“What happens if a deceased person’s account has no nomination or survivorship clause? Learn how legal heirs can claim funds, the role of Succession Certificates, RBI’s unclaimed deposit rules, and ways to avoid disputes. Essential guide for hassle-free inheritance in India.”

Dealing with the financial affairs of a loved one after their passing is never easy. In India, the process becomes even more complex when a deceased person’s bank account lacks a survivorship clause or nomination. This situation raises critical questions: How can legal heirs claim the funds? What documents are required? How can families avoid unnecessary delays and legal hassles? In this comprehensive blog post, we’ll explore the implications of such a scenario, outline the latest procedures as of 2025, and provide actionable insights to ensure a smooth transition of assets. Whether you’re a legal heir, a financial planner, or simply planning your estate, this guide is packed with up-to-date information like deceased account without nomination, survivorship clause in India, and legal heirs claiming bank account.

Understanding Survivorship Clause and Nomination in India

Before diving into the consequences of not having a survivorship clause or nomination, let’s clarify these terms in the Indian banking context.

What is a Survivorship Clause?

A survivorship clause is a provision in joint bank accounts that dictates what happens to the funds upon the death of one account holder. Common types include:

- Either or Survivor: Any surviving account holder can access the funds.

- Former or Survivor: Only the primary account holder can operate the account during their lifetime; the survivor gains access after their death.

- Anyone or Survivor: Any joint holder can operate the account, and survivors inherit it upon one’s demise.

This clause simplifies asset transfer, bypassing lengthy legal processes.

What is Nomination?

Nomination is the act of designating a person (nominee) to receive the proceeds of a bank account, fixed deposit, or other financial assets upon the account holder’s death. Under the Banking Regulation Act, 1949, and guidelines from the Reserve Bank of India (RBI), nomination ensures a hassle-free payout to the nominee, who acts as a trustee for the legal heirs.

When neither a survivorship clause nor a nomination exists, the process of claiming the deceased’s bank account becomes significantly more challenging.

The Scenario: No Survivorship Clause or Nomination

In India, when a person passes away without a survivorship clause or nomination on their bank account, the funds don’t automatically transfer to anyone. Instead, the bank freezes the account upon receiving notification of the account holder’s death, typically accompanied by a death certificate. This freeze prevents unauthorized transactions but also complicates access for family members or heirs.

Without these provisions:

- The funds can only be claimed by the legal heirs of the deceased.

- The process requires legal documentation, which can vary based on the bank’s policies and the amount involved.

- Delays, disputes, and additional costs often arise, especially if the deceased died intestate (without a will).

According to the RBI’s Master Circular on Customer Service (updated as of July 1, 2024), banks must settle claims for deceased depositors efficiently. However, the absence of a survivorship clause or nomination shifts the burden onto legal heirs to prove their entitlement, making it a time-consuming ordeal.

Legal Framework Governing Such Cases in India

The settlement of a deceased person’s account without a survivorship clause or nomination falls under Indian succession laws, depending on the deceased’s religion or personal law:

- Hindu Succession Act, 1956: Applies to Hindus, Sikhs, Jains, and Buddhists.

- Indian Succession Act, 1925: Governs Christians, Parsis, and others not covered by specific personal laws.

- Muslim Personal Law: Applies to Muslims, where inheritance follows Sharia principles.

If the deceased left a will (testate), the executor or beneficiaries named in the will must follow probate procedures. If there’s no will (intestate), legal heirs must establish their rights through succession certificates or other legal means.

The RBI also mandates banks to adopt simplified procedures for claims below a threshold limit (often ₹5 lakh, though this varies by bank as of 2025), reducing the need for extensive legal representation.

Steps to Claim a Deceased Person’s Account Without Survivorship Clause or Nomination

Here’s a step-by-step guide for legal heirs navigating this situation in 2025:

Step 1: Notify the Bank

Inform the bank of the account holder’s death immediately. Submit:

- A copy of the death certificate issued by the Municipal Corporation or Gram Panchayat.

- Account details (account number, branch, etc.).

- Proof of identity of the claimant(s).

The bank will freeze the account to prevent misuse until the claim is settled.

Step 2: Identify Legal Heirs

Legal heirs vary by personal law. For example:

- Under the Hindu Succession Act, Class I heirs (spouse, children, mother) have priority.

- In Muslim law, heirs are determined by a fixed share system.

All legal heirs must agree on the claim process to avoid disputes. If there’s disagreement, the matter may escalate to court.

Step 3: Gather Required Documents

For claims without nomination or survivorship, banks typically require:

- Death Certificate: Mandatory proof of death.

- KYC Documents: Identity and address proof of all claimants (e.g., Aadhaar, PAN).

- Affidavit: A sworn statement by legal heirs declaring their relationship to the deceased.

- Letter of Indemnity: An undertaking to compensate the bank if a dispute arises later.

- Letter of Disclaimer: If some heirs waive their rights, they must provide this document.

- Succession Certificate or Letter of Administration: Required for high-value accounts (above ₹5 lakh) or if the bank insists on legal representation.

For amounts below the threshold limit, banks may waive the succession certificate, accepting simpler documentation as per RBI guidelines.

Step 4: Submit the Claim

File a claim application with the bank branch where the account is held. Use the bank’s standard claim form (available on their website or at the branch). Attach all documents and ensure accuracy to avoid rejection.

Step 5: Bank Verification and Settlement

The bank verifies:

- The authenticity of the death certificate.

- The identity and relationship of claimants.

- The absence of disputes among heirs.

For accounts without a nominee or survivorship clause, the RBI mandates settlement within 30 days from the date all requisite documents are submitted, provided there are no complications.

Step 6: Fund Distribution

Once approved, the bank releases the funds to the legal heirs. If multiple heirs are involved, the amount may be split based on succession laws or mutual agreement.

Challenges Faced by Legal Heirs

Claiming a deceased person’s account without a survivorship clause or nomination poses several hurdles:

- Time Delays: Obtaining a succession certificate from a court can take 6–12 months, depending on the backlog and complexity.

- Costs: Legal fees, court charges, and stamp duties add financial strain.

- Disputes: Family disagreements over heirship or fund distribution can lead to litigation.

- Bank Policies: Some banks impose stricter requirements, even for small amounts, causing frustration.

A 2024 survey by the Indian Banks’ Association (IBA) revealed that 35% of deceased account claims without nomination faced delays exceeding three months, underscoring the need for proactive estate planning.

Latest Updates

As of April 2025, several developments have streamlined the process:

- RBI Threshold Increase: Many banks have raised the threshold limit for simplified claims to ₹10 lakh, reducing the need for succession certificates in smaller cases.

- Digital Submission: Leading banks like SBI, HDFC, and ICICI now allow online claim submissions, cutting processing time by 20%, per a 2025 RBI report.

- Unified Guidelines: The IBA’s revised Model Operational Procedure (April 2024) urges banks to prioritize customer service, offering templates for affidavits and indemnity letters.

These updates reflect a growing emphasis on reducing hardship for legal heirs, though challenges persist without prior planning.

How to Avoid This Situation: Proactive Estate Planning

Prevention is better than cure. Here’s how account holders can ensure a seamless transfer of assets:

- Add a Nominee: Register a nominee for all bank accounts, fixed deposits, and investments. It’s free and can be updated anytime.

- Opt for Joint Accounts with Survivorship: For couples or family members, a joint account with a survivorship clause simplifies succession.

- Draft a Will: A legally valid will clarifies asset distribution and overrides default succession laws.

- Maintain Records: Keep account details, nominee information, and wills accessible to trusted family members.

The RBI’s 2024 campaign, “Nominate for Peace of Mind,” reported a 15% increase in nomination registrations, highlighting growing awareness.

Case Study: A Real-Life Example

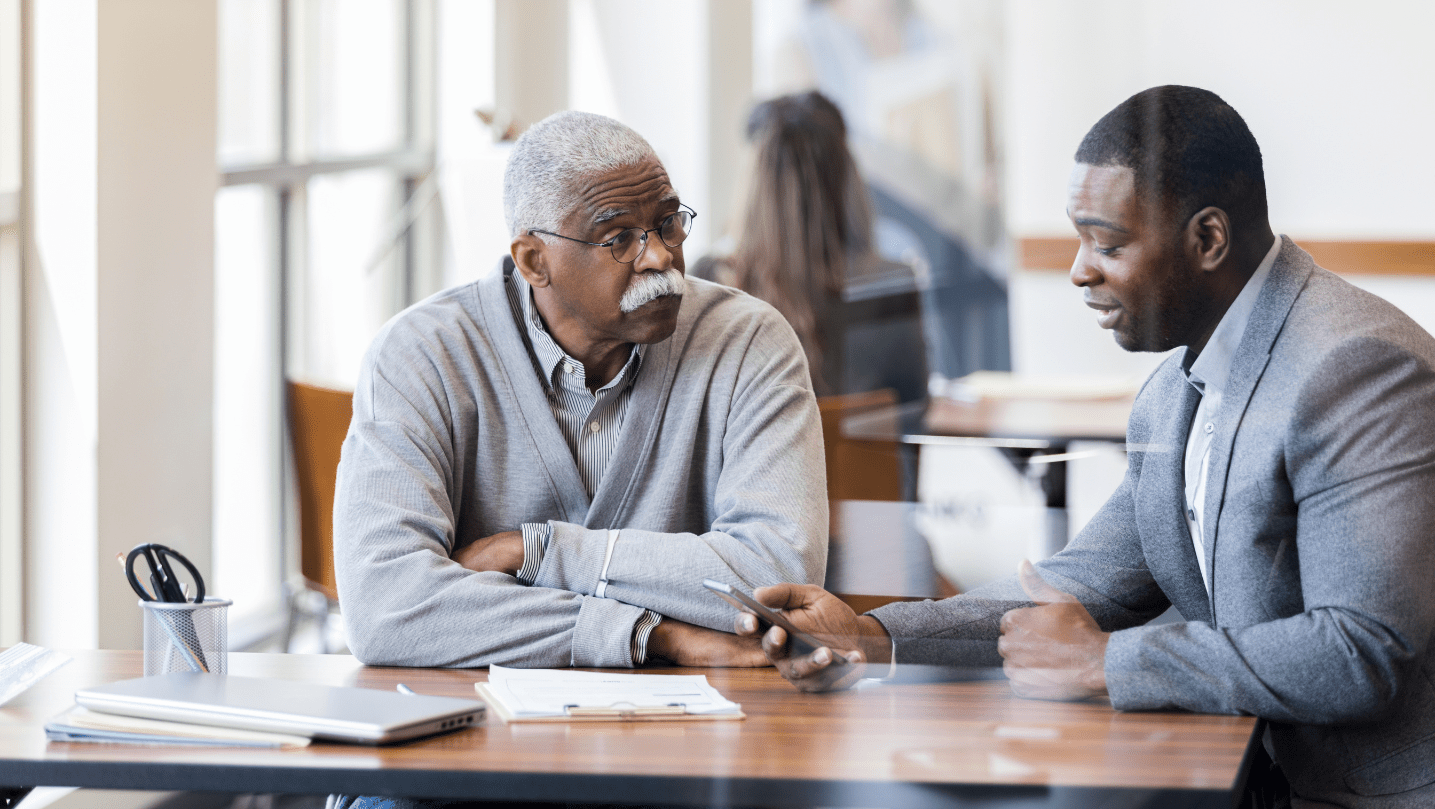

In 2023, Mr. Sharma, a Delhi resident, passed away intestate with a ₹15 lakh savings account at a public sector bank. He had no nominee or survivorship clause. His wife and two sons approached the bank, but a dispute arose when one son claimed a larger share. The bank demanded a succession certificate, which took nine months and ₹50,000 in legal fees to obtain. The family finally settled the claim in mid-2024, but not without emotional and financial strain.

This case illustrates how the absence of planning can complicate matters for loved ones.

Final Thought

The absence of a survivorship clause or nomination in a deceased person’s bank account in India transforms a straightforward process into a legal and emotional challenge. Legal heirs must navigate documentation, bank policies, and potential disputes, often at significant cost and delay. However, with 2025 updates like higher threshold limits and digital processes, the burden is easing slightly. Still, the best solution lies in proactive planning—adding nominees, opting for survivorship clauses, and drafting a will.

If you’re dealing with such a situation or planning your estate, consult a financial advisor or lawyer to ensure compliance with the latest regulations.

-

Why Is the Stock Market Falling Today? Nifty Below 25,500 and 5% Crash in IT Explained

-

Section 195 TDS on NRI Property: How Budget 2026 Just Made It Simpler for Every Indian Homebuyer

-

Meta and AMD Sign a Multi-Year 6GW AI Infrastructure Deal Worth Over $100 Billion — Breaking Down Every Detail

-

IBM is the Latest AI Casualty: Shares Tank 13% on Anthropic’s COBOL Modernization Threat