Wondering what percentage credit card companies accept in judgment settlements in India? Typically, they agree to 40-60% of the outstanding amount, depending on negotiations, financial hardship, and legal factors. Learn how to negotiate effectively and settle credit card debts for less. Get expert insights on settlement strategies today!

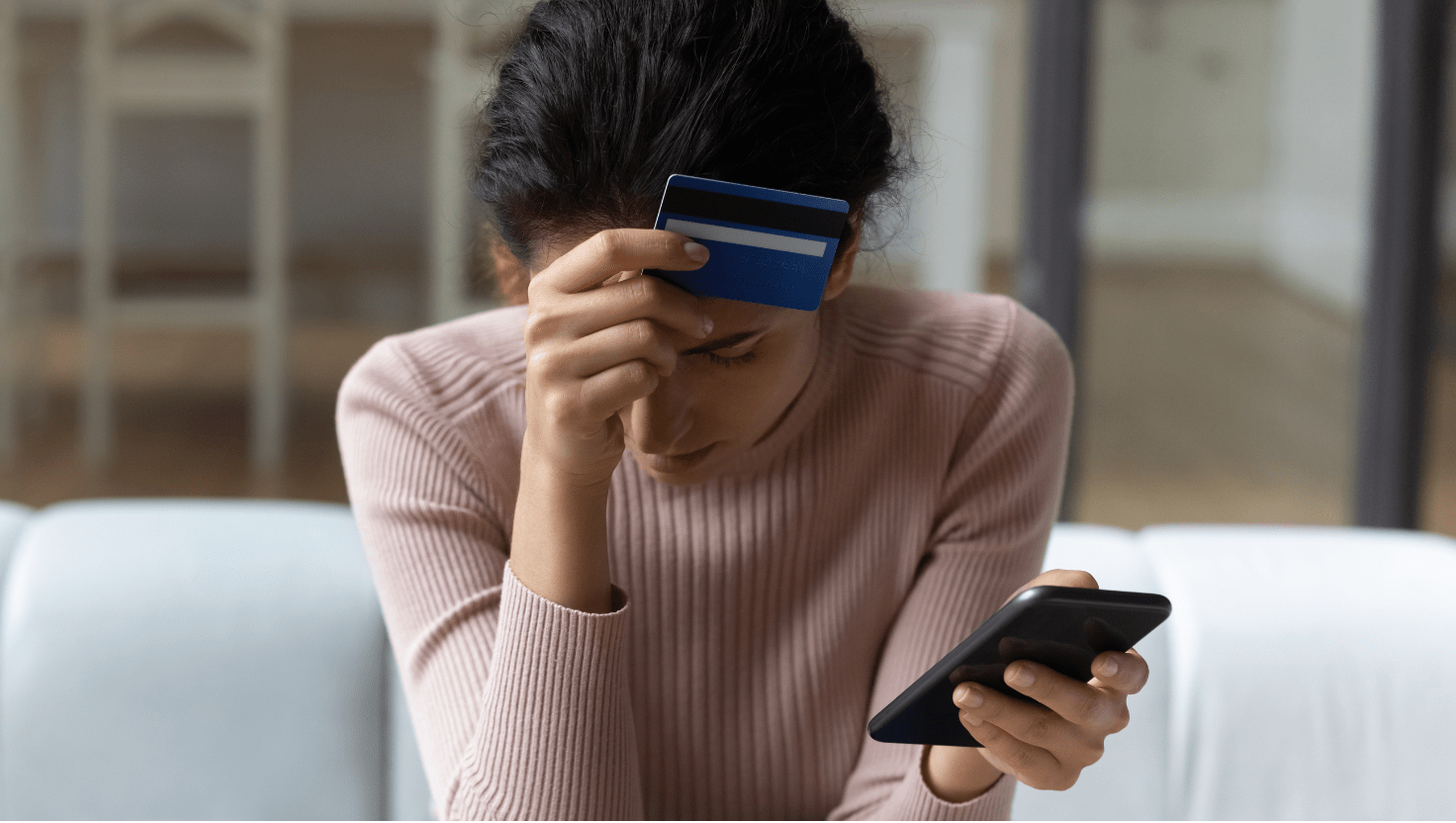

Credit card debt can become overwhelming, especially in a fast-paced economy like India, where credit usage has surged by 20% over the past five years, according to PWC. When cardholders face financial hardship and cannot repay their dues, they may consider a credit card debt settlement as a viable option. But what percentage do credit card companies typically accept in judgment settlements in India, and what factors influence this process? This comprehensive guide explores the intricacies of credit card settlements, leveraging the latest data to provide actionable insights for Indian consumers. Whether you’re struggling with mounting credit card debt or exploring debt resolution options, this blog post will equip you with the knowledge to navigate the settlement process effectively.

Understanding Credit Card Debt Settlement in India

A credit card settlement is a negotiated agreement between a cardholder and the credit card issuer to pay a reduced lump-sum amount to clear the outstanding debt. This process is often pursued when a cardholder faces financial difficulties, such as job loss, medical emergencies, or excessive debt, making it impossible to meet regular payment obligations. In India, credit card companies may agree to settle for a portion of the outstanding balance rather than risk receiving no payment if the debt is written off as bad debt.

The settlement percentage refers to the portion of the outstanding balance that the issuer agrees to accept as full payment. For example, if you owe ₹1,00,000 and the issuer agrees to a 50% settlement, you would pay ₹50,000 to clear the debt entirely. However, the exact percentage varies based on several factors, including the cardholder’s financial situation, the age of the debt, and the issuer’s policies.

Typical Settlement Percentages in India

Based on the latest available data, credit card companies in India typically accept 30% to 60% of the outstanding balance in judgment settlements. This range is influenced by the cardholder’s financial hardship, negotiation skills, and the creditor’s assessment of recovery potential. In some cases, settlements can go as low as 15% to 25% when negotiated by experienced debt settlement agencies, such as National Debt Relief, or as high as 70% to 80% for debts that are relatively recent or when the cardholder has some repayment capacity.

For instance, Bajaj Finserv notes that settlement percentages typically range from 30% to 60%, contingent on the debtor’s ability to pay and the duration of delinquency. Similarly, WalletHub suggests that settlements can fluctuate between 30% and 80%, with older debts (delinquent for over five months) more likely to settle at lower percentages. In rare cases, especially for debts over a year old, settlements as low as 10% to 50% of the outstanding amount may be negotiated, particularly if the debt has been sold to a collection agency.

Factors Influencing Settlement Percentages

Several factors determine the percentage a credit card company will accept in a judgment settlement:

- Financial Hardship: Creditors are more likely to settle for a lower percentage if you can demonstrate genuine financial distress, such as unemployment, medical bills, or other emergencies. Providing supporting documents, like income statements or medical records, strengthens your case.

- Age of the Debt: Older debts, especially those delinquent for over 90 days or sold to collection agencies, are more likely to settle for lower percentages (30% to 50%). Creditors may view these debts as less recoverable, making them more open to negotiation.

- Lump-Sum Payment Capability: Offering a lump-sum payment rather than installments can lead to a lower settlement percentage, as issuers prefer immediate cash flow. For example, a cardholder owing ₹50,000 might settle for ₹15,000 (30%) if they can pay upfront.

- Negotiation Skills: Effective negotiation, whether conducted directly or through a debt settlement agency, can significantly reduce the settlement amount. Persistence, clear communication, and a realistic offer (starting at 60% or less) can yield better results.

- Creditor’s Policies: Each credit card issuer, such as HDFC Bank, Axis Bank, or Kotak Mahindra Bank, has its own settlement policies. Some may be more lenient, while others may demand higher percentages based on their risk assessment.

- Debt Collection Status: If the debt has been transferred to a collection agency, the settlement percentage may be lower, as agencies often purchase debts at a discount and are willing to accept less to recover their investment.

The Credit Card Settlement Process in India

The process of negotiating a credit card debt settlement in India involves several steps, which may vary slightly depending on the issuer. Here’s a step-by-step guide to help you navigate the process:

- Assess Your Financial Situation: Before approaching your creditor, evaluate your outstanding balance, income, and ability to pay. Determine a realistic lump-sum amount you can offer for settlement.

- Contact the Credit Card Issuer: Reach out to your credit card company or bank (e.g., HDFC Bank, ICICI Bank) and explain your inability to repay the full amount due to financial hardship. Be honest and provide a clear rationale.

- Submit a Formal Request: Write a credit card settlement letter detailing your financial difficulties and proposing a settlement amount (e.g., 50% of the outstanding balance). Include supporting documents, such as proof of income or medical bills, to strengthen your case.

- Negotiate the Terms: The issuer may accept, reject, or counter your offer. Be prepared for multiple rounds of negotiation. Start with a lower offer (e.g., 60% or less) to leave room for compromise.

- Finalize the Agreement: Once an agreement is reached, ensure it is documented in writing to avoid future disputes. The agreement should specify the settlement amount, payment deadline, and confirmation that the debt will be considered fully settled.

- Make the Payment: Pay the agreed-upon lump-sum amount by the specified deadline. Retain proof of payment, such as a receipt or bank confirmation.

- Confirm Settlement and Monitor Credit Report: After payment, request a letter from the issuer confirming that the debt is settled and the account is closed. Check your credit report (via CIBIL or other bureaus) to ensure the settlement is accurately reflected.

Impact of Credit Card Settlements on Your Credit Score

While a credit card settlement can provide immediate financial relief, it comes with significant drawbacks, particularly its impact on your CIBIL score. In India, a settlement is recorded as a negative mark on your credit report and can remain for up to seven years. This can lower your credit score by 100 to 160 points or more, depending on the extent of delinquency and missed payments leading up to the settlement.

A lower CIBIL score can make it challenging to secure future credit, such as loans or new credit cards, and may result in higher interest rates if approved. However, you can rebuild your credit score over time by:

- Making timely payments on other debts.

- Keeping credit utilization low.

- Avoiding new credit applications for at least 6–12 months post-settlement.

- Monitoring your credit report regularly for accuracy.

Alternatives to Credit Card Settlements

Before opting for a settlement, consider these alternatives to manage your credit card debt without severely impacting your credit score:

- Balance Transfer: Transfer your high-interest credit card balance to a card with a lower APR or a 0% introductory APR. This allows you to pay off the principal without accruing additional interest during the promotional period.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate, simplifying payments and reducing financial strain.

- Debt Management Plan (DMP): Work with a credit counseling agency to create a structured repayment plan with reduced interest rates or waived fees.

- Personal Loan: Use a personal loan to clear credit card dues, especially if the loan has a lower interest rate than the credit card’s 30–40% APR.

- Liquidating Assets: Redeem long-term investments (e.g., fixed deposits, mutual funds) or pledge collateral (e.g., gold) to repay the debt gradually.

Tax Implications of Credit Card Settlements

In India, the forgiven portion of a settled debt may be considered taxable income under the Income Tax Act. For example, if you owe ₹1,00,000 and settle for ₹60,000, the remaining ₹40,000 may be treated as income, subject to taxation. Consult a tax professional to understand the potential tax liability and plan accordingly.

Tips for Negotiating a Better Settlement

To maximize your chances of securing a lower settlement percentage:

- Demonstrate Financial Hardship: Provide evidence, such as bank statements or medical bills, to prove your inability to pay the full amount.

- Offer a Lump-Sum Payment: Issuers are more likely to accept a lower percentage if you can pay immediately.

- Be Persistent and Courteous: Maintain clear and respectful communication during negotiations.

- Consider Professional Help: If you’re unsure about negotiating, reputable debt settlement agencies like Settle My Loan (SML) can assist, though they may charge fees of 10–15% of the settled amount.

- Get Everything in Writing: Ensure all terms are documented to avoid future disputes.

Should You Opt for a Credit Card Settlement?

Credit card settlement is a last resort for those facing unmanageable debt and financial hardship. While it can provide immediate relief, the long-term impact on your credit score and future borrowing ability should not be underestimated. Before proceeding, weigh the pros and cons:

Pros:

- Reduces outstanding debt significantly.

- Avoids bankruptcy or legal action.

- Provides financial relief in times of hardship.

Cons:

- Negatively impacts your CIBIL score for up to seven years.

- May result in tax liabilities on the forgiven amount.

- Closes the credit card account, limiting future credit access.

Final thought

In India, credit card companies typically accept 30% to 60% of the outstanding balance in judgment settlements, with some cases settling as low as 15% or as high as 80%, depending on the circumstances. The settlement process requires careful planning, effective negotiation, and an understanding of its impact on your financial future. By exploring alternatives like balance transfers or debt consolidation and seeking professional guidance, you can make informed decisions to manage your credit card debt effectively. Always prioritize timely payments and responsible credit usage to avoid the need for settlements in the future.

For more information on managing credit card debt or exploring settlement options, consult your credit card issuer or a trusted financial advisor. Take control of your finances today to secure a brighter financial future.