Wondering how long banks take to reverse fraudulent transactions in India? Typically, it takes 7-45 days depending on the investigation. But can banks force merchants to refund? Learn about RBI guidelines, chargeback rules, and your rights. Get expert tips to speed up fraud refunds—protect your money now!

Online transactions have become an integral part of daily life in India. However, the surge in digital payments has also led to a rise in financial fraud, such as unauthorized credit/debit card transactions, UPI scams, and phishing attacks. According to the Reserve Bank of India (RBI), banks reported a 15% year-on-year increase in fraud cases worth over ₹70,000 crore in 2022, predominantly related to card and internet transactions. If you’ve fallen victim to fraud, two critical questions arise: How long does it typically take for a bank to reverse a fraudulent transaction? And can the bank force the merchant to refund the money? This comprehensive guide answers these questions, incorporating the latest data, RBI guidelines, and practical insights for Indian consumers.

Understanding Transaction Reversals in Cases of Fraud

A transaction reversal refers to the process of undoing a payment and returning funds to the victim’s account. In cases of fraud, this typically involves unauthorized transactions where a cardholder’s details were stolen or misused. Reversals can occur through refunds, chargebacks, or authorization reversals, depending on the circumstances.

The process is governed by RBI regulations, card network rules (Visa, Mastercard, RuPay), and the Electronic Fund Transfer Act (EFTA) in India. The timeline and success of a reversal depend on factors such as the type of transaction (credit card, debit card, UPI), the speed of reporting, and the bank’s investigation process.

How Long Does It Take to Reverse a Fraudulent Transaction?

The timeline for reversing a fraudulent transaction varies based on the payment method, the bank’s policies, and the complexity of the case. Below is a detailed breakdown:

Under the Fair Credit Billing Act (FCBA) and RBI guidelines, credit cardholders in India have limited liability for unauthorized transactions, often capped at ₹0 if reported promptly. The reversal process typically follows these steps:

- Reporting the Fraud: Notify your bank within 3 days of noticing the unauthorized transaction to qualify for zero liability. Delays may increase your liability up to ₹10,000–₹25,000, depending on the account type.

- Investigation: Banks have 10 business days to investigate fraud claims and decide on a refund. For complex cases, this may extend to 30–60 days, especially if a chargeback is involved.

- Resolution: If fraud is confirmed, the bank reverses the transaction within 1–3 business days after the investigation. Refunds typically appear on your statement within 5–10 days.

Example: A 2024 Quora post described a case where a $5,000 fraudulent credit card transaction was reported immediately, and the bank’s fraud department resolved it within two weeks.

Debit card fraud falls under the Electronic Fund Transfer Act (EFTA) in India. The process is similar to credit card fraud but may take longer due to direct account debits:

- Reporting: Inform the bank within 2–3 days to limit liability to ₹0. Reporting within 3–7 days caps liability at the transaction value or ₹10,000 (whichever is lower). After 7 days, liability depends on the bank’s policy.

- Investigation: Banks must resolve the issue within 10 working days or credit the amount provisionally. Complex cases may take up to 90 days.

- Resolution: Refunds are credited within 1–5 business days post-investigation.

3. UPI Fraud

Unified Payments Interface (UPI) transactions are instant, making reversals challenging. The National Payments Corporation of India (NPCI) oversees UPI disputes:

- Reporting: Contact your bank or UPI provider (e.g., PhonePe, Google Pay) within 24–48 hours. Use the helpline 155260 for immediate reporting.

- Resolution: Failed or pending transactions are reversed within 3–5 business days. For fraudulent transfers to wrong accounts, banks act as facilitators, and reversals depend on the recipient’s consent, taking 7–30 days or more.

- Escalation: If unresolved, file a complaint on the NPCI portal or approach the Banking Ombudsman after 30 days.

Latest Data: A 2023 Mint article highlighted that UPI frauds require prompt reporting within 3 days for zero liability, with banks refunding the full amount if proven.

4. Chargeback Process

A chargeback occurs when a bank forcibly reverses a transaction by debiting the merchant’s account. This is common in credit/debit card fraud:

- Timeline: Chargebacks take 30–60 days due to coordination between the cardholder’s bank, merchant’s bank, and card networks. Disputes entering arbitration may extend to 90 days.

- Success Rate: A 2024 Chargeback Gurus report noted that only 27% of chargebacks result in successful reversals due to stringent evidence requirements.

Factors Affecting Reversal Time

- Prompt Reporting: Delays beyond 3–7 days increase liability and prolong the process.

- Merchant Cooperation: If the merchant disputes the chargeback, resolution may take longer.

- Bank Efficiency: Larger banks like SBI, HDFC, and ICICI often have faster fraud resolution systems.

- Evidence: Providing transaction details, receipts, or proof of non-delivery strengthens your case.

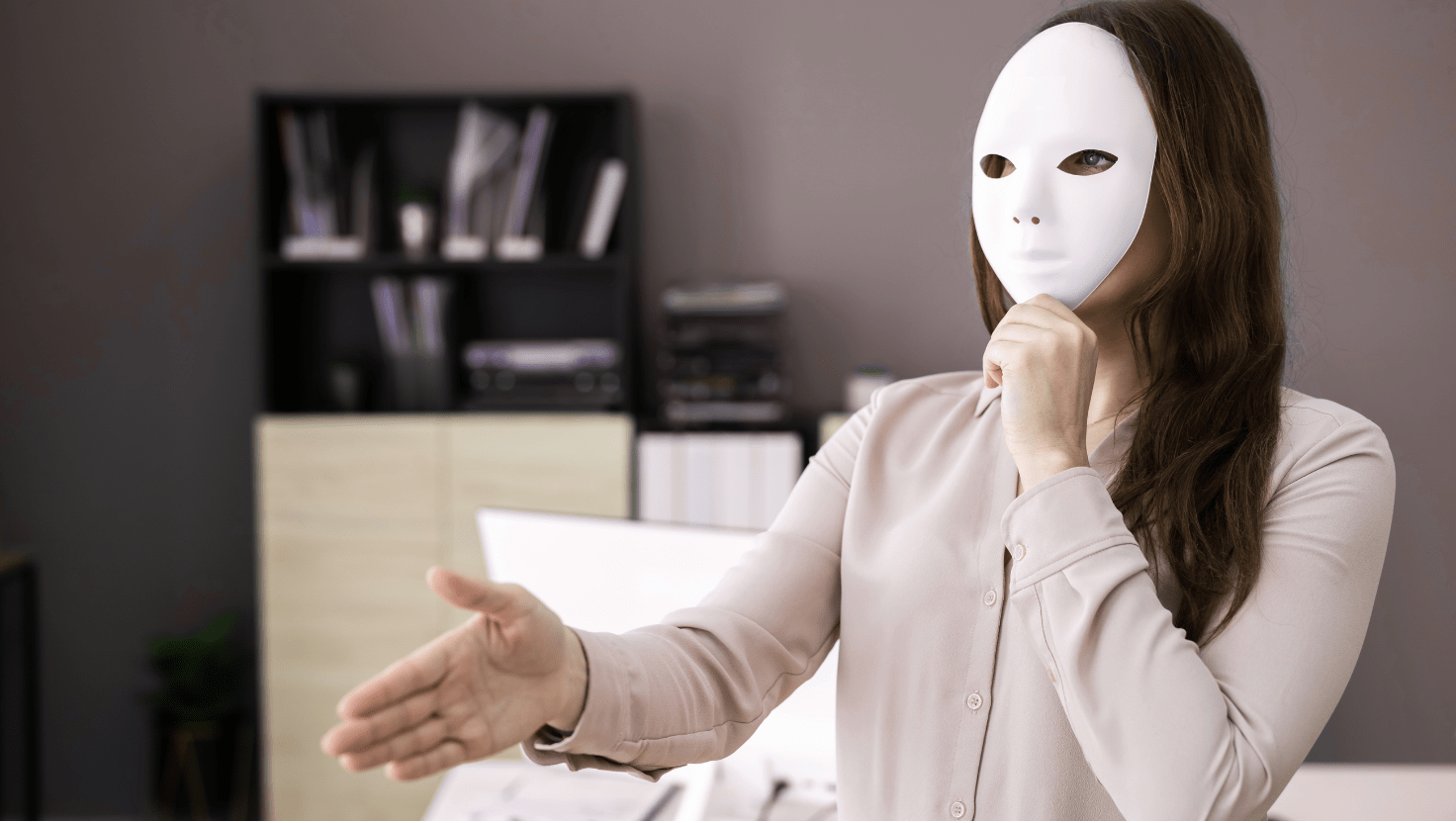

Can the Bank Force the Merchant to Refund the Money?

Yes, banks can force merchants to refund money through the chargeback process, but it’s not guaranteed and depends on specific conditions. Here’s how it works:

1. What is a Chargeback?

A chargeback is a forced payment reversal initiated by the cardholder’s bank under card network rules. It’s designed to protect consumers from fraud, unauthorized transactions, or non-delivered goods/services. The bank debits the merchant’s account and credits the cardholder.

Example: If you purchase a product online and the merchant fails to deliver, you can file a chargeback, and the bank may reverse the transaction.

2. When Can a Bank Initiate a Chargeback?

Banks can initiate chargebacks in cases of:

- Unauthorized Transactions: Fraudulent use of your card or stolen details.

- Non-Delivered Goods/Services: Merchant fails to fulfill the order.

- Billing Errors: Duplicate charges or incorrect amounts.

- Violation of Terms: Merchant breaches the sales agreement (e.g., no refund despite a return policy).

3. Can Banks Force Merchants?

- Yes, via Chargebacks: If the chargeback is valid, the merchant’s bank debits their account, and the merchant bears the cost, including additional fees (₹500–₹2,000 per chargeback). The Fair Credit Billing Act of 1974 and RBI guidelines mandate banks to offer chargeback protection.

- Merchant Disputes: Merchants can challenge chargebacks through representment, providing evidence like delivery receipts or transaction logs. If the merchant wins, the chargeback is reversed, and the cardholder may lose the refund.

- Card Network Decision: If disputes escalate, card networks (Visa, Mastercard) make the final decision, which is binding. The Australian Financial Complaints Authority (AFCA) notes that card schemes’ decisions cannot be reviewed, only the bank’s actions.

4. Limitations

- Time Limits: Banks must file chargebacks within 60–180 days of the transaction, depending on the card scheme.

- Merchant Refusal: If the merchant refuses to refund voluntarily, the bank relies on chargeback rules, which may fail if evidence is insufficient.

- Irreversible Payments: Bank transfers, wire transfers, and some UPI transactions are irreversible unless the recipient consents.

5. RBI Guidelines

The RBI’s 2017 circular on “Customer Protection – Limiting Liability of Customers in Unauthorised Electronic Banking Transactions” states:

- Zero Liability: If fraud is reported within 3 days and is due to bank negligence or third-party breaches.

- Limited Liability: ₹5,000–₹25,000 if reported within 3–7 days, depending on the account type.

- Bank’s Responsibility: Banks must refund the full amount within 10 working days if fraud is proven, without requiring the customer to prove victimhood.

Steps to Take if You’re a Fraud Victim

- Report Immediately: Call your bank’s customer care or the RBI’s helpline (155260). Provide transaction details, including date, amount, and merchant name.

- File a Complaint: Submit a written complaint to your bank, keeping a copy for records.

- Contact the Merchant: Attempt to resolve the issue directly with the merchant before escalating to a chargeback.

- Monitor Your Account: Enable transaction alerts and review statements regularly.

- Escalate if Needed: If the bank doesn’t resolve the issue within 30 days, complain to the Banking Ombudsman or NPCI.

Tips to Prevent Fraud

- Use multi-factor authentication (MFA) for online transactions.

- Avoid sharing OTPs, CVVs, or UPI PINs.

- Set low transaction limits and increase them only when needed.

- Use secure payment gateways like Bharat Bill Payment System (BBPS).

- Install fraud detection apps like Aura for real-time monitoring.

Final Thought

Reversing a fraudulent transaction in India typically takes 1–10 days for simple cases and 30–90 days for complex chargebacks, depending on the payment method and reporting speed. Banks can force merchants to refund through chargebacks, but success depends on evidence and card network rules. By reporting fraud promptly, understanding RBI guidelines, and taking preventive measures, you can protect your finances. Stay vigilant, and always contact your bank immediately if you suspect unauthorized activity.

For more details on fraud protection, visit the RBI website or call the helpline 155260. If you’ve experienced fraud, share your story in the comments to help others stay informed!