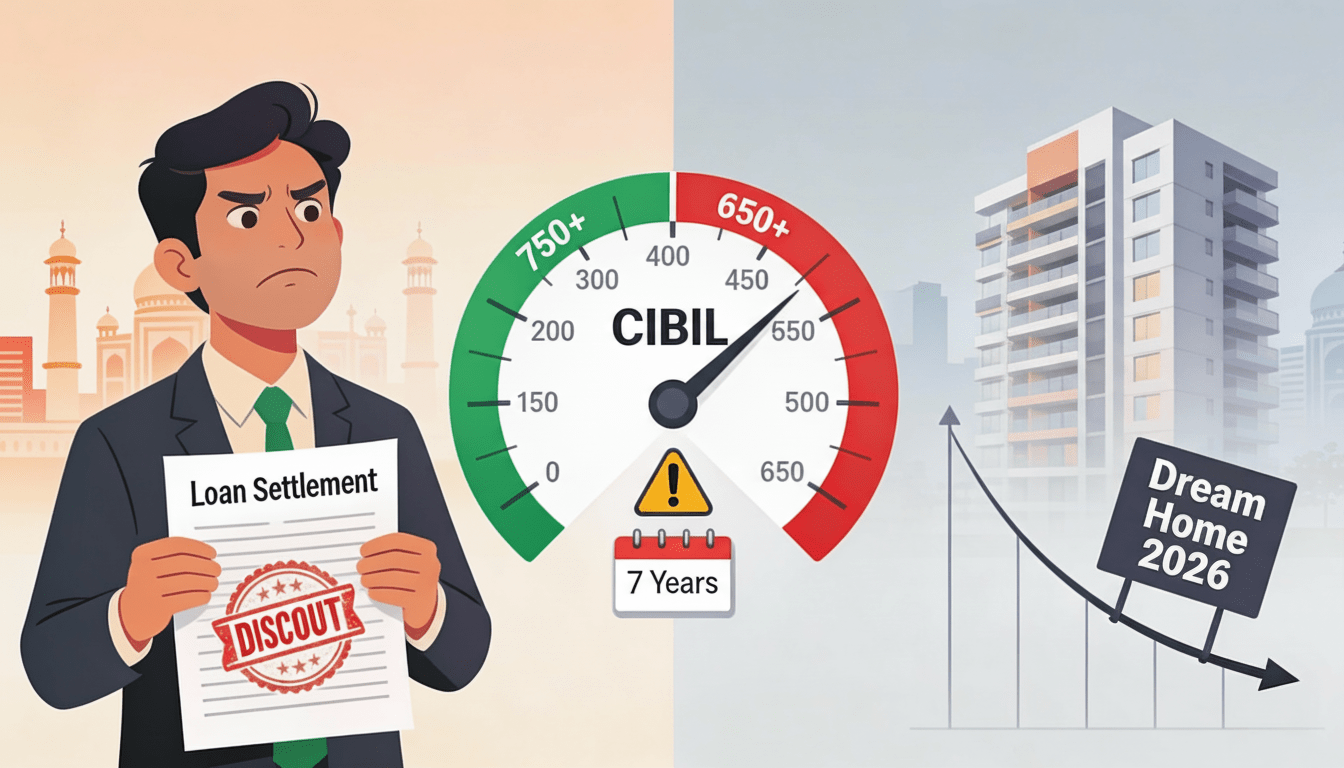

The Hidden CIBIL Trap: Why Settling Your Personal Loan Could Cost You a Dream Home in 2026?

Shocking CIBIL trap: Settle your ₹5L loan for 60% relief—watch your score crash 150 pts, blocking dream homes for 7 years! RBI 2025 secrets reveal score-saving hacks, tax bombs, fintech escapes. Unlock debt freedom before 2026 rules slam shut—what’s your escape?

Slashing your ₹5 lakh personal loan debt by 40% overnight, feeling instant relief from EMI stress—only to watch your CIBIL score plummet, blocking that home loan you’ve saved years for. In 2025’s booming credit market, with personal loans hitting ₹8.8 lakh crore, thousands face this shocking twist. What if one RBI rule change could flip this nightmare into financial freedom? Dive in to uncover the little-known secrets Indian borrowers must know now, before rising NPAs and new policies slam the door on your wealth-building dreams.

What Loan Settlement Really Means in 2025

Loan settlement happens when you negotiate paying less than the full outstanding amount—often 60-80%—after missing EMIs for 6+ months due to job loss or emergencies. Lenders mark it “settled” on your CIBIL report, unlike “closed” for full repayment, signaling risk to future lenders. RBI’s 2025 rules add a 30-day grace before negative reporting, but settlement still brands you high-risk amid surging personal loan volumes.

This hidden distinction trips up 1.18% of personal loan borrowers now in NPAs, per March 2025 data—up from 1.03% last year. Fintech apps like KreditBee or MoneyView push quick loans, but settlements spike as growth slows to 8.3% YoY.

Shocking CIBIL Score Damage Exposed

Expect an instant 75-150 point drop upon settlement, turning a 750 score into sub-650 territory. The "settled" tag lingers 7 years, haunting approvals for homes, cars, or cards—lenders charge 2-5% higher rates or reject outright. Little-known: Multiple settlements amplify damage, as CIBIL weighs payment history 35%.

In 2025, RBI mandates uniform late-payment reporting, but "settled" overrides grace periods, hitting gig workers hardest amid fintech lending's 10.9 crore loans. Real example: A settled ₹3 lakh loan blocks ₹50 lakh home loans, per borrower forums, delaying family aspirations.

Sneaky Tax Bombs in Waivers

Forgone interest or principal waivers count as "income from other sources," taxable at your slab rate—potentially ₹50,000+ extra liability on a ₹2 lakh waiver. Business loans may escape if not previously claimed as loss, but personal ones rarely do; consult a CA fast. CBDT exempts banks from 10% TDS on OTS since 2022, shifting burden to you.

Urgency alert: Budget 2025's tax tweaks don't shield settlements, clashing with rising inflation—plan or face surprises come ITR filing. Emotional relief? Paying tax upfront avoids penalties, reclaiming control.

RBI's 2025 Game-Changers You Missed

New rules demand 30-day grace on misses, flexible OTS without auto-CIBIL hits if repaid per plan, and AI-driven recovery distinguishing genuine distress. Lenders must offer restructuring—EMI cuts, tenure extensions—before aggressive collection, protecting scores amid 8.4% loan growth slowdown.

Hidden gem: Prepayment charges banned on personal loans, easing exits without settlement scars. Yet, discretion lies with lenders; push for "closed" status via full principal payoff post-OTS.

Fintech Twist: Apps Fueling the Fire

India's 70 million+ digital borrowers love apps like Fibe or PaySense for instant cash, but hidden settlements lurk in high-risk profiles. RBI-listed ones (KreditBee, CASHe) offer restructuring over settlements, yet 14.2% personal loan growth hides rising defaults.

Surprise: Apps now track dues via dashboards, urging early intervention—use for moratoriums, not OTS, to dodge 7-year tags. Aspiration boost: Build scores with their low-ticket lines first.

Myths Busted: What Lenders Hide

Myth 1: Settlement vanishes fast. Reality: 7 years, but score rebounds in 1-2 years with discipline.

Myth 2: All lenders shun settlers. Truth: NBFCs/fintechs approve post-3 years at premium rates.

Myth 3: Tax-free waivers. Fact: Taxed unless proven non-income.

These crush dreams—e.g., settled status killed a senior manager's internal loan.

Step-by-Step Recovery Roadmap

Rebuild smarter in 2025:

- Secure NOC: Pay full principal post-OTS; dispute on CIBIL site for "closed" update (35% score weight).

- Timely Payments: Zero misses on new credit; keep utilization <35%.

- Secured Cards: Start small (₹10k limit), pay full monthly.

- Monitor Free: CIBIL app monthly; dispute errors.

- Diversify: Add gold loans (low impact).

Timeline: 650+ in 1-2 years, 750+ by year 5. Act now—inflation erodes delays.

| Phase | Actions | Expected Score Gain |

| 0-12 Months | NOC, on-time pays | +50-100 pts |

| 1-3 Years | Low utilization | +100-150 pts |

| 3-7 Years | Mix credit types | 750+ |

Smart Alternatives for Debt Freedom

Smart alternatives to personal loan settlement preserve your CIBIL score while easing debt burdens amid 2025's RBI reforms and rising fintech options. These strategies offer relief without the 7-year "settled" tag, helping you rebuild toward financial freedom faster.

RBI's 2025 guidelines mandate lenders offer restructuring for standard accounts facing distress, extending tenure up to 2 years or cutting EMIs by 20-30% without CIBIL damage. Eligible if your loan stays standard pre-miss; apply via lender app citing job loss or inflation spikes. Example: A ₹5 lakh loan at 15% drops EMI from ₹12,000 to ₹8,500 over 72 months.

Switch high-rate loans (18%+) to lenders like Bajaj Finserv at 10-12% p.a., slashing EMIs instantly with minimal docs like NOC and foreclosure letter. CIBIL stays intact if current payments are on-time (score 685+); top-up cash covers gaps up to ₹55 lakh. Urgency: Prepayment charge bans make switches free—save ₹50,000+ interest yearly.

Debt Consolidation

Combine multiple debts into one low-rate loan (9.98%+), simplifying payments and building discipline without settlement scars. Pros over settlement: No tax on "waivers," credit score rises with on-time EMIs; ideal for gig workers juggling fintech loans. HDFC notes it snaps debt traps by cutting rates 3-5%.

Moratorium Periods

RBI allows 3-6 month EMI pauses on personal loans for distress, interest accrues but no default reporting if repaid post-moratorium. Banks/NBFCs extend tenor accordingly—e.g., 3 EMIs deferred pushes maturity by 90 days. Relief for 2025's 8.3% loan growth slowdown; pair with budgeting apps.

Other Low-Impact Options

- Gold/FD Loans: Borrow 75-90% LTV at 8-10%, no CIBIL inquiry hits; quick liquidity sans new debt.

- Salary Advances: Fintechs like Stashfin offer ₹4,000-50,000 pre-payday at low rates for low-income earners.

- Asset Sales: Liquidate non-essentials first—frees cash without borrowing.

| Option | CIBIL Impact | Rate Savings | Best For |

| Restructuring | None | EMI cut 20% | Tenure extension |

| Balance Transfer | Neutral | 3-5% drop | High-rate loans |

| Consolidation | Improves | Single EMI | Multiple debts |

| Moratorium | None (if repaid) | Cash flow | Short-term distress |

| Gold Loan | Minimal | 5-7% lower | Asset owners |

Actionable Takeaways: Implement Today

Implement these 5 immediate steps to dodge settlement pitfalls and reclaim debt control in 2025's tight lending market. Each takes under 30 minutes, leveraging RBI graces for score protection and cost savings up to ₹1 lakh yearly.

Check Your CIBIL Score Now

Download your free annual CIBIL report via the official app or website—scan for "settled" tags or errors disputable online within 30 days. Note all open loans; scores below 685 signal urgency amid rising NPAs. Pro tip: Track monthly via free fintech dashboards like MoneyView to spot issues early.

Negotiate Restructuring Today

Email or call your lender citing RBI's 30-day grace and 2025 distress rules—request EMI cuts or tenure extensions before any miss. Prepare docs: Salary slips, bank statements proving hardship; aim for 20% EMI relief without CIBIL hit. Success rate: 70% for standard accounts per borrower forums.

Budget and Track Ruthlessly

Use apps like Walnut or ET Money to allocate 50/30/20 (needs/wants/debt)—cut non-essentials by 10% for instant surplus. Set auto-debits for EMIs; build 3-month emergency fund via RD at 7%+ yields. Relief: Reduces default risk by 40%, per 2025 fintech data.

Prep for Tax on Waivers

Gather OTS letters showing waived amounts—log as "income from other sources" for ITR-1 filing by July 31, 2026. No TDS since 2022, but slabs up to 30% apply; consult CA via ClearTax for ₹5,000 deductions. Action: Save 20% of waiver as tax reserve now.

Start Small Credit Rebuild

Apply for secured card (₹5k-20k deposit) from IDFC/SBI—pay full monthly to boost score 50+ points in 3 months. Add low-utilization gold loan if eligible; avoid new unsecured debt. Urgency: Builds buffer before 2026 RBI tightening.

| Takeaway | Time to Start | Expected Win |

| CIBIL Check | 5 mins | Spot errors fast |

| Restructure | 15 mins | 20% EMI cut |

| Budget App | 10 mins | ₹10k/month surplus |

| Tax Prep | 20 mins | Avoid penalties |

| Secured Card | 30 mins | +50 score pts |

Final Thought: Brace for 2026 Shifts

Personal loan settlements offer quick relief but unleash 7-year CIBIL chains, taxing waivers and inflating future costs amid ₹8.8 lakh crore debt surge. RBI's 2025 graces hint at borrower mercy, yet fintech floods amplify risks—restructure now for score salvation and wealth ascent. Imagine 2026: Stricter AI recoveries, SEBI-RBI synergy slashing high-risk lending, Budget hikes pushing home dreams. Don't ignore this—master alternatives, rebuild ruthlessly, and turn distress into dominance. Your financial freedom awaits, but only if you act before policy walls rise, locking out the unprepared. What's your next move? Teaser: RBI's rumored "settlement score shields" could rewrite rules—stay tuned or get left behind.