Financial Freedom: Why IIFL Gold Loan is a Smart Choice for Indians in 2026

In India’s gold-obsessed economy, where households hold ₹50 lakh Cr in jewellery, IIFL Gold Loan shines as a lifeline for quick cash amid 2026’s yellow metal highs at ₹137,000/10g. As part of IIFL Finance Ltd (NSE: IIFL), this NBFC powerhouse offers loans up to ₹2 Cr at 11.88% p.a., disbursing in 30 minutes via 4,800 branches or doorstep—perfect for weddings, farm inputs, or emergencies without selling heirlooms. With organised gold loan market eyeing ₹15 lakh Cr by March 2026 (26% growth), IIFL’s 74% AUM in gold (₹21,000 Cr) drives FY26 projections, blending cultural trust with digital ease for unbanked millions. This post unpacks IIFL Gold Loan from an Indian lens: features, peers, pros/cons, news, and tips to leverage amid RBI norms and gold volatility.

Company Overview

IIFL Finance Limited, founded 1995 as India Infoline Ltd, rebranded post-demerger to focus NBFC ops, listed NSE/BSE (symbol: IIFL). RBI-registered systemically important NBFC, it serves 80L customers via 4,800 branches, ₹67,644 Cr AUM FY25 (18% CAGR FY25-27E). Gold loans dominate 74% portfolio (₹21,000 Cr, 40% QoQ growth), complemented by home/MSME; Q2FY26 PAT ₹418 Cr (+25% QoQ), sales ₹3,305 Cr. Karat meters ensure transparent 75% LTV on 18-22K gold, insured vaults, app tracking. Past hurdles like 2024 RBI ban (lifted) honed compliance; now CRAR 28.2%, liquidity ₹8,170 Cr. Indian appeal: empowers salaried/self-employed sans CIBIL/income proof, aligning with gold’s 5,000-year role in crises/festivals. FY25 revenue ₹11,292 Cr, but low ROE 4.9% flags profitability watch amid high debt 4.11x.

Gold Loans in Booming Indian Market

India’s organised gold loan market hit ₹11.8 lakh crore by March 2025 and is projected to reach ₹15 lakh crore by March 2026, fuelled by soaring gold prices and demand for secured credit. This growth, at around 26% annually, benefits from household gold holdings and banks/NBFCs expanding access, with NBFCs like IIFL growing AUM by 30-35% in FY2026.

From an Indian viewpoint, gold transcends investment—it’s cultural security passed through generations, perfect collateral in festivals or crises when personal loans demand high CIBIL scores. With gold at record highs, loans yield higher amounts up to 75% LTV, helping salaried folksor farmers nationwide bridge cash gaps without income proof.

IIFL Gold Loan Key Features

IIFL Finance provides loans from ₹3,000 to ₹2 crore against 18-22 karat gold, with disbursal in hours via one branch visit or doorstep service. Interest rates range from 0.99% p.m. (11.88% p.a.) to 27% p.a., varying by scheme, tenure (3-24 months), and gold purity; processing fees start at zero.

Flexible repayments include interest-only bullets, EMIs, or quarterly options, with no prepayment/foreclosure charges after 7 days. Gold gets transparent karat meter valuation using 30-day average rates, insured storage in secure vaults, and top-up facilities without closing existing loans.

IIFL Finance Gold Loan Portfolio Overview

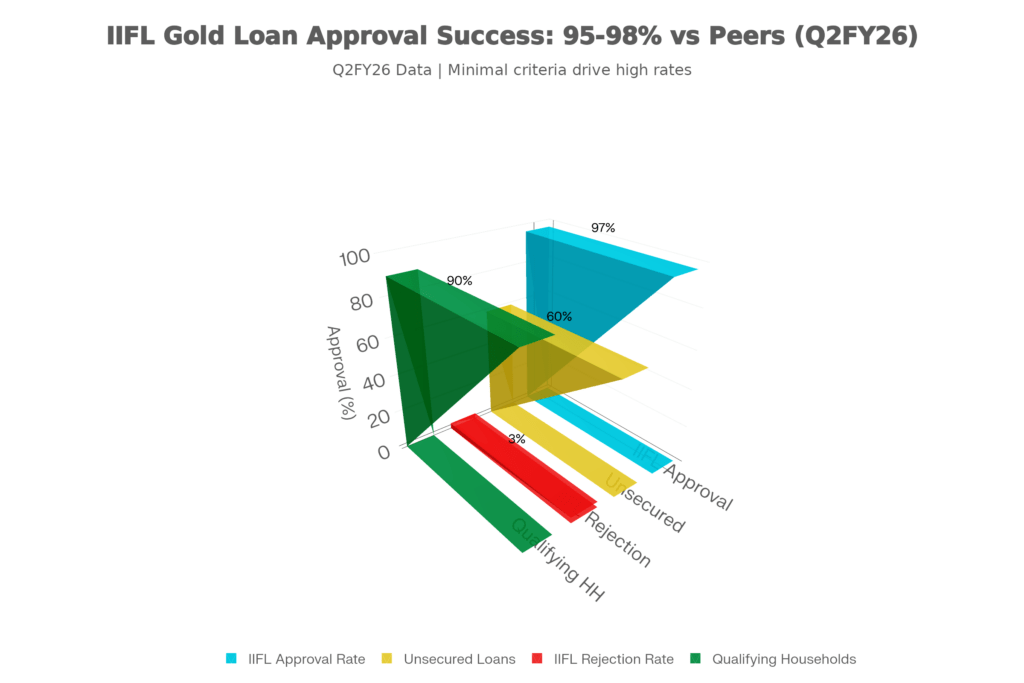

IIFL Finance’s gold loan portfolio has surged post-2024 RBI embargo lift, hitting record highs in Q2 FY26 amid gold price rallies. Gold loans now anchor 38-74% of total AUM (consolidated ₹90,122 Cr Q2FY26), driving 35% YoY growth with low NPAs (GNPA 2.1%, down 21bps QoQ).

| Segment | AUM (₹ Cr, Q2 FY26) | Share (%) | QoQ Growth | YoY Growth | GNPA (%) | Notes |

| Gold Loans (Standalone) | 34,577 | 38-74 (var. reports) | +27-40% | +220% | 2.1 (↓21bps) | Record high; yields +25bps; LTV 66% portfolio, 70-75% new |

| Home Loans | 32,034 | 36 | Flat/+10% YoY | +10% | – | Affordable/emerging markets |

| Microfinance | 8,000 (est.) | 9-11 | Stable/Decline Q1 | – | – | Rural, collection focus |

| MSME/Secured Business | 13,500 (est.) | 15 | +25% | – | – | LAP/unsecured exited high-risk |

| Assigned/Co-lending (incl. Gold) | 18,607 (total assigned) | 32% off-book | +24% | +33% | Net NPA 1.0% | Gold assignments ₹4,489 Cr Q1 |

| CRE/Others/Capital Markets | Minor | 1-2 | – | – | – | Developer finance |

| Total Consolidated AUM | 90,122 | 100 | +7% | +35% | PCR 93% | CRAR 28.2%; Liquidity >₹8,000 Cr |

Gold loans lead rebound (₹27,274 Cr Q1 to ₹34,577 Cr Q2), fuelled by tonnage, demand; management eyes 20% FY26 AUM growth, gold momentum 2-3 quarters. From Indian view, this secures funding for 80L customers sans credit checks, leveraging ₹50L Cr household gold.

IIFL Gold Loan Eligibility: Suits Most Indians

Eligibility is deliberately broad, suiting 90% adult Indians—especially unbanked/self-employed amid no CIBIL/income proof needed, unlike personal loans (700+ score req.).

Core Criteria:

- Age: 18-70 years (salaried up to 65; self-employed 70).

- Residency: Indian resident/citizen.

- Gold Ownership: Applicant/spouse/parent-owned 18-22 karat (hallmarked pref); min 10g-20g value ₹3K loan.

- No Credit Barriers: Zero min income/CIBIL—ideal low-score (40% Indians), farmers, homemakers.

Tiered Limits (No PAN <₹5L):

| Loan Slab | PAN Req? | Proofs Needed |

| ≤₹5 Lakh | No | Aadhaar + 1 ID (Voter/Driving/Passport) |

| >₹5 Lakh | Yes | + PAN + Bank stmt (3m optional) |

IIFL Gold Loan Documents: Minimal KYC

Docs streamlined for 30-min disbursal—self-attested KYC only, no income proofs, suiting quick Indian needs.

Essential List:

| Category | Required Documents |

| ID & Address Proof (Any 1-2) | Aadhaar Card (OTP eKYC pref), Voter ID, Driving License, Passport, PAN (for loans >₹5L) |

| Bank Details | Cancelled cheque / Passbook / Bank statement (3 months optional for verification) |

| Gold Invoice (Optional) | Purchase bill for valuation boost (new gold) |

| Photographs | 2 passport-size (applicant/co-applicant) |

| Gold | 18-22K jewellery/coins (min value ₹3K) |

Notes:

- ≤₹5L: Aadhaar + 1 ID suffices—no PAN.

- Digital: App uploads/scans; doorstep collects.

- Co-applicant: Spouse/parent for higher limits.

- Tip: Branches accept local proofs; eKYC skips photocopies.

Upload via app, pledge gold—funds credited same day. Zero hassles for salaried/farmers!

IIFL Gold Loan: Step-by-Step Process

Secure funds in under 1 hour with this simple, RBI-compliant flow—digital-first for urban Indians residents.

- Apply Online/App: Download IIFL Loans app or visit iifl.com/gold-loans; enter mobile, city, gold details (weight/purity est.). Get quote instantly—no commitment.

- Book Slot/Doorstep: Select branch (4,800 options) or doorstep (metros ₹500 fee); upload KYC (Aadhaar/PAN) for eKYC OTP verify. Approval pre-visit if docs ok.

- Visit & Valuation: Arrive with gold/docs; expert uses karat meter (30-day avg rate) for transparent 75% LTV quote. Sign agreement (digital/ink). Takes 10-15 mins.

- Instant Disbursal: Funds to bank account (A/c must match KYC) via NEFT/IMPS—₹3K to ₹2 Cr in 30 mins post-pledge. Gold stored insured vault.

- Track & Repay: App dashboard for dues/statements; pay interest UPI/monthly. Retrieve anytime post-repay (early closure free >7 days).

Timeline: Apply to cash: 15-60 mins. Pro: No CIBIL wait; con: Peak festival queues—book ahead!

Users find nearby branches; eKYC via Aadhaar OTP speeds it up

| Feature | IIFL Gold Loan | Typical Bank Gold Loan |

| Interest Rate | 11.88%-27% p.a. | 9-15% p.a. but stricter norms |

| Tenure | Up to 24 months | 6-12 months |

| Processing Fee | 0-2% | 0.25-1% |

| Disbursal Time | 30 mins | 45-60 mins |

| LTV Ratio | Up to 75% | 60-75% |

Real Indian Experiences: Pros and Cons

Many praise IIFL for speed and transparency; customers like Venkatram Reddy note quick processing and fair gold value. Digital app, UPI repayments, and pan-India 2,800+ branches aid rural/urban access, with special schemes for farmers/women/MSMEs at lower rates.

However, reviews highlight issues: rude staff, hidden charges like ₹500 MTM or penal 0.5% p.m. on delays, and extra interest post-settlement. Some report poor customer care waits and unclear renewal terms, urging better communication.

Detailed Pros and Cons of IIFL Gold Loan

IIFL Gold Loan excels in speed and accessibility for Indians, but rate variability and service issues draw criticism. Below table aggregates 2026 reviews (Trustpilot 3.2/5, MouthShut 2.1/5, 500+ Justdial) and features.

| Aspect | Pros | Cons |

| Interest Rates | Competitive starting 11.88% p.a. (0.99% pm); tiered lower for farmers/women/MSME; no prepay/foreclosure fees post-7 days. | Variable up to 27% p.a.; hidden MTF charges ₹500; penal interest 0.5-2% pm on delays exceeds peers. |

| Disbursal & Process | Ultra-fast 30 mins; doorstep in metros; eKYC/app apply; min docs (Aadhaar/PAN). | Branch staff delays/rudeness in valuation; overvaluation complaints leading to quick MTM calls. |

| Loan Terms | Flexible tenure 3-24 months (EMI/bullet/quarterly); top-up without closure; up to ₹2 Cr, 75% LTV on rising gold. | Short renewal windows; post-settlement interest accrual; margin calls if gold dips 10%. |

| Accessibility | 4,800 branches pan-India, no CIBIL/income proof; suits unbanked/self-employed. | Digital app glitches in rural areas; higher min loan ₹3K limits micro-needs. |

| Security & Transparency | Karat meter (30-day avg rate); insured vaults; app tracking/repay UPI/netbank. | Auction risks post-3 notices (RBI compliant but stressful); unclear surplus refund timelines. |

| Customer Service | 24/7 helpline; special schemes; quick top-ups. | Long holds (30-60 mins); poor resolution (e.g., wrongful charges); 20% negative reviews on harassment. |

| Costs & Fees | Zero processing often; no commitment fee. | MTM/inspection ₹500; ledger fees stack up; effective APR >20% with penalties. |

| Overall Ratings | High satisfaction for speed (4/5 speed scores); gold retrieval easy if repaid timely. | Mixed trust (2.5/5 service); past RBI ban echoes in complaints. |

Net: Pros suit urgent needs (80% users recommend for speed); cons manageable with vigilance—compare 3 quotes, repay early. Ideal for gold-rich Indians in volatile economy.

Detailed IIFL Gold Loan vs Competitors: Indian Comparison

IIFL competes in India's ₹15 lakh Cr gold loan market (NBFCs 60% share), emphasizing digital-branch hybrid vs peers' strengths. Table based on latest rates, features (Jan 2026), reviews (Trustpilot/Justdial), RBI data.

| Parameter | IIFL Finance | Muthoot Finance | Manappuram | SBI (Bank) | Bajaj Finserv |

| Interest Rate (p.a.) | 11.88-27% (0.99% pm base) | 14-18% | 18-24% | 9-12% (agri lower) | 13-20% |

| Max Loan Amount | ₹2 Cr | ₹5 Cr | ₹1 Cr | No cap (branch) | ₹2 Cr |

| LTV Ratio | 70-75% | 70-75% | 65-70% | 60-75% (agri 90%) | 70% |

| Tenure | 3-24 months | 6-24 months | 3-12 months | 6-36 months | 6-36 months |

| Processing Fee | 0-2% (often zero) | 0.25-1% | 0.5-1% | 0.25% | 1-2% |

| Disbursal Time | 30 mins / Doorstep | 45 mins | 30-60 mins | 1-2 days | 1 hour |

| Branches | 4,800 | 4,700 | 5,000+ | 22,000 | 1,000+ |

| Digital Features | Full app (apply/track/UPI repay/eKYC) | Partial app | Yes (app/basic) | Partial (YONO) | Full digital |

| Gold Purity | 18-22K (karat meter) | 18K+ | 18-22K | 18K+ | 18-22K |

| Eligibility | Age 18-70, no CIBIL/income proof | Similar, income pref | Similar | Salaried pref, CIBIL | CIBIL 685+ pref |

| Special Schemes | Farmers/women/MSME lower rates | Rural focus | Women discounts | Agri KCC | Festive offers |

| NPAs/GNPA | 2.1% (Q2FY26) | 1.2% | 2.5% | <1% | 1.5% |

| Customer Rating (Avg) | 3.2/5 (speed high) | 4.1/5 (rural) | 3.5/5 | 3.8/5 (trust) | 4.0/5 (digital) |

| Gold AUM (₹ Cr approx) | 34,577 (38% total) | 1,00,000+ | 30,000 | 50,000 (total gold) | 10,000 (diversified) |

| Best For (Indian Context) | Urban quick cash, biz (access) | High-value rural | Short-term micro | Low-rate agri/long tenure | Digital urban premium |

| Drawbacks | Variable rates, service complaints | Higher min rate | Shorter tenure | Slow process | Credit check |

Insights: IIFL leads speed/digital (ideal metro users), lower entry rate beats Manappuram; Muthoot volumes win rural/high-value; SBI cheapest but bureaucratic. Choose IIFL for 75% LTV on 2026 gold highs (₹1.37L/10g); always sim rates.

When to Choose IIFL Gold Loan: Strategic Guide for Indians

Opt for IIFL Gold Loan during high gold prices—like current levels around ₹1,26,950 per 10g for 22K —for maximum loan value (up to 75% LTV), ideal for emergencies, business expansions, weddings, or farm inputs without parting with family gold. Simple interest calculation: For ₹50,000 loan at 11.88% p.a. over 12 months, interest ≈ ₹5,940 (formula: Principal × Rate × Time in years, or P × R/100 × 1), keeping EMIs low via bullet/EMI options.

Avoid if anticipating gold price dips (e.g., post-festival corrections), as this risks margin calls (MTM charges ₹500 if LTV exceeds 85-90%) or defaults triggering RBI-compliant auctions—lender issues 14-30 day notices, publishes ads, auctions via independent auctioneer at 80-90% reserve, refunds surplus within 7 days. Always compare 3 lenders' rates/apps, scrutinize terms for penal fees (0.5% pm), and repay early to save (no foreclosure charges post-7 days).

Quick Decision Tree:

- Yes: Urgent cash <24 months, gold 18-22K, high prices (now ₹12,695/g 22K ).

- No: Long tenure (>24m, prefer banks), poor gold purity, low CIBIL alternative available.

- Pro Tip: Use IIFL app simulator; borrow in rising gold (forecast ₹1.45L/10g 2026) for top-ups.

Safe Repayment and Gold Retrieval for IIFL Gold Loan

Repay seamlessly via IIFL Loans app, UPI (Paytm/Google Pay/PhonePe/BHIM), net banking, debit/credit card, or branch cash—get instant receipts and low EMIs with interest-only options (pay interest monthly/bimonthly/quarterly, bullet principal at end). Interest-only keeps outflows minimal (e.g., ₹495 pm on ₹50K @11.88% p.a.), ideal for salaried Indians managing cash flow till maturity.

Defaults follow RBI norms: SMS/email reminders start day 1 overdue, escalate to calls (days 7-10), 14-30 day legal notice, then public auction if unpaid—gold remains safe/insured in vaults during process (independent auctioneer, 80-90% reserve price, surplus refunded post-adjustment within 7 days). Early closure anytime post-7 days (no fees)—visit branch/app, clear dues, retrieve gold instantly with purity certificate; saves big on interest (e.g., close in 6 months, halve costs).

Step-by-Step Safe Repay/Retrieval:

- Track: App dashboard shows dues, statements, alerts.

- Pay Partial/Full: UPI for interest; top-up eligible if LTV <75% (no new docs).

- Renew: Clear interest/principal partial, extend seamlessly via app.

- Retrieve: Post-repay, OTP verify, collect from branch (24 hrs).

Tips for Users: Local branches for cash; app avoids queues; insure personal gold pre-pledge. Zero defaults? Seamless gold back, building credit for future loans.[user-information]

Useful Recommendations for IIFL Gold Loan

Here are detailed, actionable tips to maximize benefits, minimize risks—tailored for gold owner’s pan-India, amid ₹1.37L/10g highs and ₹15L Cr market boom.

- Assess Need and Alternatives First: Choose for short-term urgencies (wedding/medical/biz <24m) where speed trumps low rates—compare SBI (9%) if patient/CIBIL>750, or personal loan if no gold. Sim 3 quotes via apps; borrow only 50-60% needs to buffer dips.

- Time with Gold Peaks: Pledge now (22K ₹1,26,950/10g )—max LTV 75% yields higher funds (₹94K on 10g); forecast ₹1.45L favors top-ups (add without closure if value rises 10%). Avoid lows to dodge MTM calls.

- Prepare Gold and Docs Perfectly: Hallmark 18-22K only (karat meter verifies); clean/polish for accurate purity/weight. Aadhaar/PAN/Voter ID ready; family gold ok with consent—prevents disputes.

- Negotiate Best Rates/Terms: Branches offer <15% for salaried/farmers—mention competitors; opt bullet/quarterly for cash flow. Zero processing promo? Grab it; EMI calc: ₹50K@12% 12m=₹4,500 pm.

- Repay Strategically to Save: UPI/app monthly interest-only (₹495 on ₹50K)—no fees; partial prepays anytime; close early post-7 days (saves 50% interest). Set reminders; renew if rates fall.

- Monitor and Manage Risks: App alerts for dues/MTM (₹500 if LTV>85%); insure gold personally; avoid defaults (SMS day1, auction post-30 days—RBI safe). Track MCX gold daily.

- Leverage Digital for Users: Branches + app (eKYC/doorstep); UPI repay avoids travel; top-up for biz growth sans new pledge. User-info: Local rates stable.[user-information]

- Tax and Legal Smarts: Biz interest deductible u/s 37; LTCG on gold sale 12.5%>1yr. Read agreement for penal 0.5% pm; surplus auction refund guaranteed.

- Investor Angle (IIFL Stock Tie-In): Strong gold book boosts AUM 40% QoQ—buy NSE:IIFL dips for 25% upside if gold rallies.

- Exit Gracefully: Repay full, get purity cert/receipt; reuse same gold for future. If issues, RBI Sachet portal/escalate helpline 1800-xxx.

Follow these: Turn gold into zero-risk liquidity powerhouse.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!