RBI’s new rule allows minors aged 10+ to independently open & operate bank accounts – a big leap for financial literacy! Teach kids money management early. Know eligibility, limits & benefits of minor accounts. Start their savings journey today! Full guidelines inside.

The Reserve Bank of India (RBI) announced on April 21, 2025, that minors aged 10 years and above can now independently open and operate savings accounts and term deposit accounts. This significant policy shift, set to reshape the banking landscape, empowers children to take their first steps toward financial independence under a structured framework. This blog post delves into the details of the RBI’s new guidelines, their implications, benefits, and what parents and minors need to know to navigate this change effectively.

Understanding the RBI’s New Guidelines for Minors’ Bank Accounts

The RBI’s revised guidelines, effective from April 21, 2025, allow minors aged 10 and above to open and manage savings accounts and fixed deposit (FD) accounts independently, subject to the bank’s risk management policies. This decision aims to foster financial responsibility and literacy from an early age, aligning with India’s broader goal of financial inclusion. Here are the key highlights of the new rules:

- Independent Operation for Minors Aged 10+: Minors above the age of 10 can open and operate savings or term deposit accounts without the mandatory involvement of a parent or legal guardian. Banks will determine the maximum transaction limits and other terms based on their internal risk policies.

- Guardian-Operated Accounts for Younger Minors: For children below 10 years or those who prefer guardian oversight, accounts can still be opened and operated through a natural or legal guardian, including the mother, as reaffirmed by a 1976 RBI circular.

- KYC Compliance: Banks are required to conduct full Know Your Customer (KYC) formalities for minor accounts, ensuring compliance with safety and identity verification standards. Ongoing due diligence will also be undertaken to maintain account security.

- Additional Banking Facilities: Depending on the bank’s policies, minors may access facilities such as internet banking, ATM/debit cards, and cheque books, promoting hands-on experience with modern banking tools.

- No Overdraft Facility: The RBI has mandated that minor accounts, whether operated independently or through a guardian, must always maintain a credit balance. Overdrafts are strictly prohibited to ensure responsible financial management.

- Transition to Majority: Upon reaching the age of 18, banks must obtain fresh operating instructions and a specimen signature from the account holder to update the account records.

- Implementation Deadline: Banks are required to align their policies with these guidelines by July 1, 2025. Until then, existing policies will remain in effect.

This policy is a significant departure from the previous framework, where minors typically required a guardian to operate their accounts until they reached the age of majority (18).

Why This Change Matters: The Importance of Financial Literacy

Financial literacy is a critical life skill, and introducing children to banking at a young age can lay the foundation for sound financial habits. According to a 2023 survey by the National Centre for Financial Education (NCFE), only 27% of Indian youth aged 15–24 demonstrated basic financial literacy. By allowing minors to manage their own accounts, the RBI aims to bridge this gap and empower the next generation to make informed financial decisions.

Benefits for Minors

- Early Financial Education: Managing a bank account teaches children about saving, budgeting, and the value of money, fostering responsible financial behavior.

- Hands-On Experience: Access to tools like debit cards and internet banking provides practical exposure to digital banking, a crucial skill in today’s economy.

- Independence and Confidence: Operating their own accounts empowers minors to take charge of their finances, building confidence and decision-making skills.

- Long-Term Savings Habit: Opening term deposit accounts encourages minors to save for future goals, such as education or personal milestones.

Benefits for Parents

- Reduced Oversight Burden: Parents can guide their children without needing to manage every transaction, allowing minors to learn through experience.

- Customized Guidance: Parents can work with banks to set appropriate limits, ensuring their child’s financial activities remain safe and controlled.

- Encouraging Responsibility: This policy provides an opportunity for parents to teach their children about financial accountability in a real-world setting.

Benefits for Banks

- Expanding Customer Base: By onboarding young depositors, banks can cultivate long-term relationships with customers from an early age.

- Promoting Digital Banking: Offering digital banking services to minors aligns with the growing trend of digital transactions, which accounted for 98% of retail transactions in India in 2024, per RBI data.

- Supporting Financial Inclusion: This initiative aligns with the Pradhan Mantri Jan Dhan Yojana (PMJDY), which has opened over 53 crore bank accounts as of March 2025, bringing millions into the formal banking system.

How Minors Can Open and Operate Bank Accounts

For parents and minors looking to take advantage of this opportunity, here’s a step-by-step guide to opening and managing a bank account under the new RBI guidelines:

- Choose a Bank: Research banks offering minor-friendly accounts, such as State Bank of India (SBI), HDFC Bank, or ICICI Bank, which are likely to update their policies to comply with the new guidelines.

- Complete KYC Requirements: Minors must provide KYC documents, such as an Aadhaar card, birth certificate, or school ID, along with proof of address. Parents may need to submit their KYC details if acting as guardians.

- Understand Bank Policies: Each bank will set its own terms, including transaction limits, account features, and eligibility for additional services like debit cards. Compare offerings to find the best fit.

- Open the Account: Visit a bank branch or use the bank’s online portal (if available for minors) to open the account. Some banks may require an initial deposit, typically ranging from ₹500 to ₹5,000.

- Learn Banking Basics: Parents should educate their children on basic banking concepts, such as deposits, withdrawals, interest rates, and the importance of maintaining a positive balance.

- Monitor and Guide: While minors can operate accounts independently, parents should periodically review account activity to ensure responsible usage.

Safeguards and Considerations for Parents

While the RBI’s new guidelines are a positive step, parents must be aware of the safeguards and potential risks associated with minors managing their own accounts:

- Bank Oversight: Banks are required to implement robust risk management policies to protect minor accounts from misuse. This includes setting transaction limits and monitoring for suspicious activity.

- Parental Guidance: Parents should have open conversations with their children about financial responsibility, including the risks of sharing account details or PINs.

- Limited Features: Some banks may restrict certain features, such as high-value transactions or credit facilities, to minimize risks for young account holders.

- Digital Safety: With access to internet banking and debit cards, minors must be educated about cybersecurity, including avoiding phishing scams and securing their login credentials.

Implications for India’s Financial Ecosystem

The RBI’s decision comes at a time when India’s banking sector is undergoing rapid transformation. With deposit growth lagging behind credit growth in recent years, as noted in a 2025 report by The Hindu BusinessLine, encouraging young depositors could help address this imbalance. By “catching depositors young,” banks can build a pipeline of financially literate customers who contribute to the economy over time.

Moreover, this policy aligns with global trends. Countries like the United States and United Kingdom have long allowed minors to operate custodial accounts or debit cards under parental supervision, with programs like Greenlight and GoHenry gaining popularity. India’s move to empower minors directly is a bold step toward modernizing its financial education framework.

Challenges and the Road Ahead

While the RBI’s guidelines are promising, several challenges must be addressed to ensure their success:

- Bank Preparedness: Banks must update their systems, train staff, and develop minor-friendly products by July 1, 2025, which may strain resources for smaller institutions.

- Financial Literacy Gap: Without adequate education, minors may struggle to manage accounts responsibly. Schools and banks should collaborate to integrate financial literacy into curricula.

- Digital Divide: While urban minors may easily access digital banking, rural children may face challenges due to limited internet connectivity or banking infrastructure.

- Parental Awareness: Many parents may be unaware of the new guidelines or hesitant to let their children manage accounts independently. Awareness campaigns are essential.

To overcome these challenges, the RBI could partner with organizations like the National Financial Literacy and Inclusion Mission to conduct workshops and create educational content tailored for minors and parents.

A Bright Future for Young Savers

The RBI’s decision to allow minors aged 10 and above to open and operate bank accounts independently is a landmark step toward fostering financial literacy and inclusion in India. By empowering young Indians to engage with the banking system, the RBI is not only promoting responsible money management but also laying the groundwork for a financially secure future. As banks prepare to implement these guidelines by July 1, 2025, parents and minors should seize this opportunity to explore the world of banking, guided by knowledge and caution.

For more information, visit the RBI’s official website or contact your bank to understand their specific policies for minor accounts. Let’s embrace this change and help our children become financially savvy from a young age!

-

Inside Anil Ambani’s 17-Storey Pali Hill “Abode”: How a Rs 3,716-Crore Mansion Landed in a Money Laundering Case

-

The Real Reason Behind Incannex Healthcare’s 1-for-30 Reverse Stock Split — Nasdaq Compliance Crisis Revealed

-

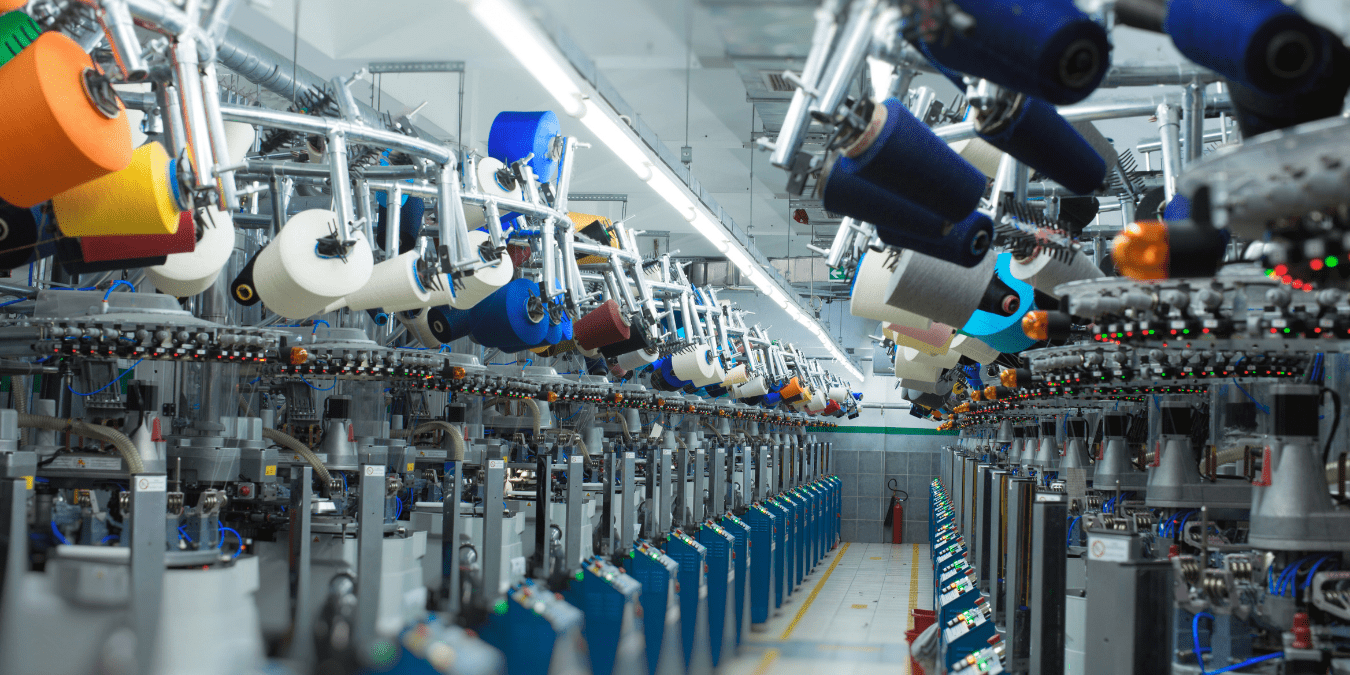

Shree Ram Twistex IPO Oversubscribed 43 Times: Sends a Strong Signal About India’s Textile Sector

-

US Slaps 126% Tariff on Solar Panels — Is Waaree Energies the Biggest Loser Among Indian Solar Stocks?