TCS employees receiving income tax notices, presented in 10 key points:

- Discrepancy Identified: Tata Consultancy Services (TCS) reported that the income tax notices sent to several of its employees are due to a discrepancy.

- Reprocessing of ITRs: The Department of Income Tax will reprocess the Income Tax Returns (ITRs) to rectify the issue.

- Number of Employees Affected: Approximately 40,000 TCS employees received these income tax notices.

- Tax Demand Range: The tax demands in the notices ranged from ₹50,000 to ₹1 lakh, depending on the employees’ salary and seniority.

- Internal Communication: TCS communicated internally that the discrepancy is likely due to a technical error and assured employees that the issue will be resolved.

- No Immediate Payment Required: Employees who received the notices are not required to pay any demand amount immediately. They will receive rectification intimation soon.

- Synchronization of TDS: The reprocessing will ensure that the Tax Deducted at Source (TDS) is in sync with Form 26AS issued by the Income Tax Department and Form 16 Part A issued by TCS.

- Clarification from Tax Authorities: TCS has received clarification from the Income Tax Department regarding the discrepancy and the steps to resolve it.

- Impact on Employees: The notices caused significant concern among employees, but TCS has reassured them that the issue is being addressed promptly.

- Market Reaction: Despite the news, TCS shares closed 0.11% higher at ₹4,522.25 after the latest trading session.

-

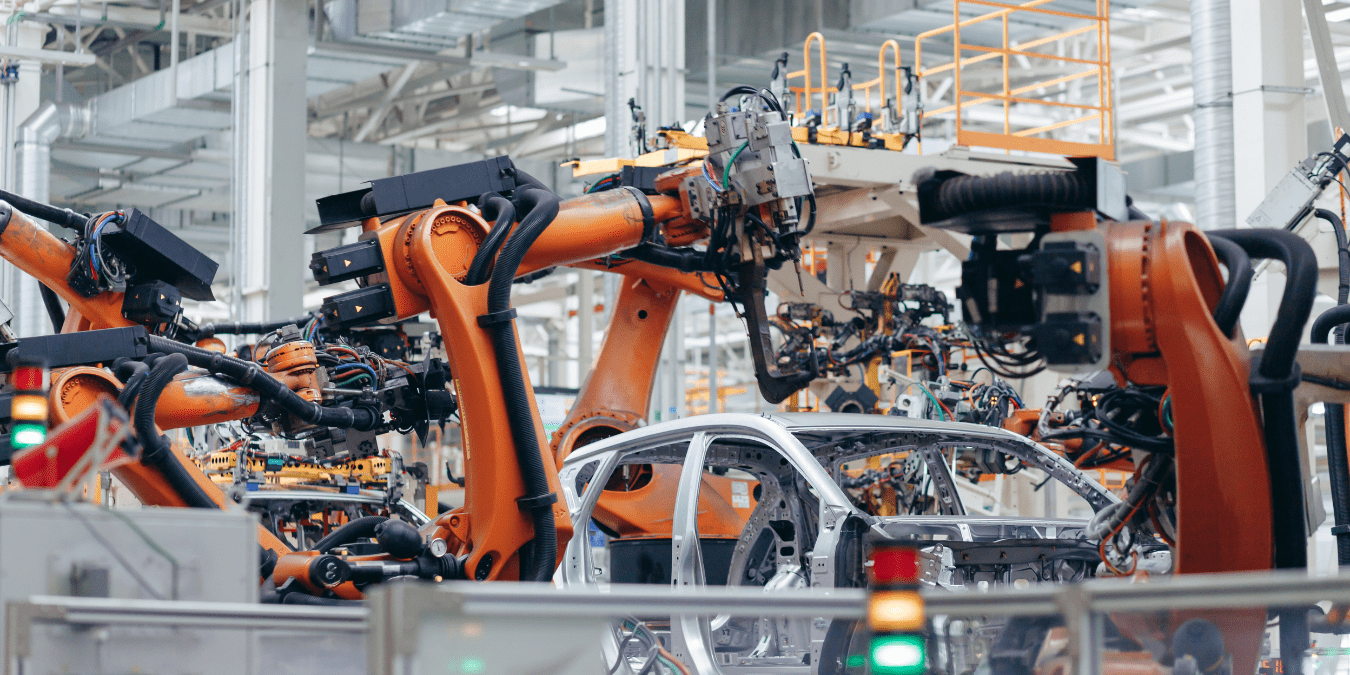

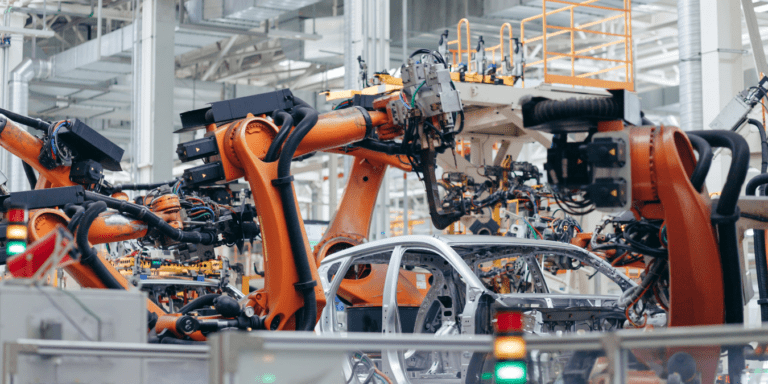

Hyundai’s $6.3 Billion AI and Robot Bet: A New Industrial Blueprint

What if a car giant secretly built a robot‑powered city in South Korea? Hyundai’s $6.3 billion AI data

-

iPhone 17e Launch: Rs 64,900 Price + 5 Reasons to Consider

Apple’s iPhone 17e just dropped in India at a disruptive Rs 64,900 for the 256GB model, shaking up

-

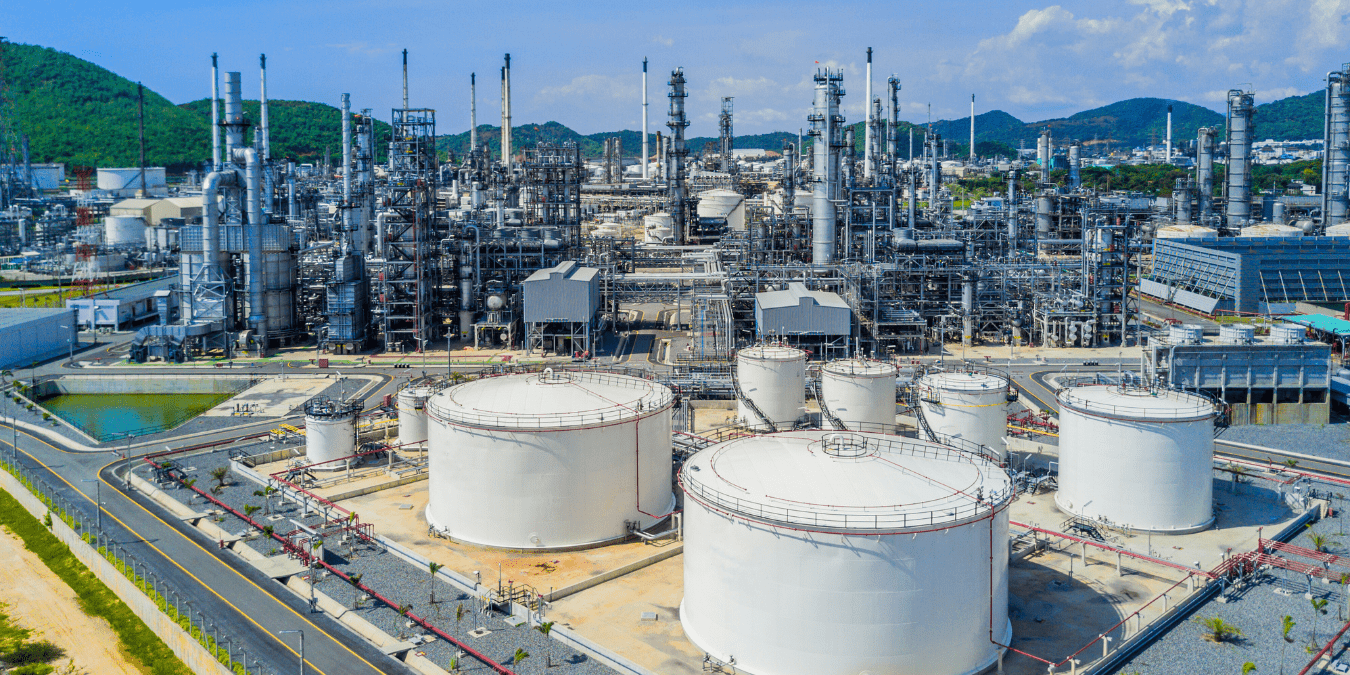

Iran Closes Strait of Hormuz Amid US-Israel War: What 20% Global Oil Cut Means for Economy

Iran just slammed shut the Strait of Hormuz—20% of world oil vanishes overnight amid US-Israel war. Brent soars

-

Indian Stock Market Trends 2026: What Data Says About the Road Ahead

Indian stock market trends in early March 2026 show a market in correction, not crisis—shaped by strong GDP growth,

-

The Man Who Pulled Noodles — and Pulled Back the Curtain on China’s Global Spy Machine

A 24-Year Insider Just Told the World How the CCP Watches, Controls, and Punishes Its Citizens — Everywhere

-

Why Trump Suddenly Turned Against the Chagos Deal Hours After Britain Said No to Iran Strikes

Trump backed the Chagos deal — then reversed overnight. The trigger? Britain secretly blocked US Iran strikes from

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!