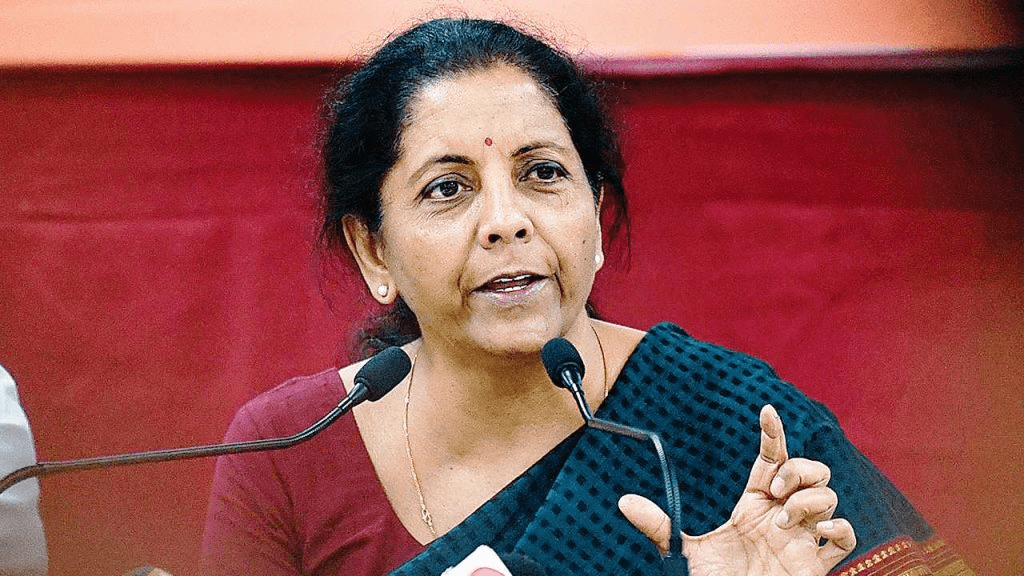

Key points about Finance Minister Nirmala Sitharaman’s announcement about the Unified Pension Scheme (UPS):

- Introduction of UPS: Finance Minister Nirmala Sitharaman introduced the Unified Pension Scheme (UPS) as a new initiative aimed at enhancing the existing National Pension System (NPS).

- Not a Rollback: Sitharaman clarified that UPS is not a rollback of the NPS or the Old Pension Scheme (OPS), but a new package designed to help government employees.

- Government Employees: The scheme is specifically targeted at central government employees who are now subscribers of the NPS.

- Guaranteed Pension: UPS guarantees employees 50% of their average basic pay over the last 12 months before retirement as a pension, provided they have a basic qualifying service of 25 years.

- Proportionate Pension: For employees with a service period of less than 25 years but at least 10 years, the pension will be proportionate.

- Minimum Pension: The scheme assures a minimum payout of ₹10,000 per month on superannuation after a baseline of 10 years of service.

- Flexibility and Choice: Sitharaman emphasized that the scheme offers flexibility and choice, aligning with the government’s approach to governance.

- No Additional Burden: The scheme is designed to help employees without imposing an additional financial burden on the government.

- Opposition’s Claims: The Finance Minister countered claims by the opposition that the scheme shows a U-turn, asserting that it is an improvement rather than a rollback.

- Adoption by States: Sitharaman expressed hope that most states would adopt the UPS due to its many benefits for employees.

-

Why Car Leasing in India Is the Smart Choice for Tax Savings and Flexibility

Car leasing in India! Learn how to avail affordable lease programs, explore top deals like…

-

Top Benefits of HDFC Personal Loan: No Collateral, Up to ₹40 Lakh Funding

HDFC Personal Loan: Get up to ₹40L with 10-second disbursal, 10.50% p.a. rates, and no…

-

IDBI Bank Debit Cards: Maximize Rewards and Insurance Protection

IDBI Bank offers a range of debit cards with varying insurance benefits tailored to meet…

-

HDFC Life Sanchay Plus Review: Is This Savings Plan Worth Your Money?

HDFC Life Sanchay Plus: a savings plan with guaranteed returns, tax-free payouts, and flexible income…

More Stories

Why Car Leasing in India Is the Smart Choice for Tax Savings and Flexibility

HDFC Life Sanchay Plus Review: Is This Savings Plan Worth Your Money?

Mastering Work-Life Balance: Secrets to Establishing Boundaries with Managers from Day One

Big Spenders Beware: Why Is the Income Tax Department Targeting Credit Card Bills Over ₹1 Lakh

Trading Support and Resistance: Sensex, Nifty50, Bank Nifty Prediction for Tuesday, June 24, 2025

Bombay High Court: Why Can’t GST Authorities Freeze Your Cash Credit Account?