10 Best Savings Accounts in India (November 2025) — Are You Missing Out?

The secret to earning up to 7% interest on your savings with no fees and exclusive insurance benefits in 2025. Discover RBI’s new nomination rules, monthly interest payouts, and smart hacks to maximize returns—before banks change the game again. Don’t miss these hidden perks shaping India’s savings revolution!

What if the savings account in your bank could actually pay you up to 7% interest, offer insurance coverage worth lakhs, and waive fees on dozens of essential services — all while helping you beat inflation? Many Indians are still unaware that the traditional savings account landscape has radically changed in 2025. The key details, hidden perks, and fresh policies could reshape how you safeguard and grow your money this year.

Read on to unravel these surprising and lesser-known aspects of India’s top savings accounts, and discover how you can maximize every rupee you deposit. If you’ve been complacent or overwhelmed by options, this eye-opening guide will spark urgency, aspiration, and relief — and potentially boost your financial well-being beyond what you thought possible.

Unique Benefits do Top Savings Accounts Offer in 2025

Top savings accounts in India in 2025 offer several unique benefits that go beyond traditional interest earnings, providing enhanced value to savers:

- High Interest Rates with Tiered Structures: Many leading banks like IDFC FIRST Bank and IndusInd Bank now provide interest rates up to 7% per annum for balances above certain thresholds (e.g., ₹5 lakh), often using tiered slabs to reward higher deposits more generously. This breaks the old norm of flat, low yields and allows savers to strategically boost earnings if they maintain larger balances.

- Monthly Interest Payout: Unlike conventional quarterly payouts, some banks such as RBL Bank credit interest monthly, accelerating compound growth and improving liquidity for savers who can reinvest interest sooner. This subtle change enhances real returns significantly over time.

- Zero or Reduced Banking Fees on Key Services: Several banks have waived fees on essential services, including ATM withdrawals, cheque book requests, and fund transfers (UPI/NEFT). IDFC FIRST Bank, for example, offers zero fees on over 30 banking services, easing transaction costs and improving savings retention.

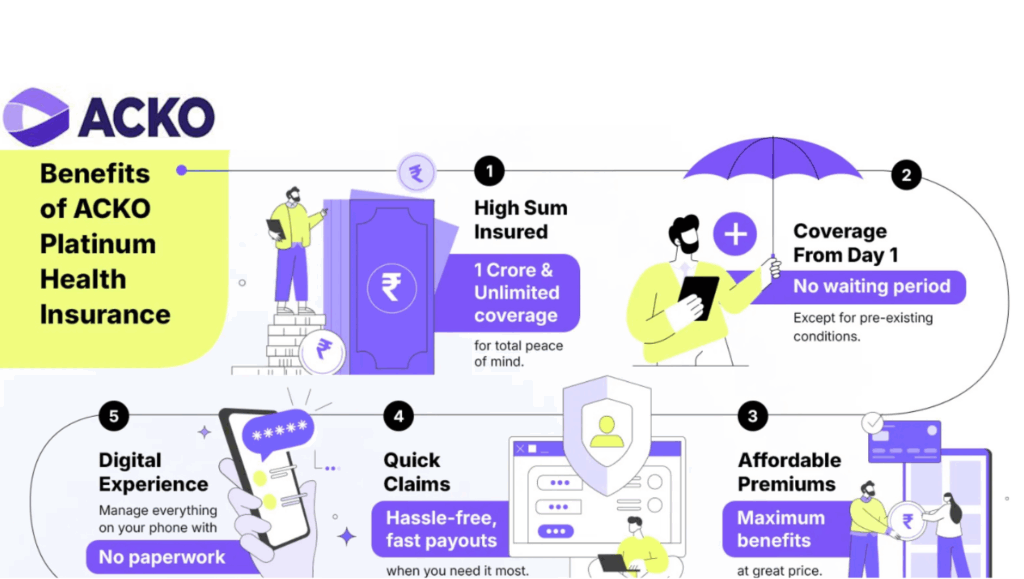

- Value-Added Insurance Benefits: Free personal accident insurance up to ₹35 lakh and other insurance coverages bundled with savings accounts are new perks that provide safety nets to account holders without extra premiums. This creates added financial security, especially attractive for working professionals and families.

- Enhanced Nomination and Succession Rules: RBI’s new rules allow up to four nominees on savings accounts and locker facilities, simplifying inheritance and legal processes in the event of the account holder’s demise. This is a key protective feature often overlooked but increasingly relevant for estate planning.

- Innovative Account Features Like ActivMoney: Banks like Kotak Mahindra offer hybrid products such as ActivMoney that link savings accounts with low-risk debt funds, potentially increasing yield to near 7% while maintaining liquidity and safety. This blend of investment and savings is a fresh concept helping savers earn more with minimal hassle.

- Digital-First and Mobile-Optimized Banking: The top accounts integrate seamless app experiences with instant notifications, real-time transactions, and digital KYC, enabling effortless saving and monitoring with zero paperwork or delays. The convenience factor supports better financial discipline and prompt decision-making.

These unique benefits reflect a major evolution in Indian savings accounts in 2025, turning them from simple deposit holders into powerful tools for growth, security, and financial management.

The 10 Best Savings Accounts of November 2025: Details, Surprises, and Standouts

| Bank Name | Interest Rate (p.a.) | Minimum Balance | Notable Features & Hidden Perks |

| IDFC FIRST Bank | Up to 7.00% (₹5L to ₹10Cr) | ₹25,000 | Zero fees on 30+ services; free personal accident insurance of ₹35L; monthly interest payouts; doorstep banking; high ATM/POS limits |

| IndusInd Bank | Tiered: 2.5% (~₹1L), 3%, 3.5%, up to 7.00% | Varies | Aggressive tiered rates rewarding high balances; premium service options; both zero balance & premium accounts |

| RBL Bank | 3.25% up to ₹1L, increasing to 7.00% progressive | None specified | Monthly interest credit; progressive slab rates; no max balance limits |

| Kotak Mahindra Bank | Flat 2.5%; Edge account can approach 7% via ActivMoney | Varies | Uniform domestic & NRI rates; ActivMoney can boost returns significantly; wide account variants for specific needs |

| SBI | 2.70% - 3.00% (uniform across variants) | Rs.0 - Rs.10,000 | No minimum balance for many variants; nomination benefits enhanced from Nov 2025; extensive branch network |

| Axis Bank | 2.75% - 3.25% | Rs.10,000 | Tiered rates; extensive digital tools; high transaction limits; salary and pension account variants |

| HDFC Bank | Flat 2.50% | Varies | Wide account options; focus on digital banking; salary & senior citizen focus; consistent interest calculation method |

| DCB Bank | Competitive rates but details less public | Not specified | Known for strong customer service and physical statements besides digital options |

| Yes Bank | Competitive, tiered 3%-6% | Varies | Cashback offers; digital-first banking approach |

| Federal Bank | Competitive rates with occasional promotions | Varies | Personalized banking with digital and branch access |

Hidden Nuggets and What You Should Know

1. IDFC FIRST Bank: The Most Powerful Interest + Zero Fees Combo

Many customers don’t realize that IDFC FIRST Bank stands alone in offering a staggering 7% interest for balances between ₹5 lakh and ₹10 crore. What’s more, they have eliminated fees on over 30 essential services—covering everything from ATM withdrawals to cheque books. The icing on the cake: free personal accident insurance up to ₹35 lakh and complimentary domestic lounge access quarterly for its premium savings account holders. This can be a game-changer for young professionals and high net-worth individuals seeking wealth security and growth.

2. RBL Bank’s Monthly Interest Surprise

Unlike many banks that pay interest quarterly, RBL Bank started monthly crediting of savings interest in May 2025, accelerating compounding effects and allowing savers to reinvest quickly. Plus, tiered rates up to 7% based on balance slabs provide a flexible, rewarding structure for savers at every level. This shift is little publicized but dramatically impacts how much your savings grow year-round.

3. RBI’s Groundbreaking November 2025 Nomination Rule

Starting November 1, 2025, RBI requires banks to allow up to four nominees to deposit accounts and safe deposit lockers, with clear informational mandates to account holders. This rule, quietly implemented, is profound: it simplifies inheritance processes and protects your family from legal complications and delays. Many Indian savers overlook this, but it could save countless headaches, especially affecting succession planning for savings accounts.

4. Tiered Interest Rates Are the New Norm, Beware the Minimum Balance Trap

Banks like IndusInd and RBL aggressively reward higher balances with rates that jump significantly—sometimes doubling beyond ₹5 lakh deposits. But maintaining these balances is crucial as falling short often results in penalties or low base interest rates on the entire balance. Kotak Mahindra's ActivMoney feature is another intriguing innovation, bundling savings with investment in debt funds to potentially boost returns to near 7%—a secret weapon for disciplined savers.

How to Choose Your Savings Account Right Now

- If you regularly maintain balances above ₹5 lakh, IDFC FIRST Bank and IndusInd Bank offer the most lucrative interest rates with premium benefits and insurance.

- For moderate balances under ₹1 lakh, consider RBL Bank for monthly interest compounding and a reliable progressive rate structure.

- Kotak Mahindra Bank is ideal for NRI savers and those who prefer uniform rates plus potential high returns via investment-linked options.

- If minimum balance or fees worry you, SBI and Axis Bank provide no/low minimum balance accounts with decent interest, backed by unmatched accessibility across urban and rural India.

- Look for banks with transparent fees waived on essential services to save a few hundred INR monthly without impacting interest earnings.

Actionable Takeaways for Indian Savers in 2025

- Act now to switch or upgrade your savings account before interest rates fluctuate further in 2026; these variations could impact returns by thousands annually.

- Use monthly interest payout accounts like RBL Bank to accelerate compound benefits rather than quarterly payouts.

- Pick accounts with insurance benefits and nomination rights as standard; they provide added security often overlooked.

- Explore hybrid accounts like Kotak’s ActivMoney for higher post-tax yields if you can tolerate low risk.

- Regularly review RBI notifications and new rules—like the multi-nomination policy and dormant account closures—for compliance and peace of mind.

The Future of Savings: What’s Next?

With rising inflation and evolving RBI regulations, savings accounts in 2026 may further integrate digital-first, fee-free models combined with wealth-building via mutual fund links or crypto-backed options. The game is set to change dramatically with AI-driven personal finance advice baked into mobile apps. Stay tuned as India’s top banks roll out these futuristic offerings that could transform your savings from simple deposits into powerful financial assets.