Future-Proof Strategy: How SBI Patrons FD Outperforms Regular Senior Citizen FDs

The shocking SBI Patrons FD secret for super seniors in 2025! Unlock higher fixed deposit returns with this exclusive scheme designed to beat rising costs and RBI policies. Ready to maximize your income fast? Find out the hidden steps that could transform your retirement savings today—before others catch on!

The shocking secret banking trick for super senior citizens in India revealed in 2025: The State Bank of India (SBI) just rolled out a specialized fixed deposit scheme—SBI Patrons—with slightly higher interest rates exclusively for those aged 80 and above. This scheme is a game-changer for millions of seniors seeking smart, risk-free ways to maximize income from fixed deposits, especially amid shifting market conditions and the latest RBI policies this year.

What is the SBI Patrons Fixed Deposit Scheme?

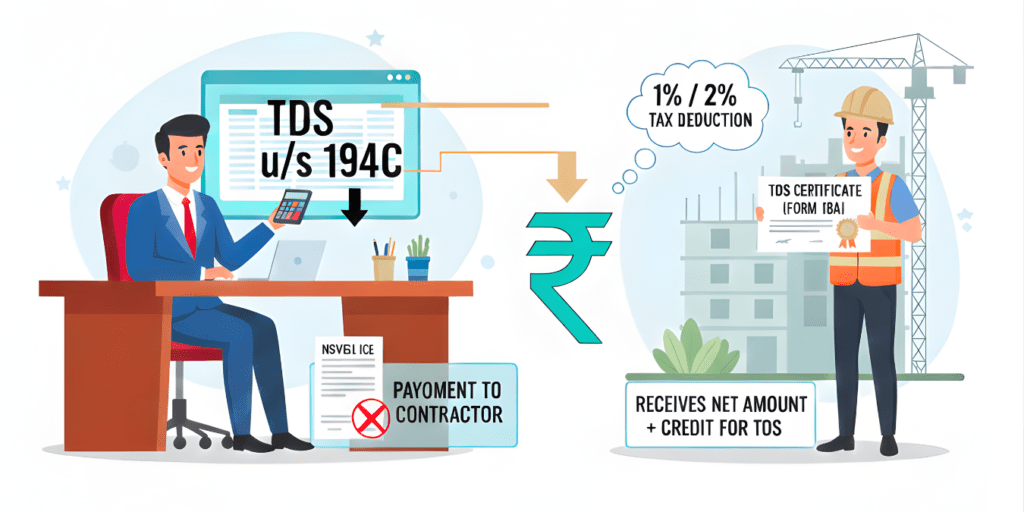

SBI Patrons is a unique fixed deposit (FD) product launched specifically for super senior citizens—those aged 80 years or more, as defined in Section 194P of the Income Tax Act 1961. The scheme offers a secret financial advantage: an interest rate that is 10 basis points (0.10%) higher than the regular senior citizen FD rates.

- This small yet powerful boost means super seniors can earn noticeably more compared to standard senior citizen fixed deposits.

- It’s designed to reward the top tier of the senior population with better returns on their safe, fixed investments.

- The scheme applies to fixed deposits of all eligible tenures, offering flexibility with competitive returns.

By adding this specialized product to the portfolio of existing FD options, SBI provides a fresh, smart income-maximizing tool for India’s aging population.

Why this scheme is a shocking trend in 2025 banking

India’s banking landscape is evolving fast with RBI policies affecting interest rates and liquidity in the economy in 2025. Here’s why SBI Patrons FD Scheme stands out:

- RBI’s Monetary Policy Committee (MPC) recently kept key interest rates stable but hinted at limited room for further hikes, creating a “new normal” rate regime.

- Fixed deposits remain one of the safest instruments amid market uncertainties and inflation concerns.

- Super senior citizens face unique income needs and risks, making guaranteed returns with slight boosts a highly sought-after deal.

- SBI, as India’s largest public sector bank, is leading ahead of competitors by introducing this niche offering sooner than others.

This subtle yet smart move lets seniors quickly access better rates without switching banks or taking risks on volatile instruments.

Current SBI FD Rates vs SBI Patrons FD Rates comparison

To understand the “hidden” advantage, here’s a quick snapshot of SBI’s FD interest rates in 2025 and the special Patrons scheme premium over these:

| Tenure | Senior Citizen FD Rate (2025) | SBI Patrons FD Rate (Extra 0.10%) |

| 1 year to < 2 years | 6.75% | 6.85% |

| 2 years to < 3 years | 6.95% | 7.05% |

| 3 years to < 5 years | 6.80% | 6.90% |

| 5 years to 10 years | 7.05% | 7.15% |

Though seemingly modest, this quick 10 bps boost translates into higher compounded interest earnings over tenure, especially for larger deposits frequently made by seniors planning for long-term security.

Who qualifies as a super senior citizen?

Understanding eligibility is essential:

- Resident individuals aged 80 years or above.

- Recognized officially under Section 194P of the Income Tax Act 1961.

- This classification is distinct from the regular senior citizen category (60 years and above).

If you’re a super senior, SBI Patrons FD offers a top hidden upgrade to traditional fixed deposits.

How to open an SBI Patrons Fixed Deposit

Opening this scheme is as quick and easy as regular FDs in SBI:

- You can invest online via SBI’s Net Banking or YONO app if you are an existing account holder.

- Offline deposits can be made at any SBI branch with valid KYC documents.

- Minimum deposit amount and tenure options mirror standard SBI FD norms, with maximum flexibility.

- Interest payout modes (monthly, quarterly, cumulative) are available based on preference.

This ensures quick access to higher returns without complex procedures.

The future of senior citizen investing: Trends powering SBI Patrons success

Several macro trends make this scheme strategically timed for maximum impact:

- A rapidly aging population in India with increasing financial independence.

- Greater digital banking adoption facilitating easy access for seniors.

- Rising healthcare and lifestyle costs driving demand for stable, safe income.

- RBI’s stable rate outlook making fixed deposits an attractive anchor in diversified portfolios.

Industry experts predict growing demand from super seniors for products like SBI Patrons that combine safety with incremental returns.

How much more can you earn?

Consider Mr. Sharma, aged 82, investing ₹10 lakh for 5 years:

- At the regular senior citizen rate of 7.05%, maturity value = approx. ₹14,073,000

- At the SBI Patrons rate of 7.15%, maturity value = approx. ₹14,180,000

- Extra income earned = ₹107,000 more over 5 years, tax-free if under certain conditions

This quick, hidden trick adds real value to senior finances.

RBI’s new 2025 policies boosting senior investor confidence

- RBI’s cautious stance on repo rates keeps fixed deposit rates attractive vs volatile equities.

- Relaxed taxation thresholds for senior citizens on FD interest income (up to ₹1 lakh TDS threshold) offer relief.

- Banks increasingly focusing on senior-centric financial literacy and specialized products.

SBI Patrons fits perfectly into this ecosystem of senior-focused financial solutions designed for reliability and ease.

Quick smart tips for maximizing your income with SBI Patrons FD

- Opt for longer tenures (5-10 years) to benefit from compounding and highest interest slabs.

- Use the cumulative interest payout option for reinvestment gains.

- Combine with senior citizen savings and health insurance schemes for holistic financial planning.

- Monitor SBI’s periodic interest rate announcements to time fresh deposits during rate peaks.

- Keep track of RBI updates affecting deposit rates and plan accordingly.

SBI Patrons vs Alternatives: Why SBI wins for super seniors

| Feature | SBI Patrons FD | Other Bank Senior Citizen FDs |

| Extra interest rate | +0.10% over senior citizen FD | Mostly standard rates |

| Credibility | Backed by India’s largest PSU | Varies and less trusted sometimes |

| Accessibility | Extensive branch + digital access | Limited digital options for super seniors in some banks |

| Flexibility | Multiple tenures, payout modes | Often restrictive or lump sum only |

SBI Patrons FD emerges as India’s top choice for super senior investors.

Top Takeaways for Indian Seniors

- SBI Patrons FD offers 10 bps extra interest for 80+ seniors, boosting FD returns.

- RBI policies in 2025 favor stable fixed deposit rates — safe haven for seniors.

- Easy application via SBI Net Banking, YONO, or branch.

- Longer tenor = more compounding benefits; monthly/quarterly payouts available.

- Compare SBI rates widely — Patrons scheme delivers a secret edge others don’t.

- Use alongside senior tax benefits and healthcare plans for best overall security.

Final Thought: Could India’s Seniors Soon Command Even More Banking Innovations?

With SBI setting the pace in super senior citizen banking, a fresh wave of innovations is on the horizon. Could we see exclusive digital-first retirement savings platforms? Or government-backed FD guarantee schemes with higher returns? The secret financial strategies for India’s aging population are evolving fast—stay tuned as the banking world unveils the next big, smart move in senior citizen wealth protection and income maximization.

This emerging trend signals a future where super seniors not only protect wealth but also grow it smartly, fast, and securely in India’s transforming financial ecosystem.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!