The Central Government increasing the minimum wage, effective from October 1:

- Effective Date: The new minimum wage rates will come into effect from October 1, 2024.

- Revision Details: The increase is a result of the revision in the Variable Dearness Allowance (VDA), aimed at helping workers cope with the rising cost of living.

- Beneficiaries: Workers in various sectors, including construction, loading and unloading, watch and ward, sweeping, cleaning, housekeeping, mining, and agriculture, will benefit from the revised wage rates.

- Skill-Based Categorization: The minimum wage rates are categorized based on skill levels—unskilled, semi-skilled, skilled, and highly skilled.

- Geographical Classification: The wages are also classified by geographical areas—A, B, and C.

- New Wage Rates:

- Area A:

- Unskilled: ₹783/day (₹20,358/month)

- Semi-skilled: ₹868/day (₹22,568/month)

- Skilled: ₹954/day (₹24,804/month)

- Highly skilled: ₹1,035/day (₹26,910/month).

- Area A:

- Frequency of Revision: The Central Government revises the VDA twice a year, effective from April 1 and October 1, based on the six-month average increase in the Consumer Price Index for industrial workers.

- Previous Revision: The last revision was done in April 2024.

- Support for Unorganized Sector: This adjustment is particularly aimed at supporting workers in the unorganized sector, ensuring fair compensation amidst rising living costs.

- Government’s Commitment: This move underscores the government’s commitment to supporting workers and ensuring they receive fair wages in light of inflation.

-

Nothing Phone 4a and 4a Pro: Snapdragon 7 Gen 4, Gaming Benchmarks, Connectivity Features and 6 Years Android Updates for India

Nothing’s latest Phone 4a and 4a Pro, launched on March 5, 2026, bring fresh vibes to India’s competitive

-

War Premium, Sanctions, and Discounted Crude: Why India’s Rush Back to Russian Oil Is More Complex Than You Think

India had almost ditched Russian oil — until Iran’s war changed everything overnight. Now Washington is quietly handing

-

BoB Raises ₹10,000 Crore for Green Infrastructure — Which Projects Will Get Funded and Who Really Benefits?

BoB’s massive ₹10,000 crore green bond bonanza: First-ever in India! But wait—which secret solar farms, wind giants, or

-

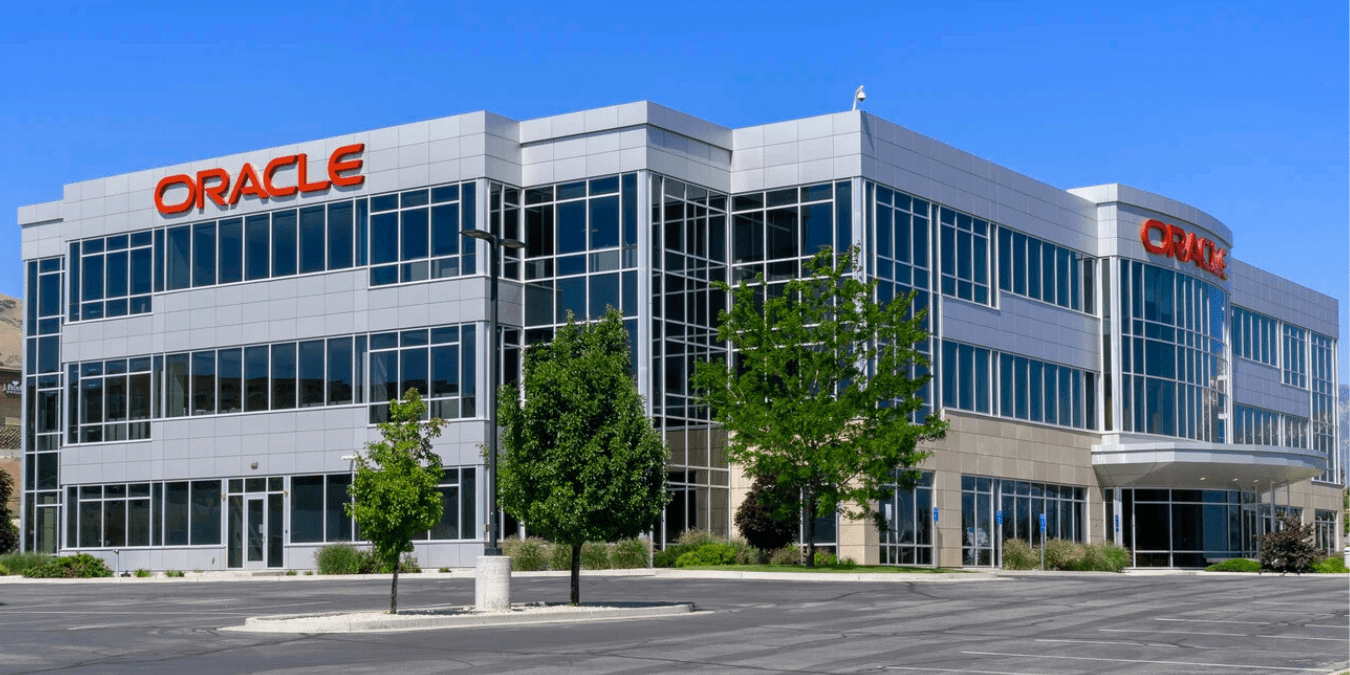

Oracle Shocks the Tech World Again — Is Larry Ellison’s AI Pivot Costing 30,000 Their Jobs?

Oracle is planning to fire up to 30,000 employees — its biggest layoff ever. But here’s the twist:

-

Diesel Prices Surge in India: Hormuz Halt Puts Spotlight on Reserves and Russian Supplies

Key Takeaway Iran’s declaration that the Strait of Hormuz is “closed” has sent global crude prices sharply higher,

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!