Photo by nappy on <a href="https://www.pexels.com/photo/crop-faceless-employee-writing-on-paper-during-workday-3619325/" rel="nofollow">Pexels.com</a>

Introduction

If you’re an NRI (Non-Resident Indian), managing finances between India and your country of residence can be a bit tricky. That’s where NRI accounts come in. These specialized bank accounts offer several features tailored to meet the unique needs of NRIs. But with multiple types available, it’s essential to understand which one suits you best.

Types of NRI Accounts

NRE (Non-Resident External) Account

Non-Resident Indians (NRIs) have several banking options in India to manage their finances effectively. The three main types of NRI accounts are NRE (Non-Resident External), NRO (Non-Resident Ordinary), and FCNR (Foreign Currency Non-Resident) accounts. Each account type serves different purposes and offers unique benefits. Here’s a detailed overview:

1. NRE (Non-Resident External) Account

Purpose: The NRE account is designed for NRIs to park their foreign earnings in India. The funds in this account are maintained in Indian Rupees (INR).

Key Features:

- Repatriability: Both the principal and the interest earned are fully repatriable, meaning you can transfer the funds back to your country of residence without any restrictions.

- Tax Benefits: The interest earned on NRE accounts is exempt from Indian income tax, making it a tax-efficient option.

- Currency Conversion: Funds deposited in foreign currency are converted to INR.

- Joint Accounts: NRIs can open joint NRE accounts with other NRIs.

- Usage: Ideal for NRIs who want to remit their foreign earnings to India and earn tax-free interest.

2. NRO (Non-Resident Ordinary) Account

Purpose: The NRO account is used to manage income earned in India, such as rent, dividends, or pension.

Key Features:

- Repatriability: Repatriation of funds is allowed up to USD 1 million per financial year, subject to certain conditions and taxes.

- Taxation: Interest earned on NRO accounts is subject to Indian income tax. TDS (Tax Deducted at Source) is applicable.

- Currency Conversion: Funds are maintained in INR.

- Joint Accounts: NRIs can open joint NRO accounts with both NRIs and Indian residents.

- Usage: Suitable for NRIs who have income sources in India and need to manage these funds locally.

3. FCNR (Foreign Currency Non-Resident) Account

Purpose: The FCNR account allows NRIs to maintain their deposits in foreign currency, protecting them from exchange rate fluctuations.

Key Features:

- Repatriability: Both the principal and the interest earned are fully repatriable.

- Tax Benefits: Interest earned is exempt from Indian income tax.

- Currency Options: Deposits can be made in various foreign currencies such as USD, GBP, EUR, JPY, etc.

- Tenure: The account can be held for a fixed term ranging from 1 to 5 years.

- Usage: Ideal for NRIs who want to avoid currency conversion risks and maintain their deposits in foreign currency.

Choosing the Right Account

The choice between NRE, NRO, and FCNR accounts depends on your financial needs and goals:

- NRE Account: Best for NRIs who want to remit their foreign earnings to India and enjoy tax-free interest.

- NRO Account: Suitable for managing income earned in India and for those who need to repatriate funds within the permissible limit.

- FCNR Account: Ideal for NRIs who want to maintain their deposits in foreign currency and avoid exchange rate risks.

Understanding the differences between NRE, NRO, and FCNR accounts is crucial for NRIs to manage their finances efficiently. Each account type offers unique benefits and serves different purposes, making it essential to choose the one that aligns with your financial objectives

Eligibility Criteria for NRE Account

To open an NRI account in India, you need to meet certain eligibility criteria. Here are the key requirements:

General Eligibility Criteria

- Non-Resident Indian (NRI) Status:

- You must qualify as an NRI as per the definition provided by the Reserve Bank of India (RBI). This typically means you reside outside India for employment, business, or other purposes indicating an intention to stay abroad for an uncertain duration.

- Person of Indian Origin (PIO) or Overseas Citizen of India (OCI):

- PIOs and OCIs are also eligible to open NRI accounts. You will need to provide a valid PIO or OCI card.

- Valid Passport:

- A valid Indian passport or an OCI card is required as proof of identity.

- Proof of Foreign Address:

- You need to provide proof of your foreign address, such as utility bills, bank statements, or a driving license.

- Employment or Business Abroad:

- You should be employed, own a business, or practice some form of trade in a foreign country.

- Students:

- Students pursuing education in a foreign country are also eligible to open NRI accounts.

Specific Criteria for Different Account Types

- NRE (Non-Resident External) Account:

- Designed for NRIs to park their foreign earnings in India. The funds in this account are maintained in Indian Rupees (INR).

- Full repatriability of both principal and interest.

- Tax-free interest income in India.

- NRO (Non-Resident Ordinary) Account:

- Used to manage income earned in India, such as rent, dividends, or pension.

- Repatriation of funds is allowed up to USD 1 million per financial year, subject to certain conditions and taxes.

- Interest earned is subject to Indian income tax.

- FCNR (Foreign Currency Non-Resident) Account:

- Allows NRIs to maintain their deposits in foreign currency, protecting them from exchange rate fluctuations.

- Full repatriability of both principal and interest.

- Interest earned is exempt from Indian income tax.

Additional Considerations

- Joint Accounts:

- NRIs can open joint accounts with other NRIs or with resident Indians (in certain cases), subject to specific conditions.

- Government Employees:

- Government employees holding diplomat passports are eligible.

- Special Cases:

- Foreign nationals employed in India, foreign students, and individuals working on oil rigs or overseas shipping companies may have specific eligibility criteria.

These criteria ensure that only eligible individuals can open and operate NRI accounts, providing a secure and regulated banking environment for NRIs.

How to Open an NRE Account

Opening an NRE (Non-Resident External) account is a straightforward process. Here are the steps to guide you through:

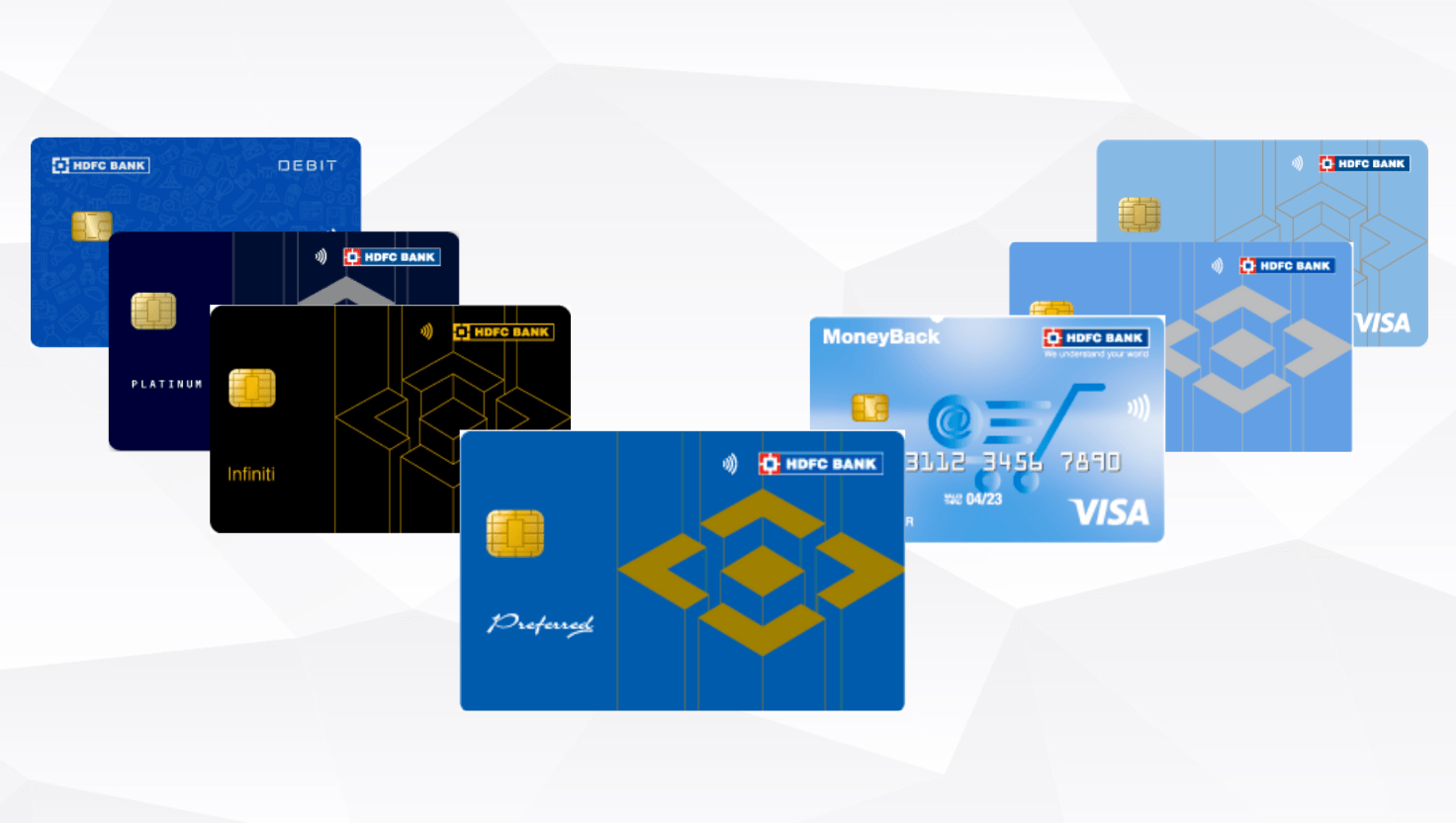

Step 1: Choose a Bank

Research and select a reputed bank that offers NRE accounts with competitive interest rates and excellent customer service. Popular options include SBI, HDFC Bank, ICICI Bank, and Axis Bank.

Step 2: Gather Required Documents

Prepare the necessary documents, which typically include:

- Filled-in Application Form: Available on the bank’s website or at the branch.

- Passport Copy: A valid passport with visa or residence permit.

- Proof of Address: Both overseas and Indian addresses (utility bills, bank statements, etc.).

- Photographs: Recent passport-sized photographs.

- Proof of Income: Salary slips or employment letter (if applicable).

Step 3: Submit the Application

You can submit your application either online or by visiting the bank branch. Many banks offer online application facilities where you can upload scanned copies of your documents.

Step 4: Verification Process

The bank will verify your documents and may contact you for any additional information or clarification. This process ensures that all provided information is accurate and meets regulatory requirements.

Step 5: Fund the Account

Once your account is approved, you need to fund it with an initial deposit. This can be done through wire transfer from your foreign bank account. The funds will be converted to Indian Rupees (INR) and credited to your NRE account.

Step 6: Account Activation

After the initial deposit, your NRE account will be activated. You will receive your account details, internet banking credentials, and debit card (if applicable). You can now start using your NRE account to manage your finances in India.

Benefits of an NRE Account

- Tax-Free Interest: Interest earned is exempt from Indian income tax.

- Full Repatriability: Both principal and interest can be repatriated without restrictions.

- Convenient Banking: Access to internet banking, international debit cards, and easy fund transfers.

By following these steps, you can efficiently open and operate an NRE account, making it easier to manage your foreign earnings in India.

NRO (Non-Resident Ordinary) Account

Overview of NRO Account

An NRO account is used to manage income earned in India, such as rent, dividends, or pension.

Benefits of NRO Account

- Currency Flexibility: Can be opened jointly with an Indian resident.

- Income Management: Convenient for managing income earned in India.

Eligibility Criteria for NRO Account

- Must be an NRI or PIO.

- Required documentation similar to NRE accounts.

How to Open an NRO Account

- Visit the bank or apply online.

- Provide necessary documents and complete the KYC (Know Your Customer) process.

- Deposit funds to activate the account.

FCNR (Foreign Currency Non-Resident) Account

Overview of FCNR Account

FCNR accounts allow NRIs to hold deposits in foreign currency, protecting them from fluctuations in exchange rates.

Benefits of FCNR Account

- Currency Stability: Deposits can be maintained in major currencies like USD, GBP, EUR, etc.

- Repatriation: Both the principal and the interest are fully repatriable.

- Tax-Free Interest: Interest earned is exempt from Indian income tax.

Eligibility Criteria for FCNR Account

- Must be an NRI or PIO.

- Valid passport and visa.

How to Open an FCNR Account

- Choose the desired currency for the deposit.

- Complete the application form and submit necessary documents.

- Transfer funds in the chosen currency.

Features of NRI Accounts

- Repatriation

NRI accounts offer varying degrees of repatriation. While NRE and FCNR accounts provide full repatriability of both principal and interest, NRO accounts have certain restrictions.

- Taxation

Interest earned on NRE and FCNR accounts is tax-free in India. However, interest on NRO accounts is subject to TDS (Tax Deducted at Source).

- Currency Options

NRE accounts are maintained in INR, while FCNR accounts can be held in major foreign currencies. NRO accounts are also in INR but can handle income generated in India.

- Interest Rates

Interest rates on NRI accounts vary depending on the bank and the type of account. Generally, FCNR accounts might offer interest rates aligned with international standards.

- Loan Facilities

NRIs can avail of loans against the balance in their NRI accounts. These loans can be used for various purposes, including personal, home, or education loans.

NRI Account Management

- Online Banking

Most banks offer robust online banking facilities, allowing NRIs to manage their accounts from anywhere in the world.

- Mobile Banking

Mobile banking apps provide added convenience, with features like fund transfers, bill payments, and more at the tap of a screen.

- International Debit and Credit Cards

Banks often provide international debit and credit cards with NRI accounts, making it easier to access funds and make transactions abroad.

- Joint Accounts

NRO accounts can be held jointly with an Indian resident, which is helpful for managing income generated in India.

Importance of Choosing the Right NRI Account

- Personal Financial Goals

Choosing the right NRI account depends on your financial goals, whether it’s saving, investing, or managing income earned in India.

- Tax Implications

Understanding the tax implications is crucial. NRE and FCNR accounts offer tax-free interest, which can be a significant benefit.

- Currency Preferences

If you prefer holding deposits in foreign currency to avoid exchange rate risks, an FCNR account might be the best option.

How to Choose the Right NRI Account

- Assessing Your Financial Needs

Evaluate your financial needs and goals to determine which account type suits you best.

- Consulting Financial Advisors

Consulting with financial advisors can provide personalized advice based on your financial situation and goals.

- Comparing Different Banks

Compare the offerings of different banks, including interest rates, fees, and additional services, to make an informed decision.

Detailed comparison of different NRE accounts offered by various banks in India, including key features:

| Bank | Account Type | Interest Rate | Minimum Balance | Repatriability | Tax Exemption | Additional Features |

| Axis Bank | NRE | 5.10%-5.40% | ₹10,000 – ₹10 lakhs | Yes | Yes | Free international debit card, internet banking |

| RBL Bank | NRE | 4.25% | ₹50,000 | Yes | Yes | High interest rates, easy fund transfers |

| Yes Bank | NRE | 4.00% | ₹10,000 | Yes | Yes | Free demand drafts, internet banking |

| Kotak Bank | NRE | 3.50% | ₹10,000 | Yes | Yes | Free inward remittances, mobile banking |

| DBS Bank | NRE | 3.00% | ₹5,00,000 | Yes | Yes | High daily withdrawal limits, internet banking |

| HDFC Bank | NRE | 3.00% | ₹10,000 (metro) / ₹5,000 (semi-urban) | Yes | Yes | Free international debit card, internet banking |

| ICICI Bank | NRE | 3.00% | ₹10,000 | Yes | Yes | Free inward remittances, mobile banking |

| Bank of Baroda | NRE | 2.75% | ₹1,000 | Yes | Yes | Free international debit card, internet banking |

| SBI | NRE | 2.70% | ₹1,00,000 | Yes | Yes | Free inward remittances, mobile banking |

| Citibank | NRE | 2.50% | ₹2,00,000 | Yes | Yes | High daily withdrawal limits, internet banking |

Detailed comparison of different NRO accounts offered by various banks in India, including key features:

| Bank | Account Type | Interest Rate | Minimum Balance | Repatriability | Tax Exemption | Additional Features |

| Axis Bank | NRO | 4.40%-5.40% | ₹10,000 – ₹10 lakhs | No | No | Free international debit card, internet banking |

| RBL Bank | NRO | 4.25% | ₹50,000 | No | No | High interest rates, easy fund transfers |

| Yes Bank | NRO | 4.00% | ₹10,000 | No | No | Free demand drafts, internet banking |

| Kotak Bank | NRO | 3.50% | ₹10,000 | No | No | Free inward remittances, mobile banking |

| HDFC Bank | NRO | 3.00% | ₹10,000 (metro) / ₹5,000 (semi-urban) | No | No | Free international debit card, internet banking |

| ICICI Bank | NRO | 3.00% | ₹10,000 | No | No | Free inward remittances, mobile banking |

| DBS Bank | NRO | 3.00% | ₹5,00,000 | No | No | High daily withdrawal limits, internet banking |

| Bank of Baroda | NRO | 2.75% | ₹1,000 | No | No | Free international debit card, internet banking |

| SBI | NRO | 2.70% | ₹1,00,000 | No | No | Free inward remittances, mobile banking |

| Citibank | NRO | 2.50% | ₹2,00,000 | No | No | High daily withdrawal limits, internet banking |

Common Misconceptions about NRI Accounts

There are several misconceptions about NRI accounts that can lead to confusion. Let’s debunk some of these myths and clarify the realities:

Myth vs Reality

Myth 1: NRI Accounts Can Be Opened Jointly with Resident Indians

Reality: NRE (Non-Resident External) accounts cannot be opened jointly with resident Indians. They can only be held jointly with another NRI. However, NRO (Non-Resident Ordinary) accounts can be opened jointly with resident Indians.

Myth 2: Interest Earned on NRI Accounts is Always Tax-Free

Reality: Interest earned on NRE and FCNR (Foreign Currency Non-Resident) accounts is tax-free in India. However, interest earned on NRO accounts is subject to Indian income tax and TDS (Tax Deducted at Source).

Myth 3: NRI Accounts Can Only Be Opened in Indian Rupees

Reality: While NRE and NRO accounts are maintained in Indian Rupees (INR), FCNR accounts can be maintained in foreign currencies such as USD, GBP, EUR, JPY, etc. This helps NRIs avoid currency conversion risks.

Myth 4: Funds in NRI Accounts Cannot Be Repatriated

Reality: Funds in NRE and FCNR accounts are fully repatriable, meaning both the principal and interest can be transferred back to the NRI’s country of residence without restrictions. NRO accounts have repatriation limits of up to USD 1 million per financial year, subject to certain conditions.

Myth 5: Only Salaried NRIs Can Open NRI Accounts

Reality: NRI accounts can be opened by any NRI, including those who are self-employed, business owners, students, or even retired individuals living abroad. The key requirement is that the individual must qualify as an NRI as per the Reserve Bank of India’s definition.

Myth 6: NRI Accounts Are Only for High Net-Worth Individuals

Reality: NRI accounts are accessible to all NRIs, regardless of their income level. Different banks offer various types of NRI accounts with varying minimum balance requirements, making them suitable for a wide range of financial situations.

Myth 7: NRI Accounts Have High Maintenance Fees

Reality: While some banks may have higher maintenance fees, many banks offer NRI accounts with reasonable or even zero maintenance fees, especially if certain balance requirements are met. It’s important to compare different banks and their fee structures before opening an account.

Myth 8: NRI Accounts Cannot Be Operated Online

Reality: Most banks offer comprehensive online banking services for NRI accounts, including internet banking, mobile banking, and international debit cards. This allows NRIs to manage their accounts conveniently from anywhere in the world.

Understanding these realities can help NRIs make informed decisions about their banking needs and avoid common pitfalls.

Conclusion

Choosing the right NRI account is crucial for managing your finances effectively while living abroad. Whether it’s the tax-free benefits of NRE accounts, the currency stability of FCNR accounts, or the income management capabilities of NRO accounts, each account type offers unique advantages tailored to the needs of NRIs. Understanding these features and how they align with your financial goals will help you make an informed decision.

Frequently Asked Questions

- What is the difference between NRE and NRO accounts?

NRE accounts are for parking foreign earnings in India and are tax-free, whereas NRO accounts are for managing income earned in India and are subject to Indian taxes.

- Can I open multiple NRI accounts?

Yes, NRIs can open multiple NRI accounts, including NRE, NRO, and FCNR accounts, as per their financial needs.

- Is the interest earned on NRI accounts taxable?

Interest earned on NRE and FCNR accounts is tax-free in India, but interest on NRO accounts is subject to TDS.

- How can I transfer money to my NRI account?

Money can be transferred to NRI accounts through wire transfers, online banking, or by depositing foreign currency checks.

- What documents are required to open an NRI account?

Typically, a valid passport, visa, proof of overseas address, and recent photographs are required to open an NRI account.

-

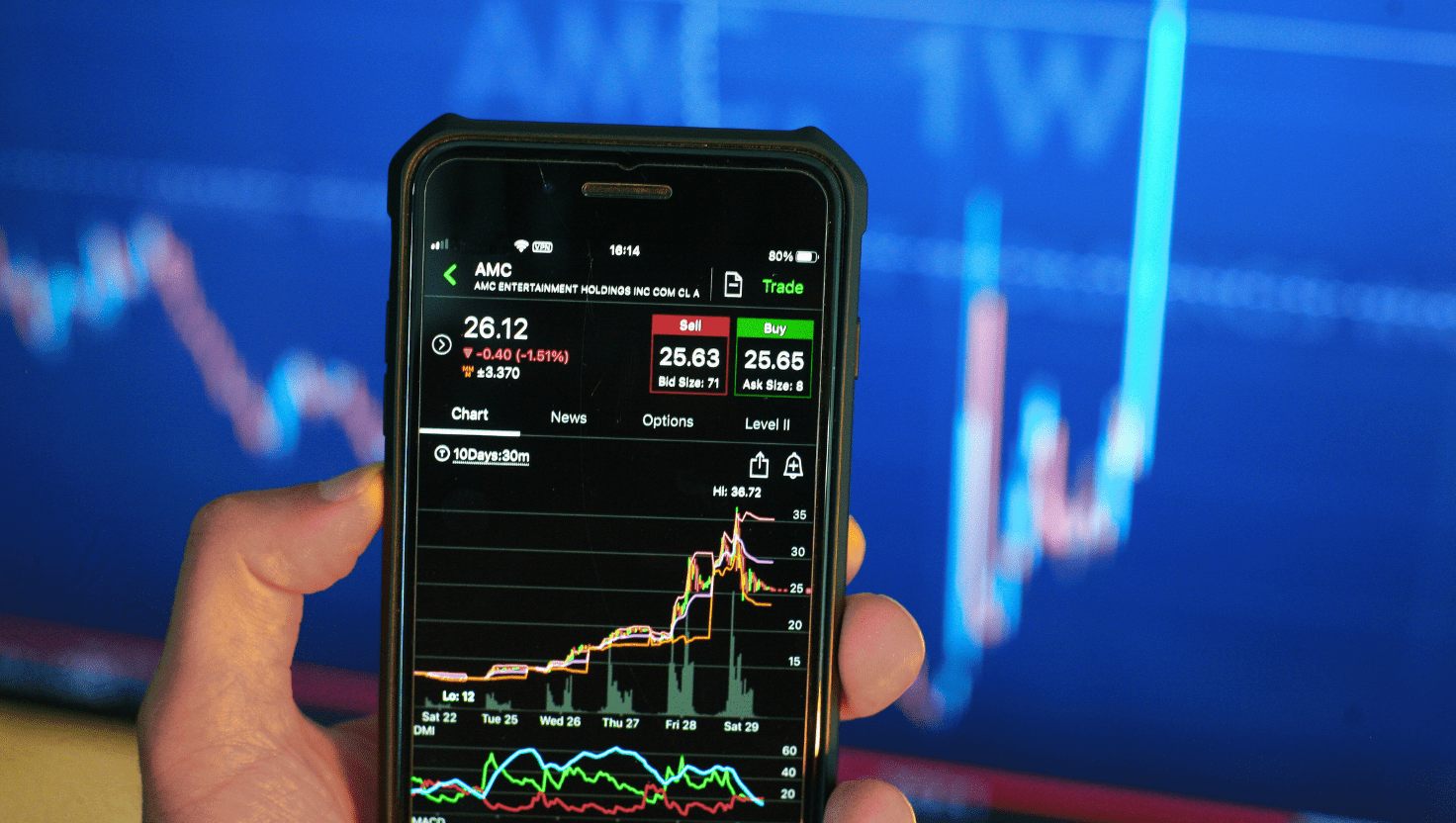

Top Global and Indian News to Watch on Thursday, 17th July 2025, Impacting the Indian Stock Market

Will U.S. tariffs shake Nifty50 or propel Sensex past 82,900 on July 17, 2025? Can Bank Nifty break

-

Indian Stock Market Analysis: Latest News and Predictions You Can’t Afford to Miss for Thursday, 17th July 2025

Will Nifty50 smash through 25,271 or crash below 25,137 on July 17, 2025? Can Bank Nifty conquer 57,318?

-

PNB MetLife Goal Ensuring Multiplier: Can This ULIP Plan Secure Your Family’s Future and Skyrocket Your Wealth?

Can the PNB MetLife Goal Ensuring Multiplier unlock your financial dreams? This ULIP blends life cover with market-linked

-

Is Your Child’s Future Safe? Explore Axis Max Life Shiksha Plus Super’s Benefits!

Can the Axis Max Life Shiksha Plus Super Plan secure your child’s future against soaring education costs? This

-

SBI Life Smart Scholar Plus: Shield for Your Child’s Dreams from Life’s Uncertainties?

SBI Life Smart Scholar Plus, the ultimate child ULIP plan for 2025! Can it secure your child’s dreams

-

Indian Stock Market Outlook for July 16, 2025: Sensex Soars, Bank Nifty Wobbles

Unlock Bank Nifty’s next big move and top stocks to watch! Get exclusive predictions, key support and resistance

-

HDFC Bank Insurance Coverage on Debit Card

The hidden perks of HDFC Bank’s debit cards! From ₹25 lakh accident cover to ₹3 crore air travel

-

What Is It Like Living on a Salary of Rs 46,000 Per Month at Age 33? A 2025 Perspective

Is Rs 46,000 enough at 33 in 2025 India? Explore the thrilling balance of rent, dreams, and savings

-

Top Stocks to Watch on Tuesday, July 15, 2025: Detailed Analysis

What’s driving the market on July 15, 2025? Will HCLTech recover from its earnings dip? Can Suzlon’s wind

-

Indian Stock Market Outlook: Sensex, Nifty 50, and Bank Nifty Predictions for July 15, 2025