Visa, MasterCard, or RuPay? RBI Gives You the Power to Pick Your Card Network

Since October 1, 2025, RBI has quietly given Indian cardholders an incredible new power—the choice to pick their preferred debit card network. Will you unlock hidden rewards, lower fees, and smarter payments? Discover how this surprising shift could transform your everyday spending—and why most still don’t know about it.

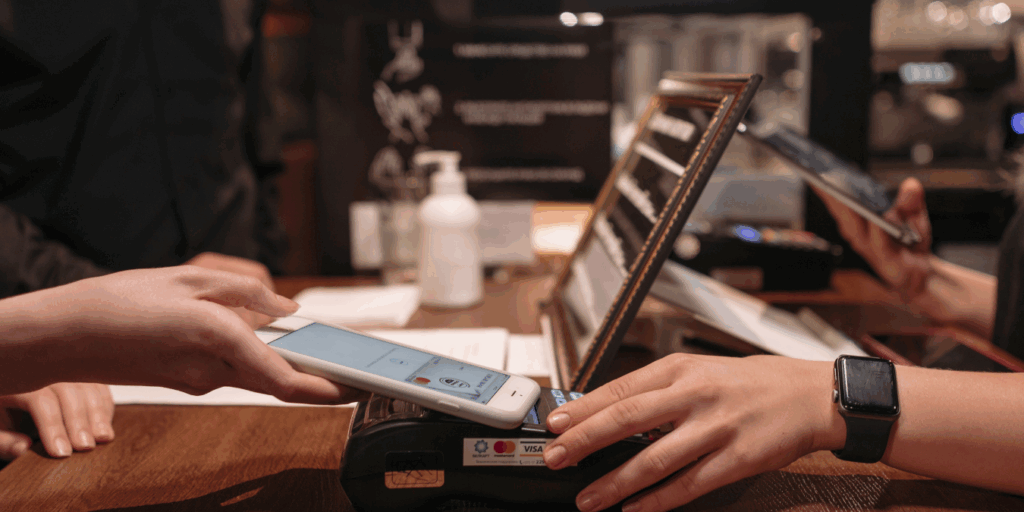

Holding a debit card that doesn’t just open doors worldwide but offers you the power to decide exactly which payment network it runs on—whether it’s Visa’s global reach, MasterCard’s trusted brand, or RuPay’s rising Indian powerhouse. Sounds like a payment revolution? It is. Since October 1, 2025, the Reserve Bank of India has quietly handed consumers an incredible new digital payment superpower: the freedom to pick their preferred debit card network. This hidden shift is not just about options—it’s a strategic game-changer that promises smarter payments, fierce competition among networks, and more rewards in your pocket. But are Indian consumers truly ready to unlock this secret advantage? Let’s explore how this emerging choice is redefining the payments landscape and what it means for you, today.

Why RBI’s Rule is a Gamechanger for Consumers

In the past, when you got a debit card, the card network was decided behind the scenes by your bank. Whether it was Visa, MasterCard, or RuPay, choices were limited by exclusive deals between banks and payment networks. You simply accepted what you were given.

RBI’s 2025 directive changes all that. Now:

- Banks cannot tie themselves exclusively to one card network.

- Customers must be offered the choice of multiple networks at the time of card issuance or renewal.

- This dismantles old barriers, encouraging vibrant competition and innovation.

- Ultimately, you win because you get to choose what suits your spending habits, lifestyle, and travel needs best.

This change paves the way for a payments market where consumer preference drives the direction—not locked agreements.

The Journey to Choice: Why This Move Today?

India’s payments evolution is one of the fastest globally. However, RBI noticed something crucial: the absence of choice for card users limited competition and innovation. Visa and MasterCard controlled large parts of the card ecosystem through exclusive agreements, stifling alternatives. Meanwhile, RuPay, India’s indigenous network, was growing, backed by UPI integration and government support.

After consultations, RBI mandated that, effective October 1, 2025, card issuers must provide consumers with the option to select the card network. Smaller issuers with fewer than 10 lakh cards and issuers with their own networks (like American Express) are exempt.

This marks a transition from issuer control to consumer empowerment—a fundamental change in the card industry dynamics.

What This Means for You: Beyond Just Choosing a Network

Why does this matter to you? Because your choice affects your payment experience, rewards, fees, and convenience. Here’s the lowdown:

Smart Savings and Lower Costs

- RuPay cards generally have lower transaction fees for merchants, potentially reducing costs passed on to customers.

- Some banks now offer better cashback and rewards on RuPay cards because they integrate seamlessly with UPI.

- Visa and MasterCard often have higher merchant fees, affecting service costs and availability.

Seamless UPI Integration

- RuPay’s native integration with India’s UPI payment system means faster and simpler payments at millions of outlets.

- Instant settlements and contactless payments mean you’re future-proofed in the digital economy.

Global Reach vs Domestic Convenience

- Visa and MasterCard remain dominant for international acceptance and travel perks.

- RuPay’s international acceptance is expanding but still limited. For frequent travelers, global networks might make more sense.

- For domestic users focused on cost and convenience, RuPay offers tremendous advantages.

Real Stories from Indian Consumers and Banks

Kotak Mahindra Bank’s Strategic Shift

Kotak Mahindra Bank openly supports RBI’s initiative, offering its customers multiple credit card options across RuPay, Visa, and MasterCard. They report that competition spurred by choice leads to better reward programs and more tailored offers, directly benefiting cardholders.

Voices on the Street

Consumers in metros appreciate the security and global acceptance of Visa and MasterCard, while users in tier 2 and tier 3 cities often prefer RuPay for its cost-efficiency and UPI-linked ease.

Merchants and the Market

Digital merchants find RuPay’s integration highly attractive due to lower processing fees and reduced complexity, making it a favorite in smaller towns and among small businesses. This has boosted digital payments inclusion, aligning perfectly with India’s digital economy goals.

What Lies Ahead: The Future of Card Networks in India

The consumer choice rule is just the beginning. Here’s what’s coming:

- Card portability may arrive soon, letting you switch networks without changing cards.

- Banks are investing heavily to upgrade IT systems to handle multi-network card issuance smoothly.

- Intense competition will spark innovation: expect new rewards, personalized offers, and advanced security features.

- RuPay aims to fast-track global acceptance, challenging the duopoly of Visa and MasterCard.

- Visa and MasterCard are doubling down on partnerships with fintechs and expanding UPI support to stay relevant.

Consumers can anticipate a smarter, richer, and more flexible card experience than ever before.

How to Choose the Right Network for Yourself

Before picking your network, consider:

- Your spending pattern: Domestic transactions may favor RuPay; international may favor Visa/MasterCard.

- Check your bank’s offers and rewards for each network.

- Think about UPI integration if you prefer quick QR code payments.

- Use card renewal season as the opportunity to switch networks for better benefits.

- Be aware that not all banks have fully implemented choice options yet — confirm with your bank.

Quick Takeaways for the Smart Indian Consumer

| Aspect | Details |

| Consumer Power | You choose Visa, MasterCard, or RuPay for debit cards starting Oct 1, 2025. |

| No More Exclusivity | Banks can’t limit you to one network via exclusive agreements anymore. |

| RuPay Benefits | Lower fees, seamless UPI, growing rewards, ideal for domestic use. |

| Visa/MasterCard Benefits | Strong global acceptance & travel benefits. |

| Renewal Opportunity | Switch networks or choose your preferred one during card renewal. |

| Market Impact | Increased competition = Better rewards, lower costs, and innovative features. |

The Secret Advantage You Didn’t Know You Had

The card in your wallet is no longer just plastic; it’s your gateway to a happier, cheaper, and more personalized digital payments future. RBI’s network choice rule is a quiet revolution empowering you to pick the card network that fits your life, whether that’s RuPay’s cost savings and digital ease or Visa and MasterCard’s global clout. Many cardholders remain unaware they can switch at renewal—don’t be one of them. Ready to unlock the secret advantage your next card can bring? With choice, the power is finally yours to wield. Your smartest financial tool yet is just waiting to be discovered.

Final Thought

Since October 1, 2025, a quiet revolution has transformed India’s payment world. Thanks to RBI’s new rules, debit cardholders can now pick their card network—Visa, MasterCard, or RuPay—free from banks’ exclusive deals. This shift brings more choices, sparking fresh competition and unlocking rewards, lower fees, and seamless UPI integration like never before. Whether you prefer RuPay’s domestic speed and savings or Visa’s global acceptance, your wallet now holds the key to a smarter payment future. Yet, here’s the shocker: many still don’t know this choice exists or that they can switch at renewal. Are you ready to discover how this hidden option can transform your spending experience? Don’t wait for your next card; explore your options today and turn your everyday payments into a powerful financial advantage.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!