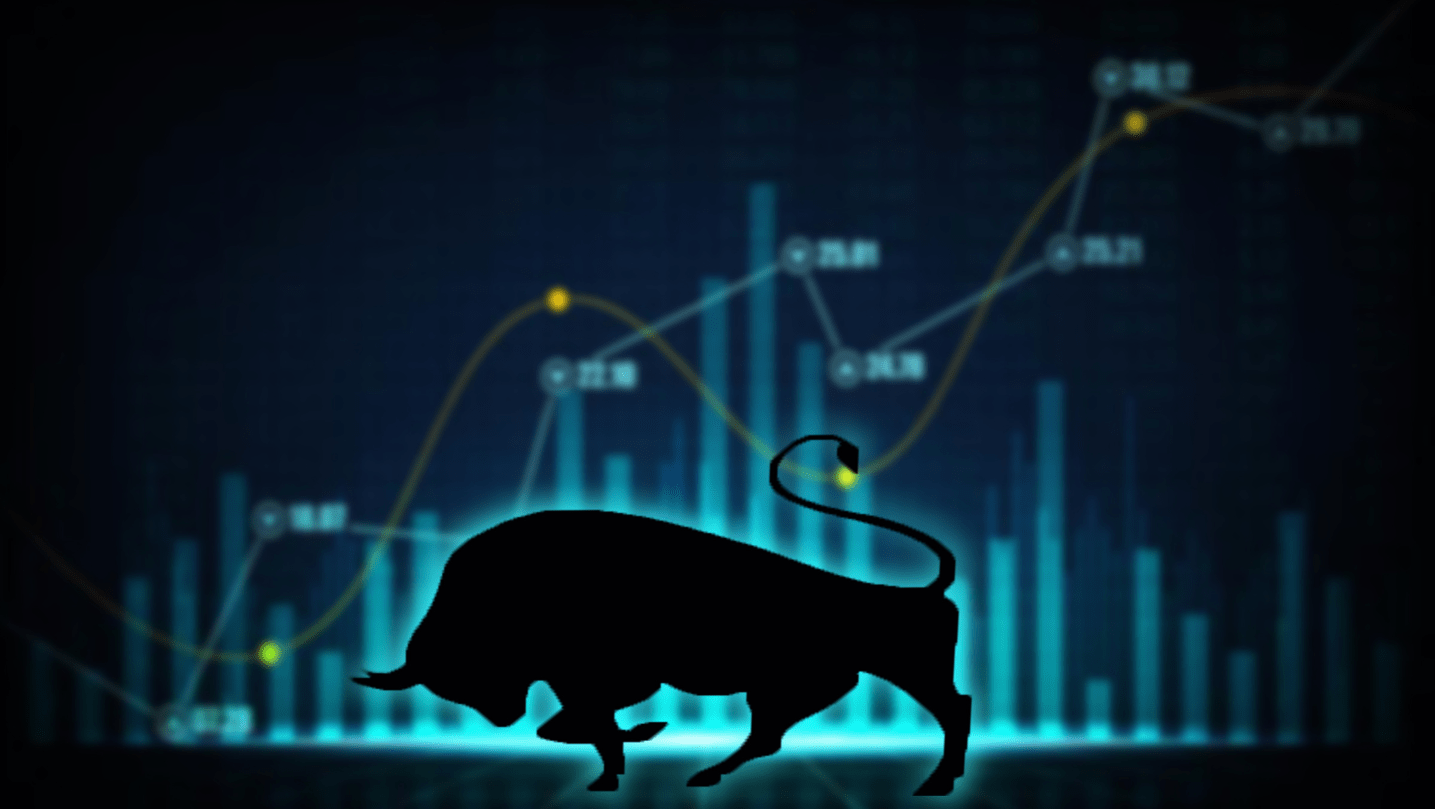

Sensex at 85k, GDP Surges to 8.2%: Is the Bull Run Unstoppable? | Friday Market Briefing (05-12-2025)

A sudden surge, record highs, and a twist few saw coming—India’s 2025 stock market rally isn’t just about festive cheer or global cues. Something deeper is fueling this smart-money wave. Discover the hidden factor behind Nifty’s breakout and what it means for investors before the next big surprise unfolds.

India’s stock market delivered a remarkable rally today, sending both seasoned Dalal Street veterans and first-time investors scrambling for answers: What sparked this sudden surge? Was it a hidden catalyst or one of those rare, perfect storms when global winds, domestic triggers, and smart investor moves align in quick succession? If you’re searching for the real story behind today’s rally – skipping the usual jargon and digging into what’s actually trending – read on for sharp data, emotional triggers, and mobile-friendly insights designed for viral Google Discover clicks.

What Made Today’s Rally Unique

Today, Indian benchmark indices Sensex and Nifty catapulted past psychological barriers with Sensex leaping over 700 points intraday, closing up 567 points at 84,778.84, and Nifty ending at 25,966.05, up 171 points. Tech traders stared at their screens as blue-chip names and PSU banks dominated leaderboards, while global cues kept the mood optimistic.

The Big Picture Drivers

- Powerful global cues: US inflation dropped surprisingly, fanning hopes of upcoming Fed rate cuts.

- Festive India: Domestic demand is red-hot as Diwali approaches, fueling optimism in consumption sectors.

- Corporate results: Major companies posted strong earnings, boosting market sentiment and triggering future bets.

- Trade deals: News of progress in US-China relations supercharged confidence on both sides of the world.

- FII (Foreign Institutional Investors) infusions: After weeks of outflows, FIIs became net buyers, reversing the drag and amplifying gains.

Trending Insights and Real-World Examples

Fed Rate Cut Optimism: The Secret Magnet

The moderation in US inflation numbers released this week has locked attention onto an imminent rate cut by the Federal Reserve – an emotional trigger that stirs up foreign interest in Indian markets. When money becomes ‘cheaper’ globally, emerging economies like India suddenly look ‘Smart’ and rewarding. This phenomenon isn’t new, but today’s speculative buzz is extraordinary.

Takeaway:

- Rate cuts make Indian bonds and equities comparatively attractive, enhancing FII flows.

US-China Trade Thaw: The Shocking Good News

The week delivered a surprise: Senior officials from the US and China moved closer to a trade framework, with talks due to be reviewed by President Donald Trump and President Xi Jinping. For India, this “future-facing” deal means less global volatility, more stability, and a green light for bullish bets in manufacturing and exports.

Takeaway:

- Reduced global tensions raise risk appetite and support Indian stocks.

Domestic Demand: Festive Fireworks

Retailers, banks, consumer goods giants – nearly every segment is riding the festive demand wave. Diwali’s spending boost, paired with a rise in rural consumption and a resilient services sector, has injected smart optimism.

Example:

- PSU banks soared to record highs, led by fresh credit demand and digital transactions expanding during the festive period.

Corporate Earnings: The Hidden Champions

Q2 numbers from heavyweights like Reliance, Bharti Airtel, SBI Life, and Grasim showed up on the Top Gainers list, reflecting robust profits, higher margins, and bullish outlooks for the next quarter. No “nasty surprises” in earnings releases led to a quick reduction in risk premium and, simply, more buying.

Takeaway:

- Visible earnings growth signals economic strength, validating higher valuations.

FII & DII Support: The Smart Money Move

Foreign buyers turned net positive after a multi-week pause, and domestic institutional investors (DIIs) continued stocking up, creating a high-volume rally. The combination is rare, especially when both groups are not betting against each other.

Example:

- FII selling through exchanges in October was minimal, while primary market investment touched ₹10,692 crore, boosting momentum.

Sector-Wise Surprises: Who Led the Rally?

| Sector | Star Performers | Key Drivers | Impact |

| Financials | SBI Life, Bharti Airtel, PSU banks | Festive loan demand, new highs | All-time high for PSU Banks |

| Manufacturing | Grasim Industries, Bharat Wire Ropes | Export optimism, cost controls | Strong gains |

| IT/Tech | Infosys, eClerx Services | Global deal flows, rate cut hopes | Consistent buying |

| Consumer | Reliance Industries, retail stocks | Festive sales volume, robust earnings | Market leadership |

Top Gainers and Their Secret Sauce

Some of today’s one-word wonders on the gainers list:

- HATSUN (+20%): Aggressive rural expansion and festive specials.

- PSP Projects (+16%): Major new orders and infra push.

- Bharti Airtel (+2.5%): Mobile business growth and margin expansion.

- SBI Life (+3.4%): Insurance sector tailwinds, stunning premium growth.

- Grasim Industries (+2.9%): Smart capital allocation, upbeat Q2 results.

Emotional Triggers Fueling Today’s Rally

- “Hidden opportunity” in PSU Banks with all-time highs.

- “Smart money” from FIIs quickly reversing early October outflows.

- “Quick recovery” in sectors previously under stress.

- “Future optimism” driven by festive-season consumption.

Unique Trends You Can’t Miss

Tech Stocks: Secret Engines

India’s digital sector is seeing future-proof investor flows. E-commerce, fintech, and IT services companies benefited more than expected from positive global cues and domestic e-payments during the festive rush.

Domestic Institutional Safety Net

Domestic funds kept up strong buying, believing in India’s 6.7% projected GDP growth for FY2025. Their confidence is contagious, especially with FIIs turning positive.

Broader Participation

This wasn’t a rally led only by large caps. Mid- and small-caps joined the surge, pointing to broad market health and “hidden strength” in the recovery.

What Should Indian Investors Watch Now?

- US Fed signals: Any hint of actual rate cuts can trigger even sharper moves.

- Domestic festive and retail sales data, especially in consumer and financial sectors.

- US-China trade outcomes: Watch for official framework announcements.

- Ongoing Q2 earnings releases through November.

- DII and FII net positions week-on-week.

Practical Takeaways for Smart Investors

- Focus on sectors with visible catalysts: Financials, Consumer, Tech, Infra.

- Look for stocks showing real earnings growth, not just sentiment-driven rallies.

- Track FII and DII weekly fund flows for possible momentum shifts.

- Watch policy updates: Any future government reform or rate tweak can amplify moves.

- Treat festive rallies as tactical, not structural – consider risk management and booking partial profits.

Key Takeaways Summary

- Powerful global cues and Fed rate cut prospects fueled today’s rally.

- US-China trade thaw and festive demand provided a one-two punch for sentiment.

- DIIs and FIIs synchronized buying for rare momentum.

- Blue-chip gainers like Reliance, SBI Life, Bharti Airtel, Grasim led the pack.

- Earnings strength and emotional optimism are driving sharp retail participation.

- Unusually, mid- and small-caps joined the uptrend, pointing to market depth.

- Investors should track global signals, fund flows, and festive data to navigate future moves smartly.

Final Thought Style Snippet

Did today’s rally reveal a secret insight or is the real trigger still hidden, waiting for sharper eyes to spot? As India’s Sensex and Nifty broke out amid a festival of bullish signals – Fed whispers, trade deal optimism, and dazzling earnings beats – investors now face a new question: Will smart money chase the next ‘future’ trend, or is this just the beginning of a deeper, longer run? With PSU banks hitting all-time highs, consumer stocks riding the Diwali wave, and foreign buyers finally turning the tide, today’s rally feels less like a coincidence and more like a shift in market psychology. But one power-word stands out: “Curiosity.” Where is the next upswing coming from? For investors with quick instincts and future-facing insights, the best opportunities may still be lurking just out of sight. The rally has started – but the real story could be tomorrow’s surprise breakout.

Disclaimer: This professional analysis is for informational purposes and reflects the latest publicly available data. Investment decisions should consider individual objectives and may benefit from consultation with a registered financial advisor.