Imagine this: an unexpected medical bill lands in your lap, or a dream opportunity knocks, but your bank account is running on fumes. You apply for a personal loan, only to be met with rejection because your CIBIL score is below 600. Sounds like a dead end, right? Not in 2025! The financial landscape in India has evolved, and even with a low CIBIL score, you can still access funds through innovative loan providers. But how? Which lenders are breaking the mold to help you? And what secrets can you uncover to secure a loan despite a poor credit score? Buckle up as we dive into the world of low CIBIL score loans, revealing the top providers, their offerings, and insider tips to boost your approval chances—all while keeping you hooked with the latest insights.

Why a Low CIBIL Score Isn’t the End of the Road

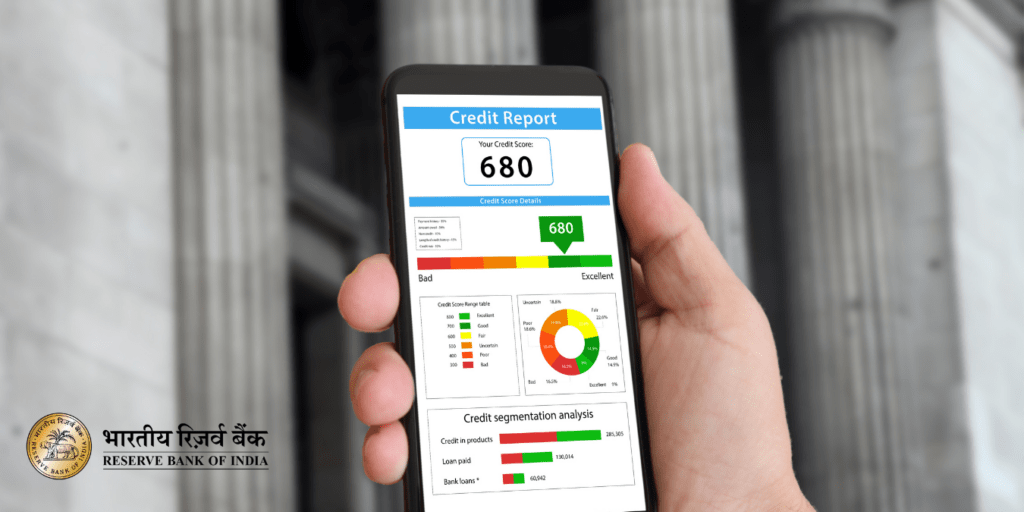

A CIBIL score, ranging from 300 to 900, is your financial report card, reflecting your creditworthiness based on past borrowing and repayment behaviour. A score below 600 is considered poor, often signalling missed payments, high credit utilization, or defaults, making traditional banks hesitant to lend.

Struggling with a CIBIL score under 600? Unlock the secret to securing loans in 2025 with top providers like Shriram Finance, Airtel Flexi Credit, Moneyview, CASHe, KreditBee, and more! These lenders offer instant personal loans with minimal paperwork and rapid approvals, even for bad credit. Discover how to access funds for emergencies or big dreams, navigate high interest rates, and boost your credit score. Dive into this thrilling guide to uncover flexible repayment options and smart tips to transform your financial future. Don’t let a low score hold you back—explore your options now!

According to CIBIL’s latest insights, over 79% of loan approvals go to those with scores above 750, leaving low-score borrowers in a tough spot. But here’s the twist: fintech companies and Non-Banking Financial Companies (NBFCs) are rewriting the rules, offering loans tailored for those with CIBIL scores under 600. These providers use alternative criteria—like income stability, employment history, and digital footprints—to assess your repayment ability, opening doors that banks often slam shut.

So, who are these game-changers? Let’s explore the top 11 loan providers in India for that cater to low CIBIL score borrowers, delivering quick approvals, flexible terms, and competitive rates. Whether you need funds for an emergency, education, or a personal project, these lenders have your back.

Understanding the CIBIL Score and Its Impact

A CIBIL score, generated by TransUnion CIBIL, reflects your creditworthiness based on factors like repayment history, credit utilization, outstanding debts, and credit mix. A score below 600 signals higher risk to lenders, often due to late payments, high credit utilization, or limited credit history. Traditional banks typically require a score above 700 for favourable terms, leaving those with lower scores facing higher interest rates or outright rejections. However, modern loan apps and NBFCs have revolutionized lending by focusing on income, employment stability, and alternative data, making personal loans for low CIBIL scores more accessible than ever.

Why Choose Loan Apps for Low CIBIL Scores?

Loan apps have transformed the financial landscape in India by offering instant personal loans with minimal documentation, quick approvals, and paperless processes. For individuals with a CIBIL score under 600, these platforms provide:

- Flexible Eligibility: Unlike banks, these lenders prioritize income and repayment capacity over credit scores.

- Fast Disbursal: Funds are often credited within hours or minutes.

- No Collateral: Most loans are unsecured, requiring no assets.

- Digital Process: Applications are 100% online, reducing hassle.

- Customized Solutions: Flexible repayment tenures and EMI options cater to diverse financial needs.

Below, we explore the top loan providers in India for CIBIL score under 600

- Shriram Finance: Flexible Personal Loans for Low Scores

Shriram Finance, a leading NBFC, is a beacon of hope for those with CIBIL scores between 600 and 700. Offering personal loans for various needs—medical emergencies, home renovations, or debt consolidation—Shriram Finance stands out with its flexible repayment options. Interest rates can range up to 42% p.a. for low-score borrowers, but their lenient eligibility criteria make approval easier than traditional banks. With a focus on financial inclusion, Shriram Finance evaluates income stability and repayment capacity, ensuring you get the funds you need without excessive red tape. Curious about their process? It’s as simple as submitting minimal documents and getting approval within days.

Key Features:

- Loan Amount: Up to ₹15 lakhs

- Interest Rate: Starting at 12% p.a.

- Tenure: 12 to 60 months

- Eligibility: Salaried or self-employed with stable income

- Benefits: Collateral-based loans for better approval odds, tailored repayment plans

Why Choose Shriram Finance?

Shriram Finance understands that a low CIBIL score doesn’t define your financial potential. Their low CIBIL score personal loans are ideal for debt consolidation, home repairs, or medical expenses. By offering secured loan options, they increase approval chances for those with scores below 600.

- Airtel Flexi Credit: Quick and Lenient Loans

Airtel Flexi Credit, backed by Airtel Finance, is a game-changer for those with a CIBIL score of 600 or lower. Designed for borrowers facing financial hurdles, this platform offers instant personal loans with flexible eligibility criteria. With interest rates starting at competitive levels and funds disbursed within 24 hours, Airtel Flexi Credit ensures you’re never left stranded. Their digital-first approach means minimal paperwork and a seamless application process via the Airtel app. Plus, timely repayments can boost your CIBIL score, paving the way for better loan terms in the future. Ready to explore how Airtel can rescue you from a financial pinch?

Key Features:

- Loan Amount: ₹1,000 to ₹5 lakhs

- Interest Rate: Competitive, starting at 10.25% p.a.

- Tenure: Flexible, up to 36 months

- Eligibility: Minimum income of ₹10,000/month, relaxed credit requirements

Benefits: 24-hour disbursal, no collateral required

Why Choose Airtel Flexi Credit?

Airtel Flexi Credit’s user-friendly app and quick approval process make it ideal for urgent needs like medical bills or travel expenses. Timely repayments can also help improve your CIBIL score, paving the way for better loan terms in the future.

- Moneyview: Accessible Loans Near 600

Moneyview is a fintech favorite for borrowers hovering around the 600 CIBIL score mark. Known for its quick approvals and user-friendly app, Moneyview offers personal loans with interest rates starting at 15% p.a. Their algorithm evaluates alternative data, such as bank statements and income stability, making it easier for low-score borrowers to qualify. Whether you need funds for a wedding or an urgent expense, Moneyview’s transparent fees and flexible tenures (up to 60 months) make it a top choice. Wondering how fast you can get funds? Approvals often happen within hours

Key Features:

- Loan Amount: ₹5,000 to ₹10 lakhs

- Interest Rate: Starting at 16% p.a.

- Tenure: Up to 60 months

- Eligibility: Minimum monthly income of ₹13,500

- Benefits: Paperless process, quick disbursal

Why Choose Moneyview?

Moneyview’s digital platform ensures a seamless application process, with funds disbursed within hours. It’s ideal for those needing quick loans for bad credit to cover education, weddings, or emergencies.

- CASHe: Short-Term Loans with Fast Approval

CASHe is a lifesaver for salaried professionals needing quick cash despite a low CIBIL score. Specializing in short-term loans, CASHe offers amounts ranging from ₹1,000 to ₹4 lakh with interest rates starting at 2.25% per month. Their approval process is lightning-fast, often completed within minutes, thanks to a proprietary Social Loan Quotient (SLQ) that assesses your digital and financial footprint. Minimal documentation and direct bank transfers make CASHe ideal for urgent needs. Want to know the catch? High interest rates for low scores mean timely repayment is crucial to avoid debt traps.

Key Features:

- Loan Amount: ₹1,000 to ₹4 lakhs

- Interest Rate: 2.25% to 2.5% per month

- Tenure: 3 to 18 months

- Eligibility: Minimum income of ₹15,000/month

- Benefits: No collateral, rapid approval

Why Choose CASHe?

CASHe’s focus on short-term loans makes it perfect for small, urgent expenses like medical bills or gadget purchases. Its 100% digital process minimizes paperwork.

- KreditBee: Instant Loans for Low Scores

KreditBee caters to young professionals and self-employed individuals with CIBIL scores as low as 600. Offering personal loans up to ₹5 lakh, KreditBee ensures quick disbursals (often within 10 minutes) and minimal documentation. Interest rates start at 15% p.a., but low-score borrowers may face higher rates. Their app-based platform simplifies the process, requiring only Aadhaar, PAN, and bank details for KYC. Curious if KreditBee is right for you? It’s perfect for those needing fast cash for emergencies or small projects, with flexible tenures up to 24 months.

Key Features:

- Loan Amount: ₹1,000 to ₹5 lakhs

- Interest Rate: 12% to 29.95% p.a.

- Tenure: 3 to 36 months

- Eligibility: Minimum income of ₹10,000/month

- Benefits: 10-minute disbursal, no physical verification

Why Choose KreditBee?

KreditBee’s fast processing and flexible repayment options make it a favorite among young professionals needing quick loans for low CIBIL score. It’s ideal for education, medical, or wedding expenses.

- PaySense: Pre-Approved Loans with Minimal Documents

PaySense is a go-to for salaried and self-employed borrowers with low CIBIL scores. Offering pre-approved loans up to ₹5 lakh, PaySense focuses on income stability over credit scores, ensuring quick approvals with minimal paperwork. Interest rates range from 16% to 36% p.a., depending on your profile. Their digital platform allows you to apply, upload documents, and receive funds within hours. Intrigued? PaySense also offers EMI calculators to help you plan repayments, making it a transparent and borrower-friendly option.

Key Features:

- Loan Amount: ₹5,000 to ₹5 lakhs

- Interest Rate: 16% to 36% p.a.

- Tenure: 3 to 60 months

- Eligibility: Minimum income of ₹18,000/month

- Benefits: No collateral, flexible EMIs

Why Choose PaySense?

PaySense’s reducing balance interest calculation lowers the overall cost as you repay. It’s perfect for personal loans for bad credit for home renovations or debt consolidation.

- NIRA: Small Loans with Competitive Rates

NIRA is a fintech gem for those seeking small loans (₹5,000 to ₹1 lakh) with CIBIL scores under 600. Operating in over 5,000 locations, NIRA offers competitive interest rates starting at 2% per month and disburses funds within 24 hours. Their focus on alternative data—like employment history and bank transactions—makes them accessible to first-time borrowers or those with poor credit. Want to know more? NIRA’s short tenures (up to 12 months) are ideal for managing small, urgent expenses without long-term debt.

Key Features:

- Loan Amount: ₹5,000 to ₹1 lakh

- Interest Rate: Starting at 2% per month

- Tenure: 3 to 12 months

- Eligibility: Minimum income of ₹12,000/month

- Benefits: Paperless process, fast funding

Why Choose NIRA?

NIRA’s small-ticket loans are ideal for short-term needs like paying bills or small purchases. Its competitive rates make it affordable for low-score borrowers.

- LazyPay: Quick Loans with Low Documentation

LazyPay, a popular choice for freelancers and salaried employees, offers instant personal loans with minimal documentation for low CIBIL score borrowers. With interest rates starting at 15% p.a., LazyPay provides loans up to ₹1 lakh, disbursed within days. Their app-based process requires only Aadhaar, PAN, and bank details, making it a hassle-free option. Curious about the downside? Short tenures and high interest rates for low scores mean you’ll need a solid repayment plan.

Key Features:

- Loan Amount: Up to ₹1 lakh

- Interest Rate: 15% to 32% p.a.

- Tenure: Up to 12 months

- Eligibility: Salaried or self-employed with stable income

- Benefits: Instant approvals, pay-later options

Why Choose LazyPay?

LazyPay’s seamless application process and pay-later feature make it perfect for shopping or small expenses. It’s a top choice for bad credit loans India.

- HomeCredit: Fast Loans for Poor Credit

HomeCredit specializes in loans for those with poor or no credit history, making it a top pick for CIBIL scores below 600. Offering personal loans up to ₹5 lakh, HomeCredit focuses on income stability and alternative data, with interest rates starting at 19% p.a. Their quick approval process and minimal documentation make them ideal for urgent needs. Wondering how they stand out? HomeCredit’s customer-centric approach includes flexible repayment options, helping you manage debt effectively.

Key Features:

- Loan Amount: Up to ₹5 lakhs

- Interest Rate: 18% to 56% p.a.

- Tenure: 6 to 36 months

- Eligibility: Minimal documentation, low score friendly

- Benefits: Fast disbursal, simple process

Why Choose HomeCredit?

HomeCredit’s focus on small-ticket loans makes it ideal for purchasing gadgets or appliances. Its lenient criteria suit those with CIBIL score under 600.

- IndiaLends: Connecting Borrowers with Low-Score Lenders

IndiaLends is a unique platform that connects low CIBIL score borrowers with suitable lenders. Offering personal loans up to ₹10 lakh, IndiaLends uses advanced algorithms to match you with NBFCs and fintechs willing to overlook a score below 600. Interest rates vary (15%–36% p.a.), but their transparent process and quick approvals make them a reliable choice. Curious about the process? Simply enter your details, and IndiaLends does the heavy lifting to find the best loan offer for you.

Key Features:

- Loan Amount: Up to ₹50 lakhs

- Interest Rate: Starting at 10.25% p.a.

- Tenure: 12 to 60 months

- Eligibility: Flexible, based on lender criteria

- Benefits: Multiple lender options, quick approvals

Why Choose IndiaLends?

IndiaLends’ platform simplifies loan shopping by matching you with lenders suited to your profile. It’s ideal for low credit score personal loans for diverse needs.

- LoanTap: Flexible Terms, RBI-Regulated

LoanTap, an RBI-regulated NBFC, offers personal loans tailored for low CIBIL score borrowers, with amounts up to ₹10 lakh and interest rates starting at 15% p.a. Their flexible repayment options, including step-up or step-down EMIs, make debt management easier. LoanTap’s digital platform ensures quick approvals and minimal documentation, ideal for emergencies or planned expenses. Want to know the secret to their appeal? Their focus on borrower-friendly terms and transparency sets them apart in 2025’s competitive market.

Key Features:

- Loan Amount: ₹50,000 to ₹10 lakhs

- Interest Rate: Starting at 15% p.a.

- Tenure: Up to 60 months

- Eligibility: Minimum income of ₹20,000/month

- Benefits: Flexible EMIs, no collateral

Why Choose LoanTap?

LoanTap’s tailored solutions, like lifestyle or celebration loans, make it ideal for low CIBIL score loans for home renovations or weddings.

How to Boost Your Chances of Loan Approval

Securing a loan with a CIBIL score under 600 requires strategy. Here are proven tips to improve your odds:

- Add a Co-Applicant or Guarantor: A co-applicant with a strong credit score (above 700) or a guarantor with stable income can significantly boost approval chances. Lenders see shared responsibility as lower risk.

- Show Income Stability: Provide proof of consistent income through salary slips or bank statements. Lenders like Shriram Finance and PaySense prioritize repayment capacity over credit scores.

- Opt for Smaller Loans: Requesting a lower amount (e.g., ₹50,000 instead of ₹2 lakh) reduces lender risk, increasing approval likelihood.

- Check Your Credit Report: Errors in your CIBIL report can drag your score down. Dispute inaccuracies through the CIBIL website to improve your profile.

- Offer Collateral: Secured loans, backed by assets like property or fixed deposits, are easier to obtain despite a low score.

- Limit Credit Inquiries: Multiple loan applications trigger hard inquiries, lowering your score. Apply selectively with lenders like Airtel Flexi Credit or Moneyview.

The Fine Print: What to Watch Out For

While these loan providers offer hope, low CIBIL score loans come with caveats. Interest rates can be high (20%–54% p.a.), especially for unsecured loans, increasing your repayment burden. Short tenures (6–36 months) may lead to high EMIs, so calculate affordability using EMI calculators on apps like PaySense or LoanTap. Always read the terms for hidden fees, such as processing charges (2%–3.5%) or prepayment penalties. Borrow only what you can repay to avoid falling into a debt trap. Curious about safer borrowing? Stick to RBI-regulated lenders like LoanTap or Shriram Finance to ensure transparency.

Improving Your CIBIL Score: A Long-Term Game Plan

While these lenders offer immediate relief, improving your CIBIL score is key to accessing better loan terms. Here’s how to climb from 600 to 750:

- Pay On Time: Timely EMI and credit card payments contribute 35% to your score. Set auto-debits to avoid misses.

- Lower Credit Utilization: Keep credit card usage below 30% of your limit. For example, if your limit is ₹1 lakh, spend no more than ₹30,000.

- Diversify Credit Mix: A mix of secured (e.g., home loans) and unsecured (e.g., personal loans) credit can boost your score.

- Avoid Multiple Applications: Limit loan inquiries to prevent score drops from hard inquiries.

- Monitor Your Report: Check your CIBIL report annually for errors and dispute them promptly.

With consistent effort, you could see a 50–100-point improvement in 6–12 months, unlocking better financial opportunities.

The 2025 Financial Landscape: Why These Lenders Shine

India’s financial ecosystem in 2025 is dynamic, with the RBI’s recent repo rate cut to 5.5% making borrowing more affordable. Fintechs and NBFCs are leveraging digital platforms and alternative data to cater to underserved borrowers, especially those with CIBIL scores under 600. The rise of apps like Airtel Flexi Credit, CASHe, and KreditBee reflects a shift toward inclusive lending, where income and intent trump traditional credit metrics. But here’s the suspenseful part: not all lenders are equal. Choosing the right one—based on interest rates, tenure, and transparency—can make or break your financial journey.

Final Thought: Your Path to Financial Freedom

A CIBIL score below 600 doesn’t have to derail your dreams. With lenders like Shriram Finance, Airtel Flexi Credit, Moneyview, CASHe, KreditBee, PaySense, NIRA, LazyPay, HomeCredit, IndiaLends, and LoanTap, you have options tailored to your needs. These providers offer quick approvals, flexible terms, and minimal documentation, ensuring you can tackle emergencies or seize opportunities. But the real question is: will you take the first step? Apply strategically, repay diligently, and watch your financial future transform. Check your CIBIL score today, explore these apps, and unlock the funds you need—because in 2025, a low score is just a hurdle, not a roadblock.