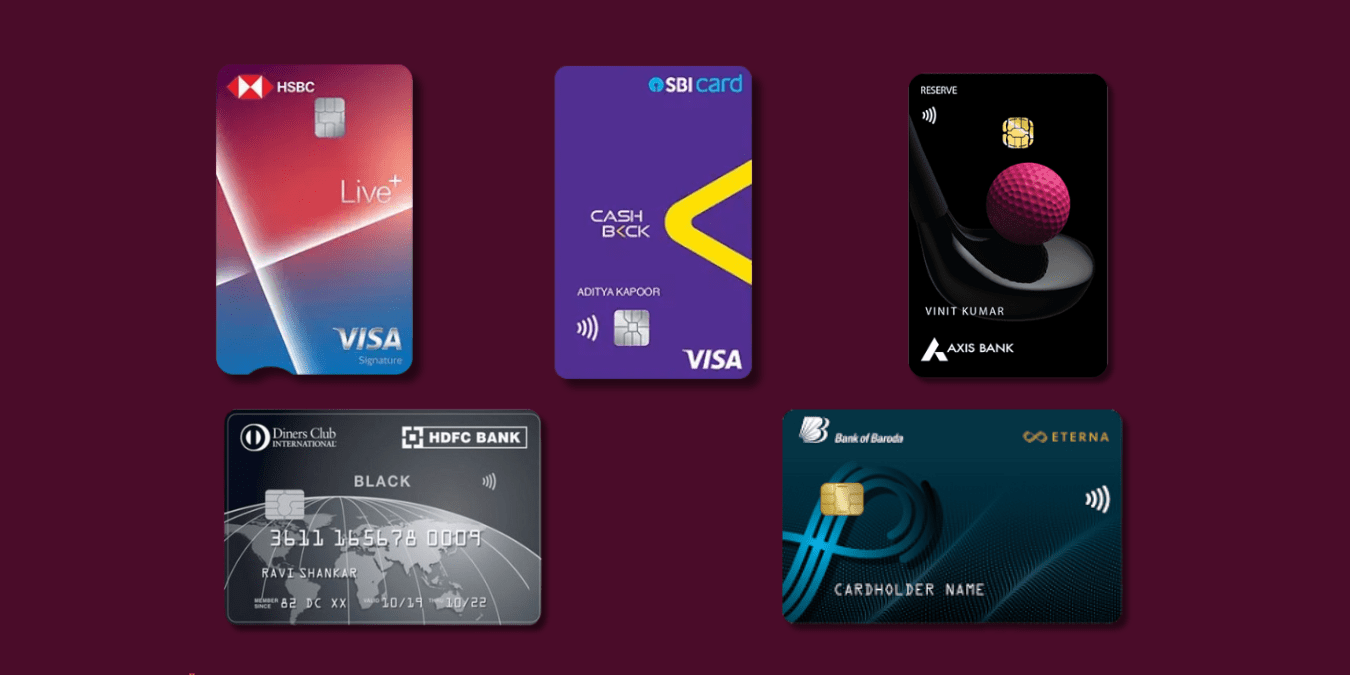

The Best Credit Card Offers in October 2025: Hidden Perks, Smart Rewards & Shocking Value You Shouldn’t Miss

This October 2025, unlock India’s smartest credit card secrets—luxury lounges, shocking cashback perks, and travel rewards banks don’t want you to miss. From HDFC’s elite Diners Club Black Metal to SBI’s viral cashback card, discover the hidden benefits transforming festive spending into free vacations and luxury dining. Which card is secretly giving ₹40,000 off holidays? Which one rewards every online payment? Don’t swipe before you read this—your next purchase could earn more than you imagine. The offers will surprise even seasoned card users.

What if your next coffee, vacation, or gadget upgrade could be free—just because you paid with the right card? As festive season deals light up October 2025, India’s biggest banks are rolling out premium, limited-time offers that blend travel luxury, dining privileges, and instant cashback like never before. From the elegant HDFC Diners Club Black Metal Edition to the effortless SBI Cashback Credit Card, the competition for wallet space is fierce.

Let’s decode what’s really worth your swipe this season — the cards offering the biggest bang for your rupee, secret perks you might overlook, and which one truly deserves a place in your pocket.

HDFC Diners Club Black Metal Edition Credit Card: The Elite Traveller’s Dream

If exclusivity had a name this season, it would be the HDFC Diners Club Black Metal Edition. This isn’t your average premium card; it’s a statement piece—crafted in metal, packed with privileges, and loaded with luxury.

Joining/Renewal Fee: ₹10,000 each (plus taxes)

Why it’s trending in October 2025: HDFC has quietly upgraded its reward ecosystem under SmartBuy 2.0, and the Black Metal is at the top of this chain.

Key highlights:

- Unlimited Lounge Access: Access more than 1,000 domestic and international lounges without worrying about limits or passes. Perfect for frequent flyers this festive season.

- 10X SmartBuy Rewards: Earn up to 10X reward points when booking flights, hotels, or electronics via SmartBuy — imagine saving tens of thousands just by planning Diwali vacations.

- Complimentary Memberships: Get an entire lifestyle upgrade with free Club Marriott, Amazon Prime, Swiggy One, and Times Prime memberships.

- Golf Privileges: Complimentary golf games and lessons at select clubs worldwide.

- Luxury Banking Compatibility: Exclusive to HDFC’s top-tier customers; the approval itself feels like a badge of prestige.

Hidden advantage: HDFC’s SmartBuy points can be converted into air miles or luxury vouchers at a value many users underestimate. That ₹1 lakh spent on festive travel could net travel tickets worth ₹10,000+.

Best for: Frequent travelers, business executives, and HNI users who live the luxury lifestyle and demand convenience at every stop.

Axis Bank Reserve Credit Card: Smart Power Meets Unmatched Privilege

If HDFC defines polished exclusivity, Axis Reserve delivers in raw power. Priced steeply yet designed for serious spenders, this card transforms every purchase into elite experiences.

Joining/Renewal Fee: ₹50,000 (plus taxes)

Key highlights:

- Unlimited Lounge Access: Walk into any domestic or international lounge—no limits, no waiting.

- 30 EDGE Reward Points per ₹200 spent: Convert your splurges into free flights, hotel stays, or luxury shopping.

- Luxury Stay Benefits: Complimentary nights across Oberoi and Taj Hotels through Axis’s Reserve Privileges Collection—a secret perk few cardholders fully exploit.

- Dining Offers: 20–25% discount via EazyDiner Prime and exclusive chef’s table access at five-star restaurants.

- Global Concierge: Personal assistance for reservations, event access, or travel emergencies anytime, anywhere.

Why it’s creating buzz in October 2025: Axis is driving strong acquisition under its ultra-premium segment, and limited-time festive tie-ups with Oberoi Hotels and Emirates Skywards are adding fuel.

Best for: Global travelers and high-spending users craving elite rewards and white-glove service.

HSBC Credit Card Offers: Simple, Strong, and Seriously Rewarding

HSBC is winning over a new generation of smart users in 2025 by offering real discounts instead of complex loyalty chains. Its aggressive online and travel offers have turned heads ahead of the festival rush.

Key highlights:

- Up to ₹40,000 Off on Holiday Bookings: Valid on select packages with MakeMyTrip, Yatra, and Agoda.

- 15% Off Flights & Hotels: Instant savings on platforms like Cleartrip and EaseMyTrip—no coupon hassle.

- Cashback on Electronics: Up to 10% cashback on Samsung, Sony, and LG purchases during Diwali flash sales.

- Dining Delights: 15% discount at top restaurants partnered through EazyDiner, plus Swiggy delivery discounts.

- Movie Magic: Buy-one-get-one-free tickets on BookMyShow every weekend.

Why it matters now: HSBC is positioning itself as India’s most value-centric global card for mid-to-high income users. The current holiday-season push—with double rewards on e-commerce spends—is driving massive search traffic.

Hidden perk: The real magic lies in HSBC’s transparent cashback tracking system. Users can see instant reflection on their dashboard—no waiting for statement credits.

Best for: Urban professionals, frequent leisure travelers, and deal hunters who want flexibility without high fees.

SBI Cashback Credit Card: The Everyday Hero

Not everyone needs a luxury card to win rewards. Sometimes, the best perks come from your grocery bill. The SBI Cashback Credit Card has become the talk of the town in 2025 among budget-conscious users who live online.

Joining/Renewal Fee: ₹999 (waived on yearly spends above ₹2 lakh)

Top benefits:

- 5% Cashback on Online Spends: From Amazon to Zomato, enjoy instant savings across e-commerce and utility payments.

- 1% Cashback on Everything Else: Perfect for offline or recurring payments.

- No Reward Complexity: Cashback auto-credits to the account monthly — smart, quick, and simple.

- Add-on Card Benefits: Secondary users get the same cashback privileges, ideal for families managing household spends.

- Seasonal Boost Offers: Extra 2% cashback this festival period on specific merchants like Swiggy, Nykaa, and Flipkart.

Why it dominates searches right now: Consumers are prioritizing instant gratification, and SBI’s cashback promise fits perfectly into that “save-as-you-spend” mindset dominating October 2025’s financial trends.

Best for: Online shoppers, salaried professionals, and families seeking instant, transparent rewards.

Bank of Baroda Credit Card Offers: The Smart Shopper’s Secret Weapon

BoB Credit Cards are gaining surprising traction this festive period—especially among value seekers attracted to instant savings and tie-ups with Indian e-commerce giants.

Key highlights:

- Partnership Discounts: 10–15% off at JioMart, Paytm Flights, and Meesho.

- Cashback on Weekend Shopping: Additional cashback bonuses for weekend transactions; perfect for festive deal hunters.

- Restaurant Offers: Instant 20% savings via Dineout and selected partner restaurants across metro cities.

- Festive Season Coupons: Free instant discount coupons on selected spends at Myntra, Nykaa, and BigBasket.

Why it’s making headlines: BoB is quietly positioning its cards as a hybrid between cashback and coupon benefits—offering flexibility and savings without high annual fees. The recent October 2025 collaboration with Paytm Travel for additional festive flight discounts is creating digital buzz.

Best for: Budget-conscious shoppers, festival deal seekers, and families spending across local and online marketplaces.

October 2025: Why Credit Card Offers Are Getting Sharper

If it feels like this year’s offers are more rewarding than before — you’re right. Banks are scrambling to capture high-spending festive consumers who now compare every perk online.

Industry trends shaping these offers:

- Post-pandemic travel boom: Lounge access and travel rewards are now seen as essential inclusions.

- Cashback Loyalty: Consumers prefer instant cashback over delayed reward miles.

- Partnership Power: Banks are co-branding with luxury hotels, flight aggregators, and online merchants to deliver tangible value.

- Google Discover Searches: Keywords like “best credit card offers 2025” and “cashback cards India” are surging—fueling competitive upgrade campaigns from leading issuers.

Quick Comparison: Top Credit Card Offers (October 2025)

| Credit Card | Joining Fee | Top Benefit | Lounge Access | Ideal For |

| HDFC Diners Club Black Metal Edition | ₹10,000 | 10X SmartBuy rewards, luxury memberships | Unlimited (Domestic + International) | Frequent luxury travellers |

| Axis Bank Reserve | ₹50,000 | 30 EDGE points/₹200 spent, hotel privileges | Unlimited | High-spending global users |

| HSBC Cards | Varies | 15–40% off travel, electronics cashback | Limited (select variants) | Urban professionals |

| SBI Cashback | ₹999 | 5% cashback online spends | Limited | Everyday spenders |

| Bank of Baroda Cards | Nominal | Shopping & travel discounts, coupon benefits | Select airports | Value seekers |

Expert Take: Which Card Wins in 2025?

It depends on how you live and spend:

- Luxury lovers: The HDFC Diners or Axis Reserve dominate with comfort, status, and limitless travel perks.

- Everyday spenders: The SBI Cashback offers unbeatable simplicity and steady value with no gimmicks.

- Deal chasers: HSBC and BoB shine this festive season through instant travel and brand discounts.

In short, there’s no single “best” card — but the smartest one aligns perfectly with your lifestyle.

Key Takeaways

- HDFC Diners Club Black Metal: Best for premium travelers wanting status and experience-driven rewards.

- Axis Bank Reserve: Superior for global travelers and HNIs who value luxury dining and hotel alliances.

- HSBC Credit Cards: Ideal blend of cashback, travel, and festival shopping perks.

- SBI Cashback Credit Card: Unbeatable for online spenders wanting instant returns.

- Bank of Baroda Credit Cards: Best low-cost, high-value pick for festive family shoppers.

Final Thought

As October 2025’s shopping and travel fever peaks, the smartest move isn’t finding more discounts — it’s choosing the right card to multiply them. The truth is, a single swipe on the perfect card can unlock what dozens of coupons can’t: unrestricted luxury, effortless cashback, and access most can’t buy. Imagine walking into a business lounge on your way to Goa, dining at a five-star hotel for half the price, and watching your statement shrink — all because you picked wisely. The real secret isn’t in the offer details banks advertise; it lies in how you spend.

So, before your next festive purchase, ask one question — “Is my card rewarding me or just recording my spend?” The answer could make your October 2025 purchases smarter, richer, and far more rewarding than ever.