mandated to accept soiled and mutilated notes.

- Private Sector Bank Currency Chests: These branches handle bulk exchanges and are equipped to process damaged notes.

- RBI Issue Offices: Located in 19 cities, including Chennai, Kolkata, and Lucknow, these offices handle severely damaged notes or disputes.

- Triple Lock Receptacle (TLR) Covers: Some banks offer TLR facilities for secure deposit of mutilated notes.

No bank can refuse to exchange valid damaged notes, and non-compliance can lead to penalties. If a bank refuses, you can file an online complaint via the RBI’s website.

Exchange Value of Cut Notes

The refund value depends on the note’s condition and denomination, governed by the RBI (Note Refund) Rules, 2009:

- Soiled Notes: Full value is provided if essential features are intact.

- Mutilated Notes:

- For notes of ₹1–₹20: Full value if at least 50% of the note’s surface remains; no value if less than 50%.

- For notes above ₹20: Full value if the largest undivided piece is >80% of the note’s area; half value if 40–80%; no value if <40%.

- Payment Method: For small exchanges, you receive new notes or coins instantly. For bulk or severely damaged notes, the value is credited via bank draft, pay order, or electronic transfer.

Why Exchange Damaged Notes?

Many people attempt to use cut notes in local markets or hide them in bundles, unaware that banks offer a straightforward exchange process. Exchanging damaged notes is beneficial because:

- Legal Tender: Damaged notes retain their face value if essential features are intact, ensuring you don’t lose money.

- RBI Mandate: All banks must provide this service, regardless of whether you’re a customer.

- Prevent Fraud: Exchanging notes through banks prevents private dealers from exploiting the process.

Common Myths About Exchanging Cut Notes

- Myth: You need a bank account to exchange notes. Fact: Non-account holders can exchange notes up to the daily limit without ID proof.

- Myth: Only the note’s owner can exchange it. Fact: Anyone can exchange notes, provided they meet RBI guidelines.

- Myth: Banks charge for all exchanges. Fact: Exchanges up to 20 notes (₹5,000/day) are free.

Tips for a Smooth Exchange Process

- Check Note Condition: Ensure the note isn’t deliberately cut or bears political slogans, as these are rejected.

- Visit During Non-Peak Hours: Bank counters can get busy, so plan your visit early.

- Carry Bank Details: For bulk exchanges, have your account number, branch name, and IFSC code ready.

- Use RBI Offices for Severe Damage: For burnt or brittle notes, directly approach an RBI Issue Office.

- Know Your Rights: If a bank refuses, escalate the issue via the RBI’s complaint portal.

Recent Updates on Currency Exchange

- ₹2,000 Note Withdrawal: The RBI withdrew ₹2,000 notes from circulation, with a deadline for exchange or deposit extended to October 7, 2023. Post this, exchanges are limited to RBI Issue Offices with ID proof and a filled RBI ₹2,000 Note Exchange Form. A limit of ₹20,000 per transaction applies.

- Digital Push: Despite the rise in UPI and card payments, cash remains vital for small transactions, reinforcing the need for clear exchange policies.

- Recycling Damaged Notes: The RBI now recycles mutilated notes into paper products, reducing waste. Previously, these were burnt.

Final Thought

Exchanging cut or damaged notes in India is a straightforward process backed by robust RBI guidelines. You can exchange up to 20 notes (₹5,000/day) free of charge at any bank, while larger quantities or severely damaged notes follow specific procedures. By understanding these rules, you can confidently reclaim the value of your damaged currency without hassle. Next time you find a torn note, don’t tuck it away—head to your nearest bank or RBI office and exchange it seamlessly.

For more personal finance tips and updates on RBI policies, stay tuned to our blog. Have you ever exchanged a damaged note? Share your experience in the comments below!