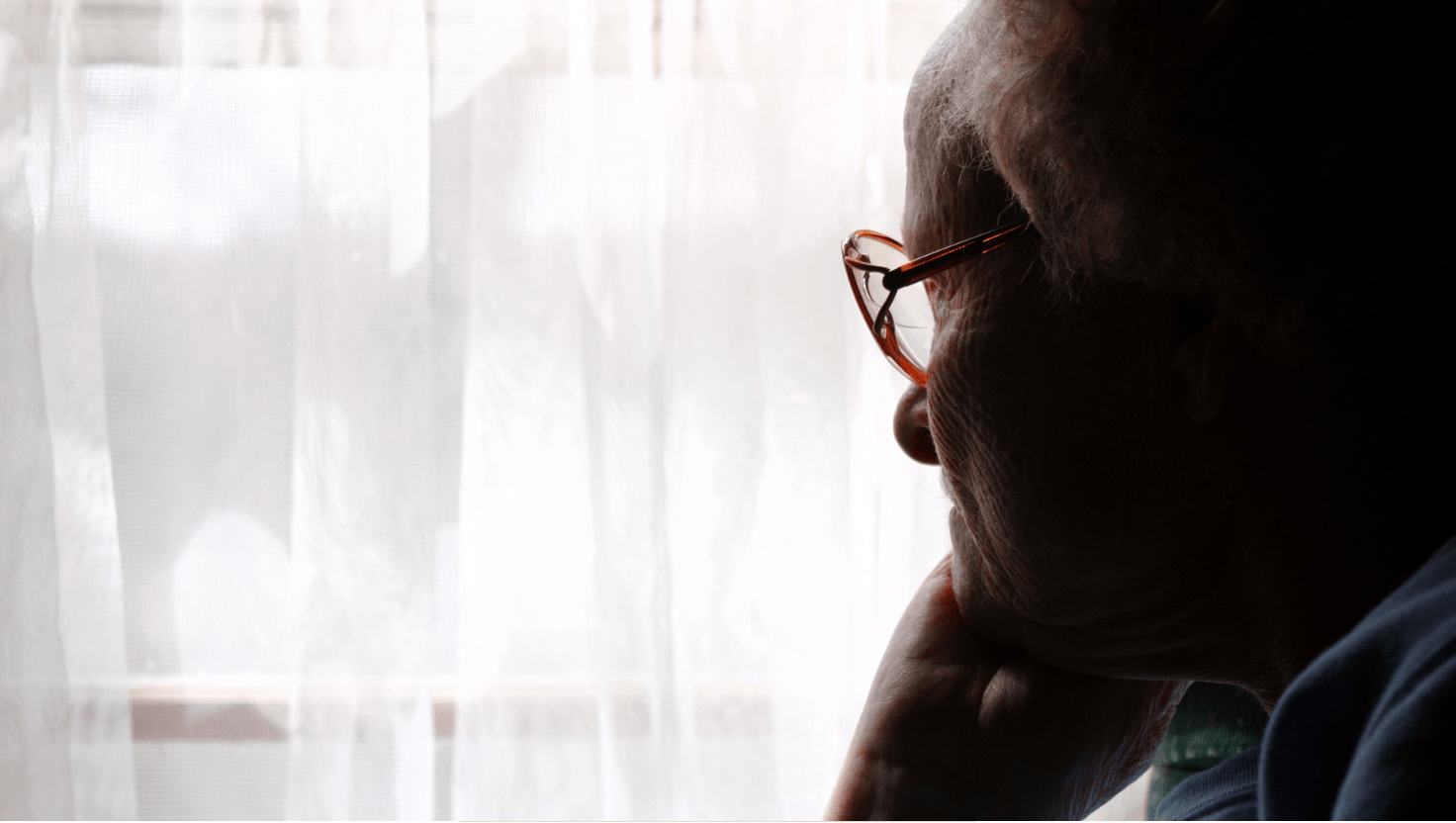

Can a Senior Citizens Savings Scheme (SCSS) joint account survive the death of its primary holder in 2025? With 8.2% returns and Rs. 90,000 crore invested, SCSS is India’s retirement lifeline. But what happens if tragedy strikes before maturity?

The Senior Citizens Savings Scheme (SCSS) is a popular, government-backed savings option designed specifically for senior citizens in India. It offers an attractive interest rate, tax benefits, and secure returns, making it a favoured choice for retired individuals seeking safe, stable income. One common query among SCSS account holders, especially those with joint accounts, is whether the account can continue if the first holder dies before maturity. Understanding this facet is crucial for the peace of mind of senior investors and their families.

What is the Senior Citizens Savings Scheme (SCSS)?

The SCSS is a government-initiated retirement benefit scheme, launched in 2004, available through post offices and select banks across India. It allows individuals aged 60 years and above to invest a lump sum with a maturity period of 5 years, extendable by 3 more years, at a currently attractive interest rate of 8.2% per annum (subject to quarterly revision). The scheme is tailored to generate steady income post-retirement with the guarantee of principal safety.

Key Features of the SCSS

Understanding SCSS begins with its core attributes, which make it a cornerstone of retirement portfolios.

Eligibility Criteria

To open an SCSS account, you must be:

- 60 years or older.

- Aged 55-60 if retired under superannuation, voluntary retirement scheme (VRS), or special VRS, with investment made within one month of receiving benefits.

- Defence personnel (excluding civilians) can join from age 50.

Non-resident Indians (NRIs) and Hindu Undivided Families (HUFs) are ineligible. In 2025, with digital verification improving, eligibility checks are faster, but account opening remains largely offline at post offices or banks like SBI, HDFC, and ICICI.

Deposit Limits and Tenure

- Minimum Deposit: Rs. 1,000, in multiples of Rs. 1,000.

- Maximum Deposit: Rs. 30 lakh per individual, across all accounts.

- Tenure: 5 years, extendable by 3 years upon maturity.

Multiple accounts are allowed, but the cumulative deposit can’t exceed Rs. 30 lakh. For instance, if Mr. Sharma has Rs. 20 lakh in one account, he can open another with Rs. 10 lakh.

Interest Rate and Payouts

The interest rate stands at 8.2% p.a. as of the third quarter of 2025, payable quarterly on the first day of April, July, October, and January. This fixed rate is locked at account opening, shielding investors from downward revisions. Compared to bank fixed deposits (FDs) offering 6-7.5% for seniors, SCSS provides superior returns with government guarantee.

Interest is taxable, but deductions under Section 80C up to Rs. 1.5 lakh apply to the principal. If annual interest exceeds Rs. 50,000, TDS is deducted, though seniors can submit Form 15H to avoid it if total income is below taxable limits.

Nomination and Account Types

Up to four nominees can be appointed. Accounts can be single or joint, but joint only with spouse. This restriction underscores the scheme’s family-oriented design, common in Indian culture where spousal financial interdependence is the norm.

Premature Withdrawal

Withdrawal before 5 years incurs penalties:

- Before 1 year: No interest, recovery of paid interest.

- 1-2 years: 1.5% deduction on deposit.

- After 2 years: 1% deduction.

Extensions allow premature closure after 1 year with a 1% penalty.

These features position SCSS as a flexible yet secure option, especially in 2025 when economic recovery post-pandemic emphasizes low-risk investments.

UPI Payments Fee: Why UPI Transactions May No Longer Be Free

ITR Deadline: Missed Filing Your ITR? Here’s How to File Updated Returns for the Last 2 Years

Top Mistakes to Avoid When Claiming HRA Exemption

Sovereign Gold Bonds Capital Gains Tax: Budget 2026 Changes

Who Can Open a Joint Account under SCSS?

Joint accounts under SCSS are uniquely structured:

- The joint account can only be opened with the spouse.

- The primary/first account holder must be a senior citizen aged 60 or above.

- The spouse (second account holder) may or may not meet the age criterion at account opening, but must be the legal spouse.

- The entire deposit is attributed solely to the first holder for the purpose of limits and benefits.

Thus, while the spouse is a joint account holder, the regulations consider the first depositor as the sole primary investor.

Can a Joint SCSS Account Continue if the First Holder Dies Before Maturity?

The Core Rule

If the first account holder (the senior citizen who opened the account) dies before the maturity of the joint SCSS account, the following applies:

- The spouse as the joint holder can continue the account on the same terms and conditions as originally specified in the SCSS Rules, provided:

- The spouse is eligible under the scheme at the time of the primary holder’s death (usually meaning the spouse is also 60 years or above), and

- The spouse does not have any other SCSS account, or the aggregate of their individual SCSS accounts plus this joint account deposit does not exceed the ₹30 lakh limit.

This continuation allows the surviving spouse to enjoy the same interest benefits and investment tenure, providing financial security without forced premature closure.

When the Spouse is Below 60 Years

If the surviving spouse is below 60 years old and the joint account was the only SCSS investment, then the nominee appointed for the account can continue to hold the account until maturity, and the account will earn interest till maturity. However, the joint account holder spouse under 60 cannot continue it themselves as per scheme rules.

Important Conditions and Details

- The aggregate investment limit (₹30 lakh) applies cumulatively for the second account holder across all individual and joint SCSS accounts they hold. If continuation breaches this limit, the excess amount has to be refunded on account closure.

- The nominee’s claim becomes valid only after the death of both joint holders. Hence, the spouse’s survival ensures continuity until the second death.

- Premature withdrawal rules still apply. The surviving spouse/joint holder can close the account prematurely subject to conditions and penalties, but cessation before maturity is not mandatory.

- The joint holder must apply formally to the relevant accounts office (Post Office or bank branch) for continuation upon the death of the first account holder, furnishing the death certificate and relevant documents.

Why Does This Provision Matter for Indian Senior Citizens?

In India, where over 70% of seniors depend on savings for income, SCSS continuity protects vulnerable spouses. Consider a narrative from Delhi: Mrs. Gupta, 62, lost her husband in 2024. Continuing their joint SCSS account provided her Rs. 20,500 quarterly interest, covering essentials amid rising healthcare costs (average Rs. 50,000 annually for seniors).

With life expectancy at 72 and widowhood common, this rule reduces financial disruption. It also complements cultural norms, where families plan intergenerationally. Data shows SCSS utilization by over 1 million seniors, with joint accounts comprising 40% in urban areas.

Recent Updates and Data for SCSS in 2025

- Interest Rate: Stable at 8.2%, outpacing bank FDs and inflation.

- Deposit Growth: Total inflows hit Rs. 90,000 crore, up from Rs. 37,000 crore in FY 2023-24, reflecting trust amid stock market volatility.

- Tech Integration: Some banks allow online interest crediting, but opening remains offline.

- Rule Enforcement: Strict checks on limits to curb misuse; no major changes since 2023 amendments.

- Tax Tweaks: Interest fully taxable, but 80TTB deduction up to Rs. 50,000 for seniors on bank interest doesn't apply here.

In India's 2025 economy, with GDP growth at 7%, SCSS offers stability for risk-averse retirees.

How to Manage an SCSS Joint Account in Case of the First Holder’s Death?

Steps for Surviving Spouse to Continue the Account

- Inform the deposit office (Post Office or bank branch) about the demise of the first account holder at the earliest.

- Submit an application for account continuation with the documents:

- Death certificate of the first account holder

- Passbook or deposit receipt of the SCSS account

- Proof of age and eligibility of surviving spouse

- The deposit office will verify the documents and update the account records to reflect the surviving spouse’s continuation.

- The account will continue to earn interest at the applicable SCSS rate till maturity or account closure by the surviving holder.

- The surviving spouse can also nominate beneficiaries for the account.

Advantages and Disadvantages of SCSS Joint Accounts

| Advantages | Disadvantages |

| Seamless continuity for eligible surviving spouse | Limited to spouse only for joint accounts |

| High, guaranteed 8.2% returns in 2025 | No continuation if surviving spouse is under 60 and ineligible |

| Tax deduction under Section 80C up to ₹1.5 lakh | Interest fully taxable; TDS applies if interest exceeds ₹50,000 |

| Quarterly payouts ensure regular cash flow | Illiquid; premature withdrawal incurs penalties (1-1.5%) |

| Government-backed security | Strict ₹30 lakh deposit limit across all accounts |

Tax Implications and Optimization Tips

Interest is added to total income, taxed per slab (up to 30% for high earners). Deduct TDS via Form 15H if income < Rs. 3 lakh. Combine with 80C for tax savings. In 2025, with new tax regime options, seniors can optimize by choosing old regime for deductions.

Final Thought

The Senior Citizens Savings Scheme remains a trusted and secure instrument catering to the retirement financial needs of Indian seniors in 2025. The provision allowing the surviving spouse to continue a joint SCSS account after the death of the first holder underscores the scheme’s commitment to sustaining financial stability and easing transitions for senior couples. Understanding these rules empowers senior investors to plan their investments better and ensures their savings continue to generate income without interruption, securing peaceful and dignified retirement years.

For senior citizens planning or already holding SCSS accounts, especially joint ones, keeping abreast of the SCSS rules on account continuation after death is essential. Consulting with your bank or post office and maintaining up-to-date documentation will help leverage the full benefits of this prudent government saving scheme.