” How your property sale will be taxed after relocating to India. This comprehensive guide covers capital gains tax, exemptions, TDS, and special considerations for NRIs, ensuring you are well-prepared for a smooth and compliant property sale process. “

Relocating to India is an exciting yet complex process, especially when it comes to managing your financial affairs, including the sale of property abroad. One of the most common concerns for Non-Resident Indians (NRIs) or those planning to move back to India is understanding the tax implications of selling property overseas. This blog post will provide a comprehensive guide on how your property sale will be taxed after relocating to India, including the latest tax laws, exemptions, and strategies to minimize your tax liability.

Understanding Tax Residency Status in India

Before diving into the tax implications of selling property, it’s crucial to understand your tax residency status in India. The Indian Income Tax Act categorizes individuals into two groups:

- Resident

- You are considered a resident if you stay in India for 182 days or more in a financial year (April 1 to March 31) or 365 days in the last 4 years plus 60 days in the current financial year.

- Residents are taxed on their global income, including income from property sales abroad.

- Non-Resident (NRI)

- If you do not meet the above criteria, you are considered a non-resident.

- NRIs are taxed only on income earned or accrued in India. However, income from the sale of property abroad may still be taxable in India under certain conditions.

Tax Implications of Selling Property Abroad After Relocating to India

Capital Gains Tax on Property Sale

When you sell a property, the profit you earn is categorized as a capital gain. Capital gains are classified into two types:

- Short-Term Capital Gains (STCG): If the property is held for less than 24 months (2 years), the gain is considered short-term.

- Long-Term Capital Gains (LTCG): If the property is held for more than 24 months, the gain is considered long-term.

a. Tax Rates for Residents

- STCG: Taxed at your applicable income tax slab rate (up to 30% + cess).

- LTCG: Taxed at 20% with indexation benefits (adjustment for inflation) or 10% without indexation (whichever is lower).

b. Tax Rates for NRIs

- NRIs are subject to the same tax rates as residents for capital gains. However, the buyer is required to deduct Tax Deducted at Source (TDS) at the rate of 20.8% (including cess) for LTCG and 30% (including cess) for STCG.

Double Taxation Avoidance Agreement (DTAA)

India has signed Double Taxation Avoidance Agreements (DTAAs) with over 90 countries to prevent taxpayers from being taxed twice on the same income. If you sell property in a country with which India has a DTAA, you can claim relief in one of the following ways:

- Exemption Method: The income is taxed only in one country.

- Tax Credit Method: You pay tax in both countries but claim a credit for the tax paid abroad against your Indian tax liability.

For example, if you sell property in the USA and pay capital gains tax there, you can claim a tax credit in India to avoid double taxation.

Indexation Benefits

Indexation is a method to adjust the purchase price of the property for inflation, reducing your taxable capital gains. The Cost Inflation Index (CII) is published by the Indian government annually. For example, if you bought a property in 2010 for ₹50 lakh and sold it in 2025 for ₹1.5 crore, the indexed cost of acquisition would be higher, reducing your taxable gain.

Tax Rates and Exemptions

To encourage investment in real estate, the Indian government provides exemptions under Section 54 of the Income Tax Act. If you reinvest the capital gains from the sale of a property into another residential property in India, you can claim an exemption. Key points to note:

- The new property must be purchased 1 year before or 2 years after the sale.

- Alternatively, you can construct a new property within 3 years of the sale.

- The exemption is available only for long-term capital gains.

Tax Rates

- STCG: Taxed at the applicable income tax slab rate.

- LTCG: Taxed at 20% with indexation benefits or 12.5% without indexation for properties purchased before July 23, 2023.

Exemptions

- Section 54: Exemption for reinvestment in another residential property within a specified period.

- Section 54EC: Exemption for investment in specified bonds within six months of the transfer.

- Section 54F: Exemption for reinvestment in a residential property if the entire sale proceeds are used.

Repatriation of Sale Proceeds

If you are an NRI or a returning Indian, you may want to repatriate the sale proceeds to India. The Reserve Bank of India (RBI) allows NRIs to repatriate up to $1 million per financial year from the sale of property abroad, subject to certain conditions:

- The property must have been purchased using foreign currency or funds from an NRE/FCNR account.

- You must provide documentation, including the sale deed, tax payment proof, and a certificate from a Chartered Accountant.

Latest Updates in Tax Laws

Reduction in LTCG Tax Rate for NRIs

In the Union Budget 2023, the government reduced the LTCG tax rate for NRIs from 20.8% to 10% without indexation for properties sold after April 1, 2023.

- Digital Tax Compliance

The Indian government has introduced stricter digital compliance measures, including mandatory e-filing of tax returns and linking of Aadhaar with PAN for NRIs. - Higher TDS for Non-Filers

If you fail to file your income tax returns for two consecutive years, the TDS rate on property sales increases to 30%.

Strategies to Minimize Tax Liability

- Plan Your Sale Timing

If possible, time your property sale to qualify for long-term capital gains, as the tax rate is lower. - Utilize Section 54 Exemption

Reinvest the sale proceeds in another residential property in India to claim tax exemption. - Claim DTAA Benefits

Ensure you claim relief under the DTAA to avoid double taxation. - Consult a Tax Advisor

Tax laws are complex and subject to change. Consulting a tax advisor can help you navigate the rules and optimize your tax liability.

Special Considerations for Non-Resident Indians (NRIs)

For NRIs, the tax implications can be slightly different:

- LTCG: Taxed at 20% with indexation benefits.

- STCG: Taxed at the applicable income tax slab rate.

- TDS: 20% for LTCG and as per slab rates for STCG.

Filing Your Taxes

To ensure compliance, it is crucial to file your taxes correctly. Here are the steps:

- Calculate Capital Gains: Determine the full value of consideration, deduct the indexed cost of acquisition/improvement, and subtract expenses on transfer.

- Claim Exemptions: Utilize available exemptions under Sections 54, 54EC, and 54F.

- File Income Tax Return: Report the capital gains and TDS in your income tax return.

Selling property after relocating to India involves navigating complex tax laws, but with proper planning and expert advice, you can minimize your tax liability. Understanding your tax residency status, leveraging exemptions like Section 54, and utilizing DTAA benefits are key to optimizing your tax outgo. Stay updated with the latest tax laws and consult a professional to ensure compliance and maximize your savings.

Frequently Asked Questions (FAQs)

1. Do I need to pay tax in India if I sell my property abroad?

Yes, if you are a resident of India, you are required to pay tax on global income, including income from the sale of property abroad.

2. Can I claim indexation benefits for property sold abroad?

Yes, indexation benefits are available for long-term capital gains on property sold abroad.

3. What documents are required to repatriate sale proceeds to India?

You will need the sale deed, tax payment proof, and a certificate from a Chartered Accountant.

4. Is TDS applicable on property sales by NRIs?

Yes, the buyer is required to deduct TDS at the rate of 20.8% for LTCG and 30% for STCG.

-

The 6x Income Rule & 35% EMI Cap: How to Calculate Your Home Loan Eligibility Like a Pro in 2026

-

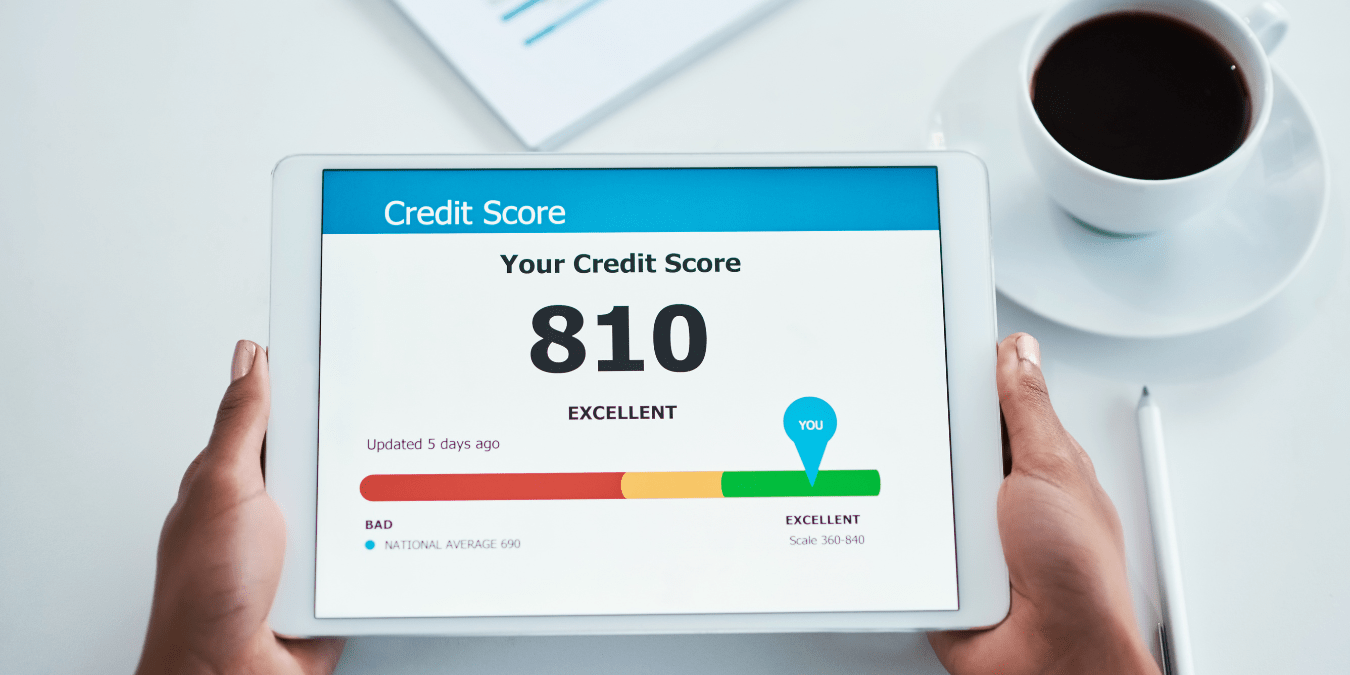

CIBIL Score Myths That Are Silently Killing Your Loan Chances (A Banker Tells All)

-

8th Pay Commission Salary Chart 2026: Projected Hikes for Employees Explained

-

LIC’s Cipla Stake Hits 9.09% Despite Pharma Slowdown