Which Banks Provide the Best Zero-Balance Savings Accounts

The surprising benefits of zero-balance savings accounts in India for 2025. Discover how these accounts go beyond zero balance to offer hidden rewards, smarter digital banking, and financial freedom for millions. Ready to transform your banking experience with perks you never expected? Find out what banks aren’t telling you yet!

Did you know that the “best” zero-balance savings accounts in India can offer you more than just freedom from maintaining a minimum balance? While many think zero balance means zero benefits, some accounts come loaded with cashback offers, complimentary insurance, and even premium lifestyle perks that go beyond basic banking. But which banks truly deliver these hidden rewards without catching you off guard with hidden fees? Uncover this and more in the ultimate guide to zero-balance savings accounts in India in 2025—a must-read before you open your next account.

Zero-Balance Savings Accounts have Revolutionized Banking

Zero-balance savings accounts have revolutionized banking in India by removing the long-standing barrier of maintaining a minimum balance for account holders. These accounts allow customers to open and operate savings accounts without the stress of maintaining any minimum amount, eliminating penalties for low or zero balances. This has made banking more accessible and inclusive, especially for those from low-income groups, students, and people new to formal financial systems.

Importantly, government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have played a critical role in expanding financial inclusion by promoting zero-balance accounts to millions of unbanked and underbanked citizens. These accounts not only bring people into the formal financial system but also offer social security benefits, such as accident insurance and direct benefit transfers, making them vital tools in India’s inclusive growth story.

What Makes a Zero-Balance Savings Account Truly Valuable?

A zero-balance savings account holds unique value by eliminating the need to maintain a minimum balance, freeing account holders from penalties and financial stress. These accounts often offer competitive interest rates, with some banks providing up to 4% or higher, helping savings grow effortlessly. Most provide free debit cards — ranging from basic RuPay to premium international variants — ensuring seamless access to funds. Account holders also benefit from multiple or unlimited free ATM withdrawals, making cash access convenient. Digital-first features like instant Aadhaar-based KYC, mobile banking apps, and UPI payments take banking to the user’s fingertips, enhancing ease and immediacy. Beyond these essentials, leading banks add enticing benefits such as cashback on spends complimentary insurance, and lifestyle rewards, making zero-balance accounts not just practical but also rewarding. This combination of financial freedom, technology integration, and added perks makes zero-balance savings accounts truly valuable choices in 2025 India.

Top Zero Balance Savings Accounts in India 2025: Beyond the Obvious

| Bank / Neobank | Interest Rate Range | Key Benefits | Notable Perks & Hidden Features |

| State Bank of India (BSBDA) | 2.70% | No minimum balance, free RuPay debit card, gov benefits | Highest trust factor; PMJDY benefits for eligible |

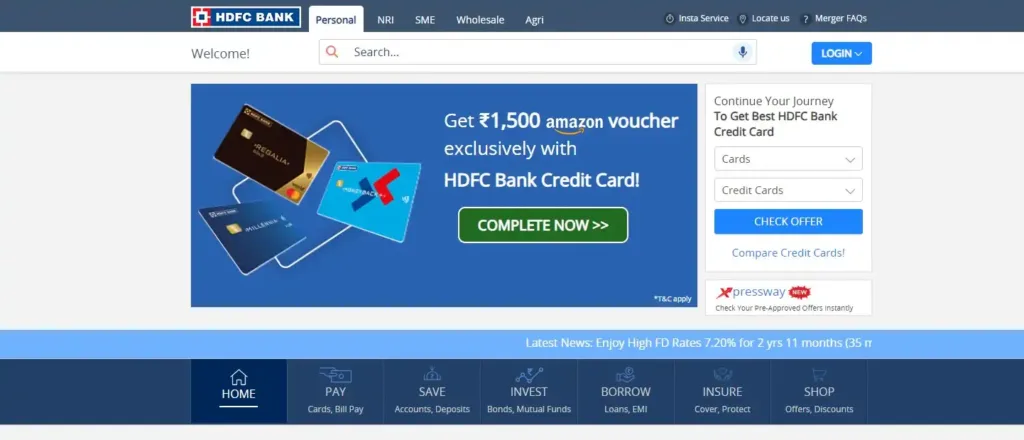

| Kotak Mahindra Bank 811 | 3.50% | Fully digital, free international debit card | Cashback offers, easy fixed deposit linking |

| IndusInd Bank Indus Delite | 3.50% | Zero maintenance charges, free movie tickets | Complimentary insurance, cashback on fuel & dining |

| AU Small Finance Bank | 3.50% | Digital banking, competitive interest | Enhanced digital experience, frequent cashback |

| RBL Bank Basic Savings | 3.25% | Free RuPay card, free cheque books | Higher FD rates, free card replacement |

| Utkarsh Small Finance Bank | 4.00% | Zero balance, attractive rates | Designed for rural & semi-urban customers |

| Neobanks like Jupiter, Fi Money, NiyoX | Varies up to 7.00% | Instant KYC, budgeting tools, no charges | Personalized recommendations, expense tracking |

Why Some Zero-Balance Accounts Are Better for Your Lifestyle

Government policies, especially the Pradhan Mantri Jan Dhan Yojana (PMJDY), have played a transformative role in shaping zero-balance savings accounts in India. Launched to promote financial inclusion, PMJDY ensures that every unbanked adult can open a basic savings account without any minimum balance requirement or maintenance charges. These accounts come with free RuPay debit cards, accident insurance coverage of up to ₹2 lakh, and eligibility for overdraft facilities, making banking accessible and secure for millions. Furthermore, government subsidies and direct benefit transfers are credited directly to these accounts, enhancing their practical value. By removing entry barriers and fostering digital transactions, these policies have made zero-balance accounts a cornerstone of India’s inclusive financial ecosystem, empowering the economically disadvantaged to save, transact, and access credit seamlessly in 2025

How Government Policies & Financial Inclusion Shape Zero-Balance Savings Accounts

- Role of PMJDY in broadening access, especially to rural and first-time bank users.

- Tax advantages and subsidies linked with certain zero-balance accounts.

- Promoting cashless and digital payments through zero-balance accounts with UPI and mobile wallets.

Why Switching to Zero-Balance Accounts Offers Relief & Aspiration

Switching to zero-balance savings accounts offers relief from the stress and surprise penalties linked with maintaining minimum balances. These accounts empower users to embrace smart, tech-enabled banking tailored for busy, mobile lifestyles. In 2025, fierce competition among banks has driven them to provide attractive rewards and higher interest rates, creating urgency to switch and benefit. Moreover, zero-balance accounts symbolize financial empowerment, especially for first-timers, millennials, and digital natives seeking seamless, inclusive banking. They offer a worry-free, accessible way to save, spend, and earn rewards, making it easier to take control of personal finances without unnecessary constraints or fees

Actionable Takeaways for Readers

- Compare interest rates and hidden benefits before choosing a bank.

- Opt for neobanks if you want maximal digital convenience and budgeting tools.

- Consider lifestyle benefits like cashback and insurance while selecting an account.

- Use online portals and apps to open accounts seamlessly with instant KYC.

- Monitor account terms regularly for changes in fees or withdrawal limits.

Future Outlook: What Next for Zero-Balance Accounts?

The future of zero-balance savings accounts in India looks promising, driven by technological advancements and evolving regulatory frameworks. Banks are increasingly integrating AI-driven personalization, offering tailored financial products and smarter budgeting tools. The Reserve Bank of India’s proposed guidelines will make digital banking features like UPI, fund transfers, and net banking free for zero-balance accounts, enhancing convenience and accessibility. The rise of neobanks and fintech partnerships will further enrich these accounts with seamless investment and credit options. Additionally, digital onboarding and paperless KYC processes will become more widespread, ensuring faster, hassle-free account openings. Overall, zero-balance accounts are set to become the default banking solution, fostering financial inclusion, digital literacy, and inclusive growth in 2025 and beyond.