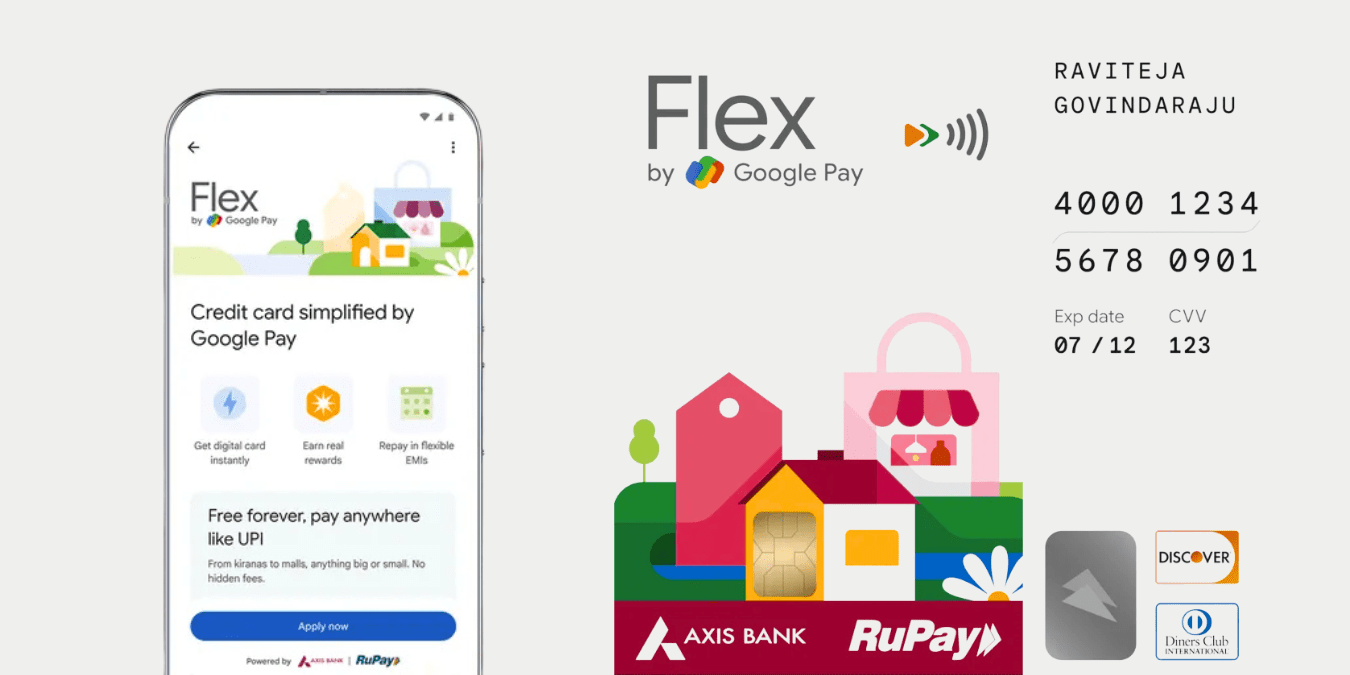

Axis Bank and Google Pay Redefine Payments: India’s First Fully Digital UPI Credit Card Revolution

India’s payment revolution just took a wild turn! Axis Bank and Google Pay have unveiled the nation’s first fully digital UPI credit card—instant, paperless, and card-free. Discover how this groundbreaking fusion of tech and finance is secretly rewriting the rules of credit and everyday digital payments forever.

In a move that could reshape the future of credit and digital payments in India, Axis Bank and Google Pay have come together to launch the country’s first-ever fully digital UPI credit card. This landmark innovation signals a new era of convenience, speed, and financial inclusion—where accessing credit doesn’t involve paperwork, physical cards, or time-consuming verification processes. Instead, everything happens seamlessly through your smartphone.

The collaboration between one of India’s leading private sector banks and a global tech giant shows how finance and technology continue to merge. The Axis Bank-Google Pay UPI Credit Card is not just about simplified transactions—it’s about empowering millions of Indians to experience credit responsibly and digitally.

Understanding the Game-Changer: What Is a Digital UPI Credit Card?

Before diving into what makes this partnership so transformative, let’s clarify what a fully digital UPI credit card really means.

Traditionally, credit cards have always been physical instruments. You’d fill out a form, wait days for approval, and then receive a plastic card via post. Even as payments went digital, the onboarding process remained slow. The new Axis Bank and Google Pay model changes that completely.

Here’s what differentiates a fully digital UPI-based credit card from the rest:

- Instant Issuance: No paperwork or waiting period—the card is generated digitally within Google Pay.

- UPI Integration: It functions directly on the Unified Payments Interface (UPI), allowing credit payments through QR codes and UPI IDs.

- No Physical Card Required: There’s no need to carry plastic; your credit line is linked directly to your UPI account.

- Secure Transactions: Multi-factor authentication, tokenization, and Google’s advanced fraud-detection algorithms ensure safety.

- Universal Acceptance: Because it’s UPI-based, any merchant accepting UPI payments can also accept this credit line.

In essence, it brings the power of credit into the most familiar payment channel for Indians—UPI.

UPI’s Journey from Innovation to Everyday Essential

To appreciate the gravity of this launch, we must look back at UPI’s trajectory. When the National Payments Corporation of India (NPCI) introduced UPI in 2016, few could have predicted how it would revolutionize India’s financial landscape. Within a few short years, UPI became the go-to method for everything—from splitting bills among friends to buying groceries, paying utilities, and more.

According to the NPCI’s 2025 projections, UPI is expected to clock nearly 2 billion transactions daily. Its success comes from three factors:

- Accessibility: It connects multiple bank accounts seamlessly.

- Affordability: No hidden fees or charges for most users.

- Adaptability: UPI apps integrate with fintech innovations like contactless payments, QR codes, and credit systems.

Until recently, UPI transactions were limited to linked bank accounts or prepaid wallets. The introduction of UPI on credit changes the game—bringing flexibility, responsible credit usage, and rewards directly into the world of instant payments.

Why Google Pay and Axis Bank?

The partnership between Axis Bank, one of India’s largest credit card issuers, and Google Pay, one of the most popular digital payment platforms in the country, is both strategic and visionary.

Axis Bank’s Prowess

Axis Bank has already built a strong presence in retail banking, particularly with digital-first products. Its experience in credit products and security infrastructure makes it an ideal partner for such innovation. The bank has consistently ranked among the top credit card issuers in India, known for its tailored card offerings and seamless mobile experience.

Google Pay’s Reach

Google Pay, or GPay, commands a huge user base across India, cutting through demographics—from urban professionals to small-town entrepreneurs. By embedding credit functionality directly inside GPay, the company extends its ecosystem deeper into financial services—making credit effortless and mobile-first.

Two Strengths, One Vision

The collaboration allows Google to leverage Axis Bank’s credit infrastructure and RBI compliance while Axis Bank taps into Google Pay’s massive user base and technological capabilities. Together, they’ve built a product that’s simple, scalable, and future-ready.

How the Axis Bank-Google Pay UPI Credit Card Works

At its core, the mechanism is elegantly simple. Let’s break it down step by step.

- Digital Onboarding:

A user selects “Axis Bank UPI Credit Card” under the Google Pay app’s “Credit” section. After entering basic KYC details, approval happens almost instantly. - Instant Activation:

Once approved, a virtual credit card is generated within Google Pay. No waiting days for card delivery or physical signature requirements. - UPI Linking:

The card is automatically linked to the user’s UPI ID, enabling them to use their UPI handle for credit-based payments (e.g., name@okaxis). - Transactions Made Simple:

Whether scanning a QR code at a store, paying online, or sending money to a vendor, users can now simply choose to “Pay via Credit” instead of “Pay via Bank”. - Repayment & Tracking:

The Google Pay app provides smart reminders, mini-statements, and AI-powered insights on spending and repayment dates. Users can clear dues right from the app. - Reward System:

To encourage responsible use, the card offers cashback, Axis EDGE Reward Points, and exclusive merchant offers for transactions done via Google Pay.

This fusion of UPI’s simplicity with credit’s flexibility creates a frictionless, digital-first experience that’s leagues ahead of traditional credit systems.

Regulatory Backing: The Role of NPCI and RBI

No innovation in India’s financial ecosystem is possible without regulatory guidance—and that’s where the RBI and NPCI play crucial roles. In early 2023, the RBI allowed linking of credit cards with UPI, paving the way for banks and payment providers to innovate responsibly.

Previously, only Rupay credit cards were permitted for UPI linkage. The Axis Bank–Google Pay card, however, expands this possibility through collaboration and compliance under these guidelines, ensuring robust KYC verification, spending transparency, and data security aligned with RBI’s digital credit norms.

What Sets It Apart from Other Credit Systems

The Axis Bank–Google Pay UPI Credit Card isn’t just a digital version of your plastic card. It reimagines credit in a mobile-first, API-driven format.

Here are five standout differences that make it revolutionary:

- No Physical Card Dependency:

Traditional credit cards are prone to loss, theft, and delays. The new model eliminates those risks entirely. - Credit with Convenience:

You can use credit even where cards aren't accepted—like small stores, local vendors, or street stalls—since they already accept UPI. - Speed of Service:

From approval to spending, everything happens in minutes instead of days or weeks. - Enhanced Security through Tokenization:

Each transaction generates a unique, encrypted token instead of revealing card details—minimizing the risk of fraud. - Eco-Friendly by Design:

No plastic. No courier delivery. No paper trails—making it a truly sustainable payment solution.

India’s Broader Shift Toward Digital Credit Ecosystems

This innovation is a key piece in a much larger puzzle: India’s rising digital credit economy.

According to a Bain & Company report (2024), India’s digital lending market is projected to surpass $350 billion by 2027. With UPI already integrated into daily life, linking it with credit enables massive financial inclusion.

For example, small business owners in rural areas—who traditionally lacked access to credit cards—can now use credit through UPI at no additional cost. Similarly, millennials and Gen-Z users seeking instant credit lines for online purchases or emergency needs no longer have to fill out lengthy applications.

This paves the way for “democratized credit”—where access to borrowing power becomes as simple as scanning a QR code.

A Look at Benefits for Different User Groups

For Consumers:

- Instant access to credit for daily transactions.

- No carrying physical cards.

- Rewards for UPI payments.

- Simplified repayment mechanisms through Google Pay.

For Merchants:

- Wider acceptance—UPI remains the common bridge.

- Credit-enabled sales, even for small-ticket transactions.

- No special hardware requirement.

For the Economy:

- Boost to formal credit usage.

- Acceleration of digital payment infrastructure adoption.

- Better credit data analytics for personalized lending.

Security and Data Privacy: How Safe Is It?

Security remains a top concern in any financial innovation—especially digital credit. Axis Bank and Google Pay have jointly emphasized robust safeguards:

- Multi-Layer Authentication:

Transactions require biometric verification (fingerprint/face ID) or UPI PIN. - End-to-End Encryption:

Google’s secure infrastructure ensures that card details aren’t stored or exposed to merchants. - Tokenization Protocols:

Each transaction is uniquely encoded, reducing risk of misuse. - RBI and PCI-DSS Compliance:

The card adheres to domestic financial security regulations, including Payment Card Industry Data Security Standards.

In short, every swipe, scan, or click passes through one of the most secure infrastructures in the global financial world.

Google Pay’s Interface: Making Credit Intuitive

User experience is the heart of Google Pay’s appeal. The company has redesigned parts of its app to welcome this new credit feature with clarity.

- Smart Tabs: “Pay with Credit” and “Pay from Bank Account.”

- AI Spend Insights: Real-time alerts categorize spending patterns—groceries, dining, travel, etc.

- Reminders: Automatic alerts when bills are due or nearing limits.

- Support Chatbot: 24x7 in-app chatbot for account queries or disputes.

By integrating these smart tools, Google Pay converts what used to be a complex credit relationship into something intuitive and transparent.

Rewards, Offers, and Future Possibilities

At launch, Axis Bank’s digital UPI credit card provides reward points on all UPI transactions, alongside special discounts through Google Pay’s partner network—restaurants, fuel stations, retail outlets, and digital subscriptions.

But the roadmap doesn’t stop there. Sources suggest future updates could include:

- EMI options within GPay.

- Loan top-ups based on spending behavior.

- Cross-platform interoperability (linking multiple credit lines).

- AI-driven budgeting tools for financial health recommendations.

These additions could transform GPay into a full-fledged financial dashboard—a one-stop command center for managing money, credit, and rewards.

Industry Reactions: What Experts Are Saying

The financial and tech industries are buzzing with optimism. Analysts believe this move will accelerate India’s shift toward a “credit for all” model.

Rajat Singh, a fintech analyst at IDC India, remarks:

"This partnership proves that the convergence of banking and technology can make credit more accessible, especially for the next 100 million digital users."

Meanwhile, Sandeep Ghosh, Group Executive at Axis Bank, has highlighted that this initiative aligns with the bank’s long-term vision of a paperless, presence-less, and cashless banking future.

Even competing banks have taken note, with some planning to introduce similar partnerships with payment apps by mid-2026.

Will UPI Credit Replace Traditional Credit Cards?

This is a key question—and the answer lies somewhere in between. For now, both will coexist.

Traditional credit cards still offer extensive international usage, add-on features, travel insurance, and premium perks. However, UPI credit cards will dominate domestic, small-ticket, everyday transactions—a segment that represents a massive share of India’s payment market.

As contactless payments become the default, it’s not hard to imagine a near future where digital-first credit becomes more common than plastic.

Challenges Ahead

No innovation is without challenges. The Axis Bank–Google Pay card must navigate:

- User Education:

Many users still associate UPI purely with debit transactions. Educating them on safe credit usage is essential. - Credit Risk Assessment:

Instant issuance demands AI-driven models to evaluate creditworthiness in real time. - Rural Connectivity Gaps:

UPI penetration in rural regions is strong, but connectivity and awareness still vary. - Regulatory Evolution:

RBI guidelines will continue to evolve to ensure consumer protection across digital credit models.

Despite these hurdles, the long-term growth trajectory remains highly positive.

The Broader Vision: India’s Fintech Future

The Axis-GPay launch fits perfectly into India’s larger fintech vision. Together with initiatives like Digital Rupee, account aggregator frameworks, and open banking, this new credit model forms a complete ecosystem that’s transparent, inclusive, and technologically advanced.

India isn’t just catching up with global fintech trends—it’s setting new precedents. The Axis Bank–Google Pay initiative could soon serve as a template for other emerging markets moving toward digital credit through national payment interfaces.

Final Thought: A Defining Moment in India’s Payment Revolution

The introduction of India’s first fully digital UPI credit card by Axis Bank and Google Pay marks more than just a product launch—it’s the beginning of a new chapter in India’s digital economy.It symbolizes the evolution from digital payments to digital credit, empowering millions of Indians to transact, borrow, and build credit—all from their smartphones. For consumers, it’s convenience. For merchants, it’s opportunity. For the nation, it’s progress.In many ways, the Axis Bank–Google Pay credit card is not just a financial tool—it’s a glimpse into the future of cashless India.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!