Are you worried about your bank deposits amid the IndusInd Bank saga? Learn how ₹5 lakh DICGC insurance, RBI regulations, and diversification can protect your savings. Explore safe investment options and stay informed about banking risks. Safeguard your money with expert insights!

In recent months, the financial sector has been abuzz with concerns over the safety of bank deposits, particularly in light of the ongoing saga surrounding IndusInd Bank. As one of India’s prominent private sector banks, IndusInd Bank has faced scrutiny over its financial health, governance, and asset quality. This has left many depositors wondering: Are my bank deposits safe? In this comprehensive blog post, we’ll explore the latest developments, analyze the risks, and provide actionable insights to help you safeguard your hard-earned money.

The IndusInd Bank Saga: What Happened?

The IndusInd Bank saga began to unfold when the bank disclosed significant accounting discrepancies related to derivative transactions. These discrepancies, which had gone unrecognized for several years, led to a substantial financial hit for the bank. An internal review revealed an unaccounted exposure of ₹2,000 crore, which the bank had to recognize in its profit and loss statement.

This revelation came to light during a recent Reserve Bank of India (RBI) inspection, where the regulator discovered the unaccounted exposure. The RBI’s concerns over IndusInd Bank’s corporate governance and accounting practices are not new. The regulator has flagged multiple issues over the years, leading to restrictions on the bank’s leadership.

Lessons from the IndusInd Bank Saga

The IndusInd Bank saga serves as a wake-up call for depositors to be more vigilant about their financial choices. Here are some key takeaways:

1. Diversify Your Deposits

To minimize risk, avoid keeping all your deposits in a single bank. Instead, spread your deposits across multiple banks to ensure that each account stays within the ₹5 lakh insurance limit.

2. Monitor Your Bank’s Financial Health

Stay informed about your bank’s financial performance, asset quality, and governance practices. Regularly review the bank’s quarterly reports, credit ratings, and news updates to identify any red flags.

3. Opt for Reputed Banks

While private sector banks like IndusInd Bank offer attractive interest rates, they may carry higher risks compared to public sector banks. Consider depositing a significant portion of your savings in well-established public sector banks, which are backed by the government.

4. Explore Alternative Investment Options

If you’re concerned about the safety of bank deposits, consider diversifying your portfolio with other low-risk investment options such as government bonds, fixed-income mutual funds, or post office savings schemes.

The Impact on Depositors

The primary concern for depositors is whether their money is safe in the bank. The IndusInd Bank saga has heightened anxiety among depositors about the broader stability of the banking system. The financial irregularities at the bank have only added to the worries of depositors who fear that their hard-earned money might be at risk.

Historically, bank fixed deposits (FDs) have been considered a safe investment option due to their fixed returns and minimal risk. However, recent events have led to renewed scrutiny of the safety of FDs. The question now is whether FDs are still as secure as they once were.

Are Bank Deposits Safe? The Big Question

Bank deposits have long been considered one of the safest investment options, especially for risk-averse individuals. However, recent events have shaken this perception. Here’s what you need to know:

1. Deposit Insurance: A Safety Net

In India, bank deposits are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI. As of February 2024, the DICGC insures deposits up to ₹5 lakh per depositor per bank. This means that even if a bank fails, your deposits up to ₹5 lakh are protected.

However, it’s important to note that this insurance covers only the principal amount and not the interest earned. Additionally, if you have deposits exceeding ₹5 lakh, the excess amount may be at risk in the event of a bank failure.

2. The Role of the RBI

The RBI plays a crucial role in maintaining the stability of the banking system. It monitors banks’ financial health, conducts regular audits, and intervenes when necessary to prevent systemic risks. In the case of IndusInd Bank, the RBI has assured the public that the bank’s operations remain stable and that there is no immediate cause for concern.

3. Regulatory Protection: The Reserve Bank of India (RBI) provides regulatory protection to depositors. In the event of a bank failure, the Deposit Insurance and Credit Guarantee Corporation (DICGC) insures deposits up to ₹5 lakh per depositor per bank. This insurance provides a safety net for small depositors.

4. Bank’s Financial Health: The financial health of a bank is a critical factor in determining the safety of deposits. Key indicators to watch include the bank’s capital adequacy ratio, non-performing assets (NPAs), and profitability. A bank with a strong financial position is less likely to face issues that could jeopardize depositors’ money.

5. Corporate Governance: Effective corporate governance practices are essential for the stability of banks. The IndusInd Bank saga highlights the importance of transparency, accountability, and adherence to regulatory norms. Banks with robust governance frameworks are better positioned to manage risks and protect depositors.

6. Market Volatility: Unlike investments in the stock market, bank deposits are generally insulated from market volatility. This stability makes them an attractive option for risk-averse investors. However, it is crucial to stay informed about the bank’s financial condition and any potential risks.

7. Risks Associated with Bank Deposits

While bank deposits are generally safe, they are not entirely risk-free. Some of the key risks include:

- Bank Failure: Although rare, banks can fail due to poor management, economic downturns, or fraud.

- Inflation Risk: The interest earned on bank deposits may not always keep pace with inflation, eroding your purchasing power over time.

- Liquidity Risk: Fixed deposits often come with lock-in periods, limiting your access to funds in case of emergencies.

Steps to Ensure the Safety of Your Deposits

Given the current concerns, here are some steps you can take to ensure the safety of your bank deposits:

- Diversify Your Deposits: Spread your deposits across multiple banks to reduce the risk of losing all your money in case one bank faces financial difficulties. This strategy also ensures that you stay within the DICGC insurance limit for each bank.

- Monitor Bank’s Financial Health: Regularly review the financial health of your bank. Look for key indicators such as the capital adequacy ratio, NPAs, and profitability. Banks with strong financial metrics are generally safer for depositors.

- Stay Informed: Keep yourself updated with the latest news and developments in the banking sector. Awareness of any potential issues can help you take timely action to protect your deposits.

- Choose Reputable Banks: Opt for banks with a strong reputation and a history of stability. Established banks with good governance practices are less likely to face financial irregularities.

- Consider Alternative Investments: While bank deposits are a safe option, consider diversifying your investments into other asset classes such as mutual funds, bonds, and equities. Diversification can help mitigate risks and enhance returns.

The Role of Regulatory Bodies

Regulatory bodies such as the RBI play a crucial role in ensuring the stability of the banking sector. The RBI’s oversight and regulatory framework are designed to protect depositors and maintain confidence in the banking system. The recent actions taken by the RBI in response to the IndusInd Bank saga demonstrate the regulator’s commitment to safeguarding the interests of depositors.

Recent Developments

As of March 2025, the IndusInd Bank saga continues to unfold with new revelations and regulatory actions. The bank’s gross non-performing assets (NPAs) stood at 2.24% in September 2024, compared to 1.92% a year earlier. Additionally, the bank’s profitability and capital adequacy ratio have been on a downward trajectory. An internal review has estimated a 2.35% adverse post-tax impact on its net worth as of December 2024.

The RBI has instructed banks to conduct a thorough review of their investment portfolios, which has led to further scrutiny of IndusInd Bank’s financial practices. This ongoing situation has heightened concerns among depositors and investors about the stability of the banking sector as a whole.

Stay Informed, Stay Secure

The IndusInd Bank saga has brought to the forefront the importance of ensuring the safety of bank deposits. While the situation has raised concerns, it also serves as a reminder for depositors to stay vigilant and informed. By understanding the factors that contribute to the safety of bank deposits and taking proactive steps to protect your money, you can navigate the current uncertainties with confidence.

In conclusion, while the IndusInd Bank saga has highlighted potential risks, it is essential to remember that the banking sector is heavily regulated, and measures are in place to protect depositors. By staying informed and making prudent financial decisions, you can ensure the safety of your hard-earned money.

-

Grab the Apple MacBook Air M4 at Unbeatable Discounts (February 2026)

-

Toxic Sales Culture in Banks? RBI’s Bold Move to Protect Customers & Clean Up Mis-Selling

-

The 6x Income Rule & 35% EMI Cap: How to Calculate Your Home Loan Eligibility Like a Pro in 2026

-

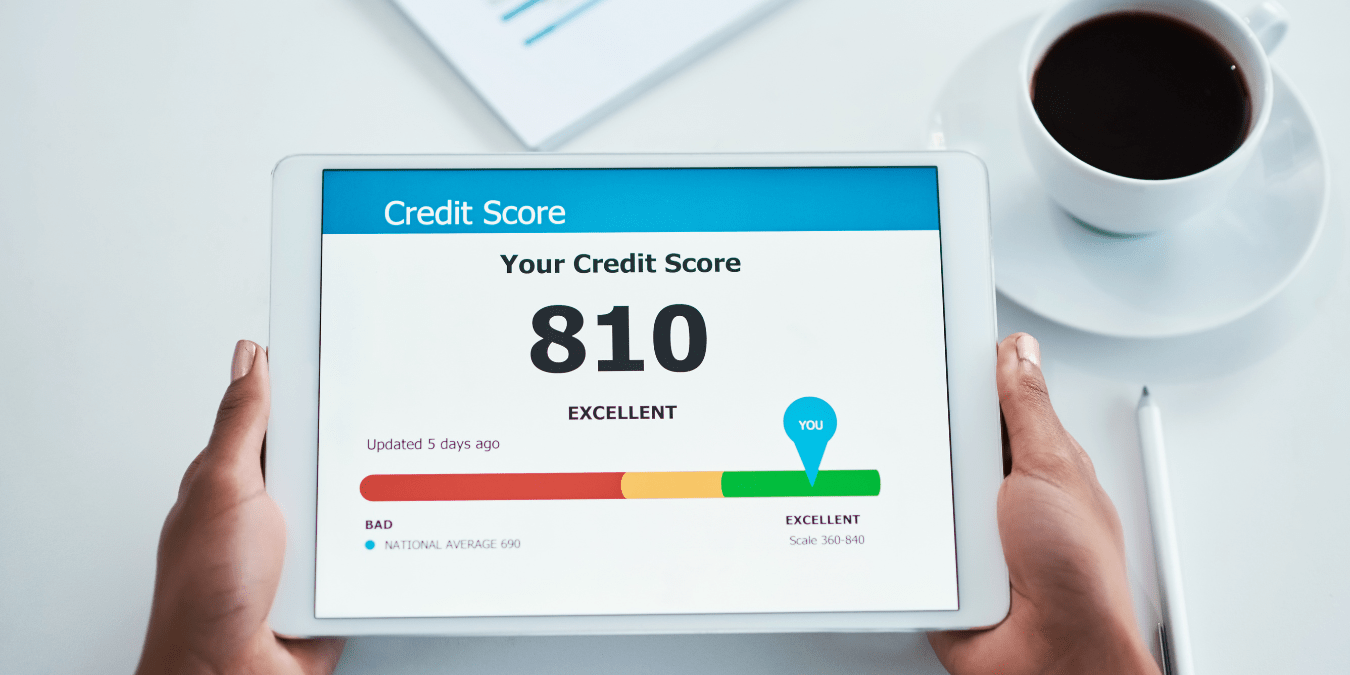

CIBIL Score Myths That Are Silently Killing Your Loan Chances (A Banker Tells All)