Struggling with high education loan EMIs? SBI’s Takeover of Education Loans Scheme – Slash your interest rates to as low as 7.15%, enjoy up to ₹3 crore loans, and repay over 15 years—no hidden charges!

You are a student chasing your dream degree at a prestigious university, but the weight of high-interest education loan EMIs is crushing your spirit. What if you could slash those monthly payments, save thousands, and still pursue your academic goals without financial stress? Enter the SBI Takeover of Education Loans Scheme—this revolutionary scheme by the State Bank of India (SBI) lets you transfer your existing high-cost education loan to SBI, unlocking lower interest rates, flexible repayment terms, and a world of financial relief. Ready to discover how this scheme can transform your financial journey?

What is the SBI Takeover of Education Loans Scheme?

The SBI Takeover of Education Loans Scheme is a golden opportunity for students to switch their existing education loans from other banks or financial institutions to SBI, India’s largest and most trusted public sector bank. By doing so, you can reduce your monthly EMIs, benefit from competitive interest rates, and enjoy a hassle-free repayment process. Whether you’re studying in India or abroad, this scheme is designed to ease your financial burden and make your academic dreams more achievable.

But what makes this scheme so irresistible? Is it the promise of lower interest rates? The flexible repayment tenure? Or the absence of hidden charges? Let’s unravel the mystery step by step with the latest data, ensuring you’re armed with all the information to make a smart financial move!

Why Choose SBI Takeover of Education Loans?

The SBI Takeover Scheme isn’t just another loan product—it’s a lifeline for students drowning in high-interest debt:

1. Massive Loan Amounts Up to ₹3 Crore

Dreaming of studying at a top-tier global university or a premier Indian institute like IIT or IIM? The SBI Takeover Scheme covers loans from ₹10 lakh to ₹3 crore, catering to both partially disbursed and fully disbursed loans, including any prepayment penalties or top-up loans. This massive limit ensures your education expenses—tuition, hostel fees, travel, and even laptops—are fully covered.

2. Competitive Interest Rates Starting at 7.15%

High interest rates can turn your dream education into a financial nightmare. SBI’s takeover scheme offers some of the most competitive rates, starting as low as 7.15% for select schemes and premier institutes. For girl students, there’s an additional 0.50% concession, making it even more affordable. Compared to private lenders charging 12-15%, SBI’s rates are a steal

3. Flexible Repayment Tenure Up to 15 Years

Worried about repaying your loan right after graduation? With SBI, you get a moratorium period (course duration + 6-12 months) and a repayment tenure of up to 15 years. This means you can focus on building your career without the pressure of immediate EMIs. Plus, you can extend the tenure if you pursue further studies with a top-up loan!

4. No Processing Fees or Hidden Charges

Unlike other lenders that sneak in hidden costs, SBI keeps it transparent. There are no processing fees for most schemes, and no hidden charges to surprise you. This ensures your loan remains cost-effective from start to finish.

5. Convenient EMI Payment Options

Paying your EMIs has never been easier. With options like Net Banking, Mobile Banking, or cheques, SBI ensures you can manage repayments seamlessly, no matter where you are in the world.

6. Top-Up Loan for Further Studies

Planning to pursue a master’s or PhD after your current course? SBI’s top-up loan facility allows you to borrow additional funds with an extended repayment period, ensuring your educational journey continues uninterrupted.

7. Collateral-Free Options for Premier Institutes

Studying at a top-tier institute like IIT, IIM, or select global universities? You may qualify for collateral-free loans up to ₹50 lakh under the SBI Scholar Loan or Global Ed-Vantage Scheme. For other schemes, collateral worth at least 100% of the loan amount is required.

Intrigued yet? The SBI Takeover Scheme is like finding a hidden treasure chest in the world of education loans. But who can claim this treasure, and what’s the catch? Let’s find out!

Eligibility Criteria: Are You Ready to Make the Switch?

Before you rush to transfer your loan, you need to meet SBI’s eligibility criteria. Don’t worry—it’s straightforward, but you’ll need to check these boxes:

- Indian Nationality: The applicant must be an Indian citizen, above 18 years of age.

- First-Time Takeover: The loan must be a fresh (first-time) takeover, not previously refinanced by another bank or institution.

- Standard Loan Status: Your existing loan must be in good standing with no overdue payments in the books of the current lender.

- Loan Term Flexibility: The takeover can happen at any point during the loan term—course period, moratorium, or repayment phase.

- Admission to Recognized Institutes: You must be enrolled in a recognized course in India or abroad, with admission secured through entrance tests or selection processes.

Sounds simple, right? But here’s the suspenseful part: missing even one of these criteria could delay or derail your application. So, ensure your loan is in good standing and your documents are ready before you apply!

Documents Required: Your Checklist for Success

To make the SBI Takeover process smooth and swift, you’ll need to submit a set of documents along with a duly filled loan application form. Here’s the ultimate checklist for 2025:

- Loan Application Form: Completely filled and signed.

- Passport-Size Photographs: 2 photographs of the student and co-borrower.

- PAN Card: For the student and parent/guardian/co-borrower.

- Aadhaar Card: Mandatory for both student and co-borrower.

- Proof of Identity: Driving license, passport, or any KYC-compliant photo ID.

- Proof of Residence: Utility bills (electricity, telephone), passport, or driving license.

- Bank Account Statement: Last 6 months for the student, co-borrower, or guarantor.

- Income Proof: IT returns or assessment orders for the last 2 years (if applicable), salary slips, or Form 16 for the co-borrower.

- Asset-Liability Statement: A brief statement of the co-borrower’s assets and liabilities.

- Collateral Documents (if applicable): Property documents, valuation reports, or other acceptable securities.

Pro Tip: Use services like GyanDhan for a customized document checklist and free pickup in metro cities to avoid any back-and-forth.

Missed a document? Your application could hit a roadblock. So, double-check this list and keep your paperwork ready to unlock a seamless takeover process!

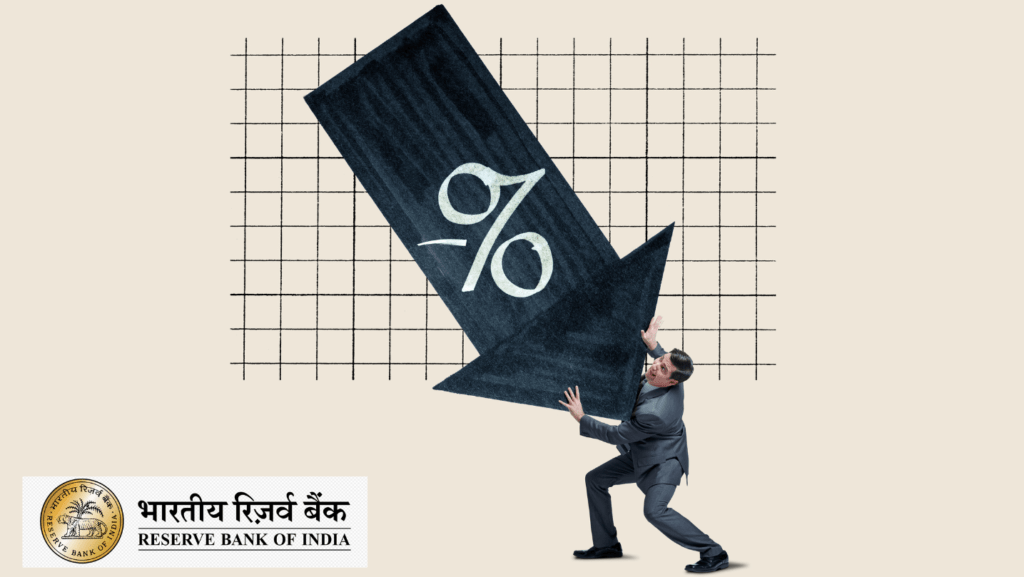

Interest Rates: The Numbers That Matter

The real magic of the SBI Takeover Scheme lies in its competitive interest rates, which are linked to the External Benchmark Rate (EBR), currently at 8.15% (Repo Rate 5.50% + Spread 2.65%). Here’s a breakdown of the latest rates :

SBI PM-Vidyalaxmi Scheme

- PMVL-Utkarsh: 7.15%

- PMVL-Uttam: 7.45%

- PMVL-Uday: 8.65%

SBI Student Loan Scheme

- Without Collateral (Up to ₹7.50 lakh): 10.15%

- With Collateral (Above ₹7.50 lakh): 9.15%

- Takeover (Above ₹10 lakh, with collateral): 9.15%

- Concession: 0.50% for girl students.

SBI Scholar Loan Scheme

- Select Institutions: 7.15% to 7.90%

- Takeover (Above ₹10 lakh): 7.15% to 7.90%

SBI Global Ed-Vantage Scheme

- With Collateral (₹7.50 lakh to ₹3 crore): 9.15%

- Takeover (Above ₹10 lakh): 8.65% to 9.15%

- Without Collateral (Select Institutions, ₹7.50 lakh to ₹50 lakh): 9.15%

- Concession: 0.50% for girl students.

SBI Shourya Education Loan

- Without Collateral (Up to ₹7.50 lakh): 10.15%

- Without Collateral (₹7.50 lakh to ₹40 lakh): 9.15%

- With Collateral (₹7.50 lakh to ₹1.50 crore): 9.15%

- Takeover (Above ₹10 lakh): 9.15% to 10.15%

- Concession: 0.50% for girl students.

SBI Skill Loan Scheme

- Without Collateral (Up to ₹7.50 lakh): 9.65%

Mean Rate of Interest (Q4 FY25): 9.89%

Curious about premier institutes? Check the SBI Scholar Loan Portal for eligible Indian institutes and the Global Ed-Vantage List for abroad studies.

These rates are floating, meaning they adjust with the EBR, ensuring transparency. Plus, additional concessions like 0.50% for SBI Rinn Raksha insurance make the deal even sweeter

How to Apply: A Step-by-Step Thriller

Ready to switch to SBI and save big? Here’s how to apply for the SBI Takeover of Education Loans:

- Visit SBI’s Website or Branch: Log in to sbi.co.in or visit your nearest SBI branch.

- Navigate to Education Loans: Find the “Takeover of Education Loans” section under Personal Banking.

- Check Eligibility: Ensure your loan meets the criteria (first-time takeover, standard status).

- Fill the Application Form: Complete the form with details of your existing loan and personal information.

- Submit Documents: Upload or submit the required documents (see checklist above).

- Wait for Verification: SBI will verify your application, documents, and collateral (if applicable).

- Receive Sanction Letter: If approved, you’ll get a sanction letter detailing the loan amount, interest rate, and repayment terms.

- Settle with Previous Lender: SBI will coordinate with your current lender to pay off the outstanding balance.

- Start Repaying with SBI: Begin your EMIs as per the agreed schedule, enjoying lower rates and flexible terms.

For a faster process, apply through the YONO SBI app or the Vidya Lakshmi Portal.

Suspense Alert: Missing a single step or document could delay your approval. So, follow this guide meticulously to ensure a smooth takeover!

Benefits That’ll Leave You Speechless

Still wondering if the SBI Takeover Scheme is worth it? Here are the jaw-dropping benefits:

- Lower EMIs: Save thousands by switching to SBI’s competitive rates.

- No Hidden Costs: Transparency with zero processing fees or hidden charges.

- Flexible Repayment: Up to 15 years to repay, with a moratorium period for stress-free planning.

- Top-Up Loans: Additional funds for further studies with extended repayment.

- Tax Benefits: Deductions on interest paid under Section 80(E).

- Concessions: 0.50% off for girl students and SBI Rinn Raksha policyholders.

Potential Challenges: The Plot Twists

No story is complete without a few twists. Here are some challenges to watch out for:

- Collateral Requirements: Loans above ₹7.50 lakh typically require collateral worth 100% of the loan amount, which could be a hurdle for some.

- Documentation Delays: Incomplete or incorrect documents can slow down the process. Use services like GyanDhan for a hassle-free experience.

- Verification Process: SBI’s thorough verification, including collateral checks, may take time.

- Floating Rates: While competitive, rates are subject to change with the EBR, so keep an eye on market trends.

Final Thought: Your Path to Financial Freedom Starts Here

The SBI Takeover of Education Loans Scheme is more than just a financial product—it’s a ticket to turning your academic dreams into reality without the burden of high EMIs. With loan amounts up to ₹3 crore, interest rates as low as 7.15%, and a repayment tenure of 15 years, this scheme is a no-brainer for students looking to save big. Whether you’re studying at an IIT in India or a top university abroad, SBI’s competitive rates, transparent terms, and student-friendly concessions make it the ultimate choice.

Ready to take the leap? Visit sbi.co.in or the Vidya Lakshmi Portal to start your application today. Don’t let high-interest loans hold you back—switch to SBI and unlock a world of savings and opportunities!

Disclaimer: Terms and conditions apply. Interest rates and eligibility criteria are subject to change. Always check with SBI for the latest updates before applying.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.