“Essential health insurance tips for diabetes patients. Learn how to choose the best plan, maximize coverage, and manage costs effectively. Get insights on pre-existing conditions, medications, and preventive care to ensure quality diabetes management without financial stress. Your guide to securing the right health insurance for diabetes care.”

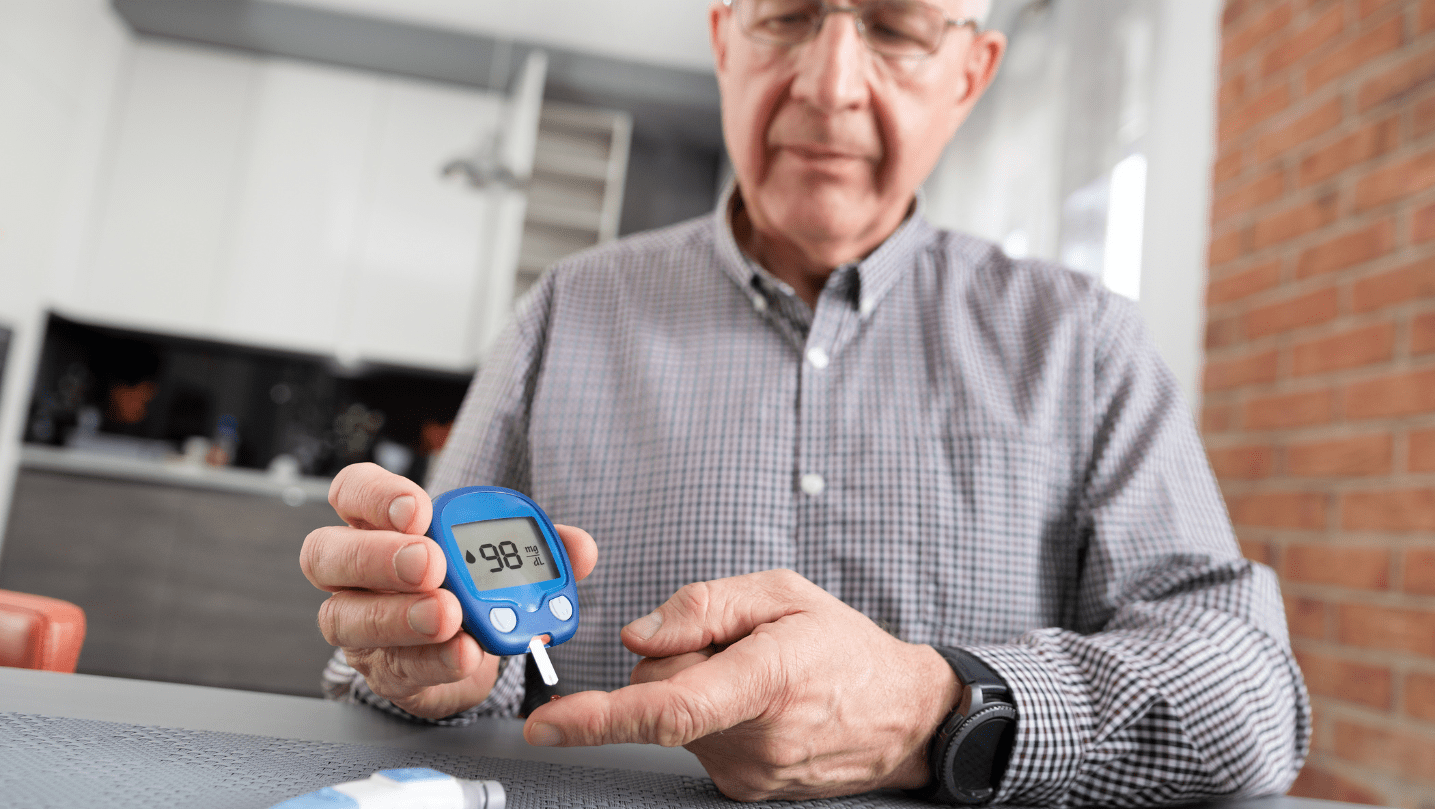

Diabetes is a growing health concern in India, with the country often referred to as the “diabetes capital of the world.” According to the International Diabetes Federation (IDF), India is home to over 77 million adults living with diabetes, and this number is expected to rise to 134 million by 2045. Managing diabetes requires consistent medical care, including regular check-ups, medications, and lifestyle adjustments. For diabetes patients in India, having the right health insurance is crucial to ensure access to quality healthcare without facing financial stress.

In this blog post, we will explore essential health insurance tips for diabetes patients in India, including the latest data, key considerations when choosing a plan, and strategies to maximize your coverage. Whether you are newly diagnosed or have been managing diabetes for years, this guide will help you navigate the complexities of health insurance and make informed decisions.

Why Health Insurance is Crucial for Diabetes Patients

The Rising Cost of Diabetes Care

Diabetes management can be expensive, especially in a country like India where healthcare costs are rising rapidly. A study by the Indian Council of Medical Research (ICMR) revealed that the average annual cost of diabetes care in India ranges from ₹10,000 to ₹30,000 for basic management, and this can go up significantly if complications arise. These costs include:

- Doctor consultations

- Medications (including insulin)

- Diagnostic tests (blood sugar monitoring, HbA1c tests, etc.)

- Hospitalizations (in case of emergencies or complications)

Without adequate health insurance, these expenses can quickly become a financial burden. Health insurance helps cover a significant portion of these costs, ensuring that diabetes patients can access the care they need without worrying about affordability.

The Role of Health Insurance in Diabetes Management

Health insurance plays a vital role in diabetes management by providing coverage for:

- Regular Check-ups: Routine visits to doctors and specialists are essential for monitoring blood sugar levels and preventing complications.

- Medications: Insulin and other diabetes medications can be costly, but health insurance often covers a portion of these expenses.

- Diagnostic Tests: Regular blood tests, HbA1c tests, and other diagnostic procedures are necessary for effective diabetes management.

- Preventive Care: Health insurance often covers preventive services, such as eye exams, foot care, and diabetes education programs, which are crucial for avoiding complications.

Key Considerations When Choosing Health Insurance for Diabetes

1. Understand Your Healthcare Needs

Before selecting a health insurance plan, assess your specific healthcare needs as a diabetes patient. Consider the following factors:

- Frequency of Doctor Visits: How often do you need to see your doctor or specialist for diabetes management?

- Medication Requirements: What types of medications do you take, and how often do you need refills?

- Diagnostic Tests: How frequently do you require blood tests, HbA1c tests, or other diagnostic procedures?

- Potential Complications: Are you at risk for diabetes-related complications, such as neuropathy, retinopathy, or kidney disease?

Understanding your healthcare needs will help you choose a plan that provides adequate coverage for your specific situation.

2. Compare Different Types of Health Insurance Plans

In India, there are several types of health insurance plans available, each with its own set of benefits and limitations. As a diabetes patient, it’s crucial to compare these options to find the best fit for your needs:

- Individual Health Insurance: Covers only the policyholder. This is a good option if you are the only one in your family with diabetes.

- Family Floater Health Insurance: Covers the entire family under a single policy. This is cost-effective if multiple family members need coverage.

- Critical Illness Insurance: Provides a lump sum payout if you are diagnosed with a critical illness, such as diabetes with complications. This can help cover high treatment costs.

- Group Health Insurance: Offered by employers to their employees. Check if your employer provides coverage for diabetes-related expenses.

3. Evaluate Coverage for Pre-Existing Conditions

In India, most health insurance plans have a waiting period for pre-existing conditions like diabetes. This waiting period can range from 1 to 4 years, depending on the insurer and the policy. When choosing a plan:

- Check the Waiting Period: Opt for a plan with the shortest waiting period for diabetes coverage.

- Disclose Your Condition: Be transparent about your diabetes diagnosis when applying for insurance. Non-disclosure can lead to claim rejection later.

4. Check for Coverage of Diabetes Supplies and Medications

Diabetes management requires regular use of supplies and medications, such as:

- Insulin: A life-saving medication for many diabetes patients.

- Blood Glucose Meters: Devices used to monitor blood sugar levels.

- Test Strips: Used with blood glucose meters to measure blood sugar levels.

- Continuous Glucose Monitors (CGMs): Advanced devices that provide real-time blood sugar readings.

When evaluating health insurance plans, ensure that these supplies and medications are covered. Some plans may have limits on the quantity or frequency of coverage, so review the policy details carefully.

5. Look for Coverage of Diabetes-Related Complications

Diabetes can lead to serious complications, such as:

- Diabetic Retinopathy: A condition that affects the eyes and can lead to blindness.

- Diabetic Nephropathy: Kidney damage caused by diabetes.

- Cardiovascular Diseases: Diabetes increases the risk of heart disease and stroke.

- Neuropathy: Nerve damage that can cause pain and numbness in the extremities.

Choose a health insurance plan that covers the treatment of these complications, including hospitalizations, surgeries, and follow-up care.

6. Review the Network of Hospitals

In India, most health insurance plans have a network of hospitals where you can avail cashless treatment. When choosing a plan:

- Check the Network Hospitals: Ensure that the plan includes hospitals and clinics near you that specialize in diabetes care.

- Cashless Treatment: Opt for a plan that offers cashless treatment at network hospitals to avoid out-of-pocket expenses during emergencies.

7. Consider Add-On Covers

Many health insurance plans in India offer add-on covers (riders) that can enhance your coverage. For diabetes patients, consider the following add-ons:

- Critical Illness Cover: Provides a lump sum payout if you are diagnosed with a critical illness related to diabetes.

- Hospital Cash Cover: Offers a daily cash allowance during hospitalization to cover additional expenses.

- OPD Cover: Covers outpatient department expenses, such as doctor consultations and diagnostic tests.

8. Compare Premiums and Sum Insured

When choosing a health insurance plan, compare the premiums and sum insured (coverage amount) offered by different insurers. Keep in mind:

- Affordable Premiums: Choose a plan with premiums that fit your budget.

- Adequate Sum Insured: Ensure that the sum insured is sufficient to cover diabetes-related expenses, including hospitalizations and complications.

9. Check for No-Claim Bonus

Some health insurance plans in India offer a no-claim bonus, which increases your sum insured if you do not make any claims during the policy year. This can be beneficial for diabetes patients who may need higher coverage in the future.

10. Read the Policy Document Carefully

Before finalizing a health insurance plan, read the policy document carefully to understand:

- Coverage Details: What is covered and what is excluded.

- Waiting Periods: For pre-existing conditions and specific treatments.

- Claim Process: How to file a claim and the documents required.

Maximizing Your Health Insurance Coverage for Diabetes

1. Utilize Preventive Care Benefits

Many health insurance plans in India cover preventive care services, such as annual health check-ups and diabetes screenings. Take advantage of these benefits to detect and address potential complications early.

2. Stay In-Network

Whenever possible, choose hospitals and healthcare providers that are part of your insurance plan’s network. This ensures cashless treatment and reduces out-of-pocket expenses.

3. Maintain a Healthy Lifestyle

Adopting a healthy lifestyle can help you manage diabetes effectively and reduce the need for frequent medical care. Many insurers offer wellness programs and discounts for policyholders who maintain a healthy lifestyle.

4. Keep Track of Medical Expenses

Maintain detailed records of your medical expenses, including doctor visits, medications, and diagnostic tests. This will help you track your out-of-pocket costs and ensure that you are maximizing your insurance benefits.

5. Renew Your Policy on Time

Ensure that you renew your health insurance policy on time to avoid a lapse in coverage. A lapse can result in the loss of benefits and the need to serve waiting periods again.

Final Thought

Managing diabetes in India requires consistent medical care and attention, and having the right health insurance is essential to ensure access to quality healthcare without financial stress. By understanding your healthcare needs, comparing different health insurance plans, and maximizing your coverage, you can take control of your diabetes management and improve your overall quality of life.

Remember, health insurance is a valuable tool in your diabetes management toolkit. Take the time to evaluate your options, seek professional guidance if needed, and make informed decisions that support your health and well-being.

-

Indian Stock Market Trends: Your Definitive Monday Market Briefing for 23 February 2026 — Sensex, Nifty, Bank Nifty, Top Picks & Sector Outlook

-

Which Bank Gives the Cheapest Personal Loan in February 2026? Here’s What 10 Lenders Are Actually Offering

-

IDFC First Bank Chandigarh Branch Fraud: How Rs 590 Crore Went Missing From Haryana Government Accounts

-

YES Bank Aims for 1% ROA by FY26: Is India’s Most Dramatic Banking Comeback Finally Complete?