UPI Goes Live in Qatar: Seamlessly Pay at Duty-Free Shops and Tourist Hotspots with UPI Payments

UPI just went live in Qatar, enabling Indian travelers to make seamless cashless payments from duty-free shops at Hamad Airport to popular tourist hotspots. Say goodbye to currency exchange hassles and enjoy real-time, secure payments through your UPI app. This groundbreaking launch is transforming how millions experience travel in Qatar while boosting the local economy. Discover surprising benefits, pro tips, and what this means for the future of cross-border payments. Ready to unlock a new level of convenience on your next trip?

The Unified Payments Interface (UPI) has officially launched in Qatar, transforming how Indian travelers make payments in the Gulf nation. From duty-free stores at Hamad International Airport to popular tourist destinations across Qatar, UPI payments are now accepted, providing a cashless, convenient payment experience. This milestone is a result of a strategic partnership between NPCI International Payments Limited (NIPL) and Qatar National Bank (QNB), introducing real-time, QR code-based UPI transactions at numerous merchant outlets. The rollout is expected to benefit both Indian travelers and Qatar’s retail and tourism sectors by enhancing payment interoperability and reducing currency exchange hassles.

What is UPI? A Quick Primer

Unified Payments Interface (UPI) is India’s revolutionary instant payment system developed by the National Payments Corporation of India (NPCI). It enables users to make secure, real-time payments via a simple Virtual Payment Address (VPA) without sharing bank account details. UPI has become the backbone of digital payments in India, processing billions of transactions daily, and its international acceptance is rapidly growing.

UPI in Qatar: Key Highlights

- Launch Date: September 2025

- Key Partners: NPCI International Payments Limited (NIPL) and Qatar National Bank (QNB)

- Technology Partner: NETSTARS powering the QR code-based payment solution

- First Merchant: Qatar Duty Free outlets at Hamad International Airport

- Merchant Coverage: Duty-free stores, major tourist attractions, retail outlets acquired by QNB

- Target Users: Millions of Indian tourists and visitors, who are the second-largest group of international travelers in Qatar

How UPI Payments Work in Qatar

Indian travelers can now use their UPI-enabled mobile apps to scan QR codes displayed at merchant point-of-sale terminals across Qatar. Upon scanning, the amount is debited instantly from the traveler’s linked bank account in India, making payments cashless and secure. The process eliminates the need for cash or currency exchange, simplifying shopping, dining, and other transactions during the trip.

Benefits of UPI Going Live in Qatar for Indian Travelers

Seamless Payments Without Currency Exchange Worries

One of the biggest pain points for Indian tourists abroad has been carrying foreign currency or exchanging rupees, often involving high fees and inconvenience. Now, UPI payments enable Indians to transact in their familiar digital ecosystem, bypassing currency conversion at the merchant end.

Enhanced Convenience and Security

Transactions through UPI are secured with multi-factor authentication, reducing the risk of fraud or theft compared to carrying cash. It also speeds up payment processes at busy retail and tourist locations, minimizing queues and wait times.

Promotes Cashless Economy in Qatar

The adoption of India’s UPI system supports Qatar’s push toward cashless digital payments, enhancing its retail and hospitality sectors with innovative payment options for global visitors.

How-to Use UPI in Qatar: A Step-by-Step Guide

- Ensure UPI App is Installed and Set Up: Use popular apps like Google Pay, PhonePe, Paytm, or any UPI-enabled banking app in India.

- Initiate Your Trip with Sufficient Bank Balance: Confirm your Indian bank account is connected to UPI and has funds available.

- Locate UPI QR Codes at Merchants: Spot the UPI-enabled QR code displayed at stores, tourist attractions, and Qatar Duty Free outlets.

- Scan the QR Code: Open your UPI app and scan the merchant QR.

- Enter Transaction Amount (if required) and Authenticate: Approve payment using UPI PIN or biometric authentication.

- Receive Instant Payment Confirmation: Your payment is successful, and the vendor receives immediate credit.

- Collect Receipt or Confirmation: Optionally get a digital or printed receipt for your purchase.

Pro Tips for Indian Travelers Using UPI in Qatar

- Use International Roaming or Local SIM: Ensure you have an active internet connection for real-time transactions.

- Pre-Plan Large Transactions: Confirm transaction limits on your UPI app; some apps have daily caps.

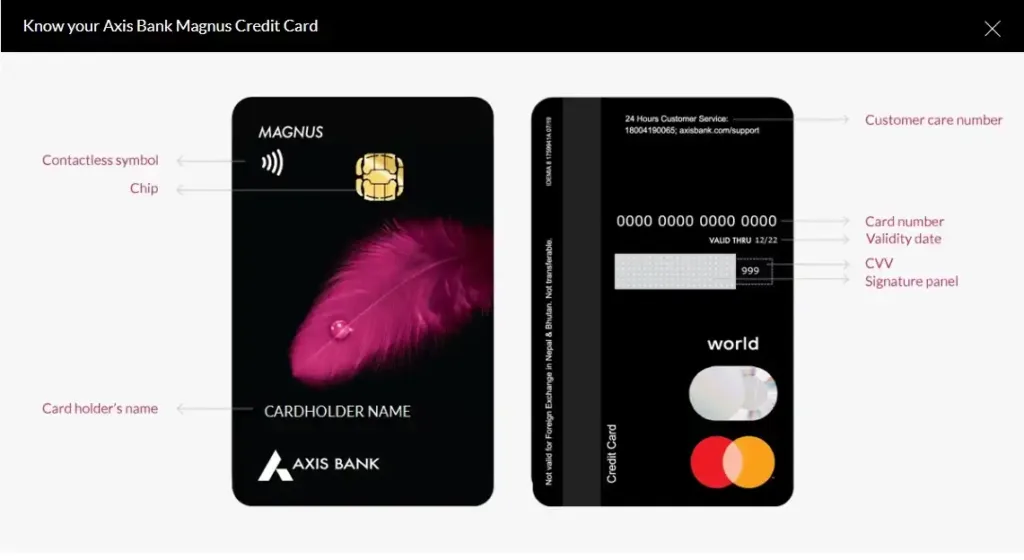

- Keep Backup Payment Methods: Carry a RuPay or international card as a fallback in places where UPI is not yet adopted.

- Check Merchant Acceptance: Look for signs indicating UPI acceptance to avoid inconvenience.

- Use Secure Wi-Fi or Mobile Data: Avoid public Wi-Fi for payments to ensure security.

Common Mistakes to Avoid While Using UPI Abroad

- Not informing your bank about international travel may restrict outbound transactions.

- Assuming all merchants accept UPI; not all outlets are equipped yet.

- Ignoring transaction fees or foreign currency conversion charges that some banks may levy on cross-border payments.

- Overlooking transaction alerts; always verify deduction notifications after each payment.

- Using outdated app versions that might cause transaction failures.

UPI’s Global Expansion: Where Else is It Accepted?

With Qatar joining, UPI payments are now accepted in eight countries:

| Country | UPI Acceptance Features |

| Bhutan | First country outside India to adopt UPI |

| France | Retail purchases via partnerships with fintechs |

| Mauritius | Acceptance through NPCI partnerships, tourism boosts |

| Nepal | Cross-border payments with India |

| Singapore | Linked with PayNow for instant cross-border transfers |

| Sri Lanka | Easier payments for Indian tourists |

| United Arab Emirates (UAE) | Retail and hospitality sectors, popular with Indian expats |

| Qatar | Major tourist attractions, Qatar Duty Free, retail outlets |

This expanding footprint underscores India’s influence in global payments and convenient digital travel for its diaspora.

Impact on Qatar’s Economy and Tourism

The integration of UPI payments in Qatar is a major boost for its retail and tourism sectors. Qatar National Bank’s merchants can experience increased transaction volumes, while consumers enjoy convenience. Cashless transactions promote a modern retail environment, encouraging spending and supporting local businesses.

UPI in Qatar Key Takeaways

- UPI payments became live in Qatar in September 2025 via partnership between NPCI International and QNB.

- Indian travelers can pay seamlessly at Qatar Duty Free and tourist hotspots using UPI QR codes.

- The initiative reduces cash dependency and currency exchange hassles for Indian visitors.

- Qatar benefits by boosting its cashless economy, retail sales, and tourism experience.

- UPI is now accepted in 8 countries, expanding India’s global digital payment presence.

Final Thought: Embrace the Digital Payment Revolution on Your Next Qatar Trip

With UPI payments now live in Qatar, Indian travelers gain immense convenience and security in making purchases—right from duty-free shopping at Hamad International Airport to exploring tourist hotspots across the nation. Embrace this seamless digital payment experience to avoid cash troubles and enjoy smooth transactions. Before traveling, verify your UPI app is ready, stay connected to the internet, and explore Qatar with ease and confidence.

Plan your next trip to Qatar with UPI in your digital wallet—experience hassle-free, cashless payments that enhance your travel comfort and convenience!