Owning a home is a cherished dream for many Indians, symbolizing stability, security, and success. The State Bank of India (SBI), India’s largest and most trusted public sector bank, has been empowering over 31 lakh families to achieve this dream through its diverse and affordable home loan schemes. With competitive interest rates, flexible repayment options, and customer-centric features, SBI Home Loans stands out as a beacon of reliability in the Indian housing finance market. In this blog post, we’ll dive deep into the latest SBI home loan interest rates, eligibility criteria, schemes, and benefits for 2025, using data from SBI’s official interest rates page and SBI’s Regular Home Loan product page. Whether you’re a first-time homebuyer or looking to renovate, this guide will help you make an informed decision to unlock your dream home.

Why Choose SBI Home Loans?

SBI Home Loans are synonymous with trust, transparency, and affordability. With a vast network of over 16,000 branches and a legacy of serving millions, SBI is the go-to choice for homebuyers across India. Here’s why SBI stands out:

- Competitive Interest Rates: Starting at 7.50% p.a., SBI offers some of the lowest home loan rates in India, linked to the External Benchmark Lending Rate (EBLR) for transparency.

- Diverse Loan Schemes: From regular home loans to specialized schemes like SBI Tribal Plus and Maxgain, SBI caters to varied needs, including purchase, construction, renovation, and plot acquisition.

- Flexible Repayment Tenure: Loan tenures extend up to 30 years, making EMIs affordable and manageable.

- Concessions for Women: Women borrowers enjoy a 0.05% interest rate concession, promoting inclusivity.

- No Hidden Charges: SBI ensures transparency with no prepayment penalties on floating-rate loans and clear processing fees.

- Pradhan Mantri Awas Yojana (PMAY) Benefits: Eligible borrowers can avail subsidies up to ₹2.67 lakh under PMAY-U 2.0.

- Digital Convenience: Apply online via homeloans.sbi or the SBI YONO app for a seamless experience.

With these advantages, SBI Home Loans are designed to make homeownership accessible to everyone, from urban professionals to rural residents.

Latest SBI Home Loan Interest Rates for 2025

SBI’s home loan interest rates are dynamic, influenced by the Reserve Bank of India’s (RBI) repo rate and the borrower’s credit profile. As of June 15, 2025, following a 50-basis-point repo rate cut, SBI reduced its External Benchmark Rate (EBR) to 8.15%. Home loan rates now range from 7.50% to 8.45% p.a. based on the borrower’s CIBIL score. Here’s a breakdown of the latest rates for key schemes:

Note: Rates are linked to the EBLR (currently 8.15%) and reset as per RBI guidelines. Women borrowers receive a 5-basis-point (bps) concession on most schemes.

How CIBIL Score Impacts Your Interest Rate

Your CIBIL score plays a pivotal role in determining your home loan interest rate. A higher score (750+) can secure the lowest rates, while a score below 650 may result in higher rates. Here’s how it works:

- CIBIL 800-900: Eligible for the lowest rate of 7.50% p.a.

- CIBIL 700-799: Rates range from 7.75% to 8.00% p.a.

- CIBIL 650-699: Rates may go up to 8.45% p.a.

- Below 650: Higher rates or potential rejection, depending on other eligibility factors.

To improve your CIBIL score before applying, ensure timely repayment of existing loans, reduce credit card debt, and avoid multiple loan applications.

SBI Home Loan Schemes: Tailored for Every Need

SBI offers a variety of home loan products to suit diverse requirements, from purchasing a ready-built flat to constructing a house in a tribal area. Below are the key schemes available in 2025:

- SBI Regular Home Loan

The flagship offering, the SBI Regular Home Loan, is ideal for salaried and self-employed individuals looking to buy a new or pre-owned home, construct a house, or renovate an existing property. Key features include:

- Purpose: Purchase of ready-built/under-construction properties, home construction, or renovation.

- Loan Amount: Up to 90% of the property value (subject to eligibility).

- Interest Rate: 7.50% – 8.45% p.a. (0.05% concession for women).

- Processing Fee: 0.35% of the loan amount (min. ₹2,000, max. ₹10,000, plus GST).

- Tenure: Up to 30 years.

- Eligibility: Age 18-70 years, minimum income ₹1,80,000 p.a., CIBIL score 650+.

This scheme is popular for its affordability and flexibility, with no prepayment penalties on floating-rate loans.

- SBI Maxgain (Home Loan with Overdraft Facility)

SBI Maxgain offers a unique overd علیه

raft facility, allowing borrowers to park surplus funds and reduce interest liability. It’s ideal for those seeking flexibility in managing EMIs.

- Purpose: Purchase of ready-to-move-in properties.

- Interest Rate: 7.75% – 8.70% p.a.

- Key Benefit: Surplus funds in the overdraft account reduce the principal, lowering interest costs.

- Drawing Power: Reduces monthly based on the principal component of EMI.

- Processing Fee: 0.35% of the loan amount (min. ₹2,000, max. ₹10,000, plus GST).

This scheme suits professionals with irregular cash flows, such as self-employed individuals or business owners.

- SBI Tribal Plus

Designed for residents of tribal or hilly areas, this scheme supports the purchase, construction, or renovation of homes in underserved regions.

- Interest Rate: 9.25% onwards.

- Loan Amount: Up to ₹50 crore.

- Processing Fee: 0.35% of the loan amount (min. ₹2,000, max. ₹10,000, plus GST).

- Eligibility: No upper age limit; tailored for tribal/hilly area residents.

This scheme reflects SBI’s commitment to inclusive homeownership.

- SBI Privilege Home Loan

Aimed at government employees, this scheme offers concessions and tailored benefits for central/state government workers or pensionable service employees.

- Interest Rate: 8.50% onwards.

- Processing Fee: 50%-100% concession in select cases.

- Key Benefit: Interest calculated on a daily reducing balance, reducing overall costs.

This is ideal for salaried government employees seeking lower rates and faster processing.

- SBI Realty Home Loan

For those looking to purchase a plot for future construction, SBI Realty offers loans up to ₹15 crore with a repayment tenure of up to 10 years.

- Purpose: Purchase of residential plots.

- Interest Rate: 8.50% – 10.15% p.a.

- Processing Fee: 0.35% of the loan amount (min. ₹2,000, max. ₹10,000, plus GST).

Borrowers can also avail a separate construction loan later, making it a flexible option for long-term planning.

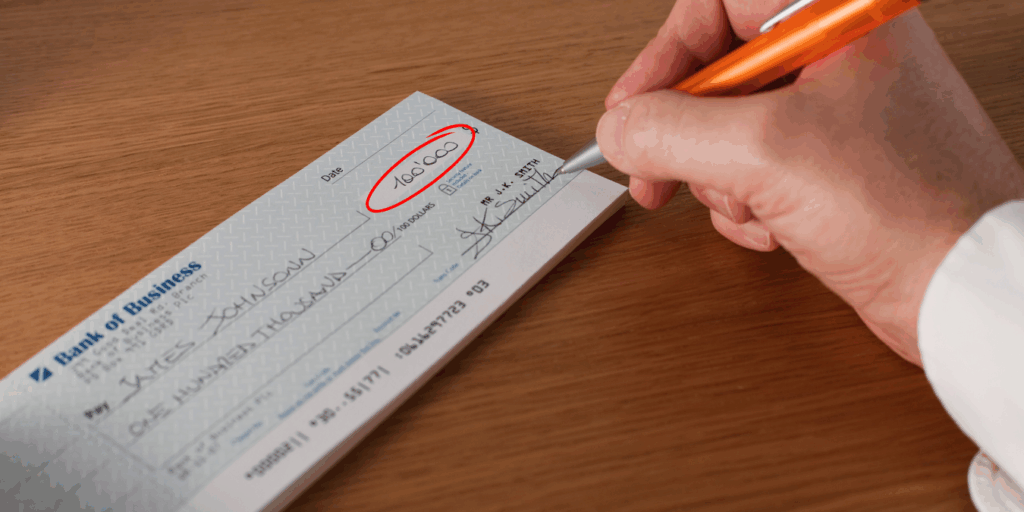

- SBI Home Loan Balance Transfer

If you have an existing home loan with another bank, SBI’s balance transfer option allows you to switch to lower interest rates (7.50% – 8.45% p.a.), reducing your EMI burden. The prepayment penalty from the original lender is funded, subject to eligibility.

- Pradhan Mantri Awas Yojana (PMAY-U 2.0)

SBI integrates PMAY-U 2.0, offering subsidies up to ₹2.67 lakh for eligible EWS/LIG/MIG families with an annual household income up to ₹18 lakh. Key features include:

- Interest Rate: 8.25% onwards.

- Processing Fee: Waived for loans up to ₹8 lakh.

- Eligibility: No pucca house owned anywhere in India; apply via pmaymis.gov.in.

This scheme makes homeownership affordable for low- and middle-income families.

Eligibility Criteria for SBI Home Loans

SBI evaluates applicants based on several factors to ensure loan affordability and repayment capacity. Key eligibility criteria include:

- Age: 18-70 years (75 for Shaurya Home Loan).

- Income: Minimum ₹1,80,000 p.a. (₹25,000 monthly for salaried individuals).

- CIBIL Score: Preferably 650+, with higher scores securing better rates.

- Job Profile: Salaried, self-employed, or non-salaried professionals (e.g., doctors, CAs).

- Loan-to-Value (LTV) Ratio: Up to 90% for properties below ₹30 lakh, 80% for ₹30-80 lakh, and 75% for above ₹80 lakh.

- Co-Applicant: Adding a co-applicant (e.g., spouse) can increase loan eligibility by combining incomes.

For non-salaried individuals, SBI considers business vintage, net profit, and existing credit facilities.

Documents Required for SBI Home Loans

To apply for an SBI home loan, you’ll need to submit the following documents:

- Loan Application: Completed form with 3 passport-size photographs.

- Identity Proof: PAN, Passport, Voter ID, or Driver’s License.

- Address Proof: Recent utility bill, Passport, or Aadhaar Card.

- Income Proof (Salaried): Form 16, last 2 years’ IT returns, 6 months’ bank statement.

- Income Proof (Self-Employed): Last 3 years’ IT returns, balance sheet, profit/loss account, business license.

- Property Documents: Sale agreement, occupancy certificate, approved plan, property tax receipt, or conveyance deed.

- Additional for NRIs: Passport, visa, employment contract, overseas bank statements.

Ensure all documents are up-to-date to expedite the application process.

Processing Fees and Other Charges

SBI maintains transparency in its fee structure:

- Processing Fee: 0.35% of the loan amount (min. ₹2,000, max. ₹10,000, plus GST).

- PMAY-U 2.0: No processing fee for loans up to ₹8 lakh.

- CERSAI Registration: ₹50 + GST (loans up to ₹5 lakh); ₹100 + GST (above ₹5 lakh).

- Property Insurance: Mandatory, premium varies.

- Prepayment Charges: Nil for floating-rate loans.

Women and government employees may receive concessions on processing fees.

How to Apply for an SBI Home Loan

Applying for an SBI home loan is straightforward, with both online and offline options: