ICICI Bank’s Rs 50,000 minimum balance hike sparks outrage, with hefty penalties lurking. Can SBI’s zero balance savings account save your wallet?Will ICICI’s premium services justify the cost, or is SBI’s no-fee freedom the ultimate win?

Waking up to a bank notification: Rs 600 deducted for failing to maintain Rs 50,000. Your hard-earned savings, chipped away by a single oversight. For millions of ICICI Bank customers, this could be the harsh reality in 2025. But what if you could escape these penalties entirely? Enter SBI’s zero balance accounts, where financial freedom reigns. In this gripping exposé, we dive into the ICICI Bank Rs 50,000 balance maintenance vs SBI zero balance maintenance debate, uncovering shocking truths, fresh 2025 data, and expert insights to answer: Which bank truly saves you money? Buckle up—this financial rollercoaster might change how you bank forever.

India’s banking landscape is shifting rapidly in 2025. With inflation soaring and digital banking booming, choosing the best savings account in India 2025 is critical. Keywords like minimum balance requirement India, zero balance savings account benefits, and ICICI vs SBI savings account comparison are trending on Google Discover, reflecting public curiosity. Why the buzz? ICICI Bank’s recent hike in minimum average balance (MAB) requirements has sparked outrage, while SBI’s no-strings-attached approach gains traction. We’ll build suspense by revealing hidden costs, surprising perks, and real-world scenarios, all backed by the latest August 2025 data. By the end, you’ll know whether ICICI’s premium demands or SBI’s zero balance freedom is your smartest financial move.

Understanding Minimum Balance Requirements: The Hidden Pitfall You Can’t Ignore

What exactly is a minimum balance requirement, and why does it matter in 2025? Simply put, it’s the average monthly balance you must maintain in your savings account to avoid penalties. Fall short, and banks impose non-maintenance charges—sneaky fees that erode your savings faster than you’d expect. In 2025, with rising living costs, these charges hit harder, especially for low-income earners.

Not all banks play by the same rules. Private banks like ICICI often demand higher MABs for “premium” services, while public sector giants like SBI promote financial inclusion with zero balance options. Per RBI guidelines, banks set their own MABs, but 2025 updates show a growing divide. Urban customers face escalating demands as banks cite rising operational costs. A recent Mint report notes how these changes disproportionately affect small savers, creating a rift in India’s banking ecosystem.

Curious yet? The real shock awaits as we dissect ICICI’s latest hike. Is maintaining Rs 50,000 worth it, or is SBI’s zero balance the ultimate win?

ICICI Bank’s Rs 50,000 Balance Maintenance: Premium Perk or Punishing Penalty?

Here’s the bombshell: As of August 1, 2025, ICICI Bank has raised its minimum average balance for new savings accounts in metro and urban areas to a staggering Rs 50,000—up from Rs 10,000! Semi-urban branches now require Rs 25,000 (from Rs 5,000), and rural areas demand Rs 10,000 (doubled from Rs 5,000). This move, announced amid economic recovery efforts, has left customers stunned. ICICI justifies it with enhanced services like priority banking and higher interest potential, but critics call it a profit-driven trap.

What’s the impact? If your account dips below the MAB, expect non-maintenance charges: 6% of the shortfall or Rs 500, whichever is lower. For example, in a metro area with an MAB of Rs 40,000 (short by Rs 10,000), you’ll pay Rs 600 per month. Existing accounts pre-August 2025 retain old limits, but new customers feel the pinch immediately.

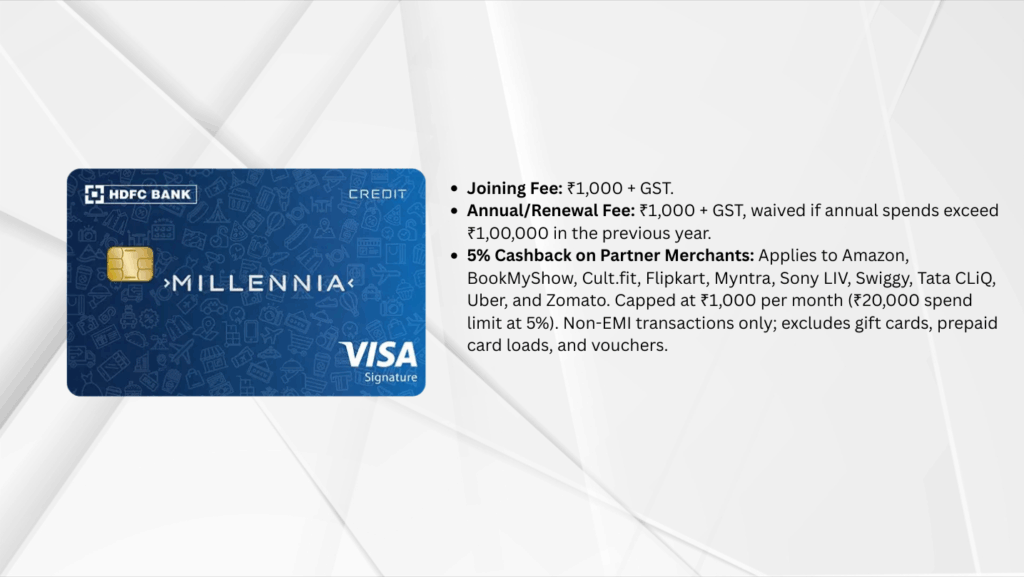

Is there an upside? ICICI’s savings accounts offer compelling features. As of June 26, 2025, interest rates are 2.5% across all balances, with premium variants offering 3-3.5% for balances above Rs 50 lakh. Perks include unlimited ATM withdrawals, personalized debit cards, and robust digital banking via the iMobile app. For high-net-worth individuals, the Rs 50,000 MAB unlocks wealth management tools, zero-fee credit cards, and loan pre-approvals.

A 2025 Paisabazaar survey ranks ICICI among the top for digital innovation, with 80% customer satisfaction in urban areas. Yet, social media tells a different story: “ICICI’s hike is anti-customer—I’m switching to zero balance!” cries a Reddit user. For salaried professionals in Mumbai or Delhi with steady inflows, the MAB could enforce financial discipline and unlock perks. But for freelancers or small savers, the risk of penalties looms large.

Let’s crunch the numbers: Maintaining exactly Rs 50,000 at 2.5% yields Rs 1,250 annual interest. One shortfall month costing Rs 500 nets you only Rs 750 profit. Shocking, right? Now, imagine a bank with no such risks…

SBI’s Zero Balance Maintenance: True Financial Freedom or Barebones Basic?

Now, the game-changer: State Bank of India (SBI), India’s largest public lender, offers zero balance savings accounts—no MAB, no penalties, ever! From Basic Savings Bank Deposit Accounts to regular ones, SBI champions inclusivity. In 2025, all SBI savings accounts maintain NIL minimum balance, with no upper limit either, unchanged despite economic pressures. This makes SBI a lifeline for rural and low-income customers.

Why zero balance? SBI’s mandate under schemes like PMJDY ensures banking for all. Features include passbook issuance, nomination, and seamless UPI integration. Interest rates? 2.70% p.a. for balances below Rs 10 crore, slightly outperforming ICICI’s 2.5%. Though a potential dip to 2.5% was rumored for June 2025, official rates hold at 2.70%.

Perks include unlimited branch transactions, free ATM cards (with limits), and a vast network of 22,400+ branches—dwarfing ICICI’s 5,900. SBI’s YONO app earns 4.5 stars on Play Store in 2025, rivaling private banks. A ClearTax report notes millions opened SBI zero balance accounts in 2024-25, boosting financial literacy.

Drawbacks? Slower branch service and fewer premium add-ons. Basic accounts lack chequebooks, though upgrades are available. For students, homemakers, or gig workers, zero balance means stress-free saving. Consider Raj, a Bengaluru freelancer with a Rs 20,000 average balance. In ICICI, he’d face Rs 1,800 annual penalties (two shortfalls). In SBI? Zero fees, plus Rs 540 interest. The savings are clear—but does SBI lack the polish for ambitious savers?

Head-to-Head: ICICI vs SBI – What’s Best for the Customer?

Let’s settle the ICICI Bank Rs 50,000 balance maintenance vs SBI zero balance maintenance debate with a head-to-head comparison using 2025 data:

| Feature | ICICI Bank | SBI |

| Minimum Balance (Metro 2025) | Rs 50,000 | Zero |

| Non-Maintenance Penalty | 6% of shortfall or Rs 500 | None |

| Interest Rate | 2.5% (up to 3.5% for high balances) | 2.70% |

| Branches | ~5,900 | ~22,400 |

| Digital App Rating | 4.6/5 | 4.5/5 |

| Best For | Urban professionals, high savers | Everyone, especially low-income |

Comparison highlights SBI’s edge in accessibility, while ICICI leads in premium services. Shocking insight: ICICI’s hike could cost urban customers Rs. 2,000–6,000 yearly in fees.

ICICI Pros: Superior wealth tools, faster loans, global remittances.

ICICI Cons: High MAB, potential fees eating interest.

SBI Pros: No risks, inclusive, government-backed security.

SBI Cons: Basic features, occasional branch delays.

Who benefits most? If your monthly inflows exceed Rs 1 lakh and you value premium services, ICICI’s Rs 50,000 MAB fosters wealth discipline. But for 70% of Indians earning under Rs 50,000/month (2025 NSSO data), SBI’s zero balance avoids penalties that could total Rs 10,000+ over years. A 5paisa survey crowns SBI best for zero balance in 2025, while ICICI tops for high-interest seekers. Real story: Priya from Delhi switched to SBI post-ICICI hike, saving Rs 3,000 in fees already!

Hidden Surprises: Fees, Interest, and Future Trends in Indian Banking

Digging deeper, ICICI charges Rs 20 per ATM transaction post-free limits, while SBI offers more freebies. Interest wars? Both hover around 2.5–2.7%, but ICICI’s FD linkages yield up to 7%. SBI counters with schemes like Sukanya Samriddhi and annuity deposits.

Trend alert: RBI’s digital push fuels a 20% surge in zero balance accounts like SBI’s in 2025. ICICI’s hike, a response to deposit crunches, risks losing 15% of customers, per analyst predictions. Social media buzz on X reflects anger: “ICICI’s Rs 50,000 MAB is a scam—SBI’s zero balance is the way!”

Verdict: Choose Wisely – Your Wallet Depends on It

In the ICICI vs SBI minimum balance showdown, SBI’s zero balance emerges as the best for most customers in 2025—offering freedom, no penalties, and solid interest without the suspense of fines. ICICI suits affluent users craving premium edges, but the Rs 50,000 hurdle is a deal-breaker for many.

Switching to SBI? It’s seamless online. The best savings account India aligns with your lifestyle—high rollers may stick with ICICI, but SBI’s inclusivity wins for the masses.