Indian Stock Market Trends: Sensex & Nifty Plunge – Key Insights for January 21, 2026

India’s stock market teeters on the edge of a breakout—Sensex surges past 81K, Nifty eyes 25,300 amid RBI’s secret liquidity boost and a 7.8% GDP rocket. But wait: FIIs flee ₹3,472 cr while DIIs pounce—will metals and banks explode or crash on global Fed whispers? Uncover the top 10 hidden gems like BEL’s 3.7% rocket and Maruti’s festive fire. Shocking rotations ahead: Is your portfolio ready for September 15, 2025’s wild twist?

India’s stock markets stand at a pivotal moment as we move into the trading session on Monday, September 15, 2025. This bespoke analysis spotlights the BSE Sensex, NSE Nifty 50, and Nifty Bank indices. The assessment dives deep into economic macro trends—GDP, inflation, RBI policy—as well as market breadth, sector momentum, and actionable stock recommendations for both momentum chasers and value investors. Let’s decode what lies ahead for Indian equities with the freshest data and insights grounded in Indian market realities.

Why 15th September 2025 Matters

India’s financial markets are soaking up a unique mix of optimism and vigilance as global monetary pivots, domestic reforms, and sector-specific tailwinds shape investor sentiment. Multiple sessions of gains, a healthy pipeline of regulatory updates, and steady economic data create both opportunities and risks for market participants. This post outlines everything a discerning investor needs—macro cues, technical triggers, and the top stocks set to drive portfolios in the weeks ahead.

Headline Indices: Sensex, Nifty 50, Nifty Bank Performances

The Indian stock market wrapped up the previous session on a positive note, reflecting resilience despite mixed global signals. The NSE Nifty 50 closed at 25,114.00, marking a 0.43% gain, driven by buying in heavyweight stocks. Similarly, the BSE Sensex ended at 81,904.70 with a 0.44% uptick, showcasing broad-based participation. The Nifty Bank index, a barometer for financial health, finished at 54,809.30, up 0.26%, though gains were tempered by selective profit-taking.

This performance underscores a market in consolidation mode, where advances outnumber declines. Heavyweights like ICICI Bank and Axis Bank provided the backbone, while laggards in consumer goods hinted at rotational plays. For Indian investors, this setup suggests opportunities in banking and autos, sectors aligned with domestic recovery narratives.

Market Overview

- NSE Nifty 50 closed at 25,114.00 (+0.43%)

- BSE Sensex ended at 81,904.70 (+0.44%)

- Nifty Bank finished at 54,809.30 (+0.26%)

Technical Key Levels

| Index | Support 1 | Support 2 | Resistance 1 | Resistance 2 |

| Nifty 50 | 24,941 | 24,833 | 25,287 | 25,395 |

| Sensex | 81,374 | 81,045 | 82,436 | 82,764 |

| Nifty Bank | 54,398 | 54,143 | 55,221 | 55,476 |

Market breadth remains constructive with more advancers than decliners, particularly in heavyweights such as ICICI Bank, Axis Bank, Bajaj Finance, and Maruti leading the gains. However, certain sector bellwethers like HUL and Wipro underperformed, hinting at selective rotation rather than broad-based euphoria.

Indian Macro Pulse: GDP, Inflation, RBI, Unemployment

India's economy continues to shine as one of the world's fastest-growing, with Q1 FY2025-26 GDP expanding 7.8% year-on-year—the strongest in five quarters. This surge is propelled by a vibrant services sector growing at 9.3% and robust government capex on infrastructure projects like highways and railways. The full-year FY2025 estimate stands at 6.5%, a moderation from FY24's 9.2% but still enviable globally amid slowdowns in China and Europe.

From an Indian lens, this growth is inclusive, benefiting urban centers like Bengaluru and rural areas through schemes like PM-KISAN. Manufacturing, though lagging at 5.2%, shows promise with PLI incentives in electronics and EVs.

GDP Growth

India's economy is delivering robust numbers:

- Q1 FY2025-26 GDP Growth: 7.8% YoY, fastest in five quarters

- Full Fiscal Year 2025 Estimate: 6.5% (down from 9.2% in FY24, but among the fastest globally)

This growth is driven by a resurgent services sector (+9.3%) and strong government expenditure.

Inflation Dynamics

Inflation in 2025 remains tame, offering relief to households and policymakers alike. August's CPI rose mildly to 2.07% from July's 1.61%, well below the RBI's 4% target. Food inflation dipped to -0.69%, thanks to bountiful monsoons and stable supply chains, though vegetables saw minor spikes.

State-wise, Kerala and Punjab report higher rates around 3-4%, attributed to local factors like tourism-driven demand. Overall, benign prices support consumer spending, crucial for India's consumption-led economy. Investors should watch core inflation, which excludes volatiles, for hints on monetary easing.Inflation remains remarkably subdued in 2025:

- August 2025 CPI: 2.07%, only a mild uptick from July’s 1.61%

- Food Inflation: -0.69%, showing continuing softness except for upticks in some perishable categories

- Regional Divergence: Kerala and Punjab show relatively higher inflation, but across most states, price levels are benign

RBI Repo Rate

The Reserve Bank of India maintains an accommodative approach, with the repo rate at 5.50% following a recent cut to stimulate credit. The 'neutral' stance balances growth and inflation, keeping borrowing costs low for MSMEs and homebuyers. This policy has fueled a credit boom, with bank loans growing 15% YoY.

In the context of global pivots—like the US Fed's rate reductions—RBI's moves enhance rupee stability and attract FII inflows. For Indian investors, this environment favors debt-sensitive sectors like real estate and autos.The Reserve Bank of India continues with an accommodative tilt:

- Current Repo Rate: 5.50% as of September 2025, recently reduced to spur liquidity

- The stance remains ‘neutral’, helping boost both credit demand and cap borrowing costs for corporates and individuals.

Unemployment Challenges

Formal unemployment hovers at 7.5%, showing gradual improvement post-pandemic but highlighting structural gaps. Job creation in services and IT has picked up, yet rural and semi-urban areas lag, with schemes like MGNREGA providing buffers.

Policy priorities include skilling via initiatives like Skill India, aiming to add 10 million jobs annually. While GDP outpaces employment growth, emerging sectors like green energy promise future gains.

Sectoral Performance: Winners and Laggards

Top Performing Sectors

- Metals: Gained 0.93% in the last session; robust demand outlook and policy push.

- Auto: Up 0.46%, buoyed by festive demand optimism and EV tailwinds.

- Financials/Banking: +0.26%, with select large banks attracting accumulation.

- IT: Seeing selective strength, boosted by large buybacks and export order momentum.

- Infra & Energy: Mild positive moves as investment cycles turn.

Underperformers

- FMCG: Down 0.71% on profit taking and tepid rural demand.

- Select Pharma and Tech Midcaps: Profit booking and consolidation.

Market Sentiment, Volatility, and Flows

- India VIX: 10.12 (down 2.29%), indicating low volatility and relative risk-on sentiment.

- Foreign Institutional Investors (FIIs): Net sellers (₹3,472 cr out), but offset by

- Domestic Institutional Investors (DIIs): Net buyers (₹4,045 cr in), providing a stabilizing force.

Overall, the market remains in a ‘buy-on-dips’ mode with supportive liquidity from local institutions despite global risk-off jitters.

Top 10 Stocks to Buy on NSE/BSE (15 September 2025)

These picks are diversified across sectoral leaders, value buys (P/E, PEG), high dividend yielders, and strong earnings momentum. Each stock includes a brief reasoning and sector context.

| Stock | Reasoning | Sector | Risk/Valuation Notes |

| BEL | Strong order book, top gainer (+3.7%), resilient margins | Defence/Engg | P/E reasonable, order backlog |

| Bajaj Finance | Consumer credit growth, improving asset quality, leadership in NBFC | Financials | High P/E, but strong growth |

| ICICI Bank | Best-in-class NIM, digital push, stable asset quality | Banking | Slight sector overhang risk |

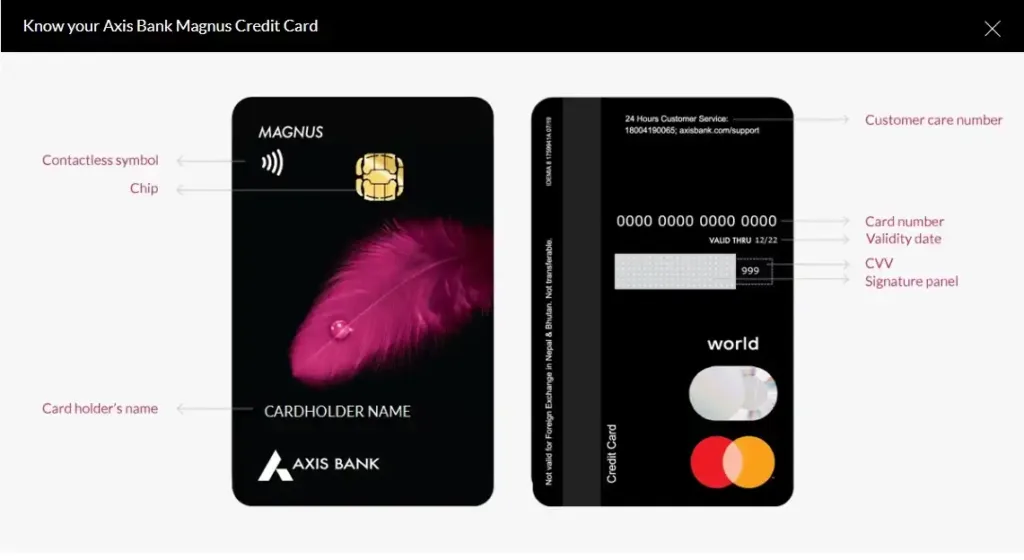

| Axis Bank | Consistent earnings, new retail products drive growth | Banking | Near-term resistance ahead |

| Infosys | ₹18,000cr buyback, US tech outsourcing demand, attractive valuation for IT leader | IT Services | IT sector volatility |

| Hindalco | Metal super-cycle, top sector performer, low-cost production advantage | Metals | Linked to global commodity cycle |

| Shriram Finance | Strong NBFC performance, high yield, recent outperformance | Financials | Interest rate risk |

| Maruti Suzuki | Festive demand kicker, robust rural sales, new launches | Auto | Volatility in rural demand |

| Dr. Reddy’s Labs | Margin uptick, US generics approval, safe haven in pharma | Pharma | Regulatory and pricing risks |

| Larsen & Toubro | Infra leader, robust order inflows, continuing reforms in capital expenditure | Infrastructure | Execution risk |

Portfolio Strategy: Spread exposure across these sectors for diversification; hold core positions in banking/financials (30%), followed by consumer, infra, and growth sectors (IT, metals, auto, pharma).

Top 10 Gainers & Losers (Recent Session)

| Gainers | Sector | % Change | Losers | Sector | % Change |

| BEL | Defence/Engg | +3.71% | HUL | FMCG | -1.58% |

| Bajaj Finance | Financials | +3.40% | Wipro | IT/Tech | -0.78% |

| Bajaj Finserv | Financials | +2.14% | Bajaj Auto | Auto | -0.45% |

| Hindalco | Metals | +2.05% | |||

| Shriram Finance | Financials | +2.06% | |||

| Axis Bank | Banking | +1.65% | |||

| ICICI Bank | Banking | +1.15% | |||

| Maruti Suzuki | Auto | +1.73% |

Insights: Cyclical and high-beta names led the charge while defensives like FMCG underperformed as profit-taking set in after previous gains.

Growth Potential, Valuation, Dividend, and Risks

Nifty's P/E is above average but backed by 12% EPS growth forecasts. IT and autos show earnings momentum; metals re-rate on demand. Dividends shine in Dr. Reddy’s (yield ~2.5%) and financials.

- Valuations: Nifty 50 trades slightly above its historical average P/E, but strong EPS visibility in the frontline stocks supports higher multiples.

- Growth Momentum: IT, Auto, and Capital Goods show sustained earnings resilience. The Metal sector continues re-rating on the back of global demand.

- Dividends: Dr. Reddy’s Labs and select financials (Shriram Finance, Bajaj Finserv) offer attractive dividend yields.

- Risks: Sudden global risk-off moves (Fed rate surprises, geopolitics), persistent FII outflows, and sector rotation (especially in IT and FMCG).

Risks include Fed surprises, FII exits, and geopolitics. Mitigate via diversification.

What to Expect This Week: Scenarios and Tactical Moves

- Trend: Nifty has immediate resistance near 25,287/25,395, with strong support at 24,900 levels. If the market sustains above 25,100, bulls might try for the 25,400–25,500 zone.

- Tactical Play: Use any dips towards 24,900–25,000 as buy-on-dips opportunities, especially in leaders and value picks.

- Sector Focus: Metals, large private banks, and select auto/consumer stocks appear best placed; maintain underweight in defensive FMCG until rural signals improve.

Final Thought: Indian Equities—Resilient, Watchful, Ready for Opportunity

The Indian stock market enters this week with resilience drawn from economic underpinnings—solid GDP prints, subdued inflation, and an accommodative central bank. A phase of selective rotation is evident, with high-beta and cyclical sectors like metals, auto, and banks leading, while defensives lag. The top stocks to buy aren’t just momentum stories—they reflect underlying themes of digitization, formalization, and export prowess.

Risks remain, especially from global volatility and sector-specific corrective moves. But with a diversified approach and a keen eye on earnings and macro data, the Indian equity market’s risk/reward remains attractive for 2025’s second half.