” Why raising India’s deposit insurance cover to Rs 10 lakh is crucial for financial security. Learn about its impact on small depositors, financial inclusion, and banking stability. Stay informed with the latest insights from AIRBEA and global benchmarks. Protect your savings today! “

In recent years, the financial landscape in India has undergone significant changes, with the government and regulatory bodies taking proactive steps to ensure the stability and security of the banking system. The All India Reserve Bank Employees Association (AIRBEA) has recently advocated for an increase in the deposit insurance cover from the current Rs 5 lakh to Rs 10 lakh. This proposal aims to enhance the financial security of depositors and strengthen the overall stability of the banking system in India. In this blog post, we will delve into the significance of this proposal, its potential impact on the banking sector, and the broader implications for depositors and the economy

Understanding Deposit Insurance in India

Deposit insurance is a financial safeguard that protects depositors in the event of a bank failure. In India, the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the Reserve Bank of India (RBI), provides deposit insurance. Currently, the deposit insurance cover stands at Rs 5 lakh per depositor per bank. This means that if a bank fails, each depositor is guaranteed to receive up to Rs 5 lakh of their deposits, irrespective of the amount held in their account.

Latest Statistics on Deposit Insurance in India

To provide a comprehensive view, let’s look at some of the latest statistics related to deposit insurance in India:

- Coverage and Fund Size: As of 2025, the DICGC insures deposits in 1,997 banks across India. The total fund size of the DICGC stands at approximately Rs 2 lakh crore, making it the third-largest deposit insurance fund globally.

- Insured Deposits: Currently, only 46.3% of bank deposits are insured due to the Rs 5 lakh cap on insurance coverage. In terms of value, 43.1% of assessable deposits are insured.

- Global Comparisons: India’s deposit insurance system ranks eighth worldwide in terms of deposit coverage. In comparison, countries like the United States and Canada offer higher coverage limits, providing greater financial security to their depositors.

- Banking Sector Performance: The consolidated balance sheet of scheduled commercial banks in India increased by 15.5% during 2023-24. The gross non-performing assets (GNPA) ratio fell to its lowest in 13 years at 2.7% at the end of March 2024.

- Public Sector Banks: Most deposits in India are held in public sector banks or systemically important banks, which are generally considered stable. However, a significant portion of insured deposits is concentrated in cooperative banks, where over 90% of customers are fully covered based on the number of accounts held.

The Need to Raise Deposit Insurance Cover

- Increasing Financial Inclusion: Over the past decade, India has made significant strides in financial inclusion, with millions of new bank accounts opened under initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY). As more people enter the formal banking system, the need for a higher deposit insurance cover becomes imperative to protect the savings of these new account holders.

- Protecting Small Depositors: A significant portion of bank deposits in India is held by small and medium depositors. Raising the deposit insurance cover to Rs 10 lakh would provide greater protection to these depositors, ensuring that their hard-earned money is safe even in the event of a bank failure.

- Enhancing Consumer Confidence: The recent collapses of several cooperative banks and non-banking financial companies (NBFCs) have shaken consumer confidence in the banking system. A higher deposit insurance cover would reassure depositors that their money is safe, thereby enhancing trust in the financial system.

- Global Benchmarks: In many developed countries, the deposit insurance cover is significantly higher than in India. For instance, in the United States, the Federal Deposit Insurance Corporation (FDIC) provides a cover of up to $250,000 per depositor per bank. Raising the cover in India to Rs 10 lakh would bring it closer to global standards.

Current Scenario and Recent Developments

The proposal to raise the deposit insurance cover to Rs 10 lakh has been under discussion for some time. The All India Reserve Bank Employees Association (AIRBEA) has been a vocal advocate for this change, citing the need to protect depositors and ensure financial stability. The association has also highlighted the fact that the current cover of Rs 5 lakh has remained unchanged for several years, despite the significant increase in the cost of living and inflation.

In 2020, the RBI had proposed an increase in the deposit insurance cover to Rs 5 lakh from the previous Rs 1 lakh, which was a significant step forward. However, given the current economic environment and the increasing number of bank failures, there is a growing consensus that the cover needs to be raised further.

Potential Impact of Raising Deposit Insurance Cover

- Boost to Small and Medium Enterprises (SMEs): SMEs are the backbone of the Indian economy, and many of them rely on bank deposits for their working capital needs. A higher deposit insurance cover would provide these businesses with greater financial security, encouraging them to keep their funds in the banking system rather than opting for riskier alternatives.

- Stimulating Savings and Investment: With a higher deposit insurance cover, individuals and businesses are more likely to save and invest in the formal banking system. This, in turn, would lead to increased liquidity in the banking system, enabling banks to lend more and support economic growth.

- Reducing the Risk of Bank Runs: A bank run occurs when a large number of depositors withdraw their funds from a bank due to fears of insolvency. A higher deposit insurance cover would reduce the likelihood of bank runs, as depositors would have greater confidence in the safety of their funds.

- Encouraging Financial Stability: By providing a higher level of protection to depositors, the overall stability of the financial system would be enhanced. This would reduce the risk of systemic crises and ensure that the banking system remains resilient in the face of economic shocks.

Challenges and Considerations

While the proposal to raise the deposit insurance cover to Rs 10 lakh is widely supported, there are several challenges and considerations that need to be addressed:

- Cost to Banks: The deposit insurance premium is paid by banks to the DICGC. Raising the cover would increase the cost for banks, which could potentially be passed on to customers in the form of higher fees or lower interest rates on deposits.

- Moral Hazard: A higher deposit insurance cover could lead to moral hazard, where banks take on excessive risk knowing that depositors are protected. This could undermine the stability of the banking system in the long run.

- Implementation Challenges: Raising the deposit insurance cover would require changes to the existing legal and regulatory framework. This could take time and would need to be carefully managed to ensure a smooth transition.

The proposal to raise the deposit insurance cover to Rs 10 lakh is a timely and necessary step to protect depositors, enhance consumer confidence, and ensure the stability of the Indian banking system. While there are challenges to be addressed, the potential benefits far outweigh the costs. As the All India Reserve Bank Employees Association (AIRBEA) continues to advocate for this change, it is imperative that the government and regulatory bodies take swift action to implement this crucial reform.

In a rapidly evolving financial landscape, the safety and security of depositors must remain a top priority. By raising the deposit insurance cover to Rs 10 lakh, India can take a significant step towards achieving this goal, ensuring that the banking system remains robust and resilient in the face of future challenges.

-

Which Bank Gives the Cheapest Personal Loan in February 2026? Here’s What 10 Lenders Are Actually Offering

-

IDFC First Bank Chandigarh Branch Fraud: How Rs 590 Crore Went Missing From Haryana Government Accounts

-

YES Bank Aims for 1% ROA by FY26: Is India’s Most Dramatic Banking Comeback Finally Complete?

-

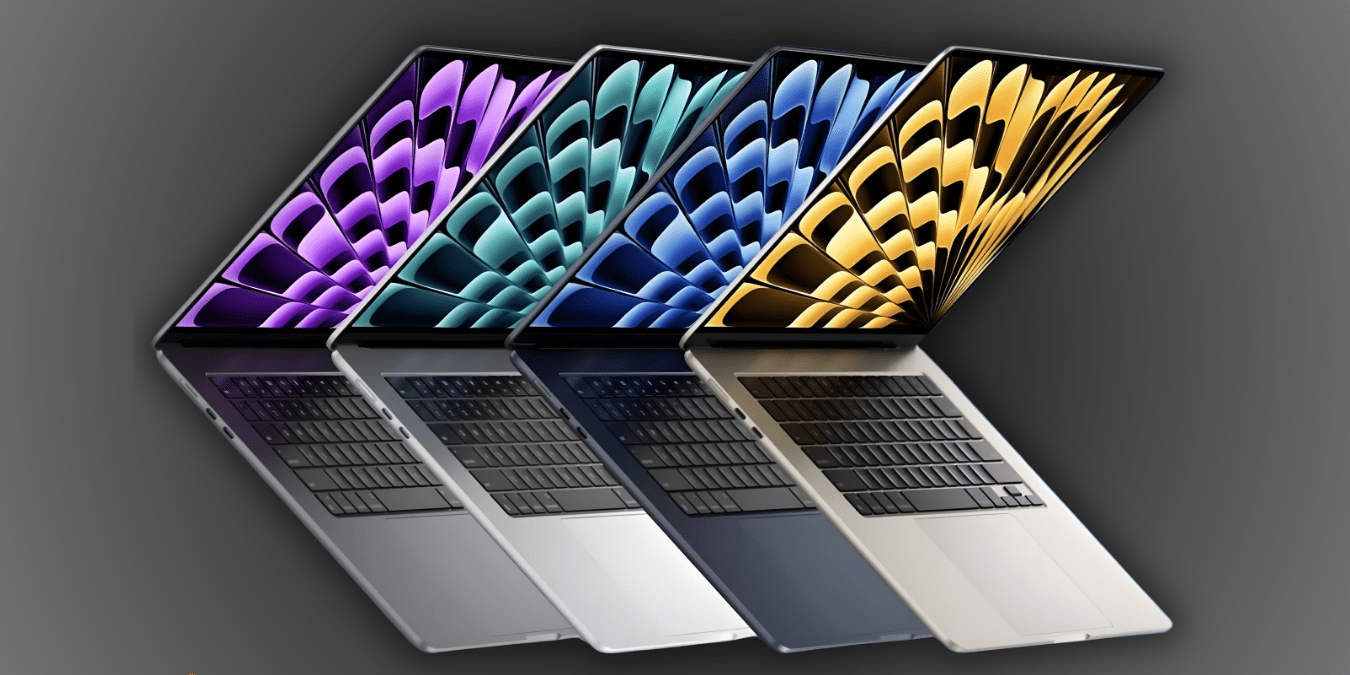

Grab the Apple MacBook Air M4 at Unbeatable Discounts (February 2026)