Is Sensex poised for a dramatic rebound above 81,000 or a shocking drop below 79,651? Will Nifty 50 conquer 24,800 or crumble to 24,300? Bank Nifty teeters at 55,000—breakout or breakdown? Unravel the mystery with top gainers like Hero MotoCorp soaring and losers like TCS sinking. From L&T’s explosive growth to HDFC Bank’s critical pivot, dive into exclusive trading insights and stock picks for August 8, 2025

The Indian stock market, comprising major indices like Sensex, Nifty 50, and Bank Nifty, remains a dynamic landscape for traders and investors. As we approach Friday, August 8, 2025, understanding support and resistance levels, analysing top gainers and losers, and identifying stocks to watch are critical for informed trading decisions. This blog post provides a comprehensive analysis of the Indian stock market, incorporating the latest data, technical insights, and predictions for Nifty 50 and Bank Nifty.

Indian Stock Market Overview: Current Sentiment and Trends

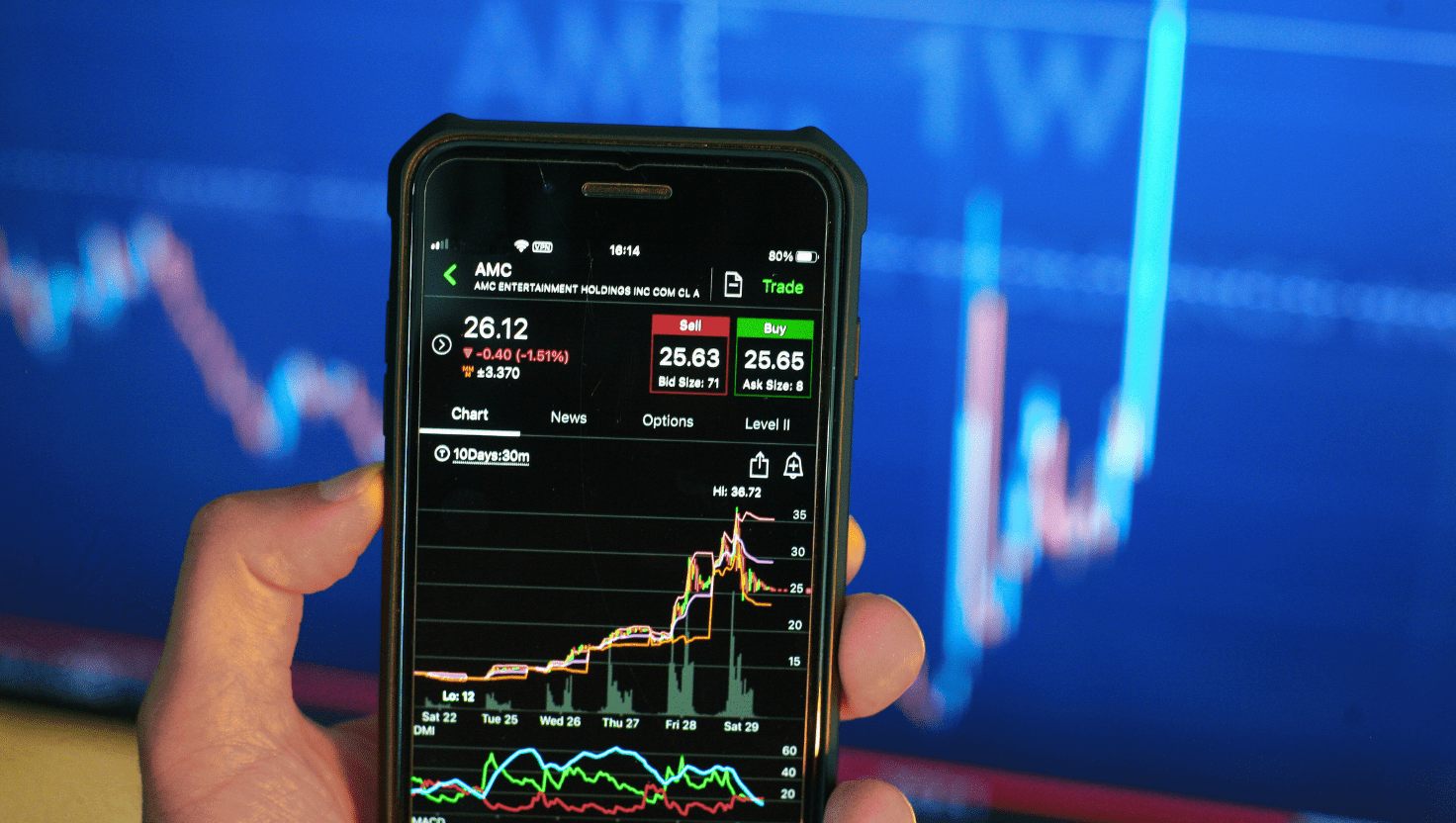

The Indian stock market has been navigating a cautious phase, influenced by global economic cues, domestic earnings, and geopolitical developments. On August 7, 2025, the Sensex closed at 80,623, up marginally by 79.27 points (0.10%), while the Nifty 50 settled at 24,596.15, gaining 21.95 points (0.09%) after a late recovery. The Bank Nifty index, however, slipped to 55,521, reflecting a bearish trend with a daily closing stop-loss at 55,796.

Market sentiment remains mixed due to concerns over U.S. tariff threats, disappointing Q1 earnings from IT giants like TCS, and anticipation of the U.S. Federal Reserve’s policy announcements. Despite these pressures, sectors like auto, IT, and pharma showed resilience, with selective stocks driving last-hour gains. The India VIX, a measure of market volatility, eased by 2%, signaling a slight reduction in investor anxiety.

For Friday, August 8, 2025, traders should focus on technical analysis, support and resistance levels, and sectoral trends to capitalize on intraday opportunities. Below, we delve into detailed predictions, key levels, and top stocks to watch.

Technical Analysis: Sensex, Nifty 50, and Bank Nifty

The Sensex is currently in a negative trend, with near-term support at 79,993/79,651 and resistance at 81,095/81,437. The index’s recovery on August 7 was driven by oversold positions in heavyweights like HDFC Bank and Reliance Industries, but broader market caution persists due to global trade concerns. A close above 80,945 could signal a bullish reversal, while a drop below 79,993 may lead to further consolidation.

Nifty 50 Outlook

The Nifty 50 closed at 24,596.15, just below the psychological 24,600 level. Technical indicators suggest a bearish undertone, with the index slipping below its 100-day EMA and the RSI hovering below 50. Key support levels are at 24,450 and 24,300, with resistance at 24,695 and 24,800. A decisive close above 24,695 could trigger a short-term rally, potentially testing 25,000. However, on-going earnings and global cues, particularly U.S. tariff negotiations, will dictate momentum.

The Bank Nifty index is under pressure, closing at 55,521 with a bearish trend. Support lies at 55,000/54,800, while resistance is at 55,796/56,098. Despite a modest rally in select banking stocks on August 7, the medium-term trend remains bearish. The low RSI suggests potential for tactical short-term rallies, particularly if the index holds above 55,000. Traders should monitor banking heavyweights like HDFC Bank, ICICI Bank, and Axis Bank for directional cues.

Key Support and Resistance Levels for August 8, 2025

| Index | Support Levels | Resistance Levels |

| Sensex | 79,993 / 79,651 | 81,095 / 81,437 |

| Nifty 50 | 24,450 / 24,300 | 24,695 / 24,800 |

| Bank Nifty | 55,000 / 54,800 | 55,796 / 56,098 |

These levels are derived from recent trading ranges and technical indicators, providing traders with critical zones for intraday trading and swing trading strategies.

Top 10 Gainers and Losers: Nifty 50 (August 7, 2025)

The Nifty 50 saw a mix of performances on August 7, with 39 constituents declining and only 11 advancing. Below is a table of the top 10 gainers and losers, based on the latest data:

| Top 10 Gainers | % Change | Top 10 Losers | % Change |

| Hero MotoCorp | +4.00% | Adani Enterprises | -2.00% |

| Tech Mahindra | +2.50% | Adani Ports | -2.00% |

| Wipro | +2.00% | Trent | -2.00% |

| Eternal | +1.80% | Tata Motors | -2.39% |

| JSW Steel | +1.50% | Grasim Industries | -1.80% |

| Asian Paints | +1.94% | TCS | -3.47% |

| HUL | +0.46% | M&M | -2.92% |

| SBI Life | +0.14% | Hero MotoCorp | -2.74% |

| IndusInd Bank | +0.50% | Wipro | -2.62% |

| Titan Company | +0.30% | Bajaj Auto | -2.54% |

The auto sector outperformed, with Hero MotoCorp and Maruti Suzuki leading gains, driven by expectations of festive season demand. Conversely, IT and auto stocks like TCS, M&M, and Tata Motors were among the top losers, reflecting profit-booking and weak earnings.

Top Stocks to Watch on August 8, 2025

Here’s a detailed analysis of top stocks to watch based on recent performance, technical setups, and fundamental triggers:

1. Larsen & Toubro (L&T)

- Sector: Infrastructure

- Performance: L&T surged nearly 4% on August 7 after reporting better-than-expected Q1 earnings, with a 63% PAT beat and a 94% YoY increase in Q3 order flow.

- Technical Outlook: The stock is trading above its 50-day EMA, with support at ₹3,500 and resistance at ₹3,800. The RSI is in the bullish zone, indicating potential for further upside.

- Why to Watch: Strong order book growth and infrastructure spending make L&T a top pick for intraday and positional trading.

2. HDFC Bank

- Sector: Banking

- Performance: Gained 0.48% on August 7, but remains a drag on Nifty 50 and Bank Nifty due to its heavyweight status.

- Technical Outlook: Support at ₹1,600 and resistance at ₹1,700. The stock is consolidating, with a potential breakout above ₹1,700.

- Why to Watch: As a banking sector bellwether, HDFC Bank’s movement will influence Bank Nifty. Monitor for volume spikes and RBI policy cues.

3. Reliance Industries

- Sector: Conglomerate

- Performance: Up 0.09% on August 7, but a 1.46% decline earlier in the week reflects cautious sentiment.

- Technical Outlook: Support at ₹2,900 and resistance at ₹3,100. The stock is near its 100-day EMA, suggesting a potential bounce if global trade concerns ease.

- Why to Watch: Reliance’s diversified portfolio makes it a safe bet amidst market volatility. Watch for updates on Jio Financial Services.

4. Hero MotoCorp

- Sector: Auto

- Performance: Top gainer with a 4% surge on August 7, driven by festive season optimism.

- Technical Outlook: Support at ₹5,200 and resistance at ₹5,500. The RSI is approaching overbought territory, so traders should watch for profit-booking.

- Why to Watch: Strong domestic demand and new model launches make Hero MotoCorp a momentum stock for intraday trading.

5. TCS

- Sector: IT

- Performance: Declined 3.47% due to lackluster Q1 earnings, dragging the IT sector lower.

- Technical Outlook: Support at ₹4,100 and resistance at ₹4,400. The stock is below its 50-day EMA, indicating bearish momentum.

- Why to Watch: As an IT sector leader, TCS’s performance will influence Nifty IT. Look for bargain buying opportunities if it holds above ₹4,100.

Sectoral Trends and Market Drivers

Auto Sector

The auto index gained 0.4% on August 7, driven by festive season expectations and pre-buying []. Stocks like Hero MotoCorp, Maruti Suzuki, and Tata Motors are in focus, with the latter facing profit-booking pressure. Traders should monitor auto sales data and festive demand for momentum plays.

Banking Sector

The Bank Nifty index remains under pressure, with mixed performances from HDFC Bank, ICICI Bank, and Axis Bank. The Nifty PSU Bank index, however, surged 2.67% on June 30, indicating selective strength. Keep an eye on RBI policy updates and FII flows for directional cues.

IT Sector

The IT sector faced selling pressure, with TCS, Wipro, and Tech Mahindra among the top losers. Weak earnings and global tech spending concerns are weighing on sentiment. However, Tech Mahindra and Wipro gained on August 7, suggesting selective recovery.

Pharma Sector

The Nifty Pharma index rose 0.5-1%, with Sun Pharma and others showing resilience. Defensive sectors like pharma are likely to attract investors amidst market volatility.

Latest News Impacting the Market

- U.S. Tariff Threats: Concerns over 20-25% tariffs on Indian exports if trade negotiations fail by August 1 continue to weigh on sentiment. Textiles and shrimp stocks like Gokaldas Exports and Avanti Feeds fell up to 4%.

- RBI Policy Stance: The Reserve Bank of India’s decision to maintain the repo rate in August has led to profit-booking in rate-sensitive sectors like realty and banking.

- FII and DII Activity: Foreign Portfolio Investors (FPIs) were net sellers of ₹4,999 crore, while Domestic Institutional Investors (DIIs) bought ₹6,794 crore worth of shares in the April-June 2025 quarter, supporting the market.

- Earnings Season: Disappointing Q1 results from TCS, Sula Vineyards (profit down 86.7%), and BHEL (loss widened to ₹455.5 crore) have added to bearish sentiment.

Trading Strategies for August 8, 2025

- Intraday Trading:

- Buy on Dips: Target stocks like L&T and Hero MotoCorp near support levels for quick gains.

- Sell on Rallies: Short TCS or Tata Motors near resistance if bearish momentum persists.

- Stop-Loss Discipline: Use tight stop-losses (e.g., 2-3% below support) to manage volatility.

- Swing Trading:

- Bullish Bets: Accumulate HDFC Bank or Reliance Industries on pullbacks to support levels for a 1-2 week horizon.

- Bearish Bets: Short IT stocks like TCS if they fail to break resistance, targeting a 5-7% downside.

- Options Trading:

- Nifty 50: Buy 24,600 Call if the index breaks 24,695, or 24,450 Put if it falls below 24,450.

- Bank Nifty: Consider 55,000 Put for downside protection or 55,800 Call for a breakout play.

Risks and Considerations

- Global Cues: Monitor U.S. Federal Reserve commentary and U.S.-India trade talks for market direction.

- Earnings Volatility: Ongoing Q1 results will drive stock-specific movements.

- Geopolitical Risks: Escalating tensions, such as U.S.-Russia tariff disputes, could impact global markets.

- Technical Risks: A break below key support levels (24,300 for Nifty, 55,000 for Bank Nifty) could trigger sharper declines.

Final Thought

The Indian stock market on Friday, August 8, 2025, is poised for cautious trading, with Sensex, Nifty 50, and Bank Nifty navigating key support and resistance levels. While auto and pharma sectors show strength, IT and banking face challenges. Traders should focus on top gainers like Hero MotoCorp and L&T, while monitoring losers like TCS and Adani Enterprises for reversal opportunities. By leveraging technical analysis, staying updated on latest news, and employing disciplined trading strategies, investors can navigate the volatile market effectively.

Disclaimer: Investing in the securities market carries risks. Consult a financial advisor before making investment decisions.