SBI Life eShield Next, a top term insurance plan ,With whole life cover up to 100 years, flexible plans, Better Half Benefit, and affordable premiums, secure your family’s future. Explore its unique features, compare plans, and boost financial immunity today!

SBI Life eShield Next, an individual, non-linked, non-participating life insurance pure risk product, you can build robust financial immunity to tackle life’s uncertainties. This innovative term insurance plan is designed to evolve with your changing responsibilities, offering flexibility, affordability, and comprehensive protection. In this blog, we dive deep into the features, benefits, and advantages of SBI Life eShield Next, ensuring you have all the information to make an informed decision.

Why Choose SBI Life eShield Next?

Life is full of milestones—marriage, parenthood, or buying a home. Each milestone increases your responsibilities, making financial security crucial. SBI Life eShield Next stands out as a new-age term insurance plan that adapts to your evolving needs, offering life cover up to 100 years and customizable options to suit your financial goals. Whether you’re a young professional, a growing family, or planning for retirement, this plan ensures your loved ones are protected at every stage.

Key Features of SBI Life eShield Next

SBI Life eShield Next offers a range of features that make it a top choice for term insurance in India. Here’s what sets it apart:

- Three Plan Options: Choose from Level Cover, Increasing Cover, or Level Cover with Future Proofing Benefit to match your protection needs.

- Life Cover Up to 100 Years: Opt for whole-life coverage (up to 100 years) or partial coverage (up to 79 years).

- Terminal Illness Benefit: Built-in coverage for terminal illnesses, with payouts up to ₹2 crore (for in-force policies).

- Flexible Premium Payment: Pay premiums as a single payment, for a limited period, or throughout the policy term.

- Customizable Death Benefit Modes: Select lump sum, monthly installments, or a combination for death benefit payouts.

- Better Half Benefit Option: Provides life cover for your non-earning spouse after your demise.

- Optional Riders: Enhance coverage with Accidental Death Benefit (ADB) and Accidental Partial Permanent Disability Benefit (APPD) riders.

- Tax Benefits: Avail deductions under Section 80C and exemptions under Section 10(10D) of the Income Tax Act, 1961 (subject to change; consult a tax advisor).

These features ensure SBI Life eShield Next is a versatile and reliable choice for securing your family’s future.

Plan Options: Tailored to Your Needs

SBI Life eShield Next offers three distinct plan options, each designed to cater to different financial needs and life stages:

- Level Cover:

- The sum assured remains constant throughout the policy term.

- Ideal for those seeking consistent coverage with predictable premiums.

- Example: A 35-year-old non-smoker opting for a ₹1 crore cover with a 20-year term pays an annual premium of approximately ₹10,586 (excluding taxes).

- Increasing Cover:

- The sum assured increases by 10% per annum (simple interest) every fifth policy year, up to a maximum of 100% of the basic sum assured.

- Perfect for addressing inflation and growing financial responsibilities.

- Example: If you choose a ₹50 lakh sum assured, it could grow to ₹1 crore over 20 years without increasing premiums.

- Level Cover with Future Proofing Benefit:

- Allows you to increase the sum assured at key life milestones (e.g., marriage, parenthood, or home purchase) without additional medical underwriting.

- This option ensures your coverage evolves with your responsibilities, offering flexibility without compromising affordability.

Once chosen, the plan option cannot be changed during the policy term, so select wisely based on your long-term goals.

Key Benefits of SBI Life eShield Next

SBI Life eShield Next is packed with benefits that ensure financial security, flexibility, and reliability:

1. Security

- Provides robust financial protection for your family, ensuring they are safeguarded against unforeseen events.

- The Death Benefit guarantees the nominee receives the Sum Assured on Death, which is the higher of:

- 10 times the annualized premium (for regular/limited premium policies).

- 1.25 times the single premium (for single premium policies).

- 105% of total premiums paid up to the date of death.

- Absolute amount assured, depending on the chosen plan option.

2. Flexibility

- Choose from three plan options and customize the death benefit payment mode (lump sum, monthly installments, or both).

- The Better Half Benefit ensures your non-earning spouse receives life cover after your demise, adding an extra layer of protection.

3. Simplicity

- Customize the plan to meet your unique needs, making it easy to align with your financial planning.

- The online application process is seamless, allowing you to secure coverage with minimal paperwork.

4. Reliability

- Offers life cover up to 100 years with the whole-life option, ensuring long-term protection.

- Backed by SBI Life Insurance, a trusted name with a claim settlement ratio of 99.02% (IRDAI Annual Report, 2020-21), ensuring reliability.

5. Affordability

- Competitive premiums make it accessible for various income groups.

- Discounts for non-smokers and women policyholders enhance affordability.

- Example: A ₹2 crore cover for an 18-year-old non-smoker NRI costs as low as ₹820/month.

6. Terminal Illness Benefit

- If diagnosed with a terminal illness before age 80, you receive the sum assured (up to ₹2 crore) as a lump sum, monthly installments, or a combination.

- If the sum assured exceeds the terminal illness benefit, the balance is paid upon death, provided the policy remains in force with reduced premiums.

7. Optional Riders

- Accidental Death Benefit Rider: Provides additional coverage up to ₹50 lakh in case of death due to an accident.

- Accidental Partial Permanent Disability Benefit Rider: Offers financial support for permanent disabilities caused by accidents.

How Does SBI Life eShield Next Work?

SBI Life eShield Next is a pure term insurance plan, meaning it focuses solely on providing death benefits without maturity or survival benefits. Here’s how it operates:

- Death Benefit: If the policyholder passes away during the policy term, the nominee receives the Sum Assured on Death, based on the chosen plan option:

- Level Cover: Fixed sum assured.

- Increasing Cover: Sum assured plus increases accrued till the date of death.

- Level Cover with Future Proofing: Sum assured plus any additional coverage added at life milestones.

- Terminal Illness Benefit: Pays out up to ₹2 crore upon diagnosis of a terminal illness, with flexible payout options.

- No Maturity or Surrender Value: As a pure term plan, there are no payouts if the policyholder survives the term, and no loans can be taken against the policy.

Premium Payment Options

- Single Premium: Pay once at policy inception.

- Limited Premium: Pay for a shorter duration than the policy term.

- Regular Premium: Pay throughout the policy term.

- Premiums can be paid monthly, half-yearly, or annually, with a 30-day grace period for regular payments (15 days for monthly).

Tax Benefits

- Premiums paid are eligible for deductions under Section 80C (up to ₹1.5 lakh).

- Death benefits are exempt under Section 10(10D), subject to prevailing tax laws. Always consult a tax advisor for clarity.

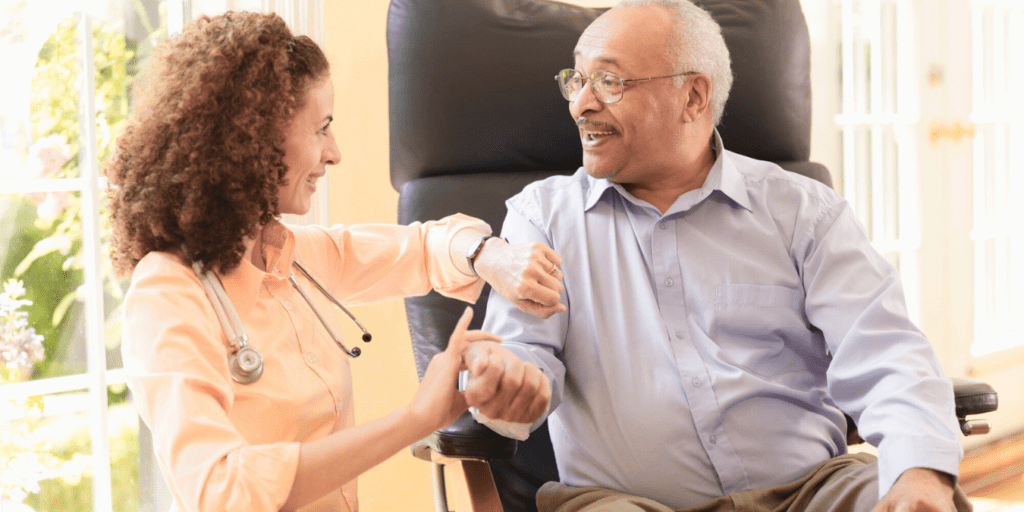

Who Should Buy SBI Life eShield Next?

This plan is ideal for:

- Young Professionals: Seeking affordable, long-term coverage with flexibility to increase sums assured as responsibilities grow.

- Families: Looking to secure financial stability for dependents, especially with the Better Half Benefit.

- NRIs: Affordable premiums starting at ₹820/month for a ₹2 crore cover make it accessible for non-residents.

- Individuals Planning for Milestones: The Future Proofing Benefit is perfect for those anticipating major life events like marriage or home ownership.

Exclusions to Understand

- Suicide Clause: If the policyholder dies by suicide within 12 months of policy inception or revival, the nominee receives 80% of total premiums paid or the surrender value (if any).

- Accidental Death Benefit Rider Exclusions: No benefits for accidents due to criminal activity, war, self-inflicted injuries, drug misuse, or diseases.

Why SBI Life eShield Next Stands Out

In a competitive insurance market, SBI Life eShield Next shines due to:

- Customizable Coverage: Three plan options and flexible payout modes cater to diverse needs.

- Long-Term Protection: Whole-life coverage up to 100 years ensures lifelong security.

- Trusted Brand: SBI Life’s 99.02% claim settlement ratio reflects its reliability.

- Affordable Premiums: Discounts for non-smokers and women, plus low starting premiums, make it budget-friendly.

- No Medical Underwriting for Milestones: The Future Proofing Benefit allows coverage increases without additional health checks, a unique feature.

How to Purchase SBI Life eShield Next

- Visit www.sbilife.co.in or platforms like Policybazaar.

- Select “Buy eShield Next Online.”

- Enter personal details (name, DOB, contact number, etc.).

- Choose your plan option, policy term, and sum assured.

- Complete the health questionnaire and nominee details.

- Submit self-attested KYC/AML documents.

- Pay the premium online via debit/credit cards or net banking.

SBI Life eShield Next vs Other Term Insurance Plans

Below is a comparison of SBI Life eShield Next with other popular term insurance plans in India, including HDFC Life Click 2 Protect Life, ICICI Pru iProtect Smart, and TATA AIA Maha Raksha Supreme, based on key features, benefits, and limitations.

| Feature/Plan | SBI Life eShield Next | HDFC Life Click 2 Protect Life | ICICI Pru iProtect Smart | TATA AIA Maha Raksha Supreme |

| Type | Non-Linked, Non-Participating, Pure Risk | Non-Linked, Non-Participating, Pure Risk | Non-Linked, Non-Participating, Pure Risk | Non-Linked, Non-Participating, Pure Risk |

| Plan Options | 1. Level Cover 2. Increasing Cover (10% p.a. every 5th year) 3. Level Cover with Future Proofing Benefit | 1. Life Protect 2. Income Plus 3. Life Long Protection | 1. Life 2. Life Plus 3. Life & Health 4. All-in-One | 1. Basic Life Cover 2. Life Plus 3. Life Income |

| Life Cover Duration | Up to 100 years (Whole Life) or 79 years | Up to 85 years | Up to 99 years | Up to 85 years |

| Sum Assured | ₹25 lakh - ₹25 crore | ₹10 lakh - No upper limit | ₹25 lakh - No upper limit | ₹20 lakh - No upper limit |

| Premium Payment Options | Single, Limited (5/10 years), Regular | Single, Limited (5/7/10/PT-5), Regular | Single, Limited (5/7/10/PT-5), Regular | Single, Limited (5/7/10/15/20), Regular |

| Terminal Illness Benefit | Up to ₹2 crore (included) | Not included | Up to ₹2 crore (included) | Not included |

| Critical Illness Benefit | Not available | Available (36 illnesses, optional) | Available (34 illnesses, included in Life & Health) | Available (40 illnesses, optional) |

| Better Half Benefit | Available (spouse cover post-demise) | Not available | Not available | Not available |

| Future Proofing | Increase sum assured at life milestones without medical underwriting | Not available | Not available | Not available |

| Accidental Death Benefit Rider | Up to ₹50 lakh | Up to ₹10 crore | Up to ₹2 crore | Up to ₹2 crore |

| Accidental Disability Rider | Available (Partial Permanent Disability) | Available (Total Permanent Disability) | Available (Total Permanent Disability) | Available (Total Permanent Disability) |

| Waiver of Premium | Not available | Available (on critical illness/disability) | Available (on critical illness/disability) | Available (on critical illness/disability) |

| Death Benefit Payout | Lump sum, Monthly, Lump sum + Monthly | Lump sum, Income, Lump sum + Income | Lump sum, Income, Lump sum + Income | Lump sum, Income, Lump sum + Income |

| Premium Discounts | Non-smokers, Women | Non-smokers, Women | Non-smokers, Women | Non-smokers, Women |

| Sample Premium (₹1 crore, 30-year-old male, non-smoker, 30-year term) | ~₹10,586/year | ~₹11,000/year | ~₹10,800/year | ~₹10,200/year |

| Free Look Period | 15 days | 15 days (30 days for online) | 15 days (30 days for online) | 15 days (30 days for online) |

| Claim Settlement Ratio (2020-21) | 99.02% | 98.66% | 97.90% | 98.53% |

| Exclusions | Suicide within 12 months (80% premiums returned), rider exclusions (war, drugs, etc.) | Suicide within 12 months, rider exclusions | Suicide within 12 months, rider exclusions | Suicide within 12 months, rider exclusions |

| Key Strengths | Future Proofing, Better Half Benefit, Whole Life cover | Critical illness rider, high sum assured | Comprehensive critical illness cover, flexible payouts | Wide range of riders, flexible income options |

| Limitations | No critical illness rider, no waiver of premium | No Better Half Benefit, no future proofing | No Better Half Benefit, no future proofing | No Better Half Benefit, no terminal illness benefit |

Secure Your Family’s Future Today

SBI Life eShield Next is a forward-thinking term insurance plan that combines affordability, flexibility, and reliability. With life cover up to 100 years, customizable options, and benefits like terminal illness coverage and optional riders, it’s a comprehensive solution for building financial immunity. Whether you’re safeguarding your family or planning for future milestones, this plan adapts to your needs, ensuring peace of mind in an uncertain world.

Ready to level up your financial security? Visit SBI Life’s official website or contact a trusted advisor to explore SBI Life eShield Next today. For detailed terms, read the sales brochure and rider brochure carefully.

Disclaimer: Tax benefits are subject to change as per Income Tax Laws. Consult your tax advisor for details. For complete risk factors and terms, refer to the official SBI Life eShield Next sales and rider brochures.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.