“Learn why and how often you should check your credit score in India. Discover tips to improve your CIBIL score, detect errors, and prevent fraud. Stay financially healthy with expert advice on credit score monitoring and maintenance. Read now to unlock better loans, lower interest rates, and financial stability!”

Maintaining a good credit score is crucial. Your credit score can influence your ability to secure loans, get favorable interest rates, and even affect your job prospects. Regularly checking your credit score is an essential practice for managing your financial health. This blog post will delve into why it’s important to review your credit score and how often you should do it, backed by the latest data and insights.

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. In India, credit scores are calculated by credit bureaus such as CIBIL (Credit Information Bureau India Limited), Experian, Equifax, and CRIF High Mark. These scores typically range from 300 to 900, with a score above 750 considered excellent. Lenders, including banks and NBFCs (Non-Banking Financial Companies), use this score to assess your ability to repay loans and credit card dues.

Key Factors Affecting Your Credit Score:

- Payment History (35%): Timely repayment of loans and credit card bills.

- Credit Utilization (30%): The percentage of your credit limit you use.

- Credit Mix (15%): A healthy mix of secured (e.g., home loans) and unsecured loans (e.g., personal loans).

- Length of Credit History (15%): The duration you’ve held credit accounts.

- Recent Credit Inquiries (5%): The number of times lenders have checked your credit report.

Why is Your Credit Score Important?

Your credit score is more than just a number—it’s a reflection of your financial discipline. Here’s why it matters in India:

- Loan Approvals: Whether it’s a home loan, car loan, or personal loan, a high credit score increases your chances of approval.

- Lower Interest Rates: A good credit score can help you secure loans at lower interest rates, saving you money in the long run.

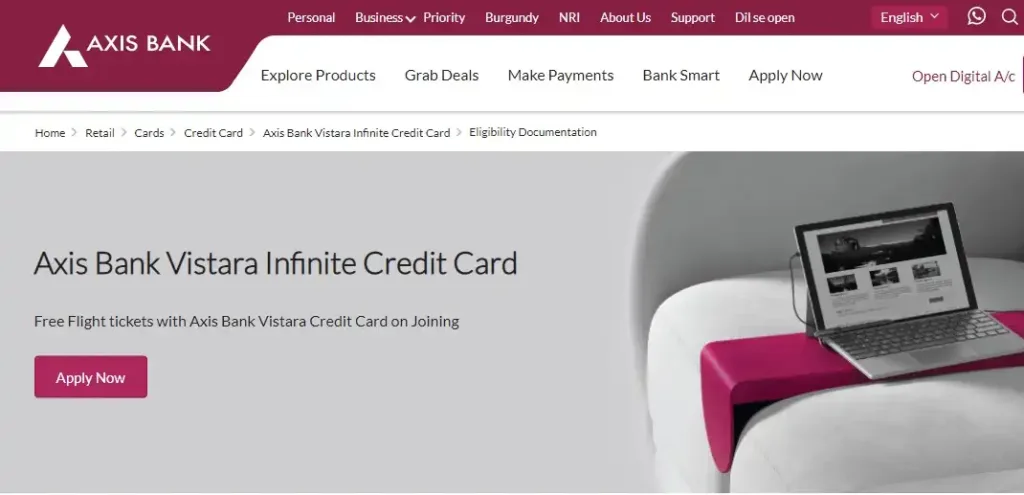

- Credit Card Approvals: Banks are more likely to approve credit card applications from individuals with high credit scores.

- Renting a Home: Some landlords in urban areas check credit scores to assess a tenant’s financial reliability.

- Employment Opportunities: Certain employers, especially in the financial sector, may review credit scores as part of their hiring process.

- Faster Loan Processing: A high credit score can expedite loan approvals and disbursements.

Given its impact on your financial life, monitoring your credit score is essential for maintaining financial stability in India.

Why is Checking Your Credit Score Important?

- Understanding Your Financial Health Your credit score is a snapshot of your financial health. It reflects your creditworthiness and helps lenders determine the risk of lending you money. A high credit score indicates that you are a reliable borrower, while a low score can signal potential financial instability.

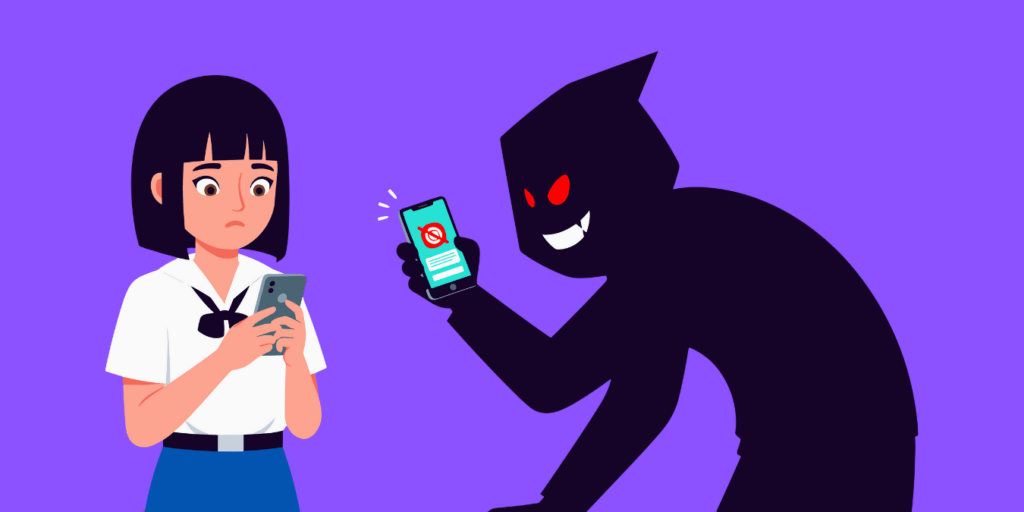

- Detecting Errors and Fraud Regularly checking your credit score can help you spot errors or signs of fraud early. According to a study by the Reserve Bank of India, a significant number of consumers had errors on their credit reports. Detecting these errors early can prevent long-term damage to your credit score.

- Improving Your Credit Score By monitoring your credit score, you can identify areas for improvement. For instance, if your score is low due to high credit utilization, you can take steps to pay down your balances and improve your score.

- Preparing for Major Financial Decisions If you plan to apply for a home loan, car loan, or any other significant financial product, knowing your credit score in advance can help you understand what to expect. It allows you to take corrective actions if needed, ensuring you get the best possible terms.

How Often Should You Check Your Credit Score?

- At Least Annually The general recommendation is to check your credit score at least once a year. This is often enough to catch any significant changes or errors.

- Before Major Financial Decisions If you are planning to make a major financial decision, such as buying a house or car, it’s wise to check your credit score a few months in advance. This gives you time to address any issues that might affect your loan approval or interest rates.

- Regular Monitoring for Identity Theft In today’s digital age, identity theft is a growing concern. Regularly monitoring your credit score can help you detect unauthorized activities early. Some experts recommend checking your score quarterly or even monthly if you have been a victim of identity theft in the past.

- Using Credit Monitoring Services Many credit monitoring services offer real-time alerts and monthly updates on your credit score. These services can be particularly useful if you want to stay on top of your credit health without manually checking your score.

How to Check Your Credit Score

Checking your credit score in India is simple and convenient. Here are some reliable methods:

1. CIBIL

CIBIL is the most widely used credit bureau in India. You can access your CIBIL score and report by visiting their official website or using their mobile app. A free version is available, but detailed reports may require a fee.

2. Experian

Experian offers free credit scores through its website and app. You can also purchase detailed credit reports for a nominal fee.

3. Equifax

Equifax provides credit scores and reports to Indian consumers. You can access your score by signing up on their website.

4. CRIF High Mark

CRIF High Mark is another credit bureau in India that offers credit scores and reports. Their services are available online and through partner platforms.

5. Bank and NBFC Apps

Many Indian banks and NBFCs, such as HDFC Bank, ICICI Bank, and Bajaj Finserv, offer free credit score access to their customers. Check your bank’s mobile app or net banking portal for this feature.

6. Financial Apps

Apps like Paytm, PhonePe, GooglePay and CRED provide free credit score checks and monitoring services. These platforms also offer tips to improve your score.

Latest Data and Trends

- Impact of COVID-19 on Credit Scores The COVID-19 pandemic has had a significant impact on credit scores. According to CIBIL, the average credit score in India increased during the pandemic due to reduced spending and moratoriums on loan repayments.

- Rising Importance of Credit Scores With the increasing reliance on digital transactions, credit scores have become more critical than ever. Lenders are using more sophisticated algorithms to assess creditworthiness, making it essential for consumers to maintain a good credit score.

- Technological Advancements in Credit Monitoring Advances in technology have made it easier for consumers to monitor their credit scores. Mobile apps and online platforms provide real-time updates and personalized tips for improving credit scores.

Some Statistics

- Average Credit Score in India As of 2024, the average credit score in India is 720. This figure has shown a steady increase over the past few years, reflecting improved financial literacy and credit management among Indian consumers.

- Credit Score Distribution Nearly 60% of Indian consumers have a credit score of 750 or higher, which is considered good or better. This indicates that a significant portion of the population is maintaining healthy credit habits.

- Credit Card Debt Indians are carrying a growing amount of credit card debt, with the total outstanding amount reaching ₹1.5 lakh crore. Despite this high level of debt, the average credit score has remained stable, suggesting that consumers are managing their debt responsibly.

- Credit Score by Age Group The average credit score varies by age group. For example, Indians aged 25 to 35 have an average credit score of 700, while those older than 55 have the highest average score of 760.

- Credit Score by Income Level Low-income families have a median credit score of 650. This highlights the challenges faced by lower-income households in maintaining good credit.

- Credit Score by Region Consumers in metropolitan areas tend to have higher average credit scores compared to those in rural areas. This statistic underscores the importance of access to financial education and resources.

Tips to Improve and Maintain a Healthy Credit Score

If your credit score isn’t where you want it to be, don’t worry—there are steps you can take to improve it:

1. Pay Your Bills on Time

Payment history is the most significant factor in your credit score. Set up payment reminders or automatic payments to avoid missed deadlines for loans and credit card bills.

2. Reduce Credit Card Balances

Credit utilization—the percentage of your credit limit you use—makes up a large portion of your score. Aim to keep your utilization below 30%, and ideally under 10%, to boost your score.

3. Avoid Multiple Loan Applications

Each time you apply for a loan or credit card, a hard inquiry is recorded on your report, which can temporarily lower your score. Limit new credit applications to only what you need.

4. Maintain a Healthy Credit Mix

Having a mix of secured (e.g., home loans) and unsecured loans (e.g., personal loans) can positively impact your score. However, only take on credit you can manage responsibly.

5. Keep Old Accounts Open

The length of your credit history contributes to your score. Even if you no longer use an old credit card, keeping it open can help maintain a longer credit history.

6. Dispute Errors on Your Credit Report

If you find inaccuracies on your credit report, file a dispute with the credit bureau to have them corrected. This can lead to an immediate improvement in your score.

The Bottom Line

Regularly checking your credit score is a vital practice for maintaining your financial health. It helps you understand your financial standing, detect errors and fraud, and prepare for major financial decisions. By staying informed and proactive, you can ensure that your credit score remains in good shape, opening doors to better financial opportunities.

Remember, your credit score is more than just a number; it’s a reflection of your financial responsibility. Make it a habit to review your credit score regularly and take the necessary steps to improve it. Your future self will thank you.

-

US Supreme Court Strikes Down Trump’s Global Tariffs as ‘Unlawful’ — The 18% Tariff on India Is Now Illegal

-

Why Gold Prices Hit ₹15,745 per Gram Today: Indian Market Volatility Explained

-

Spirit Airlines Bankruptcy and Flight Cancellations — The Real Reason!

-

Gold and silver rates today: Latest Rates in all Major Cities February 20, 2026